Source: Cointelegraph Original: "{title}"

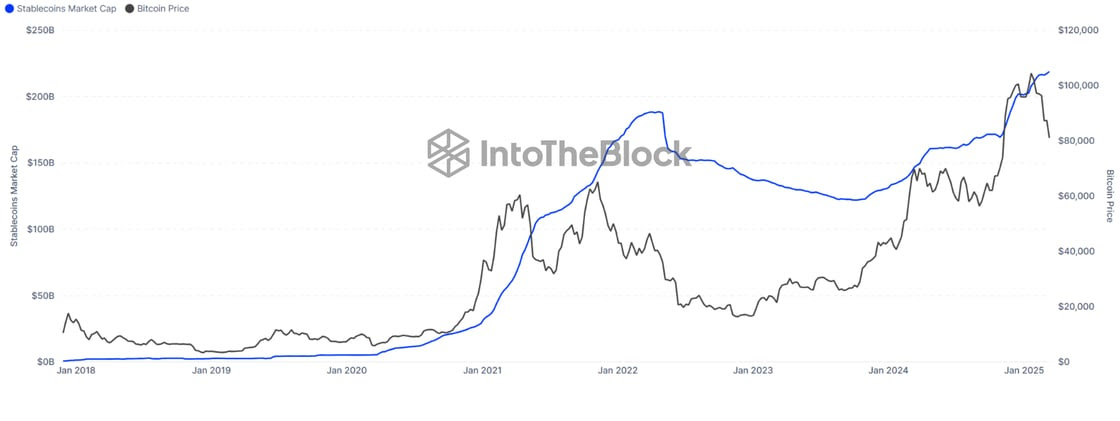

Based on the steady growth of stablecoin supply, the current pullback in the cryptocurrency market is merely in the mid-stage of a bull market cycle, not at the top. Analysts believe that the increase in stablecoin supply may indicate that more investment is flowing in.

The cumulative supply of stablecoins has exceeded $219 billion, indicating that the current market cycle is still far from its peak.

Source: IntoTheBlock

The crypto intelligence platform IntoTheBlock pointed out in a post on X on March 14 that historically, the peak times for stablecoin supply often coincide with the peaks of cryptocurrency market cycles. The platform stated, "In April 2022, the stablecoin supply reached $187 billion, just as the bear market was beginning. Now, its supply has reached $219 billion and is still growing, suggesting that we are likely still in the mid-stage of the market cycle."

The increase in stablecoins flowing into cryptocurrency exchanges may signal upcoming buying pressure and growing investor demand, as stablecoins are the primary channel for investors to enter the cryptocurrency world from fiat currency.

Nevertheless, the price of Ethereum (ETH) has dropped over 52% in the past three months after peaking above $4,100 on December 16, 2024. Analysts expect its price to fall again below $1,900, which is a "strong" demand zone that could attract more investment into the world's largest cryptocurrency.

Analysts say: The cryptocurrency market may lack clear direction ahead of the Federal Open Market Committee meeting.

