Author: Kevin, the Researcher at Movemaker

Comparing the technical differences between Move language, Aptos, and other public chains may seem tedious due to varying depths of observation. General analysis inevitably scratches the surface, while delving into the code can lead to missing the bigger picture. To quickly and accurately understand the differences between Aptos and other public chains, choosing a suitable anchor point is crucial.

The author believes that the lifecycle of a transaction is the best entry point. By analyzing the complete steps from transaction creation to final state update—including creation and initiation, broadcasting, sorting, execution, and state update—one can clearly grasp the design philosophy and technical trade-offs of public chains. Using this as a baseline, stepping back allows for understanding the core narratives of different public chains; stepping forward enables exploration of how to build market-attractive applications on Aptos.

As shown in the figure below, all blockchain transactions revolve around these five steps, and this article will focus on Aptos, dissecting its unique design and comparing it with the key differences of Ethereum and Solana.

Aptos: Optimistic Parallelism and High-Performance Design

Aptos is a public chain that emphasizes high performance, with a transaction lifecycle similar to Ethereum, but achieves significant improvements through unique optimistic parallel execution and memory pool optimization. The following are the key steps in the transaction lifecycle on Aptos:

Creation and Initiation

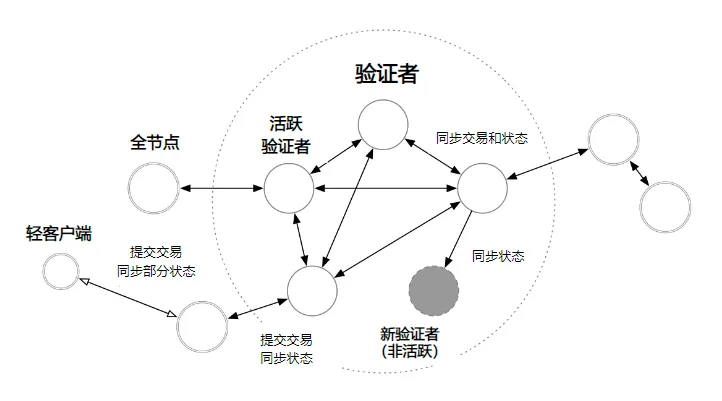

The Aptos network consists of light nodes, full nodes, and validators. Users initiate transactions through light nodes (such as wallets or applications), which forward the transactions to nearby full nodes, and full nodes then synchronize with validators.

Broadcasting

Aptos retains a memory pool, but memory pools do not share information after QuorumStore. Unlike Ethereum, its memory pool is not just a transaction buffer. After a transaction enters the memory pool, the system performs pre-sorting based on rules (such as FIFO or Gas fees) to ensure that transactions do not conflict during subsequent parallel execution. This design avoids the high hardware requirements of Solana, which needs to declare read/write sets in advance.

Sorting

Aptos uses AptosBFT consensus, where proposers cannot freely sort transactions. AIP-68 grants proposers the right to fill in delayed transactions. The pre-sorting in the memory pool has already completed conflict avoidance, making block generation more reliant on collaboration among validators rather than being proposer-led.

Execution

Aptos employs Block-STM technology to achieve optimistic parallel execution. Transactions are assumed to be conflict-free and processed simultaneously; if a conflict is discovered after execution, the affected transactions are re-executed. This method leverages multi-core processors to enhance efficiency, with TPS reaching up to 160,000.

State Update

Validators synchronize the state, and finality is confirmed through checkpoints, similar to Ethereum's Epoch mechanism, but with higher efficiency.

Aptos's core advantage lies in the combination of optimistic parallelism and memory pool pre-sorting, which reduces node performance requirements while significantly increasing throughput. As shown in the figure below, Aptos's network architecture clearly supports this design:

Source: Aptos White Paper

Ethereum: The Benchmark of Serial Execution

As the pioneer of smart contracts, Ethereum is the origin of public chain technology, and its transaction lifecycle provides a foundational framework for understanding Aptos.

Ethereum Transaction Lifecycle

Creation and Initiation: Users initiate transactions through wallets via relay gateways or RPC interfaces.

