TELL YOUR OWN STORIES.

Author: Emily Lai, Hype CMO

Translation: Deep Tide TechFlow

Cryptocurrency marketing is dazzling: from choosing the right channels, to messaging, to team coordination. Should you invest in hosting an event? Do you need to launch an ambassador program? How should the incentives for a hackathon be designed? There’s always something to do.

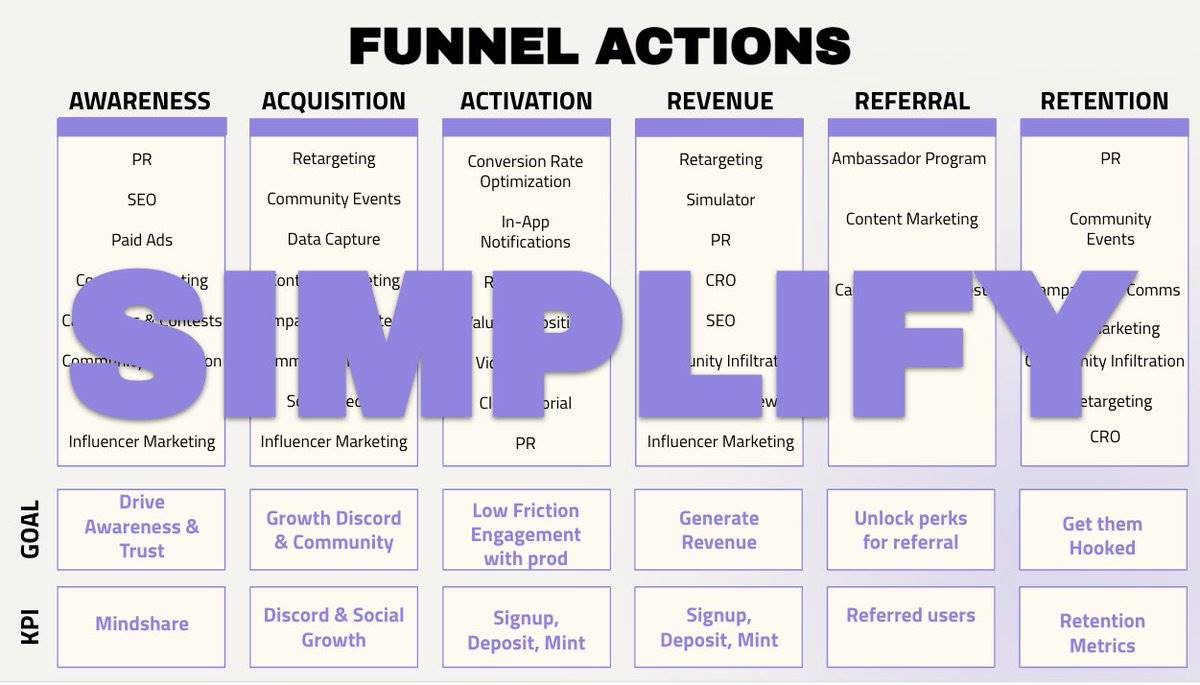

Excellent marketers simplify processes, create plans, execute tasks, and help you save on budget.

Figure: An effective marketing strategy can help you clarify seemingly complex situations.

However, cryptocurrency marketing has become increasingly challenging at this stage.

What exactly is happening?

As founders, builders, and marketers, what can we do?

Why? Here are three reasons: No new users!!!

Reason One: Increased Competition

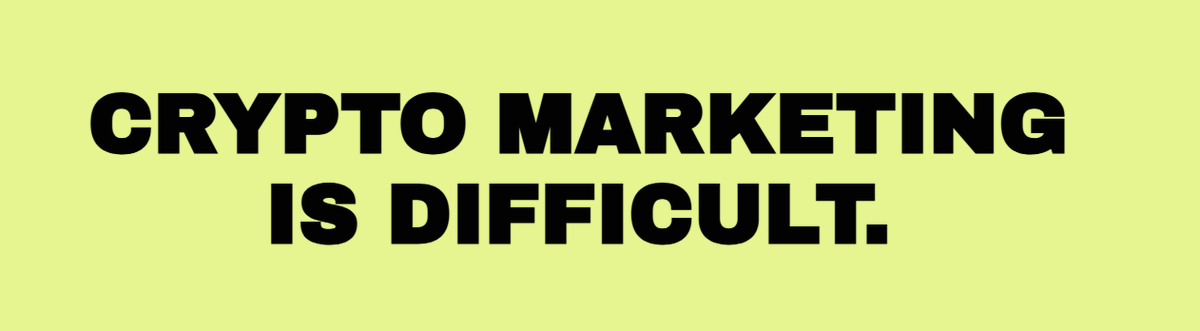

The entire cryptocurrency ecosystem's chains, infrastructure, and dApps (decentralized applications) are saturated, with every project vying for attention with its own token.

Figure: Data source: On-chain data provided by @defillama, dApps and token data provided by @alvaapp

Figure: For example, my friend @mumufengg has never used on-chain products (no hot wallet, no exposure to dApps), but his initial experience reflects the confusion of new users.

According to data from @DefiLlama, there are currently over 356 blockchains.

