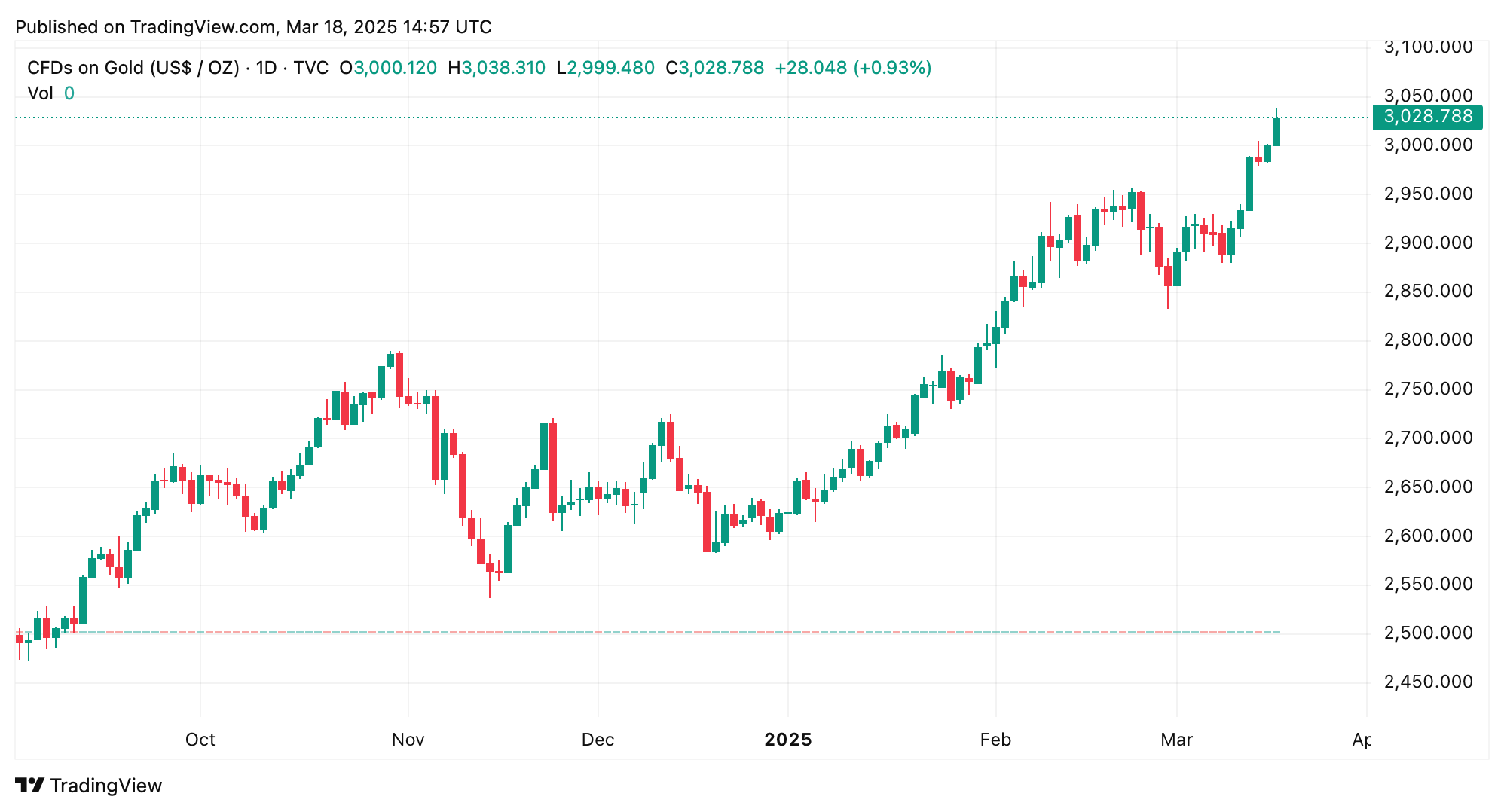

On Tuesday, at 10:30 a.m. ET, the lustrous allure of .999 fine gold commanded $3,028 per ounce in spot trading—a figure shimmering near its historic lifetime peak. Over the past half-year, the precious metal has embarked on a meteoric rise, vaulting 18.32% against the dollar and momentarily breaching the $3,038-per-ounce threshold earlier today.

Gold price on March 18, 2025.

