Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Last night, Abu Dhabi's state capital MGX announced a $2 billion investment in Binance, setting a record for the largest single investment in the crypto space to date.

Unlike the uncertainty brought about by regime changes in North America, the sovereign funds of Middle Eastern countries such as the UAE, Saudi Arabia, and Qatar are long-term and stable, with assets spread across the globe. Being invested by them means entering a higher-dimensional capital circle.

What is even more intriguing is a statement from Binance co-founder He Yi: “Welcome sovereign funds, financial investors can pass.” This raises curiosity about why sovereign funds are so favored. Have they already laid the groundwork, or are they just entering the scene? Which sovereign fund will be the next to make a significant investment?

The Magic of Sovereign Funds: The Game of National Capital

Sovereign funds are established and owned by the governments of sovereign states for long-term investment in financial assets or funds, typically managed by specialized government investment agencies. Compared to private capital, sovereign funds possess stronger capital stability and strategic goals, often used to promote national economic growth, hedge financial risks, or ensure intergenerational wealth transfer.

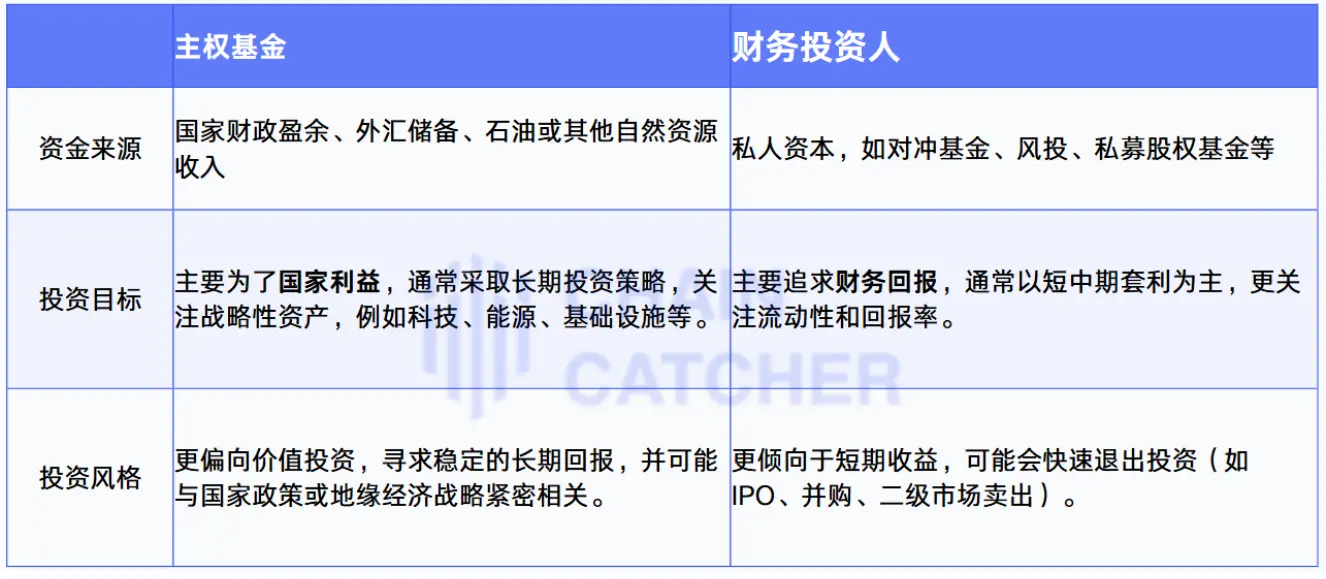

Sovereign funds differ significantly from traditional financial investors in terms of investment logic and objectives:

In recent years, with the transformation of global capital markets, sovereign funds have increasingly deepened their investments in emerging fields such as technology, AI, and Web3, becoming important players in the global capital market.