After a talk, I spoke with @cattybk from @thirdweb, who told me they have worked with over 2000 EVM chains alone. So, I checked the data from @coingecko:

Over 8700 L1 chains

Over 5200 L2 chains

In addition, there are:

Over 1500 AI agents according to @cookiedotfun

Over 50,000 new tokens added daily according to @pumpdotfun and @Dune

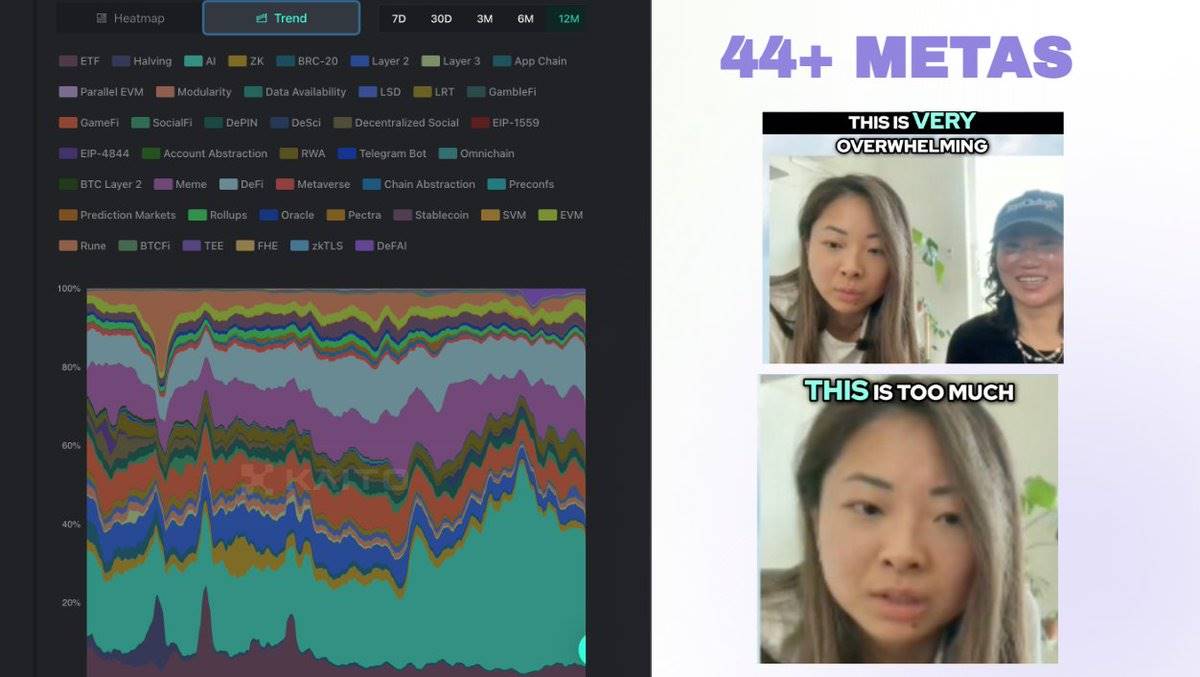

44 narratives tracked by @KaitoAI

The question is, are new users pouring in to support these new chains, infrastructure, dApps, and tokens?

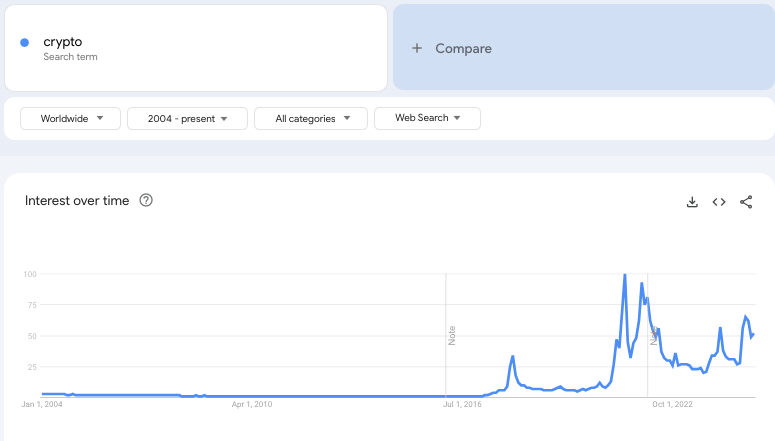

From the perspective of Total Value Locked (TVL), the performance of this cycle is comparable to the previous one, and aligns with the performance of the term "crypto" in Google search trends—search volume is cyclically declining, indicating a waning interest from mainstream users.

Even if new users come in, they face hundreds of chains to choose from, not to mention hundreds of wallets. This is more confusing than ever.

Figure: TVL trend comparison shown by data from @defillama

Figure: Google Trends shows the global search trend for "Crypto"

