"We wanted transoceanic airplanes, but we invented Zoom."

Written by: Will Wang

The year is 2025. For those in the industry, this long-evolving (over a decade) and tumultuous journey through the ups and downs of the crypto market, every remaining code Ticker today feels like a cherished memory, imbued with a sense of historical weight.

However, the actual scale of crypto assets is only $30 trillion, which is less than 1% compared to the traditional financial market of $400 trillion to $600 trillion. Despite last year's push by Grayscale, the Bitcoin ETF that made a disruptive entry into Wall Street still struggles to carry the banner of digital gold, resonating with Nasdaq while diverging from REAL gold.

In this crypto market that we are so eager to embrace, is it a case of survivor bias? Or is it a testing ground for a new financial revolution?

As Dr. Xiao Feng said, to answer this question, we must start from the origin of blockchain, examining the current hot topics of digital currency / crypto assets, the crypto market, and the underlying blockchain technology from first principles.

### 1. Blockchain: New Financial Infrastructure

If we look at crypto assets from a single dimension, such as the U.S. SEC, we might only categorize these assets as commodities and securities; if we view the crypto market from a macro perspective, it may be seen as a niche segment of the digital economy. However, if we delve deeper into blockchain and combine it with previous industrial and technological revolutions, blockchain as a new financial infrastructure will undoubtedly present a picture of the Age of Exploration, setting sail and braving the waves.

All of this is built on blockchain technology. Therefore, we must return to the basics and explore what blockchain truly is.

1.1 First Principles of Blockchain

The first principles of blockchain are not a single technology but a systematic combination of decentralization, cryptography, consensus mechanisms, transparency, and incentive mechanisms. This systematic combination is reflected in Satoshi Nakamoto's 2008 paper:

The Bitcoin white paper, by integrating various innovative technologies and redesigning social production relationships, aims to change the centralized financial system centered around traditional banks, addressing the centralization trust issues in the current financial system, and providing users with a safer, more convenient, and lower-cost payment method (a peer-to-peer version of electronic cash (system) would allow online payments to be sent directly from one party to another without going through a financial institution).

Bitcoin: A Peer-to-Peer Electronic Cash System

From the perspective of Bitcoin, the endowment of blockchain is financial infrastructure, and its initial structure is designed to solve the final consistency problem of payment clearing. Digital currencies built on blockchain can leverage the significant advantages brought by digital currencies and blockchain technology, which manifest in near-instant settlement, 24/7 availability, low transaction costs, and the programmability, interoperability, and infinite possibilities brought by the composability of digital currency Tokens. These are all sought after and difficult to achieve in traditional financial payment systems.

Investor Will Wang provided a great summary: In Trustless We Trust. If I had to add a time frame, I would say: ten thousand years.

1.2 The Essence of Finance

What is the essence of finance? It is the mismatch of value across time and space. This essence remains unchanged for millennia. But the service methods have evolved: from no banks to banks, from no central banks to central banks.

The new finance based on blockchain can greatly enhance the efficiency of finance:

A. Across Time

On one hand, this is reflected in the time value of money, which means that if I use tomorrow's money today, I must pay an interest for borrowing tomorrow's funds. This interest rate model, operating through DeFi, will unlock the limits of traditional bank fund turnover (12 times a year), significantly improving fund efficiency. On the other hand, it is the instant settlement of value, where remittances from Hong Kong to the U.S. can be realized through Web3 payments, arriving in seconds with near-zero fees, without the need for five institutions to reconcile, which is the optimal choice.

B. Across Space

The most intuitive example is in 2023, when investment guru Warren Buffett heavily invested in high-return Japanese trading companies by issuing nearly zero-interest yen bonds. However, institutions like banks and central banks in financial services can act as bottlenecks and obstacles to the global flow of value. This is precisely where new finance can break through: global, cross-space value allocation. In the blockchain and Web3 industry, there is no concept of going overseas because we are Day One Global; we are different.

