Source: Cointelegraph Original: "{title}"

Before a key week filled with important economic reports, a Bitcoin whale is betting hundreds of millions of dollars on a short-term decline in Bitcoin prices. These economic reports could significantly impact Bitcoin's trajectory and investors' risk appetite.

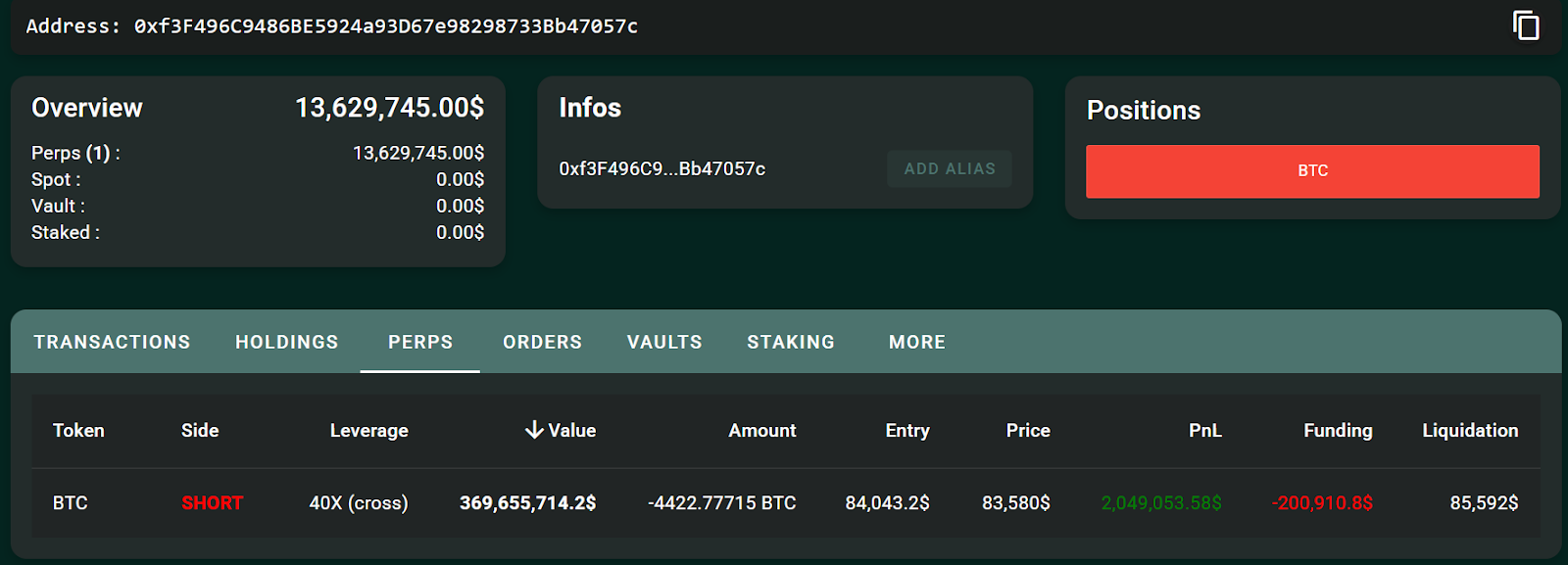

A large cryptocurrency investor, known as a "whale," has opened a short position with 40x leverage, involving over 4,442 Bitcoin (BTC), worth more than $368 million, effectively betting on a decline in Bitcoin prices.

Leverage positions use borrowed funds to amplify investment size, which can significantly increase returns but also lead to substantial losses, making leveraged trading riskier than regular investment positions.

This Bitcoin whale opened the $368 million position when Bitcoin was priced at $84,043. If the Bitcoin price exceeds $85,592, the position will face a forced liquidation.

Source: Hypurrscan

Data from Hypurrscan shows that this investor has generated over $2 million in unrealized profits; however, he has also incurred over $200,000 in losses on the funding costs of the position.

Despite the high risks of leveraged trading, some cryptocurrency investors are reaping substantial profits through this strategy. In early March, a savvy trader profited $68 million from a 50x leveraged short position as Ethereum (ETH) prices fell by 11%.

