Author: shushu, BlockBeats

On March 17, OKX officially announced that it has proactively decided to temporarily suspend its DEX aggregator service after discussions with regulatory authorities. As a result, related limit orders and cross-chain orders will be automatically canceled. OKX stated that the specific recovery time will depend on the progress of the upgrade, and during this period, users can still trade by switching to third-party protocols, while other services of the OKX Web3 wallet will not be affected.

According to community feedback, some trading bots connected to the OKX DEX API experienced occasional failures in EVM series (BSC, ETH) trading.

At the same time, Binance Wallet announced that all transactions in the Binance Web3 wallet will enjoy zero transaction fees for the next six months. Clearly, a silent war over on-chain products of trading platforms has begun.

Tightening of European Crypto Regulations

The suspension of OKX DEX services coincides with its Web3 services being scrutinized by EU regulatory authorities.

On March 11, Bloomberg reported that informed sources said European cryptocurrency regulators are reviewing the usage of a service provided by the cryptocurrency exchange OKX, which was exploited by hackers to launder $1.5 billion stolen from the trading platform Bybit. These individuals requested anonymity as the review process is confidential. They stated that national regulators from the 27 EU member states discussed this issue at a meeting hosted by the European Securities and Markets Authority's Digital Finance Standing Committee on March 6.

Subsequently, OKX responded to Bloomberg, stating that the report is misleading, emphasizing that it provides self-custody wallet services/exchange functions as an aggregator aimed at creating efficiency for users, and stressed that its Web3 wallet services are no different from those offered by other industry participants. OKX also revealed that after Bybit was hacked, it took measures to freeze the relevant funds entering CEX and developed new features to prevent hacker addresses from using its DEX or wallet services.

OKX firmly stated that it is not under investigation, claiming that the incident is merely a case of Bybit's lack of security knowledge, and in today's announcement regarding the suspension of DEX services, this possibility was expressed as "due to service upgrades."

The regulatory pressure faced by OKX is not unfounded; globally, the cryptocurrency industry is facing an increasingly stringent regulatory environment. On March 17, François Villeroy, the Governor of the French Central Bank, publicly stated that the U.S. embrace of cryptocurrencies could trigger another financial crisis, pointing out that "financial crises often start in the U.S. and then spread to the rest of the world. By encouraging cryptocurrencies and non-bank finance, the U.S. government is laying the groundwork for future turmoil."

On the same day, European Central Bank Governing Council member Villeroy, in an interview with the French newspaper Le Journal du Dimanche, stated, "By encouraging the development of crypto assets and non-bank finance, the U.S. government is sowing the seeds of future turmoil."

It can be said that the atmosphere of crypto regulation in Europe has always been high-pressure. Currently, only OKX and Crypto.com have obtained EU licenses under the Markets in Crypto-Assets Regulation (MiCA), both in Malta, while many exchanges, including Binance, Bybit, and Kraken, are still in the application process.

Arrest of Tornado Cash Founder, Dismissal of Thorchain Head, Ongoing Struggle Between DeFi and Regulation

The investigation of OKX due to the fund transfer by the Bybit hacker is reminiscent of previous situations involving Tornado Cash and Thorchain facing regulatory pressure for money laundering and fund transfers by hackers.

In April 2023, the U.S. Treasury Department released an assessment report on illegal financial activities in DeFi, revealing potential risks in DeFi services and analyzing how illicit actors exploit these services for criminal activities. Three months later, four U.S. senators proposed the "Crypto Asset National Security Enhancement and Enforcement Act," aimed at strengthening regulation in KYC, AML, and the DeFi sector.

The "Crypto Asset National Security Enhancement and Enforcement Act" provides a new framework for regulating DeFi, requiring that DeFi be regulated similarly to other cryptocurrency entities, mandating that any "person" who can control the project must be held accountable for it. The bill may state that if no specific person can control the DeFi service, any investor who invests more than $250,000 in the project should be held responsible.

In August 2023, the U.S. Treasury's Office of Foreign Assets Control imposed sanctions on Roman Semenov, one of the founders of the Tornado Cash cryptocurrency mixer, citing that he provided substantial support to the state-sponsored hacking group Lazarus Group, concealing hundreds of millions of dollars in cryptocurrency theft. In May 2024, a Dutch court ruled that Alexey Pertsev was guilty of money laundering and sentenced him to 64 months in prison.

The Bybit hack not only affected OKX DEX but also another DeFi protocol, THORChain. The primary method of laundering by the Bybit hacker was to exchange ETH for BTC through THORChain, which brought a massive volume of transactions and fees to THORChain. On February 27, according to monitoring by Ember, the Bybit hacker's laundering activities had generated $2.91 billion in transaction volume and $3 million in fee income for THORChain in a short period.

