Original Title: The collapse of US consumers:

Original Author: The Kobeissi Letter

Original Source: https://x.com/

Translation: Daisy, Mars Finance

The Collapse of US Consumers:

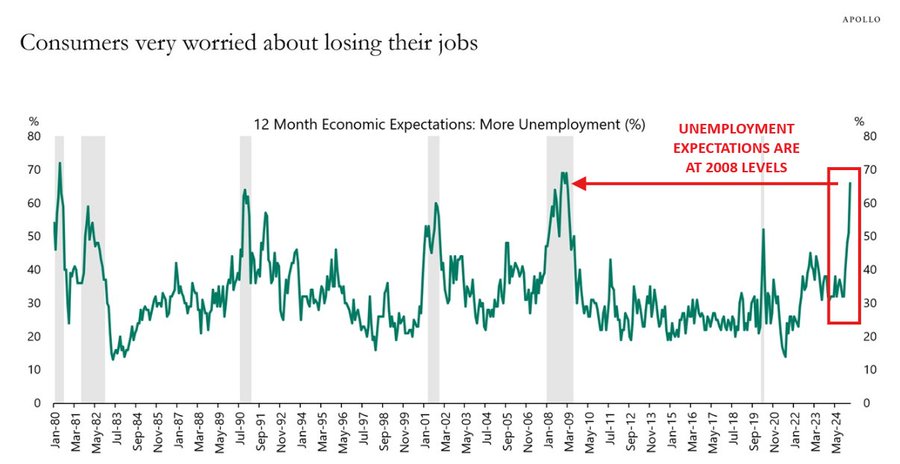

The unemployment expectations in the US have now surpassed the levels of 2020, reaching the highest point since 2008.

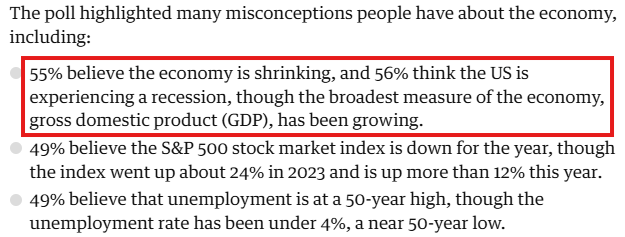

A survey in 2024 shows that up to 56% of Americans believe the US is in an economic recession.

Is the US about to enter a recession?

Here are the results of a survey conducted by Harris Polling in May 2024 (just before the election):

56% of Americans believe the US is in an economic recession, and 49% think the S&P 500 index has declined year-to-date (YTD).

However, at that time, the US GDP growth was "strong," and the S&P 500 index had risen by 12% for the year.

To this day, consumer pessimism has intensified.

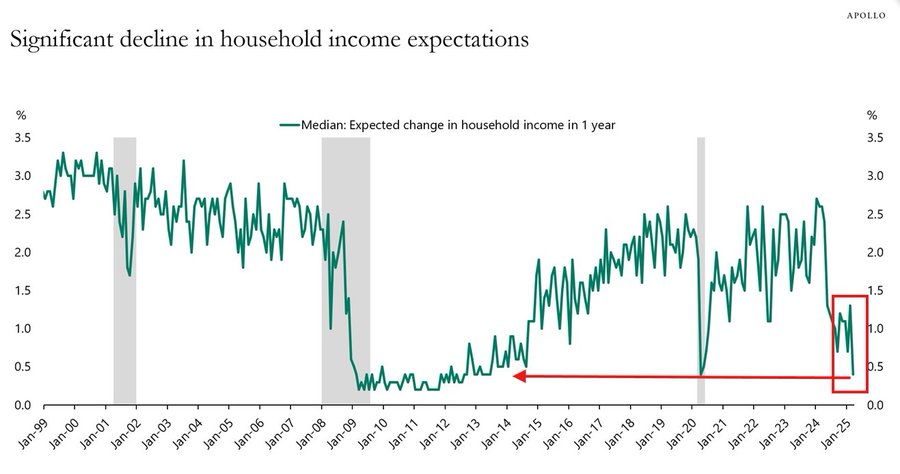

The median expected change in household income over the next 12 months has significantly decreased.