Broadcasting: Transactions enter the public memory pool, waiting to be packaged.

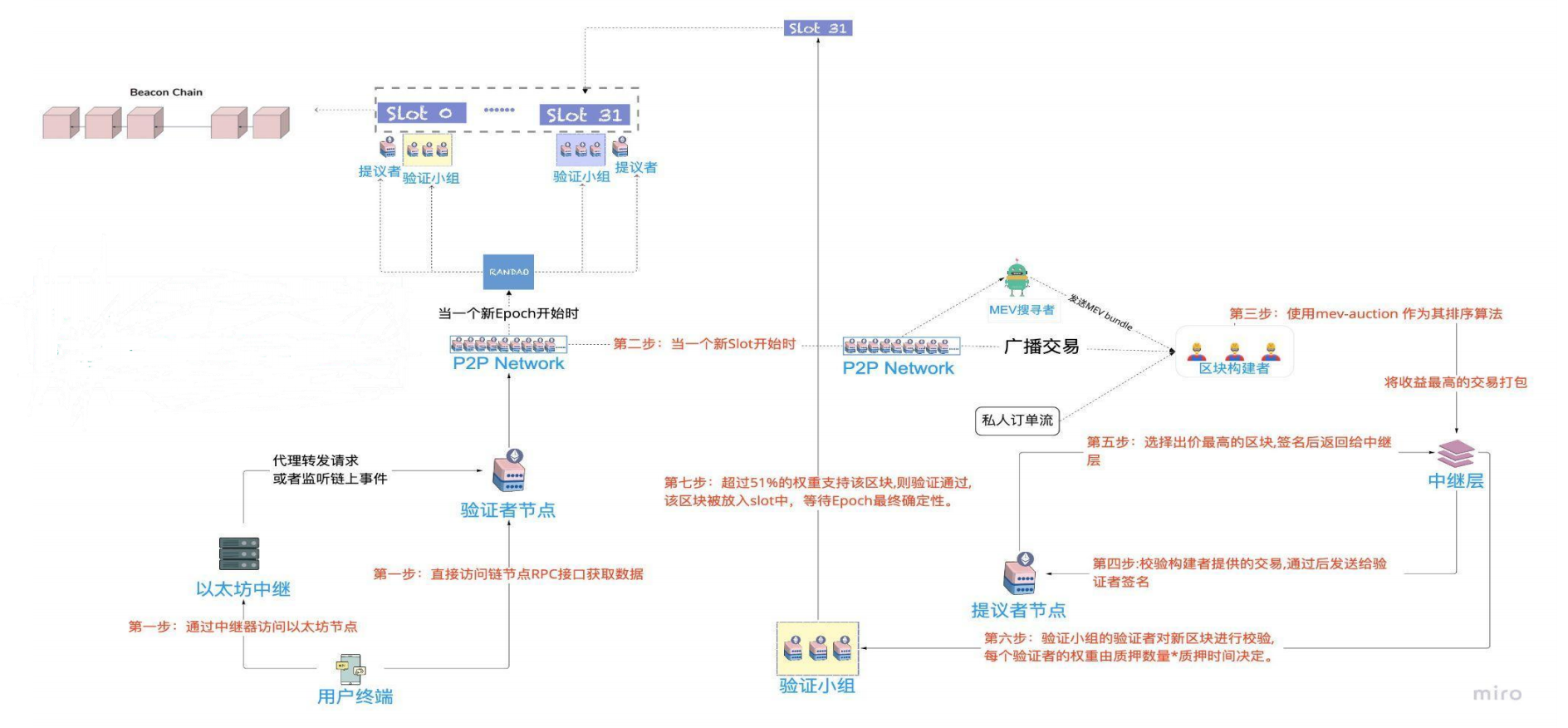

Sorting: After the PoS upgrade, block builders package transactions based on profit maximization principles, with the relay layer bidding before submission to proposers.

Execution: The EVM processes transactions serially, updating the state in a single thread.

State Update: Blocks must be confirmed for finality through two checkpoints.

