Market Overview

Before the Federal Reserve's decision, tech giants dragged down U.S. stocks, halting the two-day rally of the three major U.S. stock indices. The Nasdaq fell nearly 2%, and the S&P dropped over 1%. Tesla fell over 5%, and despite Nvidia launching new products, it still dropped over 3%.

The China concept index retreated. Xiaomi's financial report was impressive, and its ADR hit a new high. Xpeng's financial report was positive but fell nearly 8%, while NIO rose over 3%. Alibaba dropped over 3%. The offshore yuan fell more than a hundred points during the day, breaking below 7.23.

The German parliament passed a large-scale fiscal spending bill, German stocks rose nearly 1%, with defense stock Thyssenkrupp rising nearly 13%; the euro hit a five-month high, pushing the dollar index to a five-month low.

U.S. and European government bond yields rose and then fell back. Bitcoin briefly dropped over $3,000, falling below the $82,000 mark. Gold rose over 1% during the day, with futures gold closing at a new high for four consecutive days. Crude oil rose over 1% during the day before turning down, with Brent crude falling from a two-week high.

Market Review:

Yesterday, BTC experienced a bearish fluctuation during the day. The daily line closed with a short upper and lower shadow candlestick. The daily volatility was 3,100 points. Over the past three trading days, the average daily volatility has significantly narrowed compared to last week.

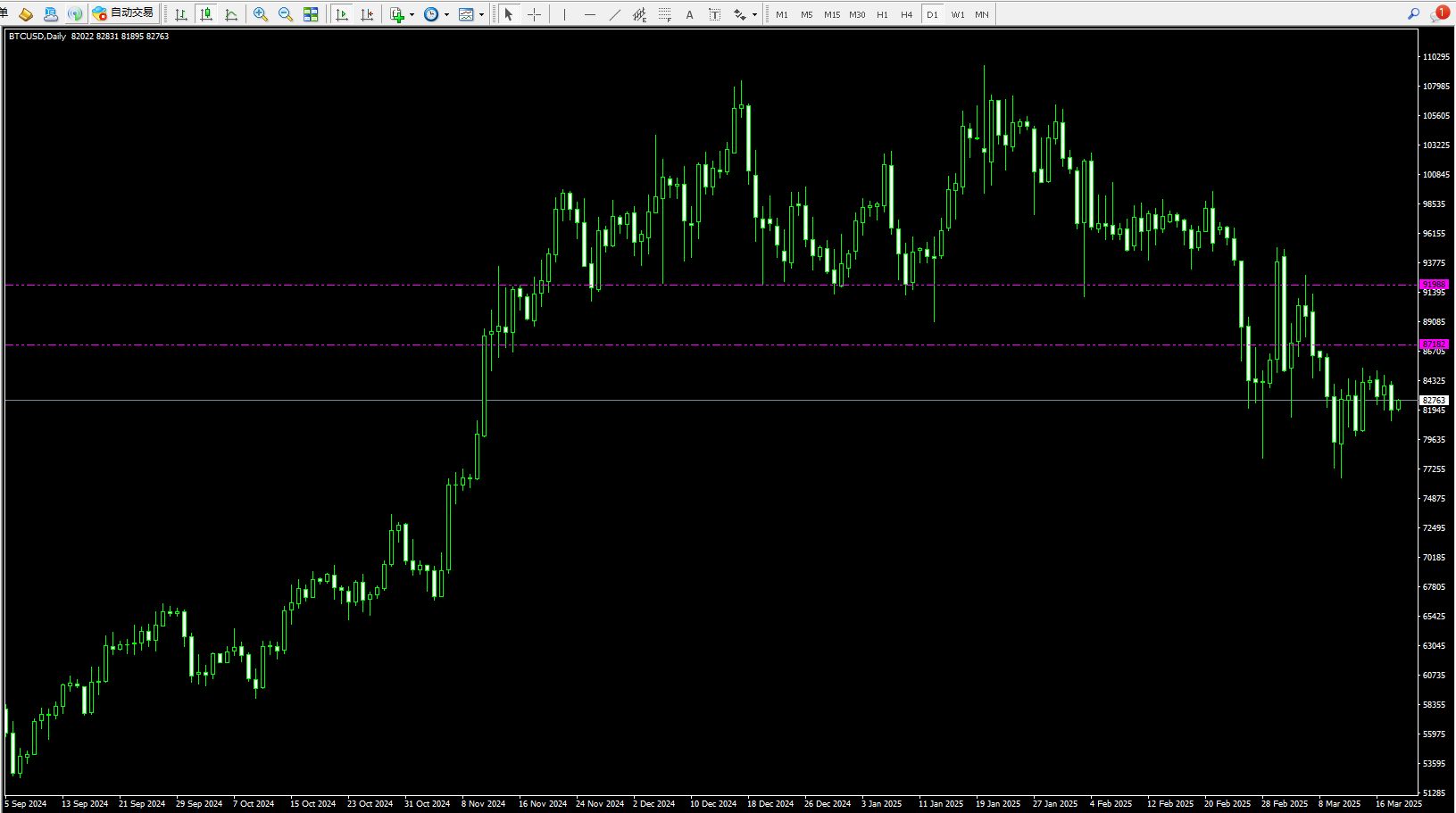

As shown in the chart above. The BTC daily and weekly charts. The daily line is currently oscillating around the support and resistance level of 83,333 mentioned in previous articles, as shown in the daily chart. The daily line alternates between bullish and bearish. It is in a sideways fluctuation. The short-term trend remains within the chaotic oscillation of the fourth wave mentioned in previous articles.

More oscillation and less trend characterize the current stage. The chaotic oscillation trend may have led to multiple failed expectations for a one-sided move. Every time you feel it is about to accelerate downward, it rebounds. Every time you feel it is about to accelerate upward, it drops!

On the weekly chart, last week closed with a doji star, and yesterday it fell to a low near 81,111 during the day. We provided clear guidance here and entered a long position last night. What is the significance of 81,111? As shown in the BTC weekly chart above. 81,111 is the lowest price from two weeks ago and also the highest price during the week of November 3, 2024.

In recent days, the article has repeatedly mentioned that the current major trend is a chaotic oscillation of the fourth wave. Yesterday's drop gave the impression of a one-sided move, but the major trend is chaotic oscillation. Therefore, after the price briefly broke below the lowest price from two weeks ago at 81,111, it rebounded. At this moment, the price has returned to oscillate around 83,000.

Market Outlook:

As shown in the chart above, the BTC four-hour chart indicates that the current trend is in a chaotic oscillation. Both bulls and bears find it difficult to sustain and break out of a one-sided move!

Continue to expect the continuation of chaotic oscillation during the day. For more real-time price alerts and layouts, please pay attention to real-time updates!

Do not buy in anticipation of a bullish trend. It is clearly stated above. It is just oscillation; after the fourth wave, there will be a fifth wave of selling pressure. It will be quite severe at that time. Therefore, do not consider buying any varieties in the spot market in the short term, especially altcoins, as the risks are extremely high later on!

Stay calm and composed!

If you found this helpful, please like and follow!

The above analysis and predictions are merely the personal probabilistic forecasts and judgments of the navigator regarding the market. Speculation carries risks; please invest cautiously!

2025.3.19 Navigator in the Crypto Circle

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。