Author: Bright, Foresight News

Recently, the payment public chain Keeta Network announced its TGE (Token Generation Event) on the Base network. Its token $KTA experienced a "value discovery" after a few days of correction to a $6 million FDV, surging nearly 1000% in the past week. On March 19, $KTA reached a peak FDV of $160 million, with the price rising from $0.006 to $0.16.

Such an increase is not exaggerated for a meme token; however, Keeta Network, which was previously obscure and whose token launch was filled with FUD doubts, is a legitimate payment public chain with a "Silicon Valley" pedigree.

Payment Layer 1 Surprises with Token Launch on Base, "Zero" Marketing Sparks FUD

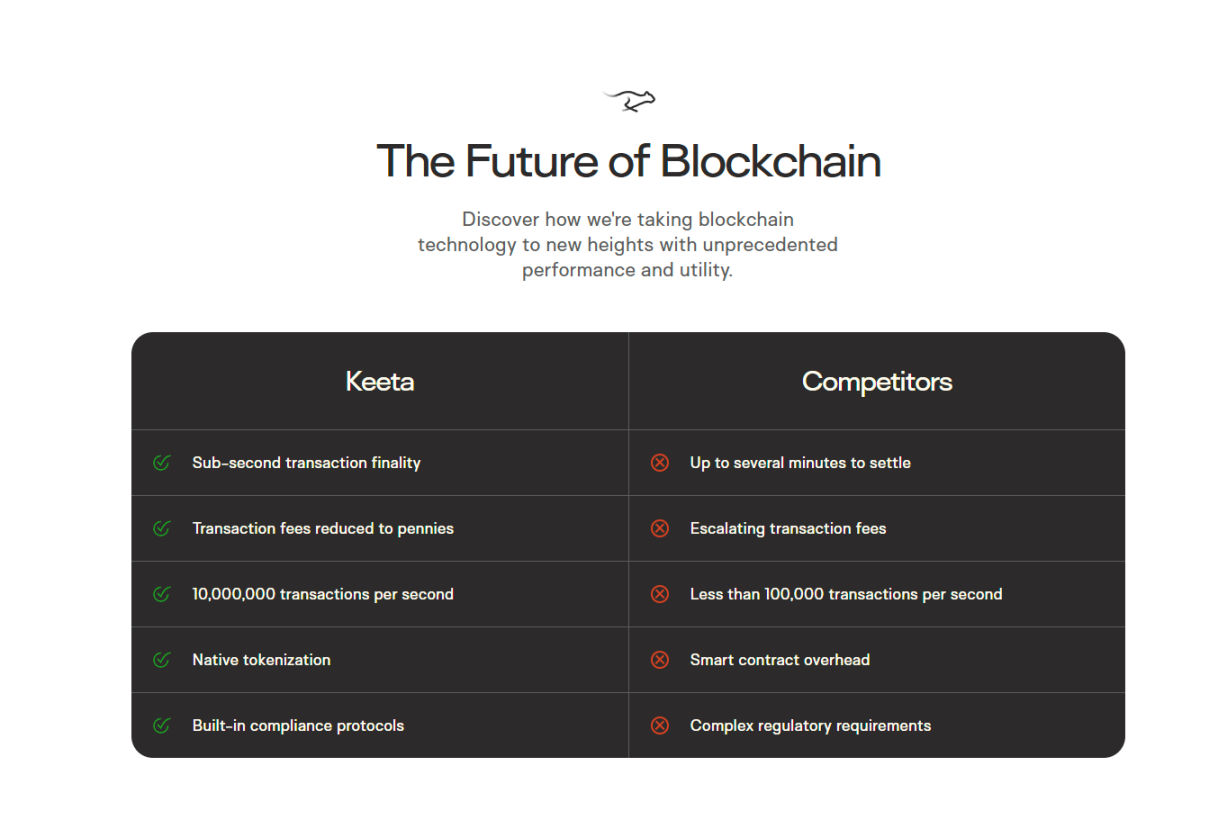

According to the official white paper, Keeta Network is a delegated proof-of-stake (dPoS) blockchain system that powers blockchain banking services globally, providing an ideal intermediary platform for Tradfi and DeFi. It is claimed that its electronic ledger can process over 50 million transactions per second. Financial institutions can connect to Keeta Network via API or custom integration, and the real-time payment track network provided by the platform can process cross-border remittances quickly, with fees 50% to 70% lower than traditional remittance channels. Currently, Keeta has announced on its website that its L1 can support 10M TPS and 400ms settlement. In early June 2023, Keeta officially launched in the United States, Canada, Mexico, Brazil, the UK, and the EU, adopting an invitation-only pilot for B2B payments.

