Source: Cointelegraph Original: "{title}"

Bankers and their allies in the U.S. Senate are resisting the "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (referred to as the "GENIUS Act"), fearing that stablecoins will undermine the intermediary role of banks and erode the market share of the banking industry.

According to an article in American Banker, the bill requires 60 votes to pass in the Senate, meaning at least 7 Democrats must vote with Republicans to push the bill through.

This could be a tough task, as U.S. Senator Elizabeth Warren is one of the most vocal critics of cryptocurrency in politics, proposing an amendment to ban tech companies from issuing stablecoins. Warren wrote, "If these companies want to engage in payment services, they must work with regulated financial institutions or facilitate transactions between these institutions. But this stablecoin bill breaks the status quo, giving large tech companies and other commercial groups the green light to issue their own stablecoins."

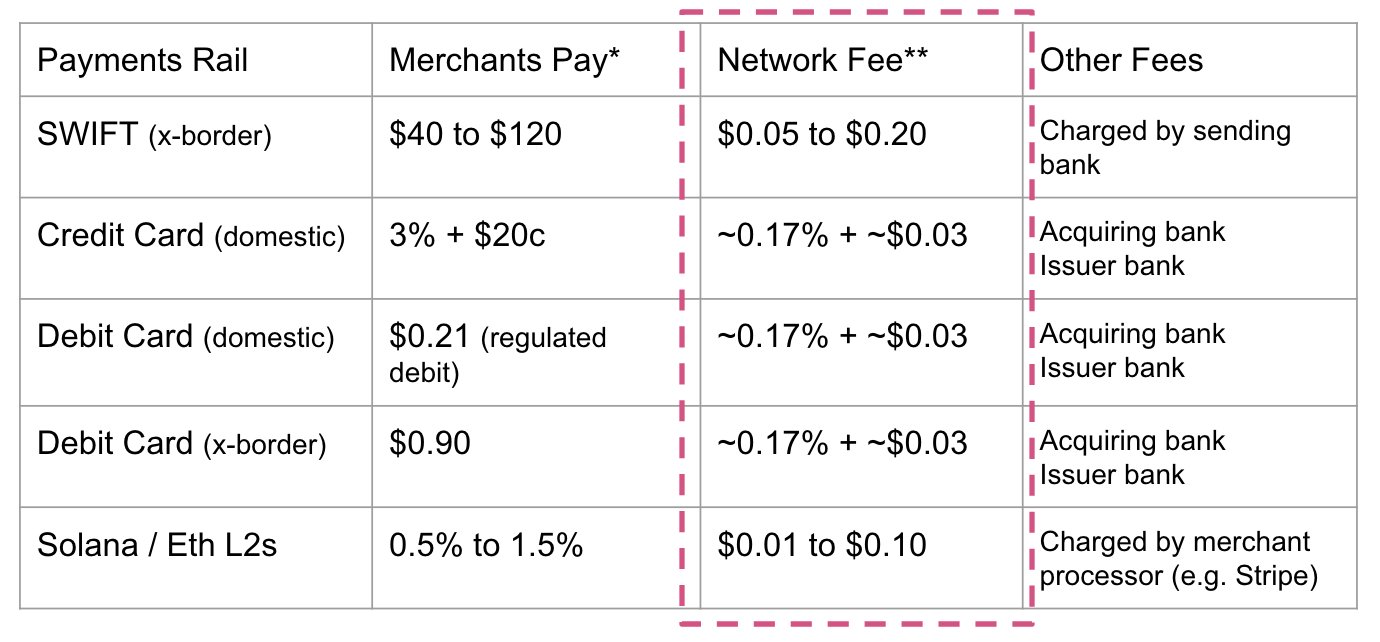

With near-instant settlement times and lower transaction costs, digital assets continue to play a disruptive role in the financial and banking sectors, significantly alleviating the burden of cross-border payments and introducing peer-to-peer transaction models.

Page one of the 2025 GENIUS Act. Source: U.S. Senate

Stablecoins: The Future Direction of the 21st Century Dollar?

On February 4, Senator Bill Hagerty introduced the GENIUS Stablecoin Act as a comprehensive regulatory framework for tokenized dollars.

Shortly after the bill was submitted to the U.S. Senate, Federal Reserve Bank President Christopher Waller stated that non-bank institutions should be allowed to issue stablecoins.

Waller believes that due to the cost-saving and efficient characteristics of stablecoins, they can expand payment application scenarios, especially in developing countries.

Comparison of stablecoin fees with traditional payment processing solutions. Source: Simon Taylor

Bank of America CEO Brian Moynihan told attendees at the Economic Club of Washington, D.C. that Bank of America may venture into the stablecoin business—most likely launching its own stablecoin pegged to the dollar.

At the first White House cryptocurrency summit held on March 7, Treasury Secretary Scott Bessent stated that the U.S. would leverage stablecoins to maintain the dollar's dominance.

Over-collateralized stablecoin issuers are collectively the 18th largest purchasers of U.S. Treasury bonds globally—surpassing countries like Germany and South Korea in purchase volume.

By adopting policies favorable to stablecoins and promoting their use globally, the U.S. government can use stablecoins as a tool to absorb inflation and protect the dollar's status as the global reserve currency.

Related: Bitso believes that USDC and USDt stablecoins are "stores of value" in Latin America.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。