A high tolerance for disorder and uncertainty essentially allows everything to happen. Believe that things will resolve themselves in time, adjust your inner state to one that has the space to process and endure, let the bullets fly for a while, and you will achieve a satisfactory outcome.

Hello everyone, as long as the market is here, so am I! I am trader Gege. Continuing from the last article, the recent market has entered a phase of continuous fluctuations. I mentioned in my previous article that we should not expect a significant one-sided rise for the time being and should rationally deal with the large range of fluctuating markets. A series of actions taken since Trump took office have amplified uncertainty infinitely, leading to institutions fleeing and continuous outflows from ETFs, with no new external funds entering the market. Poor liquidity has made the current situation normal. Once the adjustment is complete, new incremental funds will naturally enter the market, so we should face the market with a positive and optimistic attitude. Whether it is a one-sided trend, fluctuations, or a slow decline, they are all parts of the overall market and are indispensable.

There is no perpetual rise, no perpetual decline, and no eternal existence. Regarding Bitcoin, I believe the bull market has not ended. My bullish stance is based on the technical guidance from historical cyclical trends and my personal reflections after experiencing several bull and bear markets, which also has a bit of a "carving the boat to seek the sword" meaning. History is always remarkably similar but does not simply repeat itself. After the recent washout and adjustment, many bloggers are viewing it as the beginning of a bear market, and even some bullish bloggers are slowly shifting their thinking. Thinking in reverse, perhaps this is the purpose of the washout adjustment, right?

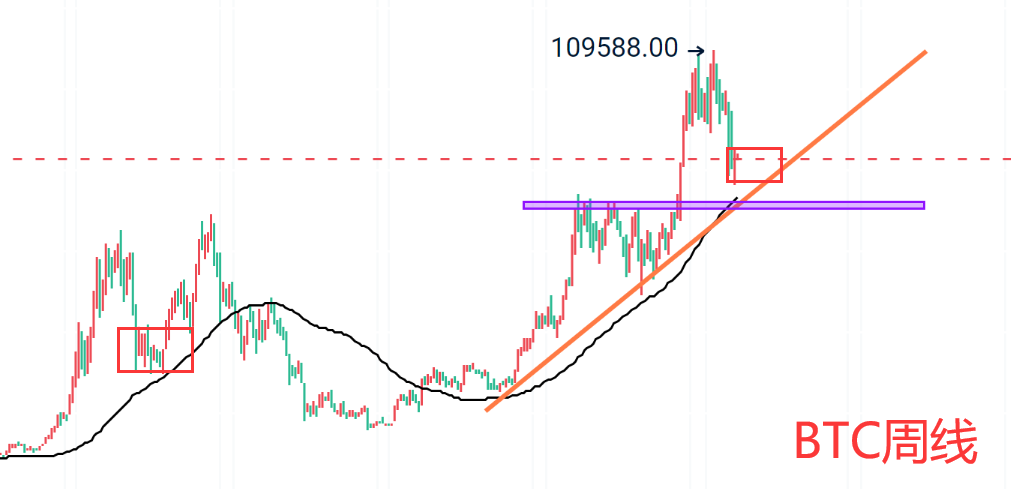

Of course, what I am saying is just my personal understanding. Setting aside market sentiment and news, let’s talk about the large cycle from a technical perspective. The weekly candlestick chart has formed a top head-and-shoulders pattern, including the MACD's double line death cross, indicating feedback from these indicators. It is understandable that some bloggers see the beginning of a bear market in the large cycle; this is also a "carving the boat to seek the sword" perspective, right?

So, what is my understanding? We can look at the trend after May 19, 2021, which was also a large-scale retracement adjustment, followed by another surge in the bull market. The same MACD double line death cross, the same not breaking below MA60, and the same not breaking below the previous bull market high. Therefore, my prediction comes from these multiple similarities in historical trends. I defined the boundary line between bull and bear markets as the price range of 70,000-69,000. As long as the bull market exists, the washout will not break this boundary. New friends can review my previous articles.

The weekly upward trend line has not been broken, MA60 has not been broken, and the 2021 high has not been broken. This is the reason I believe the bull market is still intact, and there is at least one more round of a crazy bull market. As for the MACD double line death cross, it still needs further diffusion, but the fluctuating adjustment will also allow it to recover. If the market fluctuates around the MA60 and MA30 range for a while longer, the death cross can be corrected.

Some may say that this bull market is different, and I am "carving the boat to seek the sword." Well, predicting the large cycle in advance is like digging a pipeline in advance. Instead of "carving the boat to seek the sword," what should we refer to? The future is unknown, and we can only estimate it through historical cyclical trends; otherwise, what is the difference from a blind person touching an elephant?

Today's article is to recharge the faith of friends who believe in the bull market and are steadfast bulls. The above is my personal reflection and sharing, not constituting specific operational advice. Friends on the same frequency can refer to it; if not, just consider it as not having seen it. If the key points mentioned above are broken, it is not too late to look at the bear market. Trend players can wait for the market adjustment to end and then make new plans. For short-term trading, finding the right support and resistance can allow participation in both long and short positions without any impact.

Thank you for reading the article. Today's article does not contain specific operational advice or points; I will update tomorrow. Good night!

The suggestions are for reference only. Please manage your risk when entering the market, and grasp the profit and stop-loss space yourself. Specific strategies should be based on real-time conditions, and you can consult for advice.

Alright, friends, we will say goodbye until next time. I wish everyone continued success in the cryptocurrency world! More real-time advice will be sent internally. Today's brief update ends here. For more real-time advice, find Gege.

Written by: I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。