Source: Cointelegraph Original: "{title}"

Network economist Timothy Peterson stated that if historical trends repeat, Bitcoin (BTC) is expected to reach a new all-time high before June this year.

Data uploaded to the X platform on March 15 shows that Bitcoin's exchange rate against the US dollar (BTC/USD) has about two and a half months to break its historical record of $109,000.

Bitcoin price may rise 50% in April

After peaking in mid-January, Bitcoin has fallen by 30%. This decline is a typical characteristic of a bull market correction, and Peterson has keenly noticed its rebound potential.

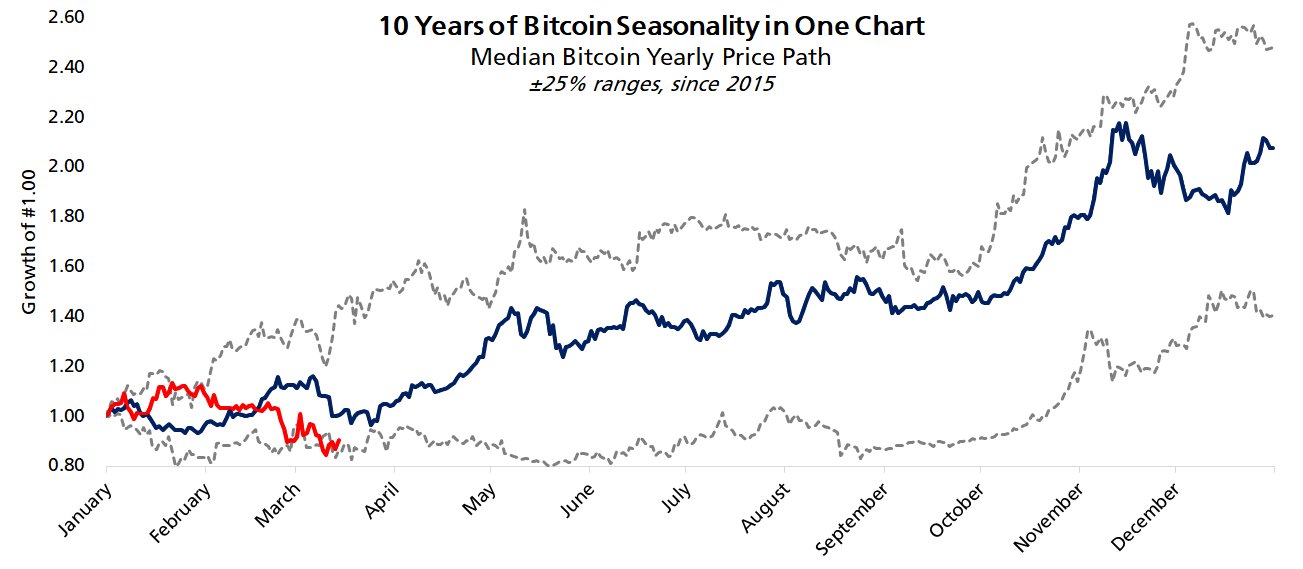

He analyzed next to a chart comparing Bitcoin price cycles: "Bitcoin's current trading price is close to the lower limit of its historical seasonal range."

"Bitcoin's gains throughout the year are concentrated in two months: April and October. It is entirely possible for Bitcoin to set a new all-time high before June."

Bitcoin seasonal comparison. Source: Timothy Peterson/X

Over the years, Peterson has created various Bitcoin price indicators. One of the indicators, "Lowest Price Forward," successfully identifies certain price levels that, once Bitcoin's exchange rate against the US dollar breaks these levels at a certain point, it will never fall below them again.

After rebounding from multi-year lows in March 2020, the "Lowest Price Forward" predicted that from September onwards, Bitcoin's price would never again fall below $10,000.

Meanwhile, as reported by Cointelegraph, a new possible bottom price level has emerged this year: $69,000, which has a "95% chance" of holding.

Peterson also set an intermediate target price of $126,000, with a deadline of June 1.

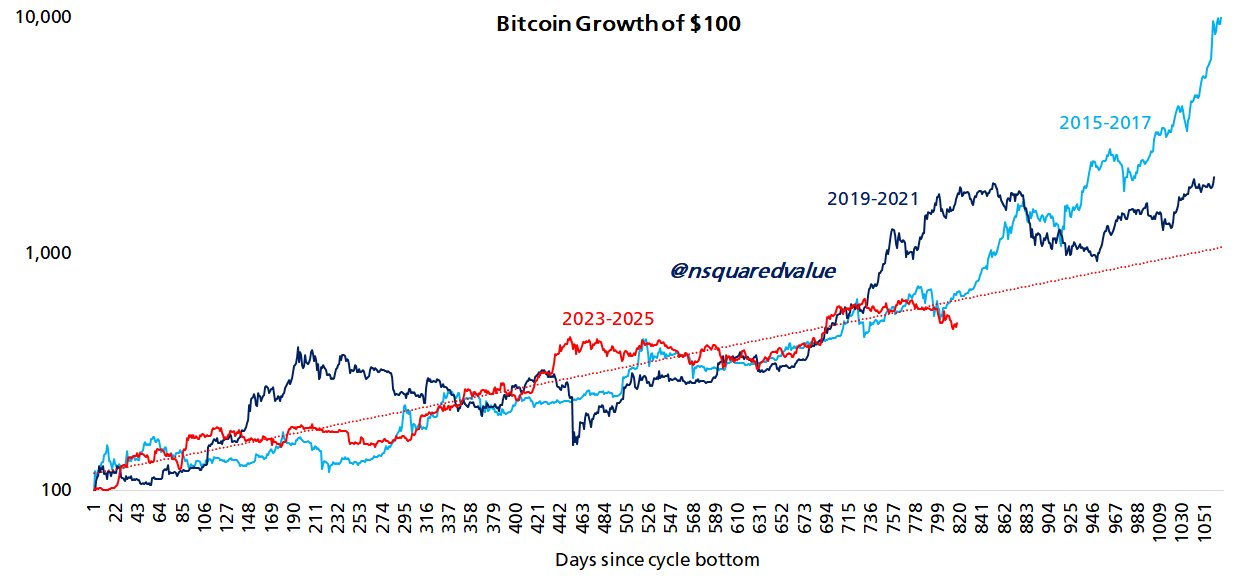

Next to a chart showing the performance of a $100 Bitcoin investment, he revealed that the weak performance of the bull market has always been temporary.

He explained: "The average duration of Bitcoin's price being below the trend line is 4 months."

"The red dashed trend line represents a price of $126,000 on June 1."

Comparison of $100 Bitcoin investment growth. Source: Timothy Peterson/X

Typical corrections in Bitcoin bull markets

Other well-known market commentators have continuously emphasized that Bitcoin's recent drop to $76,000 is a typical correction trend.

Renowned trader and analyst Rekt Capital wrote on the X platform in early March regarding this phenomenon: "Even without referencing Bitcoin's previous bull market trends, it is clear that corrections are part of the cycle."

Rekt Capital found that there have been what he calls five "significant corrections" in the current cycle from the beginning of 2023 to now.

One-week chart of Bitcoin against the US dollar. Source: Rekt Capital/X

Analysts from the cryptocurrency exchange Bitfinex told Cointelegraph this weekend that the current low marks a "washout," rather than the end of the current cycle.

This article does not contain investment advice or recommendations. Every investment and trading operation carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。