Keeta's founder and CEO Ty Schenk stated, "Keeta aims to make international remittances as simple and fast as Venmo payments, without the parties needing to worry about the security of funds." Schenk also added that compared to Swift, which is more suitable for large transfers over $1 million, Keeta has advantages in instant small payments.

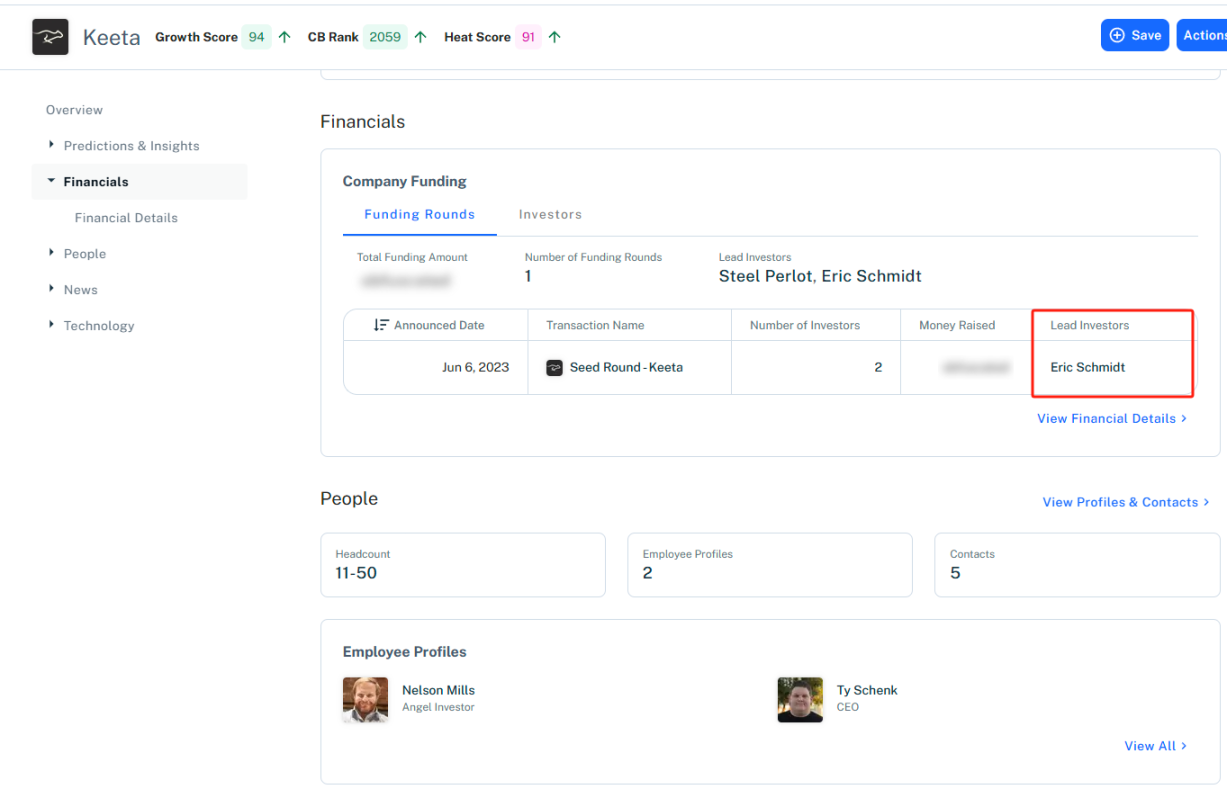

From the perspective of technical background and financing, Keeta Network is far from being a ragtag group. The CTO of Keeta Network is Roy Keene, the former chief developer of Nano, who left the company, which reached a $4 billion FDV in 2021, because he wanted to change Nano's incentive mechanism and institutional adoption rate. In June 2023, Keeta Network announced it had secured $17 million in funding led by former Google CEO Eric Schmidt. Ty Schenk revealed that this investment valued the company at $75 million.

