**Gold Hits New Historical Highs, *BTC* and US Stocks Become Difficult Brothers, AI Financing Frenzy Far Ahead of the Crypto Industry**

Macro Interpretation: Federal Reserve Chairman Powell may be frowning at the PCE price index in his office, while Trump's tariff threats have caused both US stocks and Bitcoin to plunge. As Wall Street economists firmly declare "no hope for interest rate cuts this year," the bulls in the crypto market might be thankful for Bitcoin's support level of $75,000 to $80,000. After all, compared to gold's new highs, the digital gold's kneeling position is far from elegant.

Representatives from crypto companies in the US Treasury meeting room may be holding their breath—this closed-door discussion on the "National Strategic Bitcoin Reserve Custody Plan" seems to install a political safe's combination lock for the crypto world. Meanwhile, pressure from senior Democrats to halt Trump's strategic Bitcoin reserve plan is like pouring a bucket of cold water on this unformed safe, as the political struggle unfolds under the glaring light of gold prices breaking the historical high of $2,990, showcasing a century-long race between digital assets and precious metals.

JPMorgan's adjustments to mining company ratings are quite interesting, with a mysterious operation of raising the IREN rating but lowering the target price, and Cipher Mining facing a downgrade. These actions reveal institutional investors' cautious attitude towards the computing power arms race. Just like a poker master tightening their chips at the river, these adjustments suggest that miners may need to prepare for a "prolonged battle" in the low-margin era post-halving. Interestingly, while mining company stock target prices are generally lowered, Bitcoin spot ETFs continue to attract capital, creating a dislocation phenomenon of "decentralized assets being favored while centralized carriers cool down," showcasing the polarization of the crypto world.

The financing frenzy in the AI sector makes the crypto industry look pale in comparison—a quarterly financing ratio of $20 billion to $861 million is akin to a heavyweight boxer facing a featherweight contender. Databricks' single financing amount of $15.3 billion is enough to buy the entire Bitcoin mining machine industry with leftovers. This capital siphoning effect is noted in institutional reports: when the meme coin bubble burst led to a $1 trillion market evaporation, the [Pump.fun platform on the Solana chain](http://Pump.fun on Solana) quietly profited in the bear market, with $582 million in revenue over 12 months comparable to a money printer. We often quote the old Wall Street saying: "When the shoeshine boy is talking about stocks, it's time to leave." However, the current situation is that the shoeshine boy has turned to issuing coins.

Trump's 200% tariff threat is like a black swan flapping its wings, causing not only EU wine merchants to tremble but also the crypto market to experience knee-jerk volatility. When Bitcoin stubbornly climbed back to $81,000 after the US stock market closed, on-chain data revealed a harsh truth: contract trading volume surged against the trend, like gamblers doubling down at the table. Sentiment monitoring shows that Ethereum is experiencing a trust crisis, with its community sentiment curve resembling a roller coaster, while the ETH/BTC exchange rate continues to decline without looking back.

Beneath the seemingly calm surface of the market, whale funds are stirring. The phenomenon of whale inflows reaching a multi-year high is like a deep-sea giant surfacing for air. When PAX Gold's network growth and Magic Token's whale trading suddenly became active, it reminded one of the fund managers in "The Big Short" who sensed a crisis early. Interestingly, Dogecoin's address activity is growing the fastest, as if it has started a square dance in the bear market, while Audius' sentiment indicators soaring resemble the atmosphere group in a KTV.

From a macro perspective, the crypto market is undergoing a triple pressure test: the Federal Reserve's "higher for longer" interest rate policy hangs like a sword of Damocles, the capital siphoning in the AI sector forms a financial black hole, and geopolitical black swans flap their wings frequently. However, the resilience of blockchain always finds a way out—when Morgan Stanley reports that institutional investors are starting to accumulate on dips, when Bitcoin's computing power hits new highs, and when the Lightning Network capacity exceeds $200 million, these positive signals are like a glimmer of light at the end of the tunnel. Perhaps, as the crypto adage goes: "The bear market is a paradise for builders," and this time, the builders have two new trump cards in hand: AI large models and RWA.

This "stress test" in the crypto world will ultimately prove: when the inflation monster meets the AI frenzy, Bitcoin may not be the fastest runner, but it is likely the most resilient contender. As for altcoins, they will either complete their transformation in the regulatory sandbox or turn into spring mud in the liquidity winter, after all, Darwin's theory of evolution applies in the world of code as well.

BTC Data Analysis:

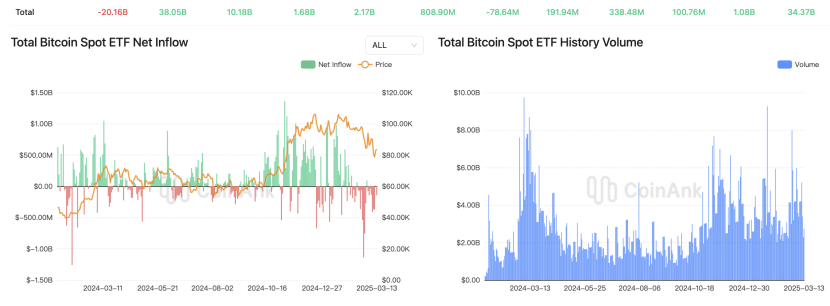

According to Coinank data, Bitcoin ETF inflows have dropped from a peak of $40 billion to $34.37 billion. Based on a management asset scale of $115 billion, this means that even if #BTC experiences a significant drop of 25%, over 95% of the invested funds remain strong.

We believe that although Bitcoin ETF inflows have fallen from a peak of $40 billion to $34.37 billion, the 95% retention rate of funds (corresponding to a management scale of $115 billion) highlights the strong resilience of institutional holdings. This phenomenon indicates three core logics:

Market Structure Evolution: As a compliant entry point, ETFs transform Bitcoin from a speculative tool into a strategic asset. Even with a 25% price pullback, institutional investors still view it as a long-term inflation hedge. Products like BlackRock's IBIT have seen historical net inflows of $16.2 billion, with low fees (0.25%) and high liquidity forming a moat that suppresses large-scale capital withdrawals.

Holding Behavior Differentiation: On-chain data shows that short-term holders (STH) account for 68% of loss-driven sell-offs, while about 83% of ETF holdings are institutional and long-term funds, with holding periods generally exceeding 6 months, demonstrating higher stickiness compared to gold ETFs (annual turnover rate of 35%).

Cycle Positioning Signals: Current outflows account for only 4.3% of the management scale, far lower than the 21% reduction in CME Bitcoin futures holdings during the March 2020 crash, reflecting an increase in market maturity. Historical data shows that when ETF fund retention rates exceed 90%, Bitcoin is often in a continuation phase of a bull market rather than a trend reversal.

If the Federal Reserve cuts interest rates or institutional allocation ratios increase (such as pension funds entering the market), existing funds may turn into price support. However, caution is needed regarding liquidity transmission risks triggered by rising US stock market volatility (VIX index), which may maintain a "low turnover oscillation" pattern in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。