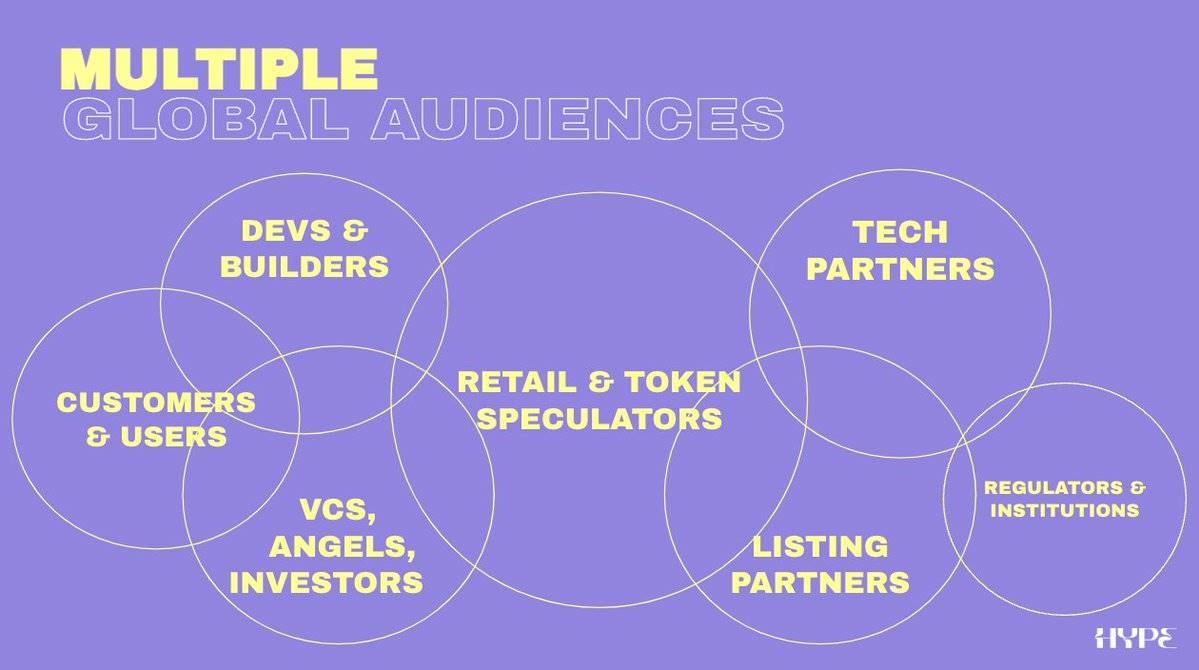

Reason Two: Fragmented Target Audience

The audience in the cryptocurrency space is diverse, with different motivations for each group, further exacerbating market fragmentation.

Developers and Builders:

If you are a developer of a blockchain/network/ecosystem, you need to attract developers to build applications that can attract new users.

This requires developer marketing and onboarding guidance. Developers' motivations may include: wanting to leverage your tech stack to realize unique ideas, obtaining development funding, or seeing higher chances of success based on network effects and distribution capabilities.

Customers and Users:

If you are a protocol, dApp, middleware, or service provider, you need to attract users to generate revenue.

For the ecosystem, dApp teams may be seen as customers.

It is important to note that users do not always align with token holders; sometimes token holders may just be speculators who do not actually use your product.

Venture Capitalists, Angel Investors, and Other Investors:

- These groups provide you with funding, and their motivation is to achieve a return on investment (ROI), usually through tokens, which do not always correlate directly with technology, user numbers, or developer counts.

Retail and Token Speculators:

- These individuals may or may not be your users. Their goal is also high ROI, profiting from token trading.

Technical Partners:

These are often other infrastructure or middleware projects. As the demand for blockchain scalability in speed, security, and cost grows, a whole field of middleware infrastructure has emerged, including chain/wallet abstraction, cross-chain bridges, interoperability, modularity, etc.

Additionally, there are service providers, not limited to agencies, but also including blockchain explorers, ad tech, unlocking software, etc.

These partners often represent a broad audience that needs to be targeted, which is why business development (BD) is so popular in the industry.

Listing Partners:

- Including exchanges, launch platforms, market makers, intermediaries, and KOL trading, etc. The performance of these groups directly affects the success of your token, and their motivations are often related to ROI.

Regulators and Institutional Investors:

- These audiences can bring significant liquidity but may also lead to your company's failure.

Beyond all these audience types, the globalization of the cryptocurrency industry further exacerbates market fragmentation. This means understanding cultural differences, coordinating messaging across different time zones, and managing localized marketing efforts.

All of this makes marketing in the cryptocurrency industry more challenging, whereas Web2 marketing is more straightforward, with clearer messaging and more consistent motivations.

For example:

Selling health supplements: targeting health-conscious individuals, seniors, and high-income groups.

Selling winter jackets: targeting people in cold climates, skiers, hikers, and snowboarders.

Selling protein powder: targeting fitness enthusiasts and bodybuilders, excluding vegetarians (if it’s whey protein).

