Trading Philosophy: Look at the trend in the long term, find entry points in the short term;

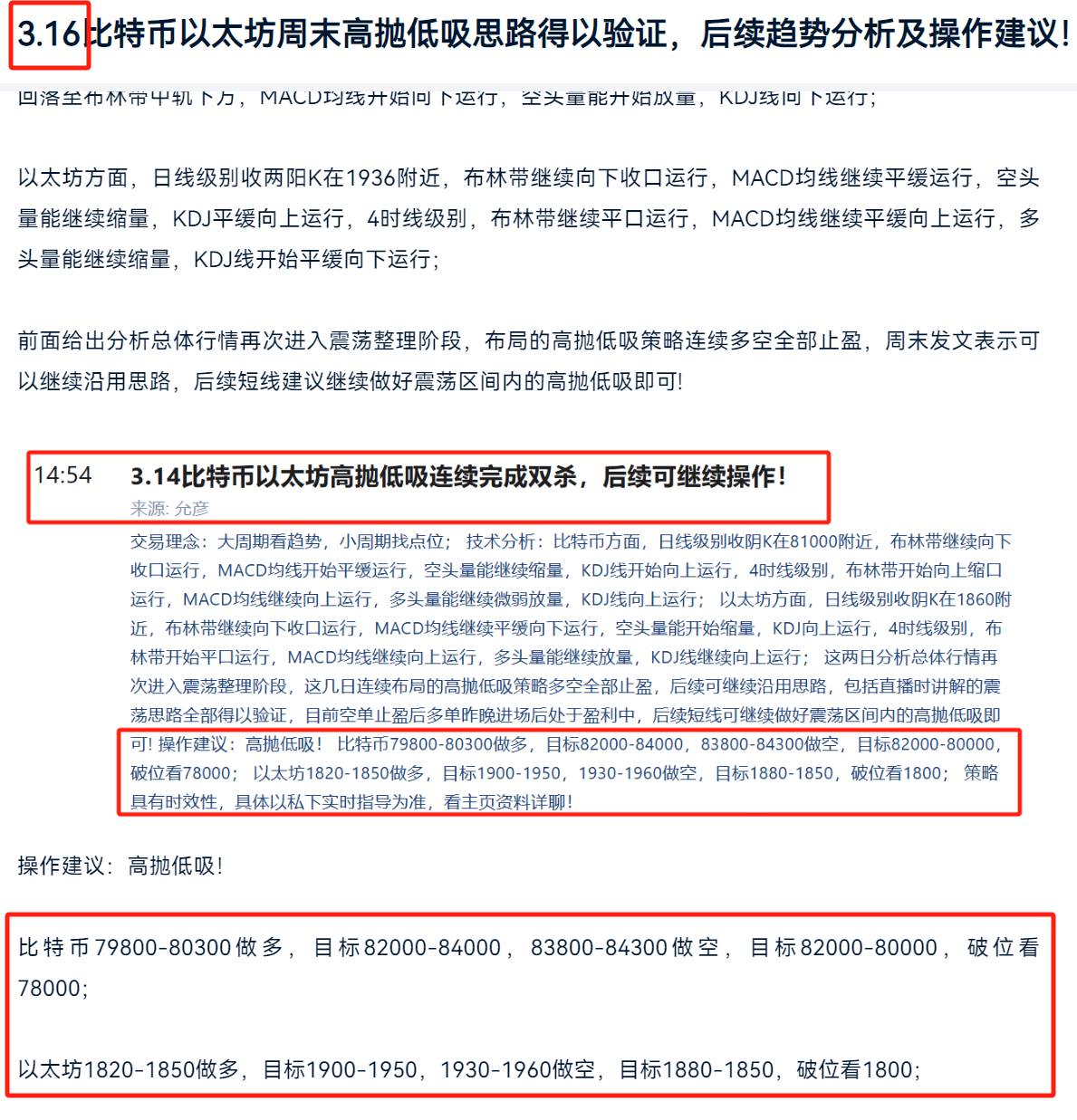

Technical Analysis: For Bitcoin, the daily level has a bearish candle closing around 82500, the Bollinger Bands continue to contract downwards, the MACD moving average starts to move upwards, bullish volume begins to increase, and the KDJ line starts to move upwards. At the 4-hour level, the Bollinger Bands continue to contract, the MACD moving average starts to flatten and move downwards, bearish volume begins to decrease, and the KDJ line moves upwards;

For Ethereum, the daily level has a bearish candle closing around 1860, the Bollinger Bands continue to contract downwards, the MACD moving average starts to move upwards, bullish volume begins to show, and the KDJ line starts to flatten and move upwards. At the 4-hour level, the Bollinger Bands continue to run flat, the MACD moving average continues to flatten and move upwards, bullish volume continues to slightly increase, and the KDJ line starts to move upwards;

The previous analysis indicates that the overall market has entered a phase of consolidation again, with the high sell and low buy strategy achieving profits for both long and short positions. The weekend article suggests that this approach can continue to be used, and for the short term, it is recommended to only take high short positions, and those entering short positions can patiently hold and wait for a decline!

Operational Advice: High sell and low buy!

Short Bitcoin at 83800-84300, target 82000-80000, if broken look at 78000;

Short Ethereum at 1930-1960, target 1880-1850, if broken look at 1800;

The strategy is time-sensitive, please refer to private real-time guidance for specifics!

Scan the QR code below to follow our WeChat public account for more real-time market updates!

Disclaimer: This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and the author are unrelated to this platform. If any articles or images published on the webpage involve infringement, please provide relevant proof of rights and identification and send an email to support@aicoin.com, and the relevant staff of this platform will conduct verification.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。