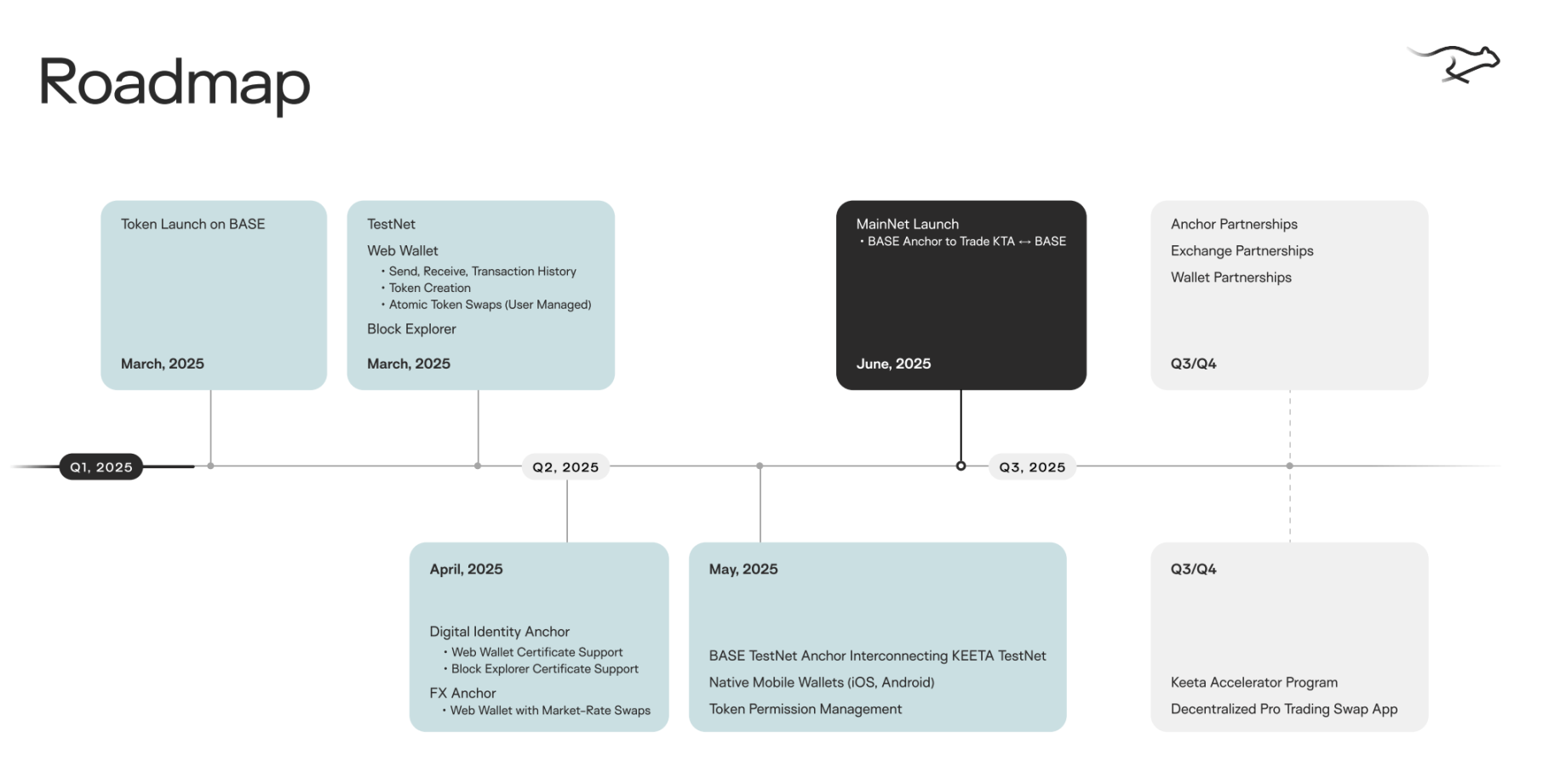

However, the well-connected Keeta Network chose to launch its TGE on March 5 without any prior disclosure, catching everyone off guard. A few hours later, they announced the tokenomics and Telegram community link on X, but Keeta's last tweet was still a "hello world" from October 22, 2022.