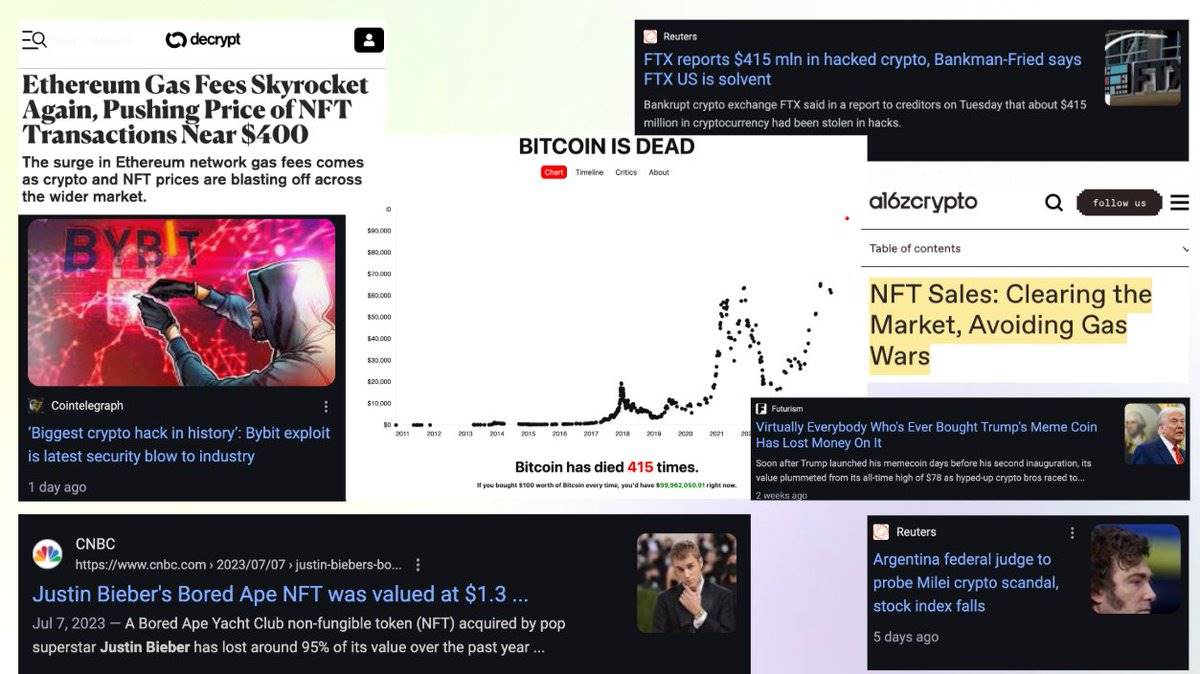

Reason Three: Technology is Not Mature and User Trust is Damaged

According to statistics, since the birth of Bitcoin, the media has declared its "death" 415 times. Additionally, the cryptocurrency industry is notorious for scams, money laundering, and crime.

Figure: Some news headlines about cryptocurrency might make your mother worry about your choice to work in this industry.

In 2021, the boom of NFTs and the metaverse attracted a large number of new users. At that time, many celebrities entered the space. If you were working in the industry then, you might have received many inquiries from old friends.

However, all of this came to a halt with the emergence of issues: high gas fees, plummeting token prices, and painful experiences of user losses. These problems led to a crisis of reputation and a loss of trust.

Mainstream users left the market, and we entered a building (bear market) cycle, while also welcoming thousands of new chains and middleware.

Figure: The industry's focus swings between "we need more applications" and "we need more infrastructure." (Inspired by the visualization from @jillrgunter)

So, why are you still here?

I don’t know, please take a deep breath, calm down, and tell me your reasons (I genuinely want to hear your stories, which are also important for your marketing).

For me, I fell down the Bitcoin "rabbit hole" in my college apartment in 2013 because I loved its values of sovereignty and self-sufficiency.

Since then, I have also seen cryptocurrencies being widely used in places like Argentina, Indonesia, and Turkey.

For example, I primarily survive on crypto stablecoins in Buenos Aires, Argentina, to cope with the crazy inflation there:

In addition, many companies are using blockchain technology and completely abstracting it.

A shoutout to @benLLS from @octantapp, who mentioned @jia_DeFi, a company that helps emerging markets unlock capital and opportunities, and Hala Systems, which is dedicated to reducing harm, enhancing safety, and stabilizing communities.

There are also companies like @bombocommunity that ensure the security of music ticketing through NFTs while abstracting the crypto language. @cattybk also mentioned some blockchain-based casual games that are acquiring users significantly outside of crypto Twitter.

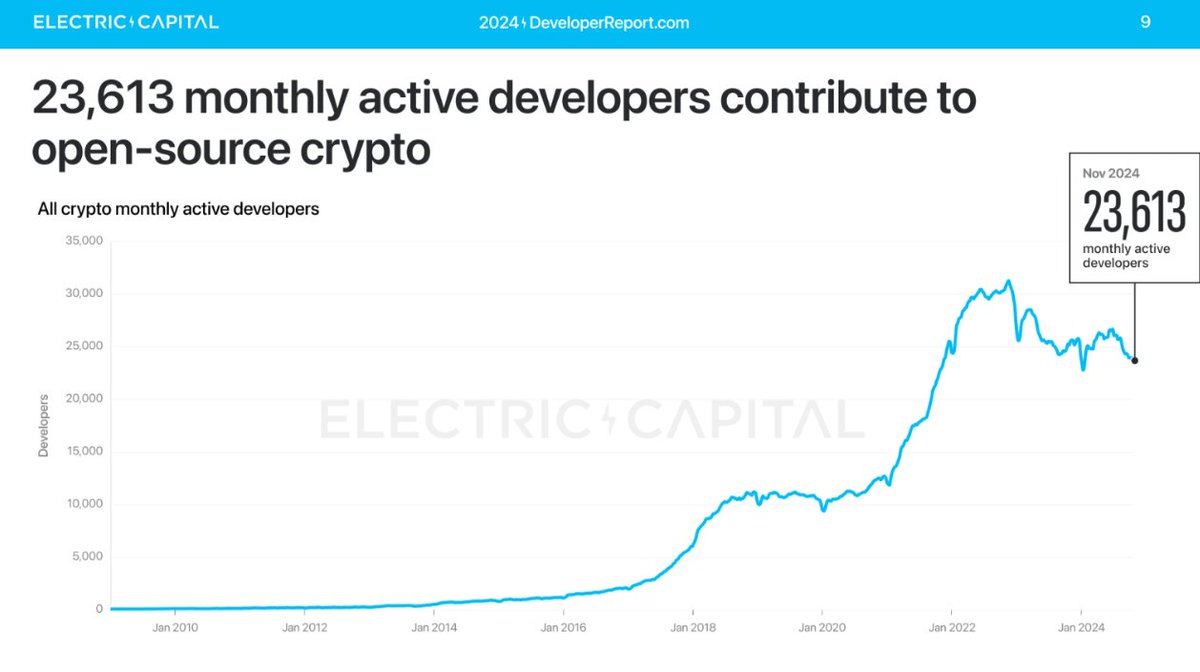

Additionally, @mariashen from @electriccapital releases a developer report every year. Although the number of developers has decreased compared to the previous cycle, the overall number of Web3 developers is still growing, indicating that we have not attracted net new users.