In fact, current expectations have dropped to the lowest level since the global economic lockdown in March 2020.

Inflation has worsened the situation:

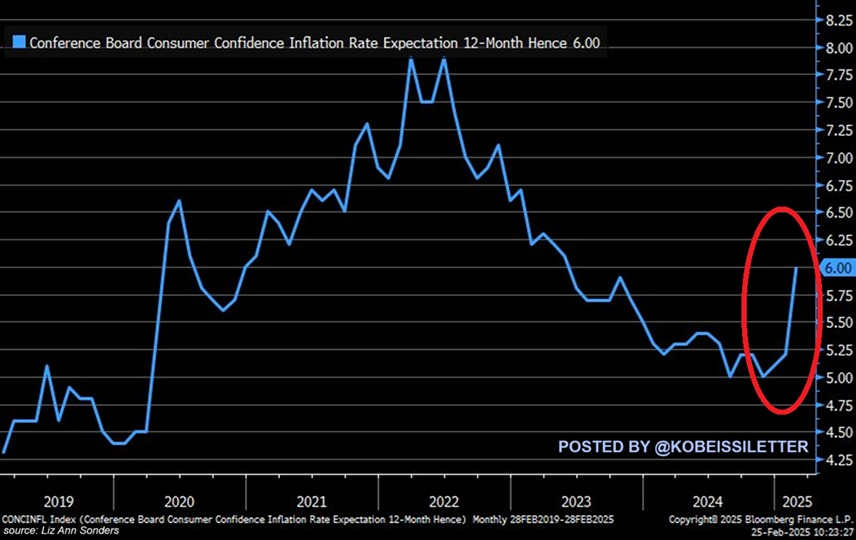

American consumers expect the inflation rate over the next 12 months to rise to 6.0%, the highest level since May 2023.

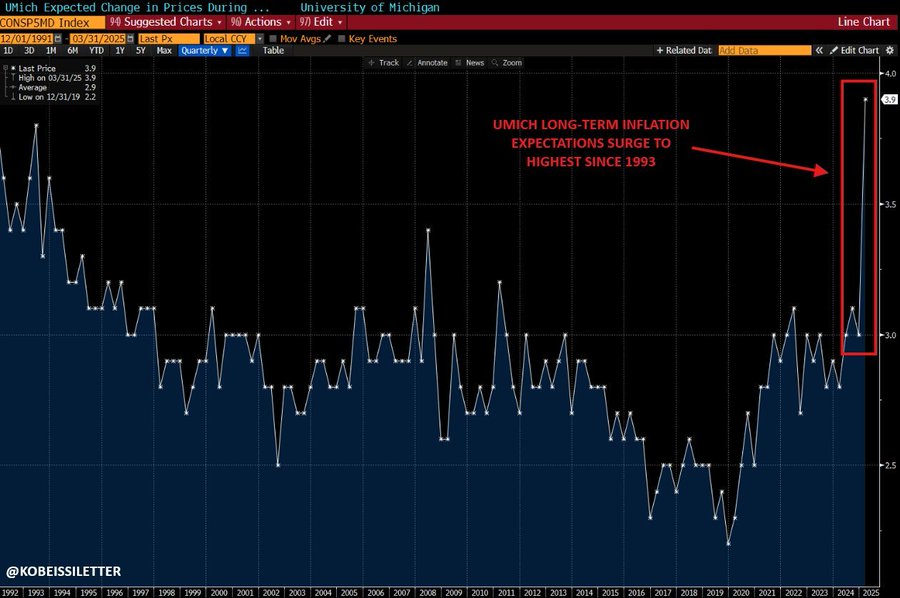

Americans anticipate an average annual inflation rate of 3.9% over the next 5 to 10 years, a new high in 30 years.