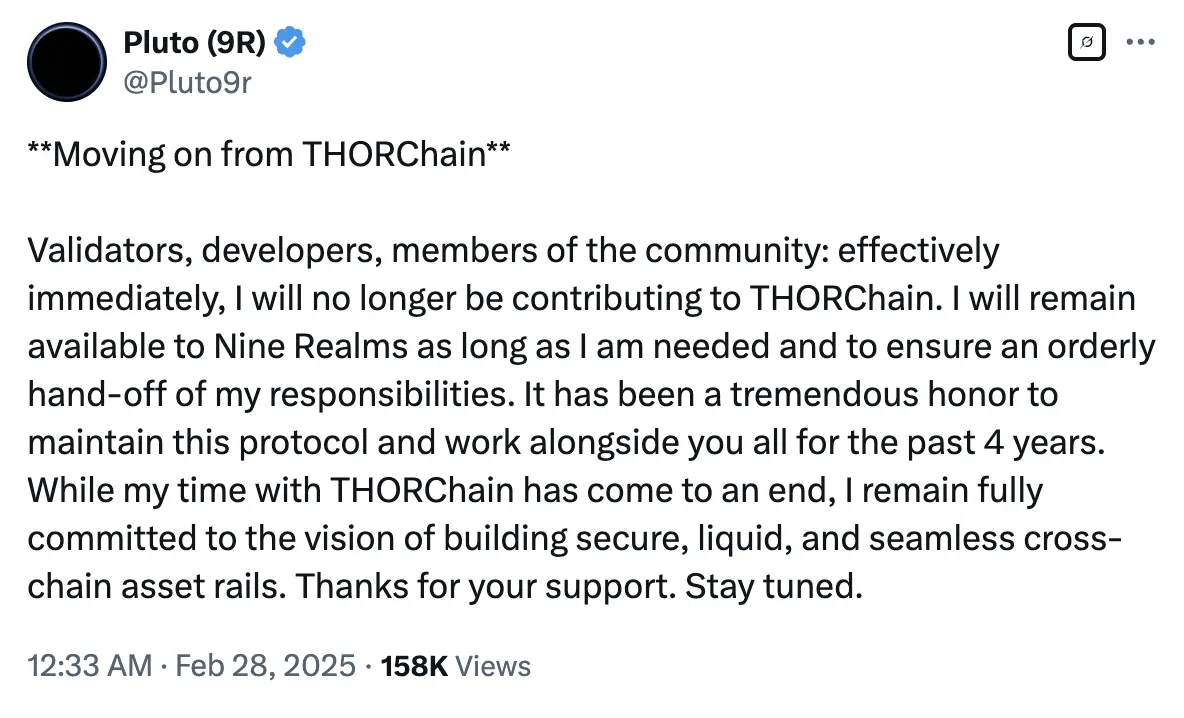

On February 28, THORChain's chief developer Pluto announced his resignation, and it is difficult to say that this is unrelated to the hacker's use of THORChain to transfer funds. This also aligns with the "Crypto Asset National Security Enhancement and Enforcement Act," which advocates that any "person" who can control the project must be held accountable.

These cases related to protocols and regulation bring us back to the classic question—if a person uses a kitchen knife to harm someone, is the seller of the knife guilty?

Previously, Wang Xin, the founder of Qvod, who was arrested for becoming a platform for disseminating obscene content, appeared on BlockBeats Space, stating that as a product receives more and more attention, the social responsibility of developers increases. He believes that developers should proactively embrace regulation and establish preventive mechanisms in advance. The "kitchen knife theory" and "match theory" seem to defend developers, proposing a relatively more neutral "automobile theory."

The automobile industry has developed for many years, with the earliest users limited to race car drivers and enthusiasts, where speed was the primary competition. However, today, cars have entered households, and car manufacturers have done much more than just improve speed. For example, safety; cars cannot go too fast. From the perspective of engine performance, cars can reach speeds of over 300 km/h, but in reality, many cars cannot achieve this. Manufacturers impose these limitations to prevent accidents from street racing. The "automobile theory" is closer to reality; developers need to design in advance and embrace regulation to solve more real-world problems.

Perhaps from this perspective, we can understand OKX's choice to suspend DEX operations and upgrade services.

What Does the Community Think?

As the currently most active wallet entry with the largest number of on-chain users, the suspension of OKX DEX services has sparked widespread discussion in the community.

Some believe that licenses are not a one-time solution and that there will still be significant compliance pressure to continue adhering to licensed regulations, and there may be a possibility of separating Web3 business under the MiCA license in the future. Meanwhile, regarding licenses, some crypto enthusiasts pointed out that obtaining a license only indicates two certainties: 1. You are willing to accept regulation; 2. Your compliance costs have significantly increased.

According to insiders, major trading platforms are currently rectifying regulatory issues, mainly including splitting trading platform wallets into independent apps; wallet apps no longer include DEX and cross-chain functions, and no longer provide CeDeFi or other official financial products; the issuing and operating entities are completely isolated from the trading platform.

After Trump took office, his pro-crypto government successively withdrew previous SEC lawsuits against crypto companies like Coinbase, Uniswap, and Ripple, and the U.S. crypto regulatory environment once became a stimulant for market sentiment. Therefore, the community optimistically believes that the EU's regulatory actions against OKX will also relax.

Additionally, the community speculates that the most likely scenario is the separation of OKX DEX and CEX businesses, and following the example of Binance Web3 wallet to implement user KYC, which would be a strategy under the pursuit of compliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。