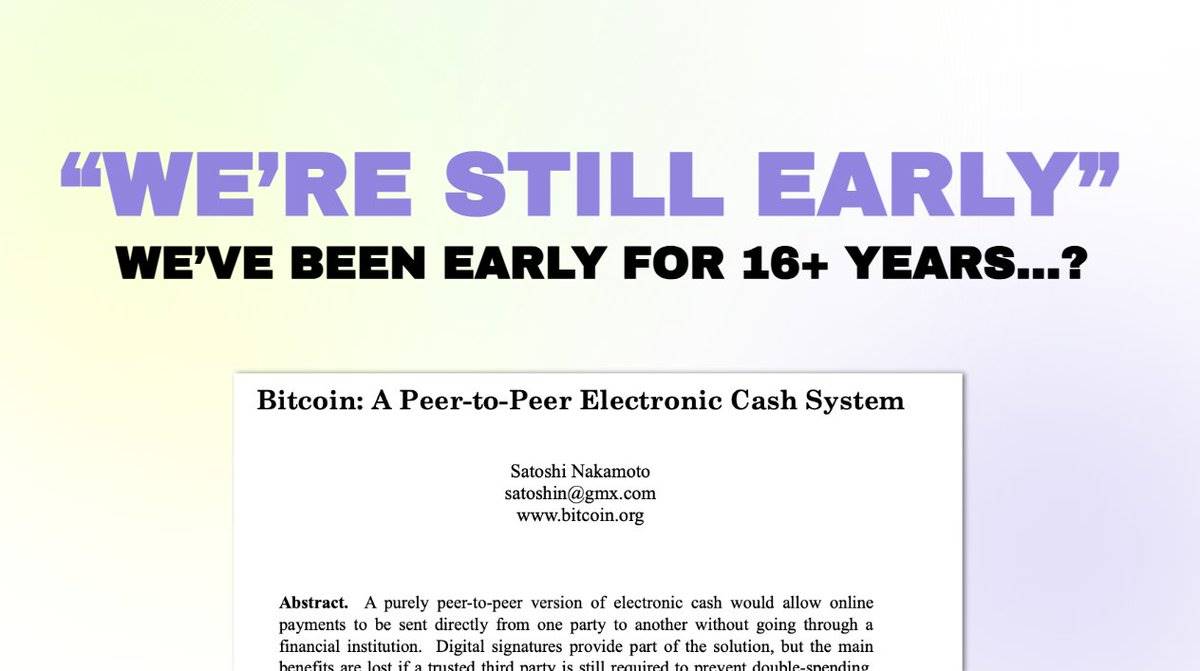

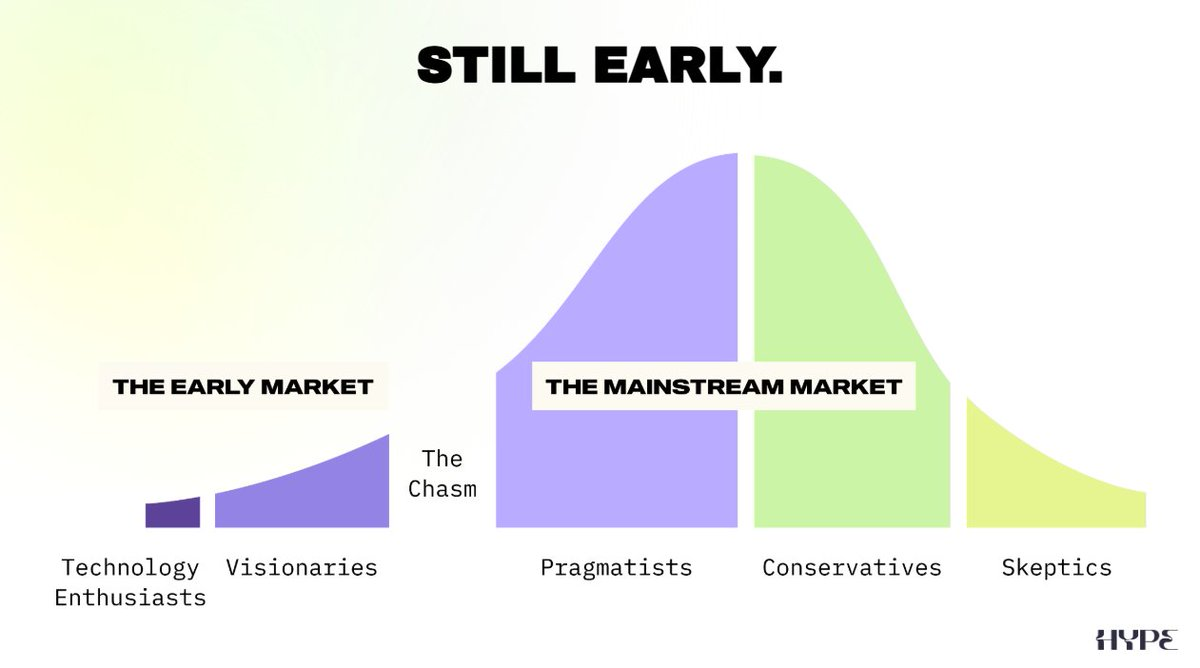

The reality is: Despite 16 years having passed, we are still in the early stages.

