Source: Cointelegraph Original: "{title}"

Earlier this week, the price of Bitcoin (BTC) succumbed to selling pressure, dropping from $84,500 on March 17 to $81,300 at the time of writing. This downward trend is likely related to the sell-off ahead of the two-day Federal Open Market Committee (FOMC) meeting scheduled for March 18-19.

FOMC meetings often serve as a market reset. Each time the FOMC convenes to discuss U.S. monetary policy, the cryptocurrency market prepares for the impact.

Historically, traders tend to reduce risk and lower leverage before the statement is released, and the market reacts strongly after the meeting and the press conference held by Federal Reserve Chairman Jerome Powell.

The FOMC meeting's press release is set to be published at 2:30 PM ET on March 19 (Wednesday), and it could trigger significant volatility in the Bitcoin market. Analyzing market behavior before its release may provide clues for Bitcoin's next move.

For traders, FOMC means volatility

Traders are closely monitoring the FOMC minutes to see if there are any changes in the Federal Reserve's stance on inflation and interest rates.

After the FOMC releases its statement, Bitcoin's price often reacts sharply. As shown in the chart below, since the beginning of 2024, Bitcoin's price has mostly declined after the FOMC decided to keep interest rates unchanged.

A notable exception was the price surge before the halving in February 2024, coinciding with the launch of the first Bitcoin spot exchange-traded funds (ETFs). When the U.S. cut rates on September 18, 2024, and November 7, 2024, Bitcoin's price increased.

However, the third rate cut on December 18, 2024, did not yield the same result. A slight reduction of 25 basis points to a range of 4.50% to 4.75% marked the peak of Bitcoin's local price at $108,000.

BTC/USD 1-day chart (marked with FOMC meeting dates). Source: Marie Poteriaieva, TradingView

Except for this time, the market typically deleverages before FOMC meetings

A key indicator that provides insight into market sentiment is the open interest in Bitcoin — the total number of unsettled derivative contracts, most of which are perpetual futures contracts worth $1.

Historically, according to charts based on CoinGlass data, Bitcoin's open interest tends to decline before FOMC meetings, indicating that traders are reducing leverage and risk exposure.

Bitcoin futures open interest and FOMC meeting dates. Source: Marie Poteriaieva, CoinGlass

However, this month has shown a different scenario. Despite a $12 billion fluctuation in open interest earlier this month, Bitcoin's open interest did not significantly decline in the days leading up to the FOMC meeting. Nevertheless, Bitcoin's price fell, which is unusual and may indicate strong directional bets.

This could also suggest that traders are less anxious about the Federal Reserve's decision, perhaps anticipating a neutral outcome. The CME Group's FedWatch Tool supports this view, showing a 99% probability that the Fed will keep rates in the 4.25% to 4.50% range.

If rates remain unchanged, Bitcoin's price may continue its current downward trend. This may be what HyperLiquid's whale investors expect, as they once opened a short position valued at over $500 million with 40x leverage. However, this position has since been closed.

How will Bitcoin spot ETFs react?

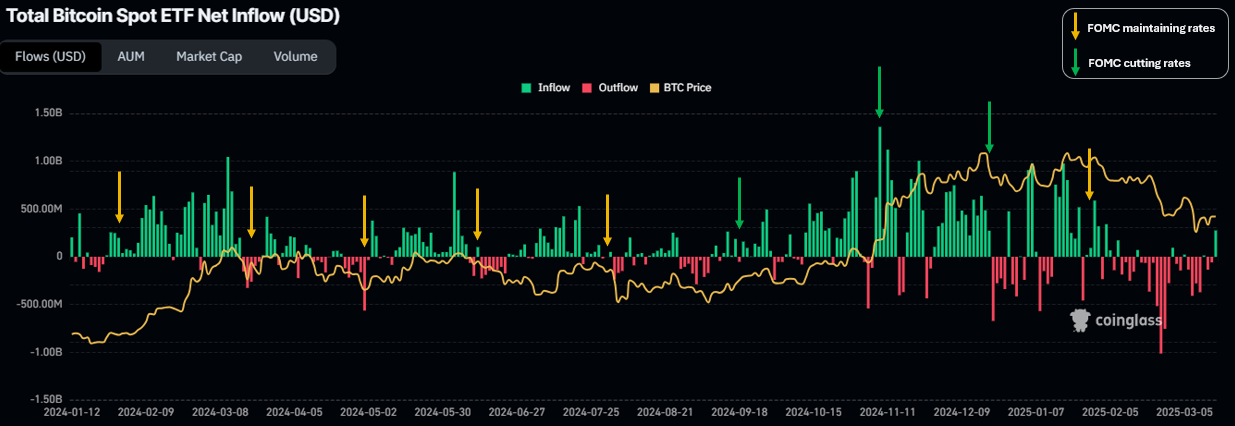

Unlike Bitcoin whale investors, Bitcoin spot ETF investors historically tend to sell their holdings before FOMC meetings.

According to CoinGlass data, since the launch of Bitcoin spot ETFs in January 2024, most FOMC meeting events have been accompanied by outflows from the ETFs, or at best, only minimal inflows. A notable exception was the last historical peak in January 2025, when even Bitcoin spot ETF investors could not resist the urge to buy.

Net inflows of Bitcoin spot ETFs and FOMC meeting dates. Source: Marie Poteriaieva, CoinGlass

On March 17, Bitcoin spot ETFs saw a net inflow of $275 million, marking a shift from a month-long outflow trend. This may indicate a change in investor sentiment and expectations regarding the Federal Reserve's policy decisions.

If inflows into Bitcoin spot ETFs increase before the FOMC meeting, investors may be anticipating a more dovish stance from the Fed, such as hinting at future rate cuts or maintaining liquidity-friendly policies.

Investors may also be increasing their Bitcoin holdings to hedge against uncertainty. This suggests that some institutional investors believe Bitcoin will perform well regardless of the Fed's decision.

Investors may also be anticipating a potential short squeeze. If traders expect Bitcoin's price to fall and have established short positions, a sudden increase in ETF inflows could influence trader behavior and trigger a short squeeze.

After the FOMC meeting, Bitcoin's price movement, along with on-chain data and the flow of funds into spot ETFs, will indicate whether these recent activities are part of a long-term accumulation trend or merely speculative positioning.

However, one point many traders currently agree on is that Bitcoin's price may experience significant volatility after the FOMC releases its statement. As cryptocurrency trader Master of Crypto recently posted on the X platform: "Tomorrow is the FOMC meeting, and a big move is expected."

Even if there is no rate cut, the possibility of the Fed releasing a dovish statement could boost the market, while the absence of a dovish statement could lead to a price drop.

This article does not contain investment advice or recommendations. Every investment and trading activity carries risks, and readers should conduct their own research when making decisions.

Related: Analysts say the recent $12 billion liquidation of Bitcoin open interest is crucial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。