April futures, meanwhile, gleamed even brighter, eclipsing $3,047 per ounce as speculators wagered on continued momentum. Not to be outshone, silver danced around at $34 per ounce Tuesday, its own six-month trajectory glittering with a 13% climb.

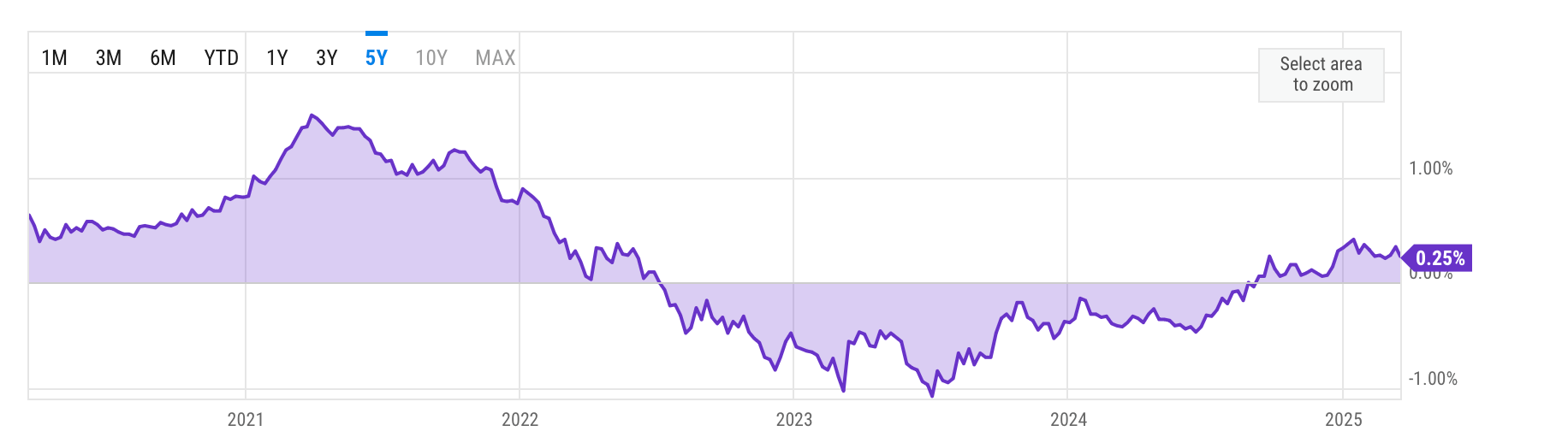

Long before Trump’s return to office, gold and silver commenced their stratospheric climb, coinciding precisely with Western nations tightening sanctions on Russia. The U.S. dollar, meanwhile, has charted a mercurial path.

Trump’s November 2024 electoral victory initially electrified the greenback, propelling it skyward on anticipations of aggressive tariffs and muscular domestic economic output. The U.S. Dollar Index (DXY) scaled multiyear highs, buoyed by zeal for policy-fueled expansion.

Yet by February 2025, cracks emerged: the dollar faltered against rivals like the euro and yen as trade ambiguities and whispers of sluggish growth eroded confidence. This stumble has sparked debates over its enduring supremacy as the world’s preferred safe harbor and reserve anchor.

10-2 Year Treasury Yield Spread (I:102YTYS) via ycharts.com.

Even so, March 2025 finds a great deal of capital cascading into U.S. dollars and U.S. Treasuries—a paradoxical embrace shaped by labyrinthine forces. Debt instruments retain their luster, prized for perceived security amid geopolitical tremors and economic crosscurrents.

The 10-year Treasury yield hovers near 4.31%, its minor oscillations belying steadfast appetite despite uneven economic signals and recession jitters. Buyers cling to bonds as bulwarks against turbulence, with fixed-income markets absorbing steady inflows.

Though the greenback’s vigor has dimmed lately—softened by lackluster data and fiscal unease—it still clings to near-term resilience, buttressed by attractive rate spreads and its entrenched reserve pedigree. Skepticism nibbles at the once-unshakable bullish thesis, yet capital inflows show, the American currency still commands reverence as a bastion of transient stability.

Gold, Treasuries, and the U.S. dollar each wield outsized influence in today’s theater of finance, their trajectories sculpted by capricious investor psychology and the aftershocks of Trumpian policymaking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。