Figure: Classic chart of early adopters from the book "Crossing the Chasm"

We have crossed the chasm, and the mainstream market with a high risk tolerance has accepted Bitcoin and views cryptocurrency as an asset class.

But we have yet to convey the following message to them: why do we need thousands of blockchains, let alone an application that allows them to use it daily, surpassing Instagram, Temu, TikTok, WhatsApp, or ChatGPT (the popularity of these platforms has far outpaced that of the crypto industry).

What does this mean? Are we not building what people need? Or… is it just not mature enough?

I believe there are many kind-hearted individuals in this industry who are willing to drive social progress. I know some of them, such as @vijaymichalik, @arlery, @motherpredicte, @divine_economy, @alipaints, and this is just a small portion.

If you are building in the crypto industry with good intentions, what are the marketing fundamentals you need to master and apply?

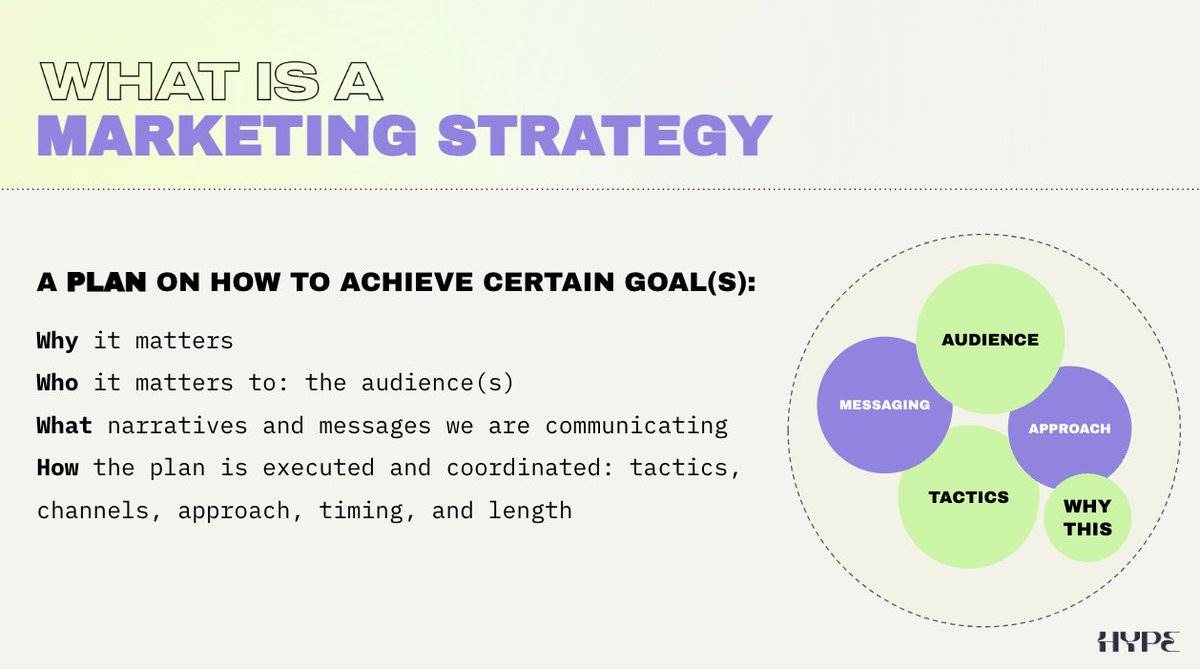

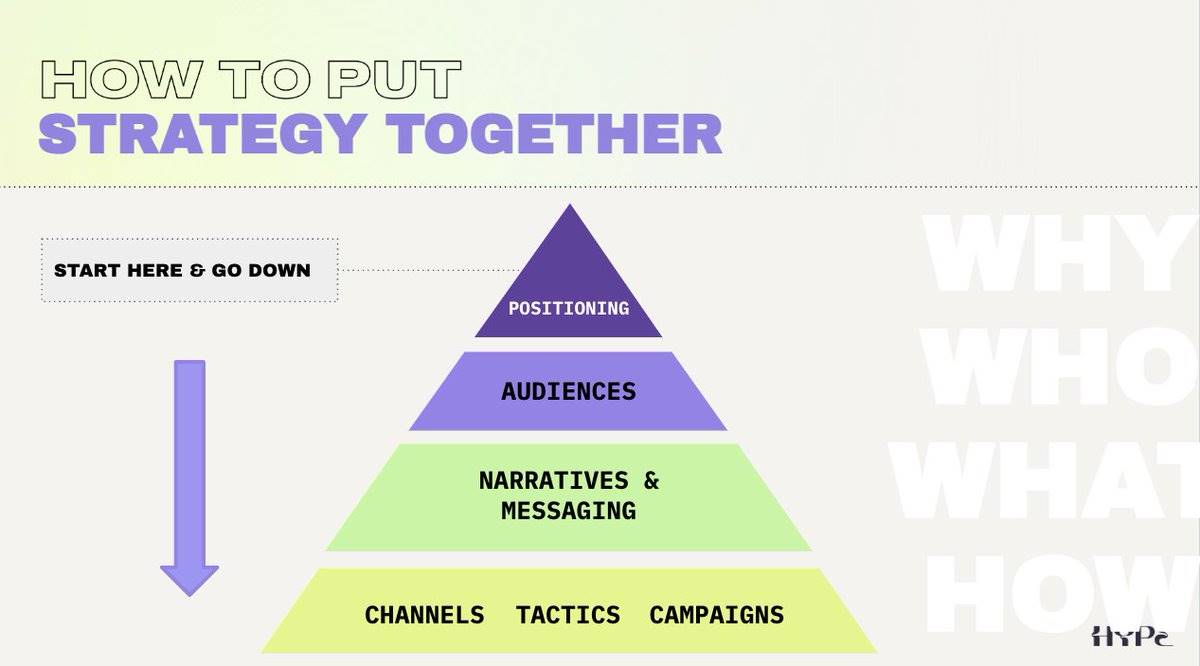

These are two slides I often show in my talk "What is Marketing," which essentially condense marketing strategy into four words.

You can see me explain this in more detail in the video I did with @modenetwork: Click to watch.

