With great power comes great responsibility.

Written by: Golem, Odaily Planet Daily

Recently, the leading cryptocurrency exchange Binance has once again become the focus of market discussions—receiving unanimous praise from the crypto community for several initiatives.

Firstly, RedStone (RED) launched on Binance's pre-market and announced it would airdrop 10% of the total token supply to the community, but ultimately betrayed users, with only over 4,000 people qualifying for the airdrop. After discovering the market sentiment, Binance decisively sided with community users and suspended the RED token. Eventually, the project team had to "soften" their stance and reallocate 2% of the total supply from "ecosystem and data providers" to the community members who were omitted from the initial airdrop distribution.

Coincidentally, RedStone is not the only one trying to exploit the community and retail investors. On March 4, GoPlusSecurity (GPS) launched on Binance, and the price immediately began to decline, making retail investors the ones left holding the bag, with the price halving.

Just when the community felt they were once again becoming liquidity exits, only able to vent their frustrations through ineffective complaints, Binance took action. On March 7, Binance verified that GPS's market maker was continuously selling tokens without placing any buy orders, and temporarily froze the market maker's account.

On March 9, Binance officially announced that during an investigation into one of GoPlus Security's (GPS) market makers, it discovered that this market maker was also responsible for the market-making activities of MyShell (SHELL). To better protect Binance users, Binance took the following additional measures against the market maker's misconduct: the market maker has been delisted and banned from any further market-making activities on Binance; the market maker's related earnings have been confiscated and will be used to compensate users of the GPS and SHELL projects (the detailed compensation plan will be decided and announced by the relevant project teams).

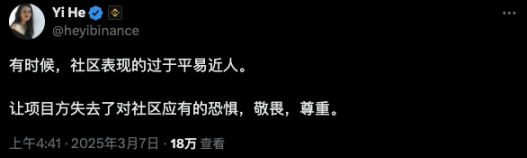

These actions have earned Binance unanimous praise from the community, with many users exclaiming that the "liquidity terminator" Binance has finally stood on the side of the community. Binance co-founder He Yi also played with popular memes on the X platform, expressing that what the project parties should truly fear, respect, and revere is the community.

Sometimes, Binance's overly approachable demeanor has led project parties to lose the fear, respect, and reverence they should have for Binance.

Binance's actions towards the community are not "occasional good deeds"

As the cryptocurrency industry began a collective attack on VCs and the increasingly ugly behavior of altcoins in 2024, Binance, as a liquidity center, has also been discussed as a tool for colluding with project parties and VCs to exploit the community. Rumors of "girlfriend coins," negative public opinion regarding external or internal interests granting junk projects listing qualifications, and other issues have occasionally surfaced, forcing Binance to repeatedly prove how many "bowls of noodles" it has eaten.

When a company grows large enough, issues such as corporate illness and corruption are inevitable. Even a strong company like ByteDance in Web2 had 353 employees dismissed for violations throughout 2024. In the Web3 industry, which is closer to users and directly related to money, there will inevitably be more malicious groups. The market maker involved in the GPS incident is rumored to be a brokerage pipeline that claims to expedite listings on Binance, continuously exploiting retail investors on the platform. There may be even more similar malicious groups lurking beneath the surface, but Binance's handling of the GPS incident has clearly indicated its alignment with the community and retail investors, countering previous conspiracy theories about "Binance exploiting the community."

However, Binance's "good deeds" towards the community are not merely occasional acts of appeasement during times of reputational crisis; Binance has always valued the voice of the community and has long regarded it as an important driving force in its development process.

Binance co-founder He Yi has long referred to herself as "Binance's first customer service," frequently active on social media platforms like X, addressing issues for Binance users, collecting suggestions for Binance's Web3 wallet products, and responding to criticisms about Binance. As a founder, she could have remained behind the scenes, but she still chooses to set an example, expressing Binance's desire to hear more voices and encourage more people to participate in building Binance.

On March 7, Binance announced it would optimize its listing mechanism, introducing two community governance methods: "Voting for Listing" and "Voting for Delisting," aimed at giving users more rights to participate in decision-making. Voting for Listing means that users with a holding of no less than 0.01 BNB can vote to support their favorite projects; projects with high votes and passing due diligence will be listed on Binance. Voting for Delisting means that users with a holding of no less than 0.01 BNB can vote to express their intention to delist projects already in the "Monitoring Zone." "Voting for Listing" and "Voting for Delisting" return more power to the community.

Previously, users' complaints about VC coins were mainly due to the lack of growth space in the secondary market after high-valuation tokens were listed, making retail investors the ones left holding the bag for VCs. The second half of 2024 marked the peak of the cryptocurrency community's condemnation of VC coins and Binance, coinciding with the peak of the Solana meme coin craze. Binance successfully met the community's speculative demands by listing meme coins with community foundations and lower market capitalizations, achieving a win-win situation for both itself and the community. (Recommended reading: Can listing meme coins truly create a win-win situation for Binance and the community?)

Now, as the meme coin craze fades, some of the funding attention has returned to "value coins," and users' demands have shifted back to needing sufficient left-side trading space. At this point, Binance's focus has shifted to maintaining the community's protection from "malicious exploitation" while providing users with enough left-side trading space for new coins through innovative mechanisms.

Not every action taken by Binance may be correct, but they are certainly what the market and community need.

With great power comes great responsibility

Historically, due to differences in industry division and influence, the community and retail investors, as end users but positioned at the downstream of the cryptocurrency industry, have long been isolated by information asymmetry, losing not only their voice but sometimes also being "exploited" by upstream VCs, project parties, exchanges, and market makers. Examples include VCs unlocking massive low-priced chips to crash prices, project parties secretly selling tokens through airdrop schemes, and exchanges charging listing fees in exchange for community liquidity exits.

The trust relationship between the upstream and downstream of the cryptocurrency industry is rapidly collapsing. Gradually, avoiding VCs and altcoins, immediately selling airdrops upon receipt, and shorting new coins upon listing have become the community and retail investors' helpless consensus in the face of "industry malfeasance." However, although we are in a cryptocurrency industry that has not yet been fully touched by regulatory scrutiny, it does not mean that no one can stop these malicious acts.

"With great power comes great responsibility." Cryptocurrency exchanges still play a pivotal role in the entire cryptocurrency industry, being one of the rule-makers and enforcers of the market, and therefore should bear the important responsibility of promoting fair competition in the industry and safeguarding user interests.

Binance is fulfilling this responsibility, whether standing with the community to counter unfair airdrop rules from project parties or freezing malicious market maker accounts. Binance is proving through action that it will no longer be the "good guy" for project parties but will become a guardian of the industry ecosystem. In the future, the industry needs more "Binance" to make a fair, transparent, and sustainable market environment the cornerstone of the cryptocurrency industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。