Ethereum's serial execution and memory pool design limit performance, with a block time of 12 seconds per slot and relatively low TPS. In contrast, Aptos achieves a qualitative leap through parallel execution and memory pool optimization.

Solana: Extreme Optimization of Deterministic Parallelism

Solana is known for its high performance, with a transaction lifecycle that differs significantly from Aptos, especially in memory pool and execution methods.

Solana Transaction Lifecycle

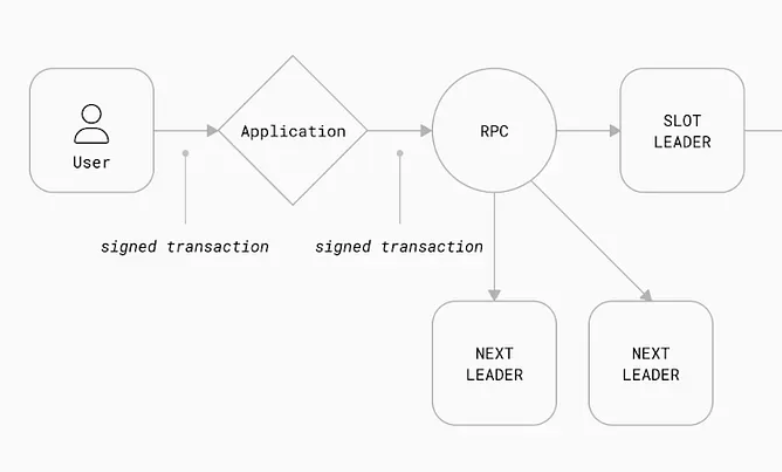

Creation and Initiation: Users initiate transactions through wallets.

Broadcasting: There is no public memory pool; transactions are sent directly to the current and the next two proposers.

Sorting: Proposers package blocks based on PoH (Proof of History), with block times of only 400 milliseconds.

Execution: The Sealevel virtual machine employs deterministic parallel execution, requiring prior declaration of read/write sets to avoid conflicts.

State Update: BFT consensus quickly confirms the state.

The reason Solana does not use a memory pool is that it could become a performance bottleneck. Without a memory pool, and due to Solana's unique PoH consensus, nodes can quickly reach consensus on transaction order, eliminating the need for transactions to queue in a memory pool, allowing for almost instantaneous transaction completion. However, this also means that during network overload, transactions may be dropped rather than waiting, requiring users to resubmit.

In contrast, Aptos's optimistic parallelism does not require declaring read/write sets, resulting in a lower node threshold while achieving higher TPS.

Source: Shoal Research

Two Paths of Parallel Execution: Aptos vs Solana

The execution of a transaction represents the update of the block state, transforming the transaction initiation command into a state with finality. How is this change understood? Nodes assume the transaction is successful and calculate its impact on the network state; this calculation process is execution.

Thus, parallel execution in blockchain refers to the process of multi-core processors simultaneously computing the network state. In the current market, parallel execution is divided into two methods: deterministic parallel execution and optimistic parallel execution. The difference in these two development directions lies in how to ensure that parallel transactions do not conflict—specifically, whether there are dependencies between transactions.

It can be seen that the timing of determining dependencies in the transaction lifecycle—decides the differentiation between deterministic parallel execution and optimistic parallel execution, with Aptos and Solana choosing different directions:

Deterministic Parallelism (Solana): Read/write sets must be declared before broadcasting transactions, and the Sealevel engine processes conflict-free transactions in parallel, while conflicting transactions are executed serially. The advantage is efficiency, while the disadvantage is high hardware requirements.

Optimistic Parallelism (Aptos): Assumes transactions are conflict-free, with Block-STM executing in parallel and verifying afterward; if conflicts arise, it retries. Memory pool pre-sorting reduces conflict risk, resulting in a lighter node burden.

For example: Account A has a balance of 100, transaction 1 transfers 70 to B, and transaction 2 transfers 50 to C. Solana confirms conflicts in advance through declarations and processes them in order; Aptos executes in parallel and adjusts if insufficient balance is found. The flexibility of Aptos makes it more scalable.