C. Value

Stablecoins, synthetic dollars, or dedicated currencies are essentially Tokens pegged to the dollar, further highlighting the essential attributes of currency through digital currencies and blockchain technology, enhancing their core functions, improving currency operating efficiency, and reducing operating costs. Additionally, Tokens circulating on the blockchain can represent other assets, such as Tokenized MMFs, allowing for instant transmission of this value Token. Visa has always stated that it is about Money Transfer; with blockchain, it should be changed to Value Transfer.

Tokenization and Unified Ledger—Building the Blueprint for Future Currency Systems

Just as the essential attributes of currency (value scale) and core functions (medium of exchange) remain unchanged, despite the evolution through shells, tokens, cash, deposits, electronic money, and stablecoins as carriers or forms of currency. The essence of new finance also remains unchanged; what needs to change are the service methods of banks, exchanges, etc. What needs to be considered is how to provide better financial services in a distributed, digital, and cross-temporal and spatial scenario.

1.3 New Financial Revolution

Compared to traditional finance, the greatest innovation of new finance is the change in accounting methods—the blockchain as a public, transparent global ledger. The way humans have kept accounts has only changed three times in thousands of years, each time profoundly shaping economic forms and social structures, with each breakthrough reflecting the co-evolution of technology and civilization.

The single-entry bookkeeping of the Sumerian period (around 3500 BC) allowed humanity to break through the limitations of oral communication for the first time, facilitating early trade and the formation of states, as there was a need to record taxes and trade. The Code of Hammurabi in ancient Babylon included clauses for commercial disputes.

Double-entry bookkeeping played a role in the commercial revolution of the Renaissance (14th-15th centuries), as the prosperity of Mediterranean city-state trade, investments by the Genoese fleet, and the Medici family's multinational banking required complex financial tools, thus promoting the emergence of banks and multinational companies and the establishment of commercial credit.

Following this was the familiar distributed ledger introduced by Bitcoin in 2009, which facilitated decentralized finance, changes in trust mechanisms, and the rise of digital currencies.

This new finance, based on the transformation of distributed ledger methods, is inevitably intertwined with blockchain, smart contracts, digital wallets, and programmable currencies. Blockchain, as the ledger settlement layer of financial infrastructure, was initially designed to solve the final consistency problem of payment clearing. The combination of digital currencies built on distributed ledgers and smart contracts can bring infinite possibilities to new finance: near-instant settlement, 24/7 availability, low transaction costs, and the programmability, interoperability, and composability of digital currency Tokens.

Thus, new finance mainly presents three major changes:

- The accounting method has shifted from centralized double-entry bookkeeping to decentralized distributed bookkeeping;

- Accounts have transitioned from bank accounts to digital wallets;

- The unit of accounting has changed from fiat currency to digital currency.

The most important distributed ledger, born from the digital characteristics of cross-time, cross-space, and cross-organization, is the financial foundation of the Fourth Industrial Revolution.

### II. The First Three Industrial Revolutions

Dr. Xiao Feng cited the research findings of a Nobel Prize-winning economist: "Industrial revolutions had to wait for a financial revolution." This Nobel laureate believes that all industrial revolutions rely on the support of new financial service methods to flourish, develop, and grow. Conversely, without the backing of a financial revolution, the industrial revolutions in human society might not have succeeded. Similarly, another economist further pointed out that each industrial revolution is a combination of energy revolutions, industrial revolutions, and financial revolutions, with the financial revolution often being a prerequisite.

His research findings cover the first three industrial revolutions, and now we have entered the Fourth Industrial Revolution—the era of intelligence and digitization. Let's first review the past three industrial revolutions:

The First Industrial Revolution (from the 1760s to the 1840s) was marked by the steam engine and occurred in Britain. The British national debt system and joint-stock banks provided financing channels for railways and factories, greatly enhancing productivity.