We are indeed experiencing the cumulative effects of years of inflation.

The long-term inflation expectations in the US have officially reached the highest level since 1993.

As President Trump introduced large-scale tariff policies, economic uncertainty increased, and inflation expectations rose accordingly.

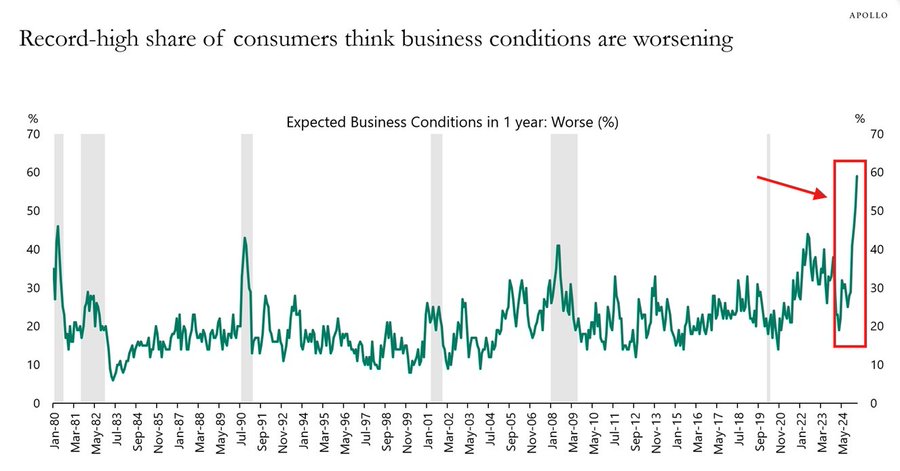

The result is a severe collapse in consumer confidence.

A record approximately 60% of American consumers expect the business environment to worsen over the next 12 months.

Even during the worst times of the 2008 housing market crash, the peak of this indicator was only about 42%.

It is safe to say that American consumer pessimism has reached a historic high.

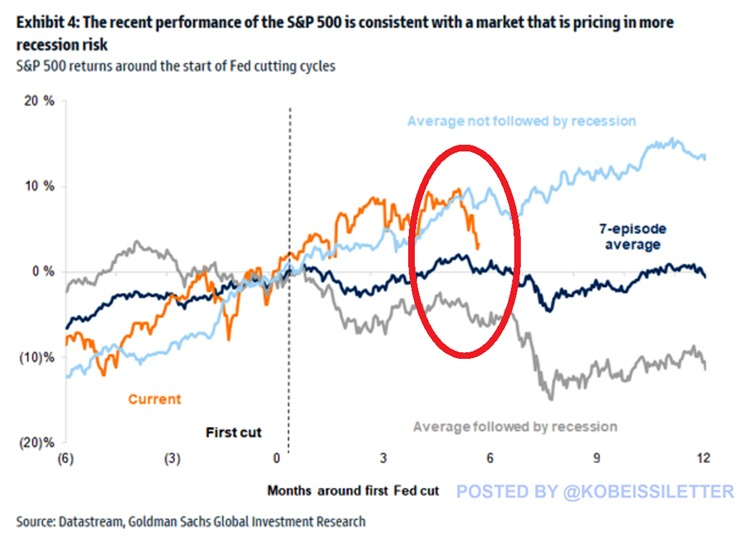

The market is digesting expectations of an economic recession:

Since the Federal Reserve began cutting interest rates in September 2024, the S&P 500 index has fallen by 2%.

During periods of recession, the S&P 500 index typically declines by 6% within 6 months and 10% within 12 months.

Historical data shows that the average 6-month return after a policy shift is only 1%.

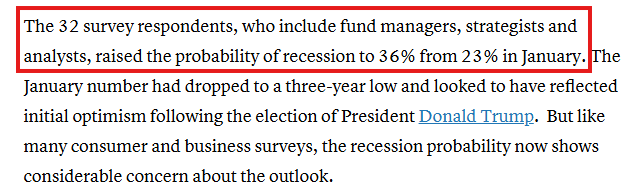

Moreover, it is not just ordinary consumers who feel pessimistic.

