Author: flowie, ChainCatcher

After "going solo" on Pump.fun to create an AMM, Raydium has begun to fight back. This morning, according to Blockworks, Raydium launched a meme coin launch platform called LaunchLab, similar to Pump.fun.

Perhaps influenced by this news, the Raydium token, Ray, surged by about 30% to $2.07, before retreating to around $1.80 at the time of writing.

However, after the meme craze in the Solana ecosystem has cooled down, can there be a winner after the split between Raydium and Pump.fun?

There May Have Been Doubts Early On

The LaunchLab launched by Raydium is essentially a fork of Pump.fun, but with optimizations and improvements. For example, unlike Pump.fun, which only supports SOL as a quote token, LaunchLab will support multiple quote tokens, providing users with more options.

Raydium's move to take on Pump.fun may seem like a forced counterattack, but there may have been doubts from the start.

Raydium core contributor Infra mentioned in an interview with Blockworks that development of LaunchLab began "months ago," but the project was shelved because they "didn't want the team to feel that Raydium was directly competing with them."

However, with Pump.fun's AMM plans coming to light, Raydium may have decided to stop pretending.

In this round of meme frenzy, Pump.fun and Raydium were arguably the best "partners."

The token issuance mechanism of Pump.fun is divided into "internal" and "external" markets. When the trading volume of tokens issued on Pump.fun reaches $69,000, it enters the "external" trading phase.

The external trading primarily relies on Raydium, which provides deep liquidity pools and stability to help tokens on Pump.fun trade better. However, Raydium charges a fee of 0.25% on each transaction, which means Pump.fun has to pay substantial fees.

As a leading AMM platform in the Solana ecosystem, it is precisely because of the boom in memes and Pump.fun that it has made a significant profit over the past year.

The "2024 Memecoin Annual Consumption Report" shows that meme coin trading in the Solana ecosystem generated at least $3.093 billion in fees in 2024. Among them, Raydium likely earned over $1 billion, while Pump.fun only earned $240 million.

However, last month, as Pump.fun launched its own AMM in an attempt to break free from its reliance on Raydium, Raydium's passive income model was disrupted. As a result, Ray's token price dropped by over 20% on that day.

The purpose of Pump.fun building its own AMM is also clear: to keep the money that Raydium would have earned for itself. Additionally, after building its own AMM, Pump.fun can fully control the rules and fee distribution of the liquidity pool, potentially giving it stronger control over users.

As the biggest beneficiary of Pump.fun, its going solo has indeed had a huge impact on Raydium's revenue.

According to data from Blockworks Research, in the past 30 days, meme coins from Pump.fun accounted for 41% of Raydium's trading fee revenue.

Fortunately, Raydium has indeed made money. After experiencing a significant drop and the threat of Pump.fun going solo, data from Blockworks Research indicates that Raydium still has about $168 million on its balance sheet, which can support its attempts to create a new meme launch platform.

Can There Be a Winner After the "Breakup" of These Difficult Brothers?

The recent meme craze in the Solana ecosystem has cooled down, and market attention has temporarily shifted to Binance's BSC chain.

Both Raydium and Pump.fun have significantly dropped from their peaks.

According to DeFillam data, Raydium's TVL has fallen about 60% from its peak of $2.7 billion at the end of January to $1.1 billion, and daily trading fees have dropped over 90% from $10 million at the end of January to around $800,000; the token price has also fallen over 75% from a peak of $7.60 to around $1.80.

Pump.fun's trading fees have also dropped over 95% from a peak of $15 million to $800,000. Yesterday, according to Lookonchain monitoring, there was only one token on Pump.fun with a market cap exceeding $1 million within 24 hours.

Perhaps due to the significant decline in revenue and the difficulty of making money, neither Pump.fun nor Raydium wants to let the other profit.

But after both have created similar platforms, can this pair of difficult brothers have a winner?

Currently, the reality is that the overall market is down, and the market has been somewhat fatigued after a long period of PVP, with attention on Solana ecosystem memes shifting to the BSC chain. With demand gone, it seems difficult for Pump.fun and Raydium to achieve miracles.

On the other hand, is the other's business really that easy to run? After Pump.fun built its own AMM, it was also questioned by Raydium. Raydium's core contributor Infra stated on the X platform that Pump.fun completely abandoning Raydium is a "strategic misjudgment."

Infra believes that Pump.fun has underestimated the value brought by Raydium's liquidity support, and questions whether users have enough motivation to migrate to Pump.fun's new AMM given Raydium's dominant position in Solana.

However, for Raydium, Pump.fun has already established a strong user base and brand recognition in the Solana ecosystem, creating user stickiness through "foolproof" operations and social interactions. It is not easy for Raydium to make its token platform more attractive in a short time. Additionally, Pump.fun has been criticized for a large number of worthless tokens, and if Raydium's LaunchLab adopts a similar low-threshold token creation mechanism, it will face similar scrutiny.

Currently, from the reactions of Twitter users, it seems that after the shift in attention, the mutual confrontation between Pump.fun and Raydium has not attracted much attention, and it is temporarily difficult to determine who wins or loses.

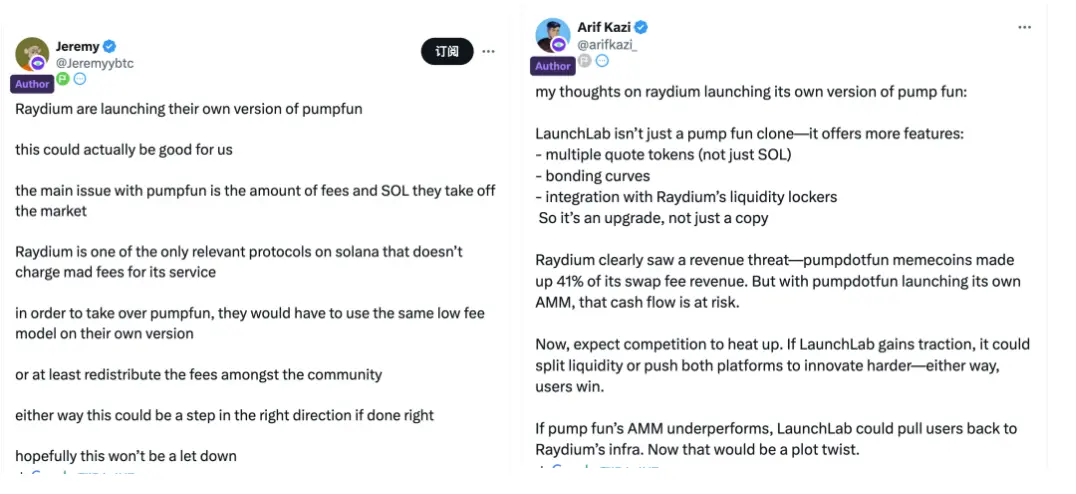

Crypto KOL Jeremy and SonicSVM BD head Arif Kazi, among others, believe that regardless of how the competition between the two plays out, users are the real winners, as it may lead to lower fees or better innovations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。