Douglass North pointed out in "The Rise of the Western World" (1973) that before the industrial revolution, Britain underwent financial system reforms (such as the national debt system and improvements in the banking system), property rights protection, and reductions in transaction costs, providing capital accumulation and risk-sharing mechanisms for technological breakthroughs (such as the steam engine and textile machinery). He concluded that "the industrial revolution had to wait for the financial revolution" summarizes this phase.

The Second Industrial Revolution (from the late 19th century to the early 20th century) was represented by electricity and wireless communication and occurred in the United States. The development of the U.S. financial system (such as investment banks and stock markets) was a prerequisite for capital aggregation, providing channels for large-scale financing for enterprises. For example, railway construction required substantial long-term investments, and the U.S. attracted domestic and foreign capital by issuing railway bonds and stocks, with investment banks (like J.P. Morgan) playing a key role in integrating dispersed capital.

The Third Industrial Revolution (from the late 20th century to the early 21st century) was marked by computers, code, and the internet, also emerging in the United States. At that time, the Silicon Valley venture capital model (such as Sequoia Capital and KPCB) became the core financing mechanism of the third industrial revolution. VCs provided early funding for high-risk, high-return startup tech companies (like Apple, Microsoft, and Google) through equity investments; for instance, from 1970 to 2000, U.S. VC investments grew from hundreds of millions of dollars annually to the hundreds of billions level, directly driving the commercialization of semiconductor, software, and internet technologies.

On this basis, the Nasdaq stock market, established in 1971, became the main channel for technology companies to raise funds through its low barriers to entry, high liquidity, and inclusivity towards tech enterprises. For example, Microsoft (listed in 1986) and Amazon (listed in 1997) obtained expansion capital through IPOs. At the same time, tools such as stock options and Employee Stock Ownership Plans (ESOP) attracted talent to join innovative companies, binding human capital with financial capital.

### III. The Fourth Industrial Revolution

If the fourth financial revolution based on blockchain has already established the foundational prerequisites, then according to the assertion that "industrial revolutions had to wait for a financial revolution," it is essentially searching for where the fourth industrial revolution will be born.

The term "Fourth Industrial Revolution" was first officially proposed by Germany in 2013. Its core idea is to apply information technology to the manufacturing sector, thereby changing traditional standardized and large-scale production, establishing a highly flexible and intelligent industrial production model. However, merely confining intelligent information technology to the industrial sector clearly fails to recognize the profound impact that the technological revolution represented by AI and blockchain has on human civilization.

3.1 Cathy Wood's Perspective on the Technological Revolution

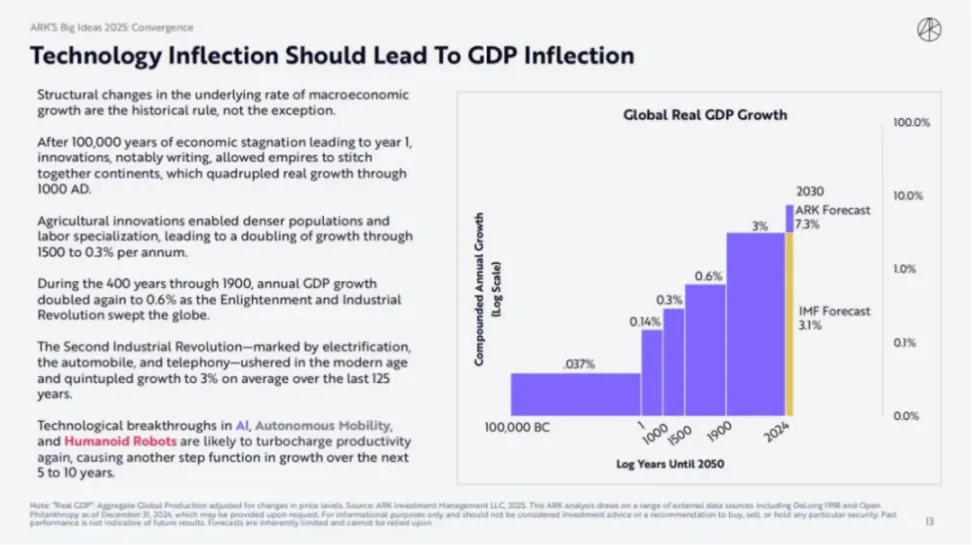

Cathy Wood, known as the queen of tech investment, released the ARK Invest report "Big Ideas 2025" at the beginning of the year, stating that although the International Monetary Fund (IMF) predicts a global economic growth rate of 3.1% by 2030, she believes that the annual economic growth rate at that time should exceed 10%!

