Author: Luke, Mars Finance

The Tide Recedes, Clouds of Recession Loom

At the beginning of 2025, the U.S. financial market shifted from frenzy to unease. When Trump won the election last November, investors ignited a "Trump trade" frenzy, hoping that his tax cuts and deregulation policies would sustain economic prosperity, causing the stock market to soar. However, this wave of optimism quickly faded, replaced by concerns over a "Trump recession."

The Nasdaq index experienced its largest single-day drop since September 2022, with tech and bank stocks plummeting for consecutive days, and consumer spending willingness shrinking at the fastest rate in four years. AFP bluntly stated that the "honeymoon period" between the financial markets and Trump has ended. JPMorgan raised the probability of a recession this year from 30% to 40%, Goldman Sachs adjusted it from 15% to 20%, and the probability of a U.S. recession in 2025 on Polymarket also reached 40%.

The market began to question: Are Trump's policies pushing the U.S. economy toward the abyss? In this storm, everyone is asking: When will the Federal Reserve cut interest rates to pause this turmoil?

Tariffs and Layoffs: The Triggers of Recession?

Less than two months into Trump's presidency, his policies have already stirred waves. He revived the tariff weapon, proposing tax increases of 10% to 25% on Canada, Mexico, the EU, and even China, attempting to reverse trade imbalances and stimulate manufacturing to return.

At the same time, the "Department of Government Efficiency" led by Musk announced layoffs of 172,000 federal employees in February alone, the highest record for the same period since 2009, with the total number potentially exceeding 100,000 in the future. These measures have unsettled the market: rising corporate costs, emerging price pressures, and faltering consumer confidence.

The Atlanta Fed predicts that GDP growth will slow in the first quarter, and historical patterns show that since 1980, whenever the Federal Reserve raised interest rates above 5%, a crisis occurred within 2 to 4 years. We are currently in the risk window following the rate hikes of 2022.

On March 9, Trump stated, "This is a transitional period; we are doing great things." However, Nomura Securities strategists believe he may be intentionally creating a recession to slow economic growth and push for deflation. Barclays' latest forecast also reflects this trend, predicting that the Federal Reserve will cut rates by 25 basis points in June and September, a shift from the previous expectation of only one rate cut in June, possibly indicating deeper concerns about inflation and economic slowdown.

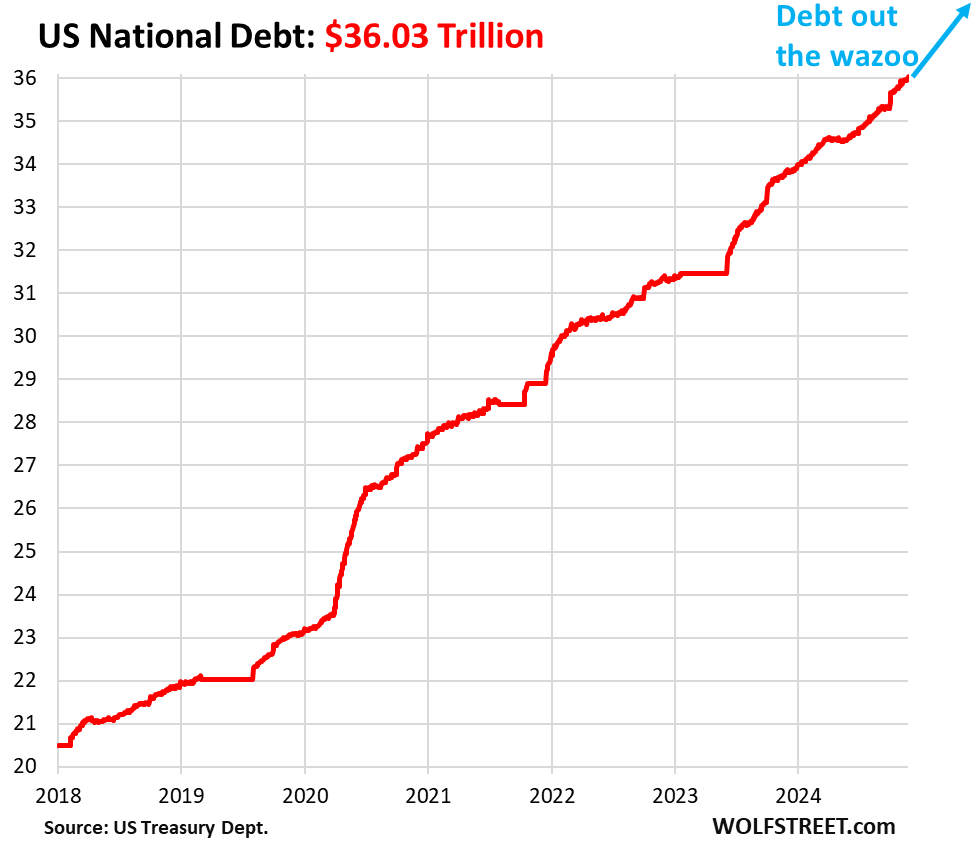

Debt Overhang and the Federal Reserve's Game

Trump's policies may be targeting deeper objectives. The U.S. federal debt has reached $36 trillion, with interest payments becoming a fiscal burden. According to estimates from the Congressional Budget Office, interest costs will reach $952 billion in fiscal year 2025, potentially soaring to $1.8 trillion in ten years. If the Federal Reserve cuts rates by 100 basis points, the government could save $300 to $400 billion in interest annually, a temptation that is hard for Trump to resist.

He has threatened to replace Federal Reserve Chairman Powell, and Musk appeared with him at the White House on March 11, frequently criticizing monetary policy while announcing layoff plans. Treasury Secretary Basant stated that the economy needs "detoxification" to break free from dependence on government spending, seemingly laying the groundwork for short-term pain.

Currently, the federal funds rate remains at 4.25%-4.5%. Powell stated earlier this month that inflation (CPI around 3%) has not yet dropped to 2%, and the economy remains resilient, so there is no rush to cut rates. However, cracks are appearing in the labor market, with total layoffs doubling in February. If the unemployment rate rises from 4% to 5%, the Federal Reserve may be forced to act. The market speculates that June could be the starting point for rate cuts, and Barclays' forecast further reinforces this expectation, suggesting that a September rate cut would be a follow-up response to economic slowdown.

The Cost of Transformation and Unknown Risks

Trump's ambitions may extend far beyond the immediate. His economic advisor, Stephen Miller, proposed that the U.S. needs to reshape the dollar system to escape the deficit drag of being a reserve currency. He envisions forcing China and the EU to sell off dollar assets and shift to long-term bonds through the "Mar-a-Lago Agreement," achieving dollar depreciation and stimulating manufacturing to return. If this plan comes to fruition, it would reshape the global trade landscape, but the prerequisite is that the economy must first "detox"—actively bursting bubbles and reducing leverage.

On March 11, Trump told a hundred corporate executives, "We must rebuild the nation." However, the cost of this transformation is high: a declining stock market, a weakening dollar, and even a short-term recession could all be necessary paths.

Harvard economist Lawrence Summers warned that the probability of recession is nearing 50%, and inflation could return to 2021 highs; British analyst Dario Perkins pointed out that a true recession is not a "purifier" but could leave lasting scars. If left unchecked, the Republican prospects for the midterm elections in 2026 will be overshadowed. From the "Trump trade" to the "Trump recession," the Federal Reserve's choices are crucial—whether the predicted rate cuts in June and September by Barclays will materialize depends on the evolution of inflation and employment data, and the success or failure of this gamble remains uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。