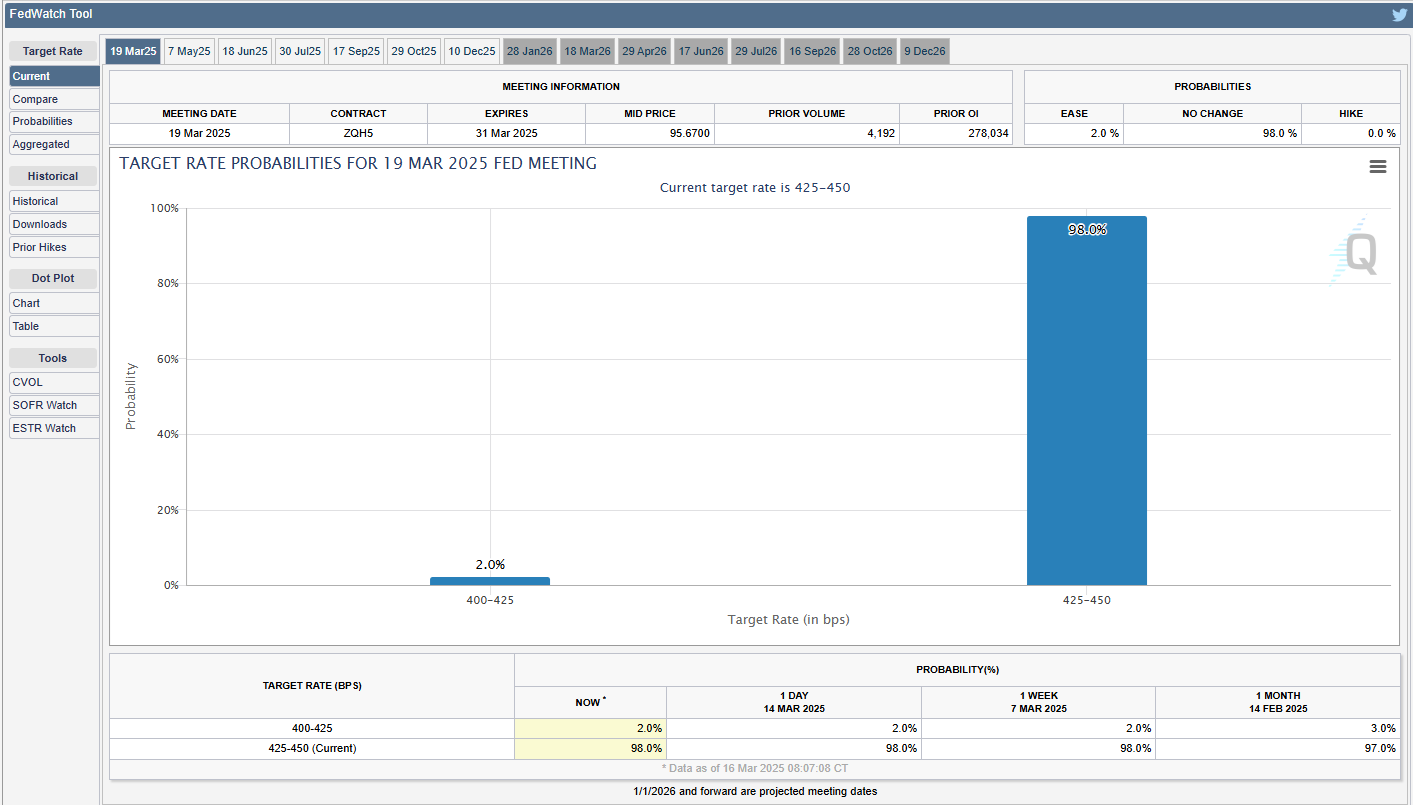

This leveraged bet comes just a week before the release of significant macroeconomic data, including the upcoming Federal Open Market Committee (FOMC) meeting on March 19, which could influence investors' interest in risk assets like Bitcoin.

Bitcoin needs a weekly closing price above $81,000 to avoid downward price movement before the FOMC meeting.

Due to increasing macroeconomic uncertainty surrounding global trade tariffs, Bitcoin prices still face the risk of significant downward volatility.

Ryan Lee, Chief Analyst at Bitget Research, stated that to avoid downward price volatility before the FOMC meeting, Bitcoin's weekly closing price needs to be above $81,000.

The analyst told Cointelegraph, "The key level to watch for the weekly closing price is the $81,000 range. If it can maintain above this level, it will indicate resilience, but if the price falls below $76,000, it could trigger more short-term selling pressure."

The analyst made these comments just days before the next FOMC meeting scheduled for March 19. According to the latest predictions from the CME Group's FedWatch tool, the market currently expects a 98% probability that the Federal Reserve will keep interest rates unchanged.

Source: CME Group's FedWatch tool

The analyst added, "The market largely expects the Federal Reserve to maintain interest rates, but any unexpected hawkish signals could put pressure on Bitcoin and other risk assets."

Related: Research shows: Panic selling of Bitcoin led to $100 million loss for new investors in 6 weeks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。