ARK Invest believes that changes in macroeconomic growth align with historical patterns, exhibiting a stair-step phenomenon, where each leap is brought about by significant technological transformations.

Since the beginning of human history, the economy stagnated for 100,000 years, and innovation (especially writing) allowed empires to connect continents, resulting in a fourfold increase in actual growth rates by the year 1000. Subsequently, agricultural innovations increased population density and labor specialization, leading to a doubling of the growth rate by 1500, reaching 0.3% per year.

After that, the First Industrial Revolution swept the globe, bringing the average annual economic growth rate to 0.6%. The Second Industrial Revolution, marked by electrification, automobiles, and telephones, initiated modernization, allowing humanity to quintuple economic growth over the past 125 years, reaching an average of 3%.

Without a new technological revolution, the IMF's predictions are likely correct. However, Cathy Wood believes that breakthroughs in fields such as AI, blockchain, and intelligent robotics may once again enhance productivity, representing a significant technological revolution that will propel economic growth to a new level in the next 5 to 10 years.

www.ark-invest.com/big-ideas-2025

3.2 AI Restructuring the Spatial Dimension of Human Economic Activities

I strongly agree with Cathy Wood's two logics:

1) Each technological revolution elevates economic growth to a new level;

2) AI is a significant technological revolution.

This should be uncontroversial in 2025. What I want to express is:

Every technological or industrial revolution essentially reconstructs the spatial dimension of human economic activities through technological breakthroughs, breaking through existing physical or institutional boundaries to create entirely new value exchange domains. This "expansion of economic space" is not merely an expansion of geographical range but is achieved through a transformation of the technological-economic paradigm, elevating three aspects: the combination of production factors, the boundaries of value creation, and the system of transaction rules.

For example, during the First Industrial Revolution, the use of the steam engine shifted production from home workshops to factories, while railways and ships expanded trade ranges, allowing raw materials and goods to be transported across regions. This indeed represents an expansion of geographical space, fundamentally integrating surface resources and colonies into a single capitalist production network. The Second Industrial Revolution, characterized by electricity and internal combustion engines, brought about urbanization and the rise of multinational companies, with economic activities no longer confined to local areas but extending to national and even global scales. The information technology of the Third Industrial Revolution, especially the internet, created a virtual economic space, breaking geographical limitations with e-commerce and digital services. The Fourth Industrial Revolution may involve AI, blockchain, and the Internet of Things, further merging the boundaries of physical and digital spaces, potentially encompassing economic activities in the silicon-based world of AI agents.

The greatest value of AI lies in embodied intelligence and spatial intelligence, which requires a large number of physical robots and virtual AI agents. Investor Wang Chao previously discussed that if the future is a society composed of tens of millions of AI agents, then interactions between humans, machine-to-machine interactions, and various interactions make Crypto a viable solution.

Cathy Wood stated that AI agents will change the logic of how people search and shop, supported by digital wallets; digital wallets can further integrate traditional banking financial services such as savings, lending, insurance, investment, and consumption. Through innovative paradigms with AI agents, the value chain of global e-commerce and digital consumption on downstream platforms can be shifted upstream.

I also believe that only programmable currencies based on blockchain smart contracts can facilitate the value flow of AI silicon-based civilization, supported by Web3 digital wallets. This means that the Fourth Industrial Revolution will inevitably require a new financial system based on blockchain; otherwise, it will be reduced to an outdated concept of traditional finance aimed at cost reduction and efficiency improvement.