Optimistic Parallelism Completes Conflict Confirmation in Advance through Memory Pool

The core idea of optimistic parallelism is to assume that transactions processed in parallel will not conflict, so the application side does not need to submit transaction declarations before execution. If a conflict is found during verification after execution, Block-STM will re-execute the affected transactions to ensure consistency.

However, in practice, if transaction dependencies are not confirmed in advance, a large number of errors may occur during actual execution, causing the public chain to lag. Therefore, optimistic parallelism is not merely assuming that transactions are conflict-free; it involves risk avoidance at a certain stage, which is the transaction broadcasting stage.

In Aptos, after a transaction enters the public memory pool, it undergoes pre-sorting based on certain rules (such as FIFO and Gas fees) to ensure that transactions within a block do not conflict during parallel execution. Thus, it can be seen that proposers in Aptos do not actually have the ability to sort transactions, and there are no block builders in the network. This pre-sorting of transactions is key to Aptos's implementation of optimistic parallelism. Unlike Solana, which requires transaction declarations, Aptos does not need this mechanism, significantly lowering the performance requirements for nodes. In terms of network overhead to ensure transactions do not conflict, the impact of Aptos's memory pool on TPS is far less than the cost of introducing transaction declarations in Solana. Therefore, Aptos's TPS can reach 160,000, more than double that of Solana. The impact of transaction pre-sorting makes capturing MEV on Aptos more challenging, which has both pros and cons for users, and will not be elaborated on here.

Security-Based Narrative as the Development Direction of Aptos

RWA: Aptos is actively promoting the tokenization of real-world assets and institutional financial solutions. Compared to Ethereum, Aptos's Block-STM can process multiple asset transfer transactions in parallel, avoiding delays in rights confirmation due to network congestion. On Solana or Sui, although transaction speeds are fast, the lack of a memory pool design may lead to transaction drops during network overload, affecting the stability of rights confirmation for RWAs. Aptos's memory pool pre-sorting ensures that transactions enter execution in order, maintaining the reliability of asset records even during peak periods. RWAs require complex smart contract support, such as asset division, profit distribution, and compliance checks. The modular design and security of the Move language allow developers to more easily build reliable RWA applications. In contrast, the complexity and vulnerability risks of Ethereum's Solidity increase development costs, while Solana's Rust programming, though efficient, has a higher learning curve for developers. Aptos's ecosystem friendliness is expected to attract more RWA projects, creating a positive cycle. Aptos's potential in the RWA field lies in the combination of security and performance. In the future, it can focus on collaborating with traditional financial institutions to bring high-value assets like bonds and stocks on-chain, leveraging the Move language to create strong compliance tokenization standards. This "security + efficiency" narrative can help Aptos stand out in the RWA market.

In July 2024, Aptos officially announced the integration of Ondo Finance's USDY into its ecosystem, with major DEXs and lending applications. As of March 10, USDY's market capitalization on Aptos was approximately $15 million, accounting for about 2.5% of USDY's total market cap. In October 2024, Aptos announced that Franklin Templeton had launched the Franklin on-chain U.S. government money market fund (FOBXX) represented by the BENJI token on the Aptos Network. Additionally, Aptos is collaborating with Libre to promote the tokenization of securities, bringing investment funds from Brevan Howard, BlackRock, and Hamilton Lane on-chain to enhance access for institutional investors.

Stablecoin payments require ensuring the finality of transactions and the security of assets. Aptos's Move language prevents double spending through its resource model, ensuring the accuracy of each stablecoin transfer. For example, when users pay with USDC on Aptos, the transaction state updates are strictly protected, avoiding fund loss due to contract vulnerabilities. Furthermore, Aptos's low gas fees (thanks to high TPS spreading costs) make it highly competitive in small payment scenarios. Ethereum's high gas fees limit its payment applications, while Solana, despite low costs, faces risks of transaction drops during network overload, which can affect user experience. Aptos's memory pool pre-sorting and Block-STM ensure the stability and low latency of payment transactions.