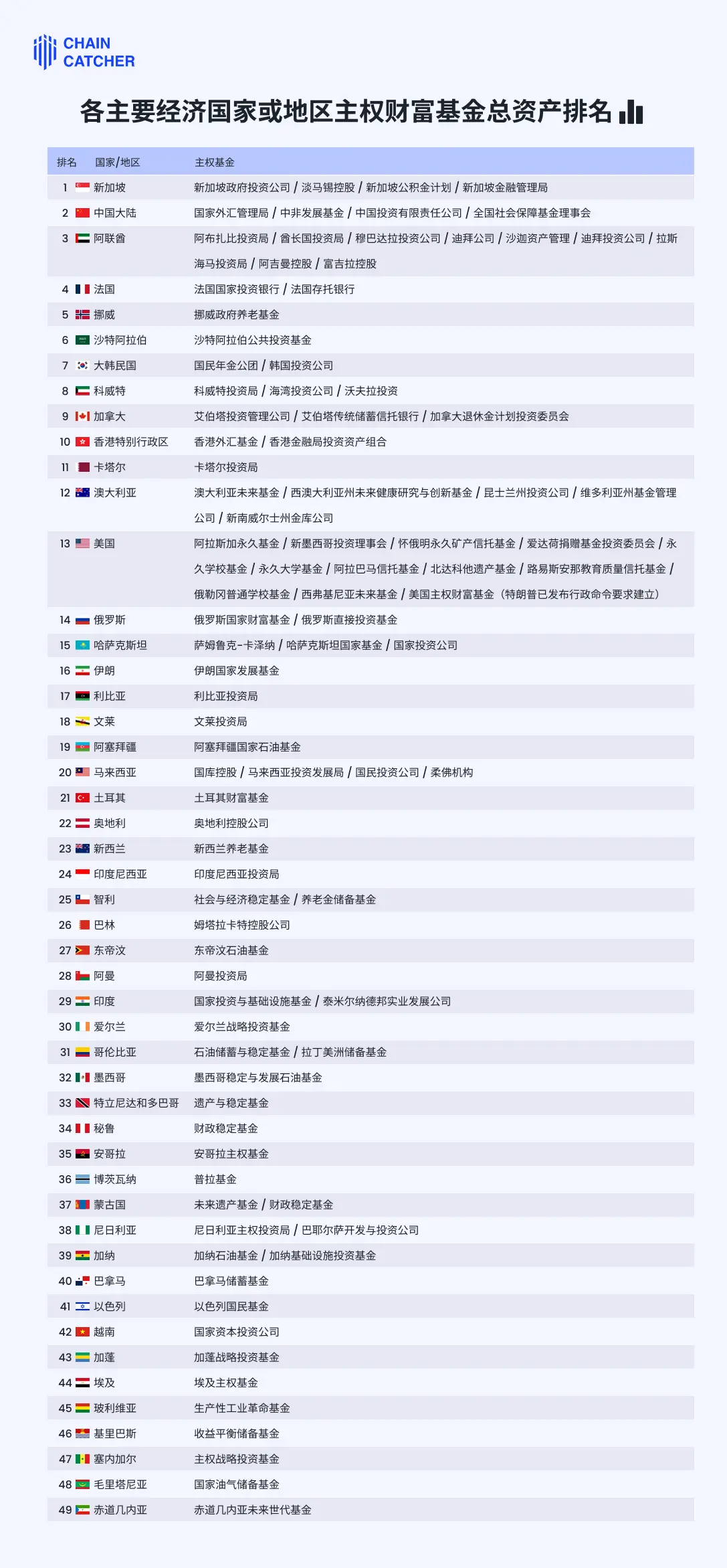

Currently, the largest sovereign funds are mainly distributed in Middle Eastern, Nordic, and Asian countries, often managing hundreds of billions or even over a trillion dollars in assets. According to Wikipedia, ChainCatcher has compiled a list of "Top Sovereign Wealth Funds from Major Economies or Regions":

Sovereign Funds Have Long Been Deep in the Crypto Market

Sovereign funds' bets on the crypto market are not a spur-of-the-moment decision but a long-term strategy.

As early as 2021, Khaldoon al-Mubarak, CEO of Abu Dhabi's sovereign fund Mubadala, publicly stated: “From our perspective, we are focused on the ecosystem surrounding crypto and are actively investing. This may involve areas such as blockchain technology and energy usage.”

In fact, Mubadala entered the crypto market in 2019 and invested in the UAE's first regulated crypto exchange, MidChains.

Other sovereign funds have also taken action in the crypto space:

- Singapore's sovereign fund Temasek has invested in FTX and Web3 gaming service provider Immutable.

- In 2018, Singapore's sovereign fund GIC participated in Coinbase's financing.

- In December 2022, digital asset platform Amber Group announced it raised about $50 million from a new sovereign fund.

- In April 2023, Saudi sovereign fund Sanabil disclosed several investments in the Web3 space, including well-known institutions like a16z and Polychain Capital.

- Abu Dhabi's sovereign fund has held approximately 4,700 equivalent bitcoins in the BlackRock IBIT ETF, with expectations for further expansion.

Sovereign Funds Entering the Scene: The "Coming of Age" for the Crypto Market

Abu Dhabi's sovereign fund MGX's $2 billion bet on Binance marks a significant "coming of age" for the global crypto market. The investment from sovereign funds not only signifies capital inflow but also represents an official level of recognition.

Crypto KOL 0xcult stated that Abu Dhabi's investment in Binance is a key milestone in the industry's development, as the entry of sovereign funds is often seen as a signal of industry maturity.

More importantly, sovereign funds can bring real "hard currency." According to Global SWF statistics, sovereign wealth funds (SWF) manage $11.09 trillion globally. BlackRock's CEO has stated that if sovereign funds and companies invest 2% to 5% of their capital in cryptocurrencies, Bitcoin could reach $700,000.

Additionally, sovereign funds primarily focus on long-term holdings and have a much higher risk tolerance than typical institutions, which can reduce short-term speculation in the market and enhance overall stability.

Who Will Be the Next Heavyweight Player?

With the UAE taking the lead, who will be the next country capital to spend lavishly? The author has compiled a few potential sovereign funds for reference.

Singapore's Temasek announced a pause in crypto investments after the collapse of FTX, but if the market matures further, especially with more sovereign funds entering, Temasek may consider returning.

There have been rumors that Qatar's sovereign wealth fund intends to purchase Bitcoin. Given the rapidly increasing acceptance of crypto assets in the Middle East, sovereign funds in the region may follow suit and deepen their investments in this field.

Meanwhile, Trump recently signed an executive order planning to establish a U.S. sovereign wealth fund within a year. Under his vision of a "crypto capital," if this fund materializes, the crypto space could potentially be included in its investment portfolio.

The next "invisible whale" to make a move may soon be revealed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。