### IV. Token Economic Engine

The UK relied on credit and bond markets to support the First Industrial Revolution, while the U.S. relied on investment banks and capital markets to support the Second Industrial Revolution. The Third Industrial Revolution was supported by venture capital (VC) from Silicon Valley and the emerging Nasdaq stock market. Does the Fourth Industrial Revolution not require a new financial model?

As Dr. Xiao Feng said:

Many people are reluctant to admit that blockchain is the infrastructure supporting the Fourth Industrial Revolution, which is why we often mention "consortium chains" or "non-token blockchains." However, the practices of the past decade have proven that such attempts mostly do not work. We must bravely acknowledge that blockchain, as a tool for adjusting production relationships, has its core entry point in finance. Without financial demand, we do not need blockchain at all. This means that as humanity enters the Fourth Industrial Revolution, innovating digital and intelligent production relationships, a new financial revolution is indispensable. Otherwise, none of this may happen or succeed.

Clearly, a new financial model based on blockchain is already in place, and the token economic engine built upon it has begun to roar.

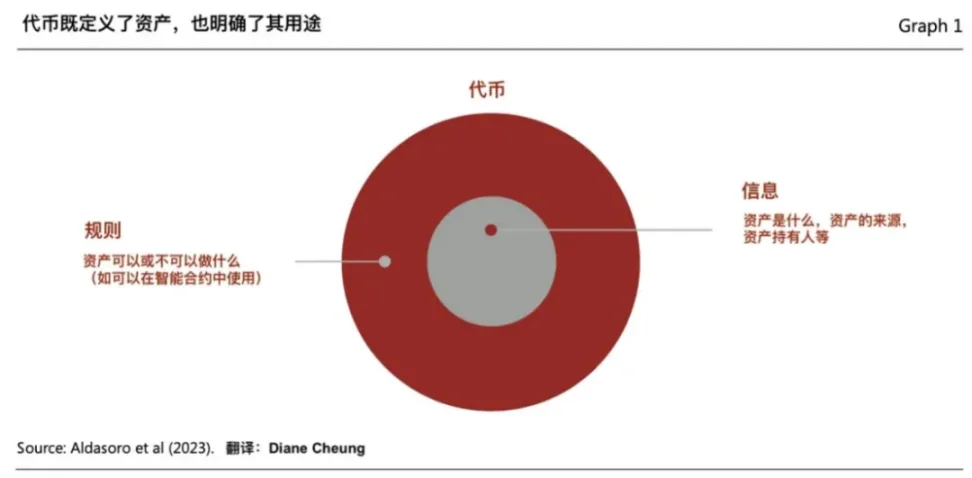

Although there can be many classifications of tokens, from Dr. Xiao Feng's initial three-token model to the current five types of tokens, and even the recent seven-token type framework provided by a16z, it is said that "Online is New Onchain," and all assets will be tokenized on-chain. However, I believe that functional tokens (Utility Tokens) that combine project network usage rights are key to leading the crypto market. If other token types are upgrades or transformations, then functional tokens can represent an innovation.

In 2023, Dr. Xiao Feng delivered a closing speech on "The Three-Token Model of Web3 Applications" at the Hong Kong Web3 Carnival. I also wrote an article in July 2023 titled "Value Capture and Compliance Progress: Exploring the Application of the Three-Token Model in China," discussing functional tokens, which still seems very applicable today.

Dr. Xiao Feng's Closing Speech at the 2023 Hong Kong Web3 Carnival

Web3, based on blockchain networks, is an economic model based on value networks (stakeholder capitalism), emphasizing data trustworthiness, data sovereignty, and value interconnection. Under the premise that all value can be tokenized, value includes not only ownership but, more importantly, usage rights.

Usage rights are non-exclusive, possess multiple sharing characteristics, can be authorized and licensed multiple times, and can even achieve open-source and CC0 infinite cycles, facilitating ordinary users' participation and value sharing. The core of the usage rights system is stakeholder capitalism, and the original organizational forms may not be suitable. Decentralized autonomous organizations (DAOs) based on open-source organizations and non-profit organizations naturally align with stakeholder capitalism, becoming the primary organizational form of the new economic model of Web3.