Additionally, there is a version shared at the last India Blockchain Week (@ibwofficial), which mainly discusses the background of founders/personal brands, using @megaeth_labs as an example: Click to watch.

Three Important Tips for Acquiring Crypto Users

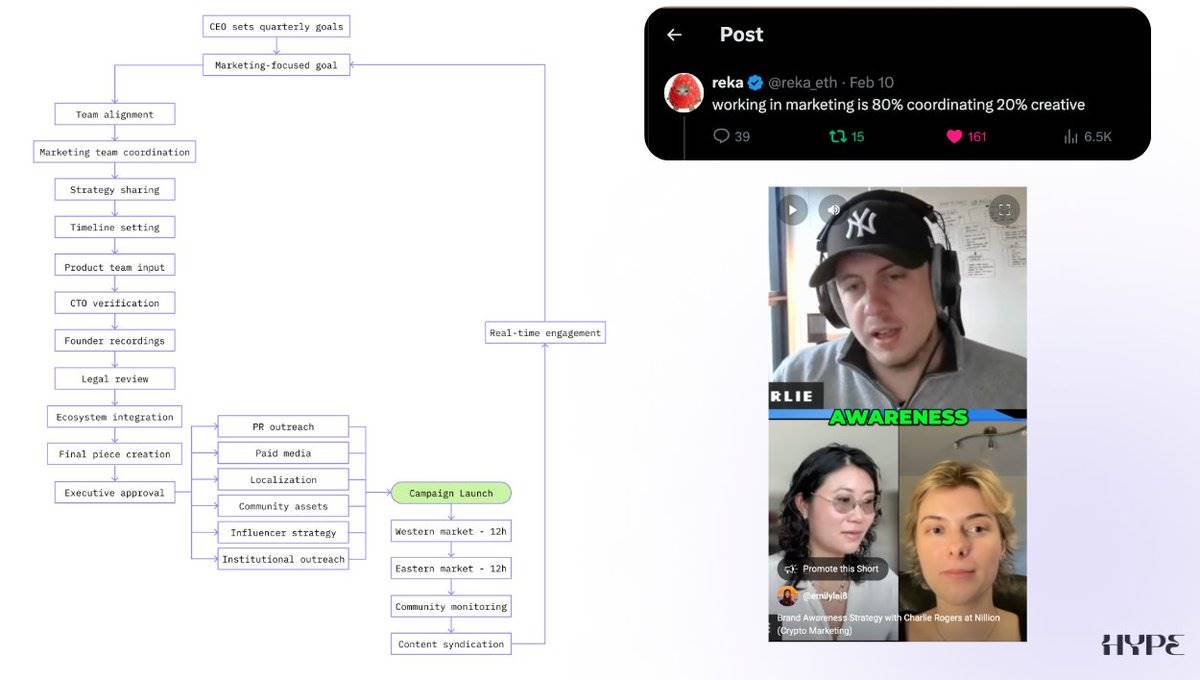

There are seven types of audiences in the crypto space, distributed across multiple geographic regions. Additionally, your internal team members (business development, product, marketing, creative, legal, etc.) also need to collaborate.

In one of the AMOS series by @moremarketsxyz, hosted by @xkonjin, I participated alongside @reka_eth, and we invited @jaambutties (CMO of @nillionnetwork) to share how he coordinates brand activities.

This coordination allows all stakeholders to get involved, amplifying your marketing efforts and helping to break through and capture the scarce and valuable attention in this field.

Ultimately, because the technology is still in its early stages and the industry is extremely saturated, we do need to do some things that cannot be scaled. This includes onboarding newcomers one by one, engaging personally, and educating them.

While I love showing @pumpdotfun to friends who have never been exposed to the crypto space, I also have to give immense credit to @a1lon9:

What's even better?

