1. Market Observation

Keywords: FOMC, ETH, BTC

Bitcoin closed last week with a bullish candle, rebounding nearly 10 points from a low of $76,600. Markus Thielen, founder of 10x Research, stated that it is currently difficult to determine whether Bitcoin will regain an upward trend in the short term, suggesting to close short positions at this stage. He pointed out that Bitcoin may need to undergo a consolidation period of up to 8 months. The market is currently in a wait-and-see mode, with the ETF market lacking "buying the dip" momentum. Most ETF capital inflows are driven by arbitrage-focused hedge funds, while persistently low funding rates also suppress the willingness to deploy further capital.

Bitfinex analysts believe the current adjustment is a normal "washout" behavior. Although several technical indicators have turned bearish, Bitcoin's four-year cycle remains an important factor influencing its price. Due to Bitcoin's high correlation with traditional financial markets, its movements may need to sync with the stock market (especially the S&P 500) to find a bottom. He noted that the $72,000 to $73,000 range constitutes a key support zone, but Bitcoin's next movements will primarily be dominated by macro factors such as global government bond yields and stock market trends. Although the impact of the trade war has been somewhat digested by the market, ongoing economic pressures may further dampen market sentiment. Notably, network economist Timothy Peterson predicts, based on historical seasonal patterns, that Bitcoin is expected to reach a new high before June, with a median target price of $126,000.

Economist Peter Schiff warned that a 12% drop in the Nasdaq index could signal a larger decline for Bitcoin. He analyzed that if the Nasdaq enters a bear market and drops 40%, Bitcoin's price could fall to $20,000. In contrast, gold has shown a negative correlation with the Nasdaq, rising 13% since December 16, 2023.

In terms of market dynamics, a recent poll by Data For Progress shows that 51% of American voters oppose the government including cryptocurrencies in its strategic reserves. Meanwhile, the number of Bitcoins held by the hacker group Lazarus Group has reached 13,562, making North Korea the third-largest Bitcoin-holding national entity in the world. On the other hand, Binance founder Changpeng Zhao's weekend purchase of TST and mubarak with BNB may lead to a recovery in BNB chain market activity. GMGN data shows that in the past 24 hours, seven meme coin projects have exceeded a market cap of $1 million, with mubarak's market cap rising to nearly $150 million.

From March 17 to 23, major global central banks will welcome the highly anticipated "Super Week," with several central banks, including the Federal Reserve, Bank of Japan, and Bank of England, holding monetary policy meetings. The market generally expects central banks to maintain interest rates, but investors need to closely monitor the central banks' assessments of the economic outlook. Especially in the context of uncertainty surrounding Trump's trade policies, the central banks' stance may significantly impact market sentiment.

2. Key Data (as of March 17, 13:30 HKT)

Bitcoin: $83,149.42 (Year-to-date -11.15%), Daily Spot Trading Volume $24.523 billion

Ethereum: $1,895.97 (Year-to-date -43.22%), Daily Spot Trading Volume $10.533 billion

Fear and Greed Index: 32 (Fear)

Average GAS: BTC 2 sat/vB, ETH 0.48 Gwei

Market Share: BTC 60.77%, ETH 8.4%

Upbit 24-hour Trading Volume Ranking: XRP, AUCTION, BTC, STMX, VANA

24-hour BTC Long/Short Ratio: 0.998

Sector Performance: The crypto market sector generally declined, with the CeFi sector up 2.71% and the RWA sector up 0.72%

