Source: Cointelegraph Original: "{title}"

The U.S. Senate Banking Committee has decided to advance the "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (referred to as the "GENIUS Act") with a vote of 18 in favor and 6 against.

No amendments proposed by Senator Elizabeth Warren were included in the bill, including her suggestion to limit the issuance of stablecoins to banking institutions.

Warren argued, "Without amendments, this bill will greatly facilitate the funding of terrorism. It will make it easier for Iran, North Korea, and Russia to evade sanctions."

Senator Elizabeth Warren advocates for the inclusion of amendments in the bill. Source: U.S. Senate Banking Committee Republicans

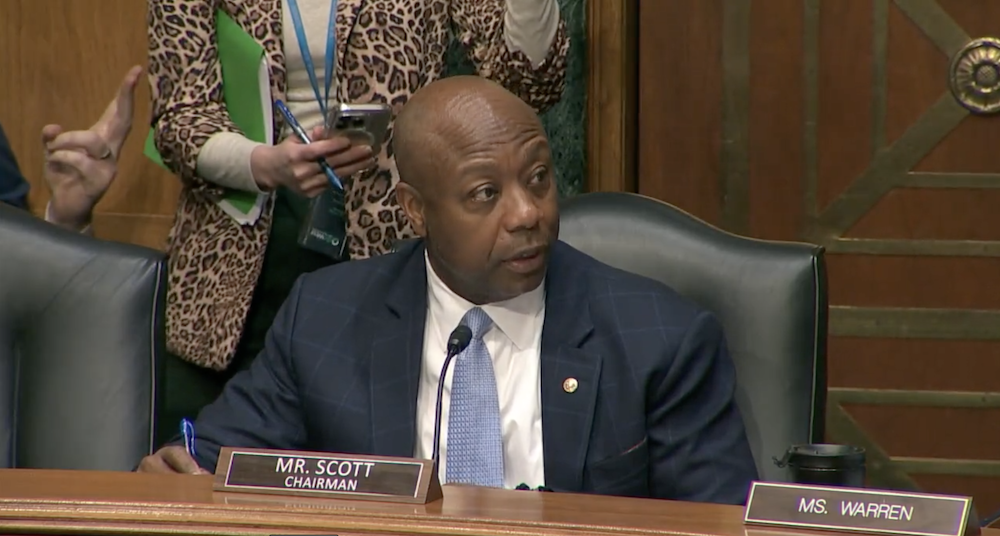

Senate Banking Committee Chairman Senator Tim Scott described the bill as a victory for innovation. The senator stated, "The GENIUS Act establishes some common-sense rules requiring stablecoin issuers to maintain one-to-one reserve backing, comply with anti-money laundering laws, and ultimately protect U.S. consumers while promoting the strong position of the dollar in the global economy."

Before the bill is submitted to President Trump and ultimately signed into law, it must still be passed by both houses of Congress.

However, the Senate Banking Committee's advancement of the bill marks the first step toward the clear and comprehensive legislation demanded by the crypto industry.

Senate Banking Committee Chairman Senator Tim Scott presided over the hearing. Source: U.S. Senate Banking Committee Republicans

The GENIUS Act has been comprehensively revised with stricter provisions

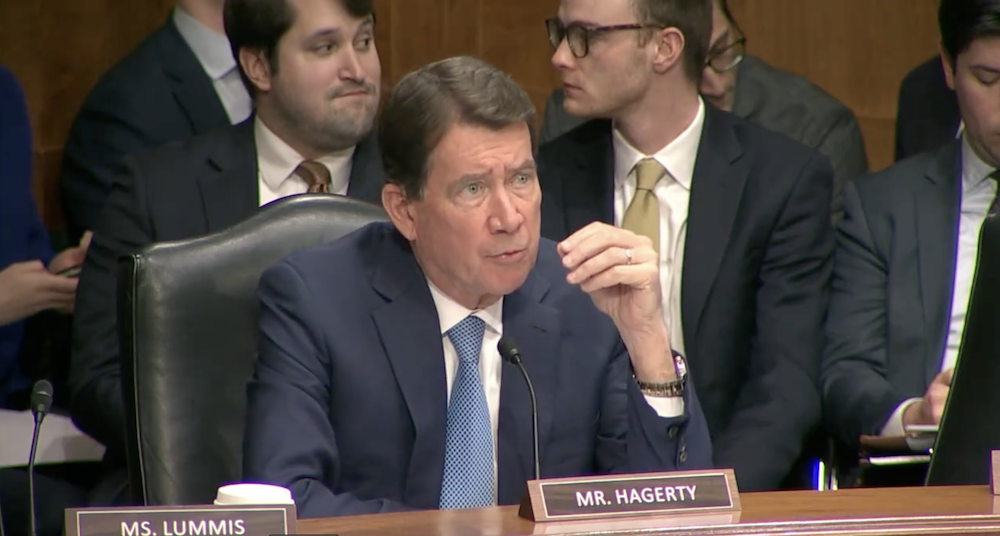

Senator Bill Hagerty, who introduced the bill in February 2025, defended the bill against the amendments proposed by Senator Warren, arguing that the bill already includes provisions for consumer protection, anti-money laundering, and crime prevention.

On March 10, Hagerty announced that the bill had been updated to include stricter reserve requirements for stablecoin issuers, anti-money laundering provisions, safeguards against terrorist financing, transparent risk management procedures, and compliance with sanctions regulations.

According to Dom Kwok, founder of the Web3 learning platform Easy A, the newly added provisions will make it more difficult for foreign stablecoin issuers to comply with regulations, giving U.S. domestic companies a competitive advantage.

Senator Bill Hagerty defends his proposed bill against the amendments. Source: Senate Banking Committee Republicans

Attorney Jeremy Hogan stated that the GENIUS Act signifies the impending integration of the traditional financial system with stablecoins.

In a post on the X platform on March 10, the attorney wrote, "This legislation clearly lays out a plan for the interaction between stablecoins and the traditional digital banking system. 'Integration' is in the works."

At the White House cryptocurrency summit on March 7, U.S. Treasury Secretary Scott Bessent explicitly stated that the Trump administration would leverage stablecoins to protect the dollar's status as the global reserve currency.

Related: DeFi Executive: The "GENIUS Stablecoin Act" is the "Trojan Horse" for Central Bank Digital Currencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。