FUD quickly followed. Some questioned whether Keeta had been hacked and issued fake CA, while others believed the team was collectively trying to exploit the situation. More people doubted that the non-public TGE would lead to rampant insider trading. As a result, Keeta's token price unexpectedly began to decline.

The Keeta project team immediately held a Space to clear their name. However, it seemed they had not considered the marketing aspect of the crypto market at all. Keeta Network hardly posted to directly address the community's concerns, and its apparent community size and Twitter activity were still at a "very early" stage. For a time, only Keeta's official Twitter was posting about being "the fastest payment public chain," "decentralized," and "fully compliant," with the few comments mostly expressing confusion and insults. In the short term, Keeta found itself in a double bind of falling token prices and FUD.

Simply Offering Good News, Relying on "Contrast" to Drive Up Prices?

Yet, this unconventional approach led to Keeta's "value discovery" being delayed for quite some time.

While the token price continued to decline, Keeta frequently took actions to prove its legitimacy, such as posting CA on its website and having the founder repeatedly confirm on Twitter that the TGE was indeed initiated by the official team. Subsequently, as people hesitated, they conducted a roadmap-compliant lock-up. Founder Ty Schenk first interacted with Aerodrome (Base DEX) and then frequently uploaded videos of the developing Keeta Testnet on his personal Twitter, alleviating many concerns from on-chain degens. As of March 19, the top eight individual addresses of Keeta held a total of 6.48%, with a net inflow of $460,800 in the past week and a net outflow of $112,100, indicating bullish sentiment among whales.