Under the usage rights system, all participants in decentralized organizations collaborate on a large scale as stakeholders, making their contributions and sharing organizational value. In this context, the shareholder ownership represented by centralized project shareholders has become meaningless; what truly holds value is the usage rights of the project.

Usage rights cannot be converted into shares, but they can be tokenized. By combining blockchain distributed ledger technology, usage rights can be standardized and fractionalized in the form of Tokens, which relates to the interests of every participant in the project network. This type of token is called a Utility Token.

In this new economic model of Web3, tokens are essentially carriers of value. Only by deeply understanding the essential value of tokens can we design the optimal economic model for Web3 applications, achieving multi-layered growth flywheels and incentivizing all participants.

Web3 New Economy and Tokenization

Web3 New Economy and Tokenization

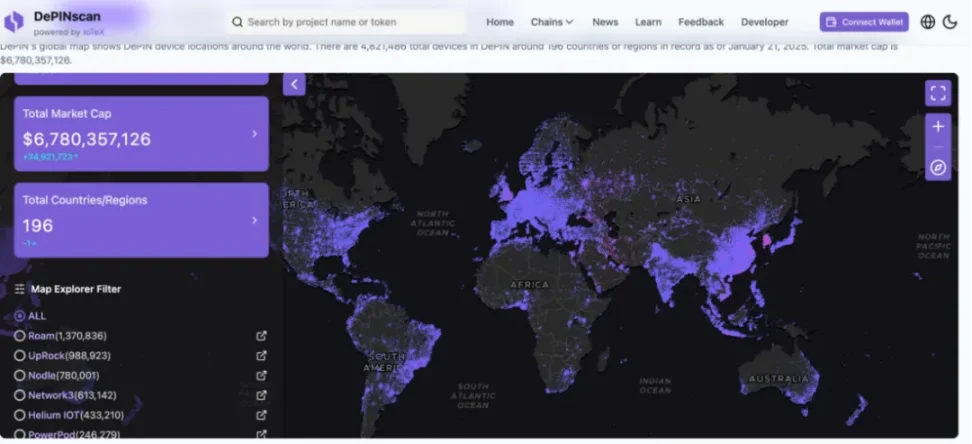

Let’s look at a vivid case of a token economic engine—Web3 decentralized telecom operator Roam. This project can effectively address the pain points that arise in Web2 scenarios through a Web3 approach, making it a model of Web3 moving from virtual to real.

Roam is committed to building a global open wireless network, ensuring that humans and smart devices can achieve free, seamless, and secure network connections whether stationary or in motion. Compared to the geographical limitations and homogenization of services of traditional telecom operators, Roam leverages the inherent global advantages of blockchain by building a decentralized communication network based on the OpenRoaming™ Wi-Fi framework while integrating eSIM services, creating a globally open and free wireless network.

In just over two years of development, Roam now has 1,729,536 nodes in 190 countries, 2,349,778 application users, and conducts 500,000 network verification activities daily, making it the largest decentralized wireless network in the world. Additionally, Roam users can earn free eSIM data while building and verifying Wi-Fi nodes, allowing Roam to operate as a telecom service provider using an internet model.

depinscan.io/projects/roam

Globally, although traditional Wi-Fi still accounts for over 70% of data traffic, its outdated infrastructure and privacy data security issues limit its potential. To address these challenges, Roam has partnered with the Wi-Fi Alliance and the Wireless Broadband Alliance (WBA) to combine traditional OpenRoaming™ technology with Web3's DID+VC technology, creating a decentralized communication network. This not only reduces the high upfront costs of global network construction but also achieves seamless login and end-to-end encryption features similar to cellular networks.

Roam encourages users to participate in network co-construction through the Roam App, sharing Wi-Fi nodes or upgrading to the more secure and convenient OpenRoaming™ Wi-Fi. Users can enjoy