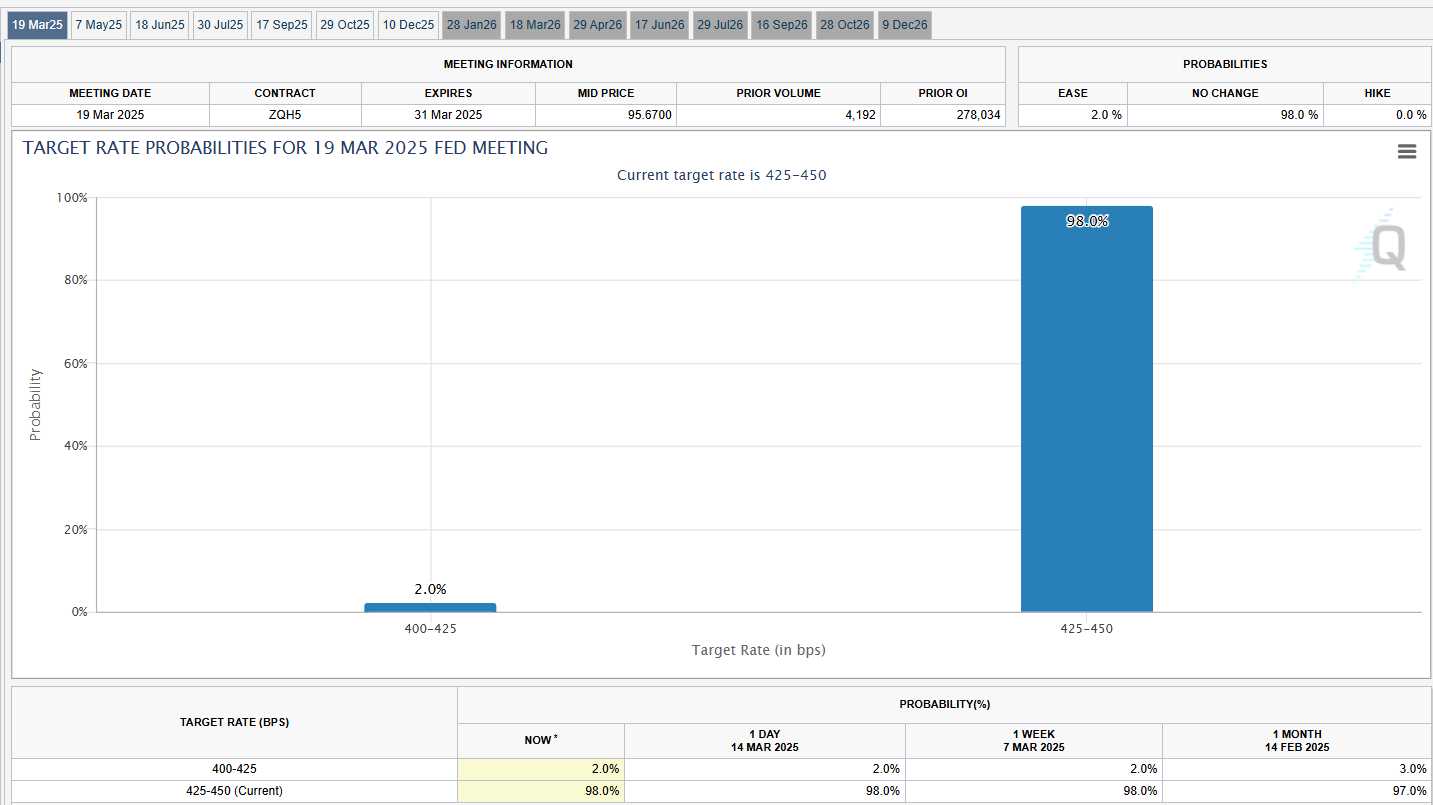

Despite the increase in stablecoin supply, the cryptocurrency market may still lack a clear trend direction ahead of next week's Federal Open Market Committee (FOMC) meeting.

Stella Zlatareva, a special editor at Nexo digital asset investment platform, stated that next week's FOMC meeting could be decisive for the cryptocurrency market, as it remains influenced by macroeconomic developments.

Zlatareva told Cointelegraph, "Bitcoin's movement below key technical levels resembles the trajectory of the S&P 500, highlighting the cautious tone in the market as traders await key economic data for direction, including U.S. retail sales data and the outcome of the FOMC meeting."

She added, "All eyes are on the FOMC meeting next Wednesday, with expectations to gain insights into U.S. monetary policy and potential interest rate adjustments, especially considering the recent decline in the U.S. Producer Price Index (PPI) and the drop in initial jobless claims, which indicate that the U.S. economy is slowing down."

These predictions were made just days before the next FOMC meeting scheduled for March 19. According to the latest estimates from the CME Group's FedWatch tool, the market currently sees a 98% probability that the Federal Reserve will keep interest rates unchanged.

Source: CME Group's FedWatch tool

Despite potential volatility in the short term, investors remain optimistic about the remainder of 2025. VanEck predicts that the cyclical peak price of Ethereum will reach $6,000, while Bitcoin's price will reach $180,000.

Related: U.S. Senate Banking Committee Advances the "GENIUS Stablecoin Act"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。