In the March CNBC Federal Reserve survey (covering fund managers, strategists, and analysts), the probability of a recession has significantly increased.

The recession probability jumped from 23% in January to 36%.

Institutional investors' sentiment has clearly turned pessimistic.

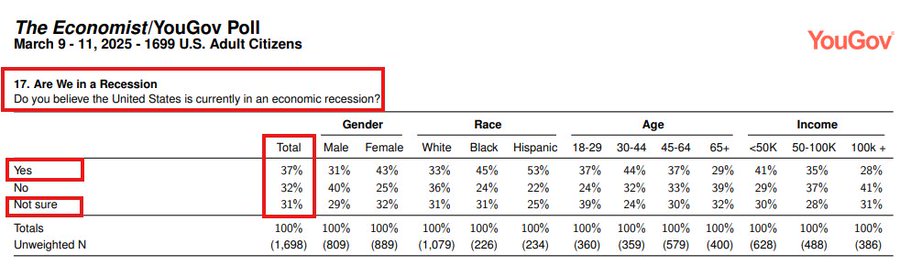

In last week's Economist/YouGov poll, Americans were asked about their views on the economy.

Currently, 37% believe the US is in a recession, and 31% are uncertain.

Only 32% think the US is not currently in a recession.

This is precisely why expectations for interest rate cuts have risen significantly.

This time, white-collar jobs have also been impacted.

Since May 2023, the US professional and business services sector has lost 248,000 jobs.

Employment in this sector has declined for 17 consecutive months, marking the longest decline since 2008.

The labor market is weakening.

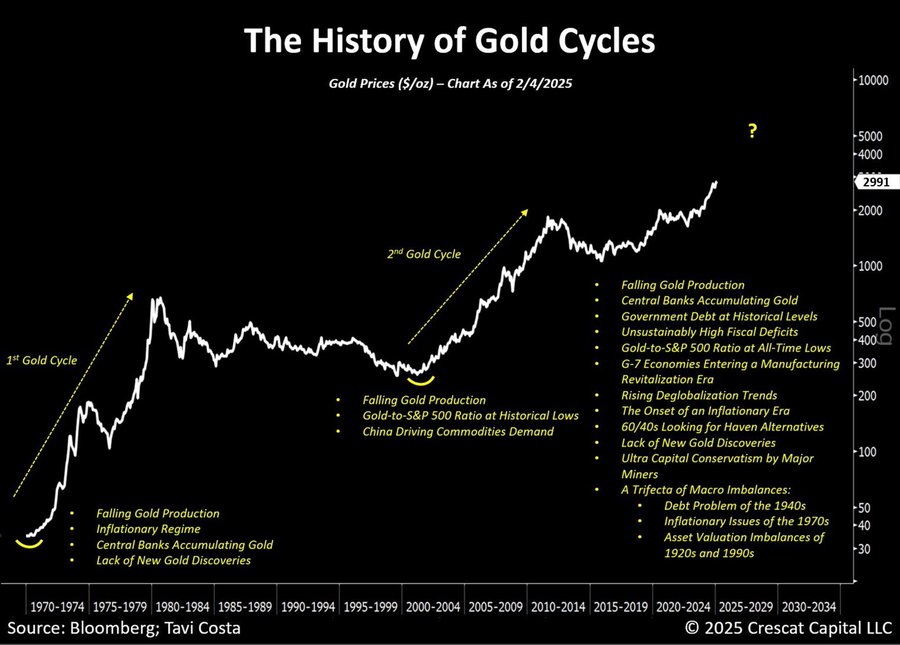

Finally, one of the most indicative signs of the economy is gold.

Against the backdrop of the US debt crisis, inflation, trade uncertainty, and recession fears, gold prices have soared.

We expect significant changes to occur in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。