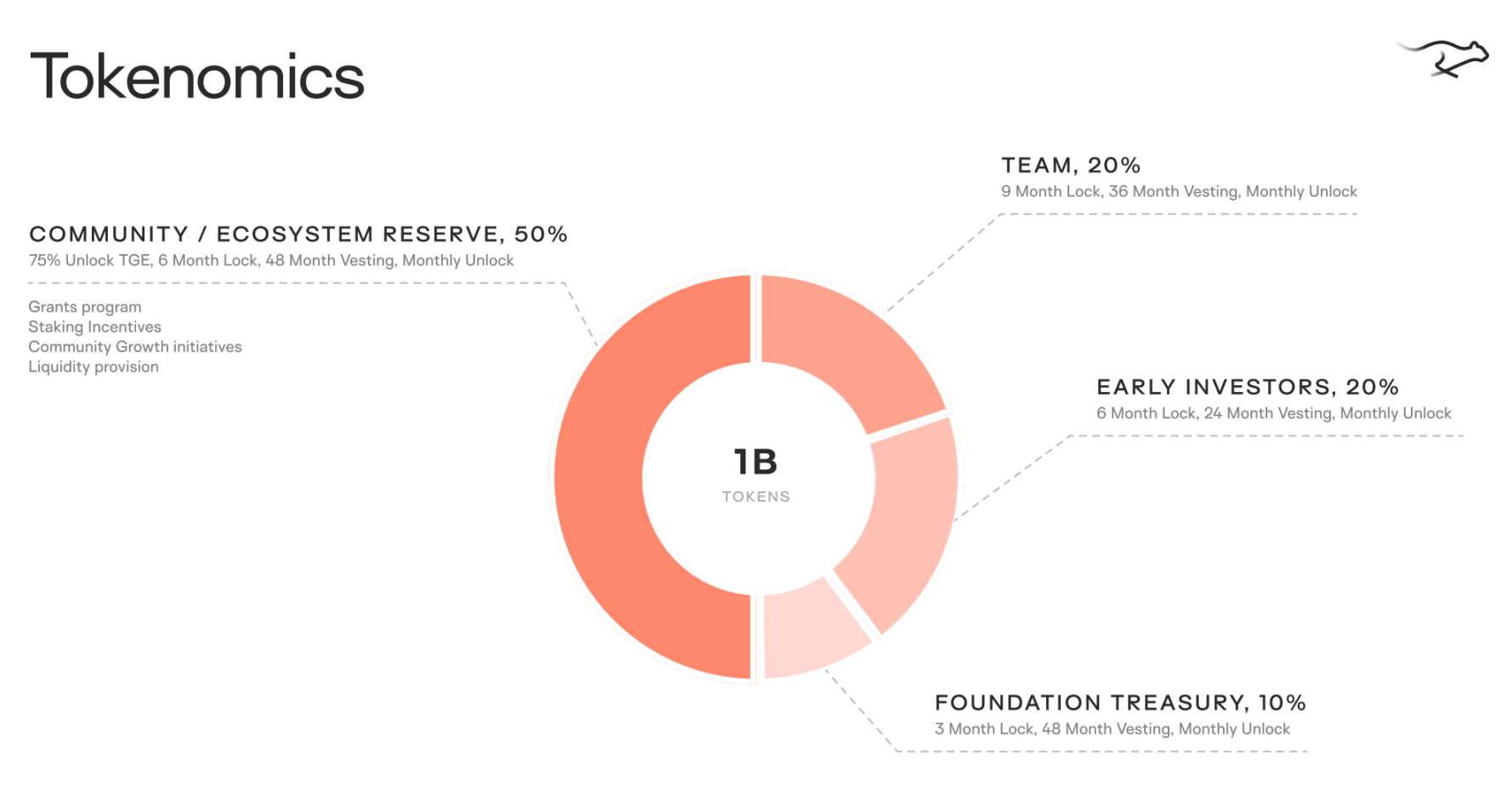

Moreover, Keeta's tokenomics are quite straightforward and "brutal." The team allocation is 20%, locked for 9 months, then linearly unlocked over 36 months with monthly distributions. Early investors hold 20%, locked for 6 months, then linearly unlocked over 24 months with monthly distributions. The foundation's share is 10%, locked for 3 months, then linearly unlocked over 48 months with monthly distributions. The community/ecosystem share is 50%: 75% is unlocked at TGE, with the remaining locked for 6 months, then linearly unlocked over 48 months. Relatively speaking, Keeta's low circulation leaves ample room for subsequent price-driving actions.

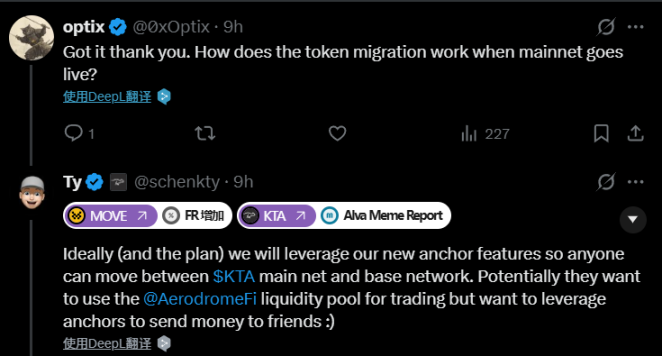

When addressing community concerns about "why Keeta Network, as an L1, chose to launch its token on Base, an L2," Ty Schenk clearly stated: "The transaction fees on Base are significantly lower than those on the ETH mainnet, and Keeta does not want to be confused with other meme tokens." Ideally (and this is Keeta's plan), Keeta will utilize the new anchoring feature to allow $KTA to cross-chain from Base to the mainnet.

As the founder continuously and down-to-earth addressed community concerns, $KTA managed to carve out an independent market amidst the meme frenzy of the day. This unique success once again proves the importance of "DYOR." Does this provide an unconventional path to success for many VC projects that have plummeted 90% upon listing on CEX?

In an era where monsters roam, a little white flower (even if it only appears pure) can evoke the geek atmosphere and decentralized vision of crypto, prompting the market to hit the buy button. When all projects are marketing, acquiring new users, and converting in a homogenized manner, shouting "big things are coming," it may signify a shift in market style. It is unclear whether Keeta stumbled upon success or if it was a case of wisdom disguised as folly, but the facts have indeed favored Keeta.

When marketing dims and FOMO recedes, how should we measure value? Perhaps it is time to repeatedly hone our "keen eye" in the dull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。