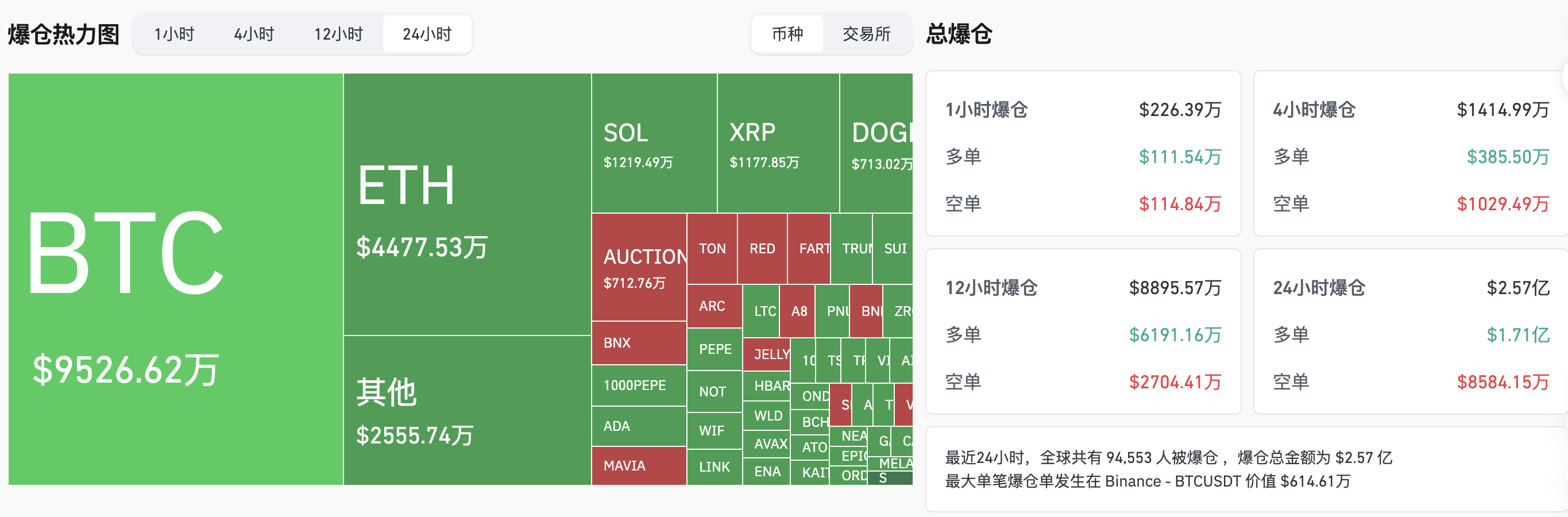

24-hour Liquidation Data: A total of 94,553 people were liquidated globally, with a total liquidation amount of $257 million, including $95.26 million in BTC and $44.77 million in ETH.

3. ETF Flows (as of March 14 EST)

Bitcoin ETF: -$68.41 million

Ethereum ETF: -$35.30 million

4. Important Dates (Hong Kong Time)

NVIDIA holds GTC conference until March 21. (March 17)

U.S. February Retail Sales Month-on-Month (March 17, 20:30)

- Actual: Not released / Previous: -0.90% / Expected: 0.6%

Bank of Japan's target interest rate until March 19. (March 19)

NVIDIA CEO Jensen Huang delivers keynote speech. (March 19, 01:00)

U.S. EIA Crude Oil Inventory (in 10,000 barrels) for the week ending March 14. (March 19, 22:30)

- Actual: Not released / Previous: 144.8 / Expected: Not released

Federal Reserve FOMC announces interest rate decision and economic outlook summary. (March 20, 02:00)

U.S. Federal Reserve interest rate decision (upper limit) for the week ending March 19. (March 20, 02:00)

- Actual: Not released / Previous: 4.50% / Expected: 4.5%

Federal Reserve Chairman Jerome Powell holds a monetary policy press conference. (March 20, 02:30)

Bank of England interest rate decision until March 20. (March 20, 20:00)

- Actual: Not released / Previous: 4.50% / Expected: 4.5%

U.S. Initial Jobless Claims for the week ending March 15 (in 10,000) (March 20, 20:30)

- Actual: Not released / Previous: 22 / Expected: 22.5

5. Hot News

Golden Ten: Rumors in the Crypto Circle Suggest Trump May Use Sovereign Fund to Buy Bitcoin

U.S. Treasury Secretary: No Guarantee the U.S. Won't Fall into Recession

Analyst: Bull Market May Return in June, Bitcoin Median Target Price Expected to Reach $126,000

CZ Appears to Respond to Purchase of TST and mubarak: Testing Something Over the Weekend

Address Belonging to DFG Founder Has Accumulated $18.68 Million in UNI and MKR

Pakistan Establishes Cryptocurrency Committee to Regulate Blockchain and Digital Assets

Trump Family Crypto Project WLFI Purchased $2 Million of AVAX and MNT Two Hours Ago

Cumulative Net Inflows of U.S. Spot Bitcoin ETF Have Dropped to Lowest Level Since January 2

Telegram Founder Pavel Durov Granted Permission to Leave France for Dubai, TON Rises 20%

Binance Alpha Launches mubarak

10x Research: Bitcoin "Very Likely" to Consolidate Again for 8 Months

Base Ecosystem Game Project Henlo Kart Experiences Contract Vulnerability, HENLO Token Drops 96.5%

"Crypto Tsar" David Sacks Sold Over $200 Million in Digital Assets Before Taking Office

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。