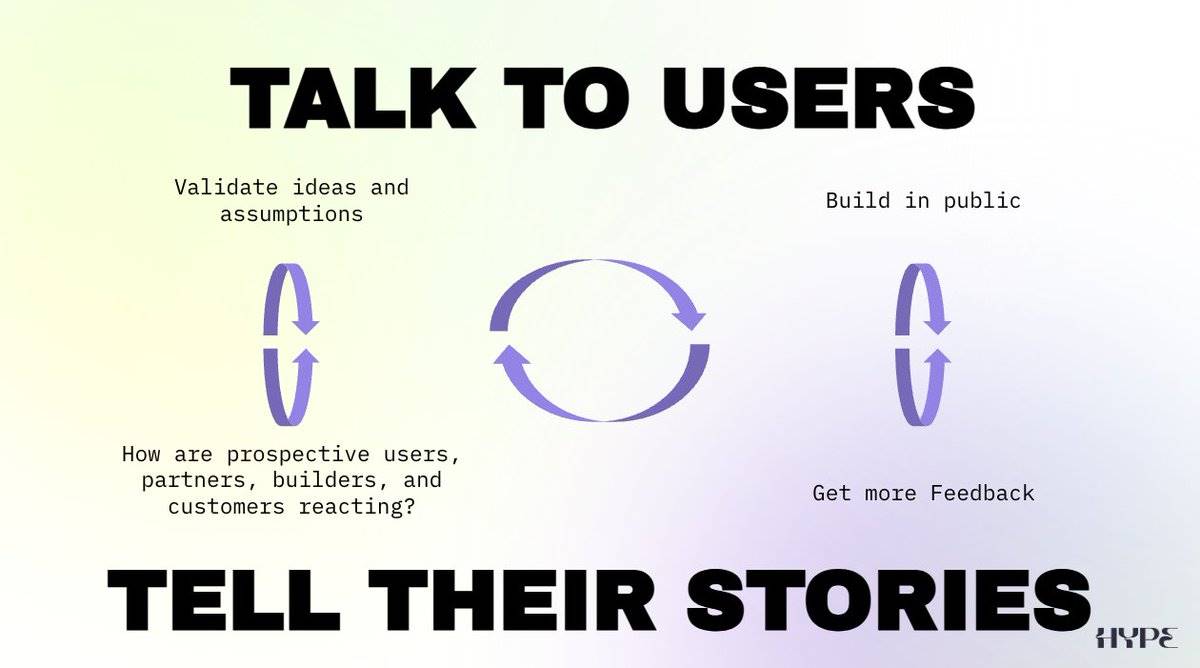

To break through the distraction of attention, you need consistent messaging and content output to maintain relevance.

This is why founders reply to tweets, why they participate in AMAs (Ask Me Anything sessions), and even now appear in live videos.

This is also why teams record during events.

Engage in conversations with users, developers, investors, and customers, and tell their stories.

At the same time, you can gain valuable product feedback.

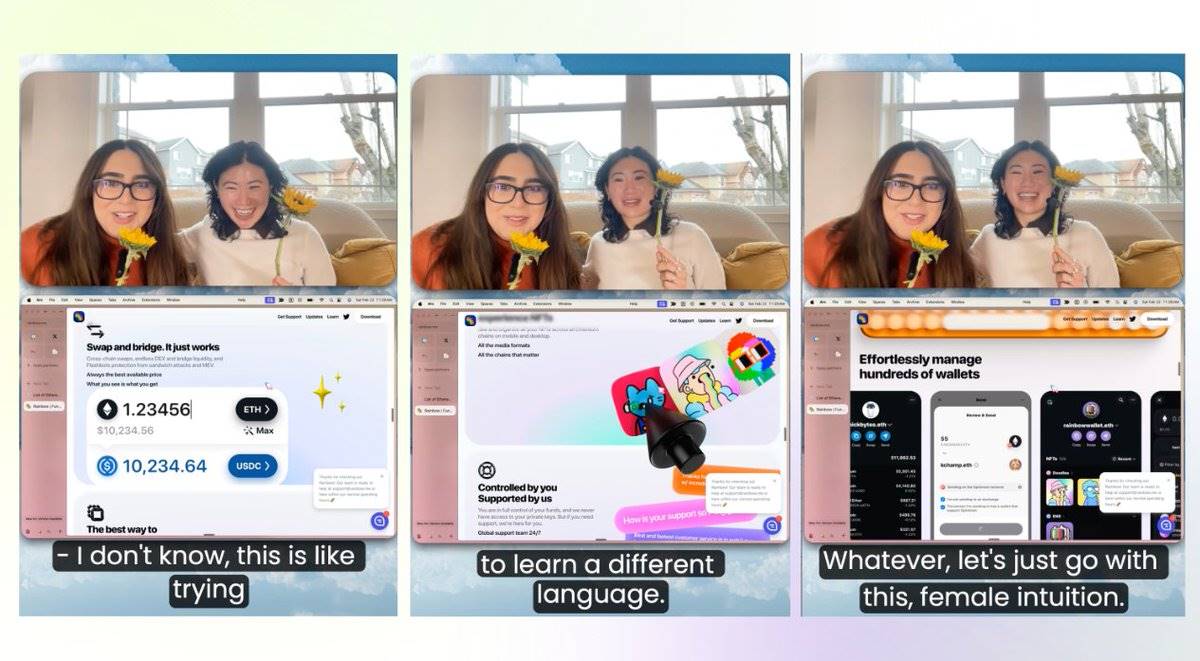

My friend @shayyydz chose her first crypto wallet. At the time of writing, this post received 5200 views because she chose @rainbowdotme.

Finally, if you are a founder or builder—this is the most important thing:

Let’s return to the earlier question of “Why are you still here?” and do some self-reflection.

No one knows your "why" better than you. Tell us why you are building, why this matters. These stories are not only the vision you convey to your team but also the core content for recruiting new members, attracting investors, and building community.

Keep repeating these stories and try different content formats.

Thank you for reading this far. If you’re willing, please also share your story with me.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。