PayFi and stablecoin payments need to balance decentralization with regulatory compliance. AptosBFT's decentralized consensus reduces centralization risks, while its modular architecture supports developers in embedding KYC/AML checks. For instance, a stablecoin issuer can deploy compliance contracts on Aptos to ensure transactions comply with local regulations without sacrificing network efficiency. This is superior to Ethereum's centralized relay model and compensates for the potential compliance shortcomings of Solana's proposer-led approach. Aptos's balanced design makes it more suitable for financial institutions to enter the market.

Aptos's potential in the PayFi and stablecoin payment sectors lies in the trinity of "security, efficiency, and compliance." In the future, it will continue to promote the large-scale adoption of stablecoins, build cross-border payment networks, or collaborate with payment giants to develop on-chain settlement systems. High TPS and low costs can also support micro-payment scenarios, such as real-time tipping for content creators. Aptos's narrative can focus on "next-generation payment infrastructure," attracting traffic from both enterprises and users.

Aptos's advantages in security—memory pool pre-sorting, Block-STM, AptosBFT, and the Move language—not only enhance its resistance to attacks but also lay a solid foundation for RWA and PayFi narratives. In the RWA sector, its high security and throughput support asset tokenization and large-scale transactions; in PayFi and stablecoin payments, low costs and efficiency drive real-world applications. Compared to Ethereum's robust but inefficient model and Solana's high-speed but high-threshold approach, Aptos opens up new avenues with a balanced strategy. In the future, Aptos can leverage these advantages to shape a "security-driven value network" narrative, becoming a bridge connecting the traditional economy with blockchain.

Summary: Aptos's Technical Differences and Future Narrative

Through the lens of the transaction lifecycle, we can clearly compare the technical design differences between Aptos, Ethereum, Solana, and Sui, revealing their respective core narratives. The following table summarizes the similarities and differences among the four in the broadcasting, sorting, and execution stages, highlighting Aptos's unique advantages:

Aptos's design achieves a clever balance between performance and security. Its memory pool pre-sorting combined with Block-STM's optimistic parallelism reduces node thresholds while achieving a high throughput of 160,000 TPS, surpassing Solana's deterministic parallelism and Sui's object-level parallelism. Compared to Ethereum's serial execution, Aptos's parallel capabilities represent a qualitative leap; while in contrast to Solana and Sui's radical optimization by eliminating the memory pool, Aptos retains the pre-sorting mechanism, ensuring network stability under high load. This "seeking speed within stability" approach, coupled with the resource model of the Move language, grants Aptos higher security—whether against DDoS attacks or preventing contract vulnerabilities, it outperforms Ethereum's traditional architecture and Solana's high hardware dependency.

Compared to Sui, which is also based on the Move language, the differentiation between Aptos and Sui is more enlightening. Sui focuses on objects, pursuing extreme performance through DAG sorting and object-level parallelism, making it suitable for high-concurrency asset management scenarios; whereas Aptos centers on accounts, relying on memory pools and optimistic parallelism, balancing generality and ecosystem compatibility. This difference not only reflects the choice of technical paths but also foreshadows the differentiation in application directions: Sui may excel in complex asset operations, while Aptos holds an advantage in security-driven scenarios.

It is precisely based on this combination of security and performance that Aptos demonstrates immense potential in RWA and PayFi narratives. In the RWA sector, Aptos's high throughput supports large-scale asset tokenization, with recent collaborations with Ondo Finance (USDY market cap of approximately $15 million), Franklin Templeton, and Libre already showing results. In PayFi and stablecoin payments, Aptos's low costs, high efficiency, and compliance support micro-payments and cross-border settlements, making it a strong candidate for "next-generation payment infrastructure."

In summary, Aptos integrates considerations of security and efficiency at every stage of the transaction lifecycle, distinguishing itself from Ethereum's robust but inefficient model, Solana's high-performance but high-threshold approach, and Sui's object-driven extreme optimization. In the future, Aptos can leverage the narrative of a "security-driven value network" to connect traditional finance with the blockchain ecosystem, continuously making strides in the RWA and PayFi sectors, and building a new landscape for public chains that combines trust and scalability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。