Author: BitpushNews Mary Liu

At 12:00 AM Beijing time on March 20, the Federal Reserve will announce its latest interest rate decision, followed by a press conference by Chairman Powell, as global markets hold their breath.

The financial markets are facing numerous uncertainties. The uniqueness of this meeting lies in its comprehensive assessment of the impact of a series of new policies from the Trump administration on the U.S. economy. Federal Reserve policymakers will discuss the progress of inflation control and decide whether to adjust monetary policy.

The market has already come under pressure, Bitcoin consolidates and retreats

Optimism lasted only a few days, and risk markets fell again ahead of the Federal Reserve's meeting. As of the time of writing, the price of Bitcoin is approximately $82,715, down 1.5% in the past 24 hours.

Mainstream cryptocurrencies such as Solana, Ethereum, and XRP have seen even more significant declines. The U.S. stock market is also under pressure, with both the Nasdaq and S&P 500 indices experiencing declines. Concerns are growing that the Federal Reserve may not immediately ease its policies, despite a slowdown in February's inflation data, which was not significant and only reflects a single month's data.

The Federal Reserve is likely to remain steady, but the "dot plot" hides secrets

The market generally expects the Federal Reserve to maintain the current target range for the federal funds rate at 4.25%-4.50%. According to CME Group's FedWatch tool, traders believe the likelihood of a rate cut in March is negligible.

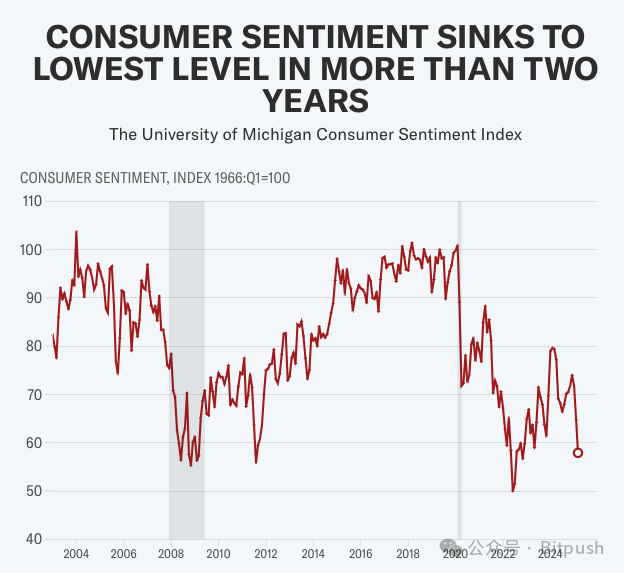

Previously, Federal Reserve officials have repeatedly emphasized a "wait-and-see" approach, partly due to the significant uncertainty brought about by President Trump's economic policies, which have begun to affect business and consumer confidence, leading to stock market declines and concerns about an economic recession.

The focus of this meeting will be the "Economic Projections Summary" released alongside the policy statement, particularly the highly anticipated "dot plot." This chart will show the median forecasts of the 19 committee members for future federal funds rates, serving as an important basis for market speculation on future rate paths.

Although Nomura Securities analysts expect little change in the median forecast of this "dot plot," any slight adjustments could trigger significant market volatility, given the tense market sentiment and uncertainty regarding future rate cuts.

Under Trump's "policy fog": The shadow of stagflation looms, Wall Street sounds the alarm

Recent economic data and market sentiment indicate that analysts are beginning to worry about the risk of "stagflation," which means that if bad news arises in the economy, U.S. stocks may also decline.

In simple terms, there are concerns that Trump's policies may lead to slower economic growth while prices rise, which is stagflation. Wall Street institutions have begun to worry about this and adjust their expectations.

Several institutions, including JPMorgan, Goldman Sachs, and Morgan Stanley, have recently lowered their economic growth forecasts for the U.S., primarily because they believe that the Trump administration's restrictive trade and immigration policies may adversely affect the economy.

Looking at inflation, although the price index for February shows a slowdown in inflation, Goldman Sachs economists point out that considering the Trump administration has already begun imposing tariffs and may escalate them in the future, the Federal Reserve may have to reconsider their inflation forecasts. Goldman Sachs even predicts that the Federal Reserve may raise the core inflation rate to 2.8% in its 2025 economic forecast while lowering the GDP growth rate to 1.8%, mainly due to the impact of tariff policies.

How do Federal Reserve expectations affect the nerves of the crypto market?

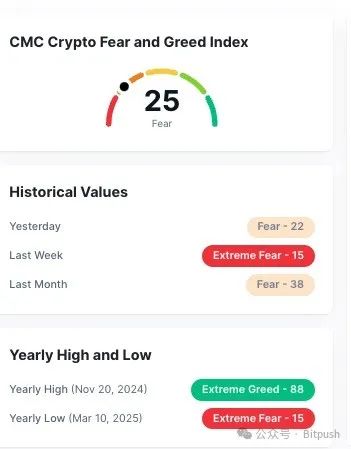

Cryptocurrencies like Bitcoin are typically viewed as "risk assets," and their price movements are closely related to investors' risk preferences. In a high-interest-rate environment, relatively safe assets like bonds become more attractive, potentially leading to capital flowing out of high-risk assets like cryptocurrencies. Currently, Bitcoin's price hovers around $83,000, and the market sentiment index remains in the "fear" range, which may indicate that the market has already anticipated potential negative news.

According to predictions from Polymarket participants, economic uncertainty and global tensions may exacerbate bearish pressure in the cryptocurrency market. Polymarket data shows that the likelihood of Bitcoin closing this week between $81,000 and $87,000 is 51%.

Conclusion

The Federal Reserve's policy statement and Powell's speech will undoubtedly set the tone for the short-term direction of the cryptocurrency market. Dovish signals may ignite hopes for a market rebound, while a hawkish stance could prolong the current downward trend. In a market already characterized by pessimism, any slightly positive signals could act as a catalyst for price increases. However, for cryptocurrency investors, remaining vigilant and cautious is always the best strategy to cope with market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。