During the Asian trading session on Tuesday, spot gold once again broke through the key $3000 mark, reaching a historic high of $3028. As a traditional safe-haven asset, gold prices have set 14 historical highs since Trump took office in January, driven by escalating global trade tensions and strong safe-haven buying. After a cumulative increase of 27% in 2024, gold has risen over 15.19% so far this year.

Escalating Trade Concerns and Soaring Safe-Haven Demand

Tariff policies are one of the driving factors behind the recent surge in gold prices. The unpredictable trade policies of the United States have made gold a favored asset for investors amid geopolitical and economic turmoil.

Since the beginning of this year, the U.S. has continuously imposed tariffs on major trading partners such as China, Mexico, and Canada, and has levied a 25% tariff on all steel and aluminum imported into the U.S. The U.S. government's "tariff stick" has provoked a fierce backlash in global trade policies. The European Commission stated on the 12th that a "strong counterattack" has become the only "cure," and starting next month, tariffs will be imposed on U.S. goods worth €26 billion. Canada has responded even more swiftly, announcing retaliatory tariffs on U.S. goods worth CAD 29.8 billion starting March 13.

There are no winners in a trade war; the global economy is the first to suffer, increasing vulnerability and darkening economic prospects. Global stock markets have plummeted, and market participants have turned to seek safe-haven assets, making gold the preferred choice for capital inflow.

At the same time, Trump has used tariff threats as a bargaining chip, and his erratic policy actions and statements have continuously eroded global market confidence. The market is not afraid of bad news but dislikes uncertainty. The upward trend in gold prices this year closely aligns with the timing of escalating trade conflicts, highlighting the direct impact of tariff policy uncertainty on gold prices.

Growing Concerns Over U.S. Recession and Eroding Market Confidence

The weakening momentum of U.S. economic growth has also provided upward momentum for gold. Data released by the U.S. Department of Commerce on Monday showed that U.S. retail sales in February fell far short of expectations, adding to signals that consumers are reducing spending, deepening market concerns over a slowdown in consumer spending. Previous data indicated that the U.S. consumer confidence index has declined for three consecutive months. For the crucial services sector of the U.S. economy, last week's preliminary February services PMI was reported at 49.7, which not only fell short of market expectations but also dropped below the expansion threshold, marking the first contraction since January 2023 and signaling a bleaker economic outlook.

Meanwhile, the trade war has further raised inflation expectations by pushing up the prices of imported goods, while the U.S. government's layoff plans, which have resulted in the dismissal of tens of thousands of federal workers, have intensified market concerns about economic growth prospects. Investors have developed a "heightened sense of risk" regarding U.S. stocks, leading to a concentration of funds in gold.

Support from Safe-Haven Demand and Interest Rate Cuts, Gold Prices Expected to Continue Rising

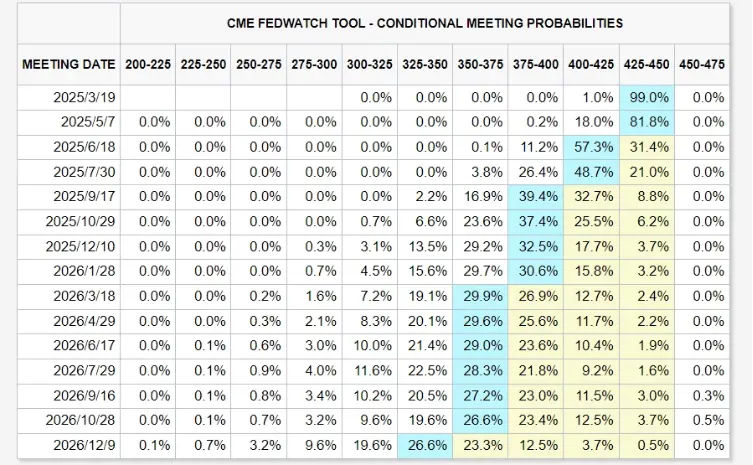

The U.S. economy is facing a "triple blow" from tariffs, government layoffs, and consumer tightening, shaking the confidence of businesses, consumers, and workers, and increasing the risk of recession. The market generally expects the Federal Reserve to implement multiple interest rate cuts in 2025 to stimulate economic growth, with the latest FedWatch predictions indicating that the next rate cut may come as early as June. Expectations of liquidity easing and a declining U.S. dollar index will support a rise in gold prices.

Additionally, since the Russia-Ukraine conflict, the West has frozen Russian central bank assets, and central banks around the world have begun to intentionally move away from dollar reserves, shifting their focus to gold. Demand for gold purchases from central banks has continued to grow, surpassing 1,000 tons for three consecutive years.

Various signs indicate that the gold market is entering a new cycle dominated by risk premiums, with many market institutions generally expecting that strong buying power may drive gold prices to continue rising in the medium to long term.

4E, as the global partner of the Argentine national team, provides investors with convenient and flexible gold trading options. Through 4E, investors can enjoy up to 500 times leverage for both long and short positions, trading with just USDT, and opening positions with as little as under 6 USDT. Additionally, 4E supports trading in cryptocurrencies, foreign exchange, U.S. stocks, indices, oil, silver, and other commodities, with over 600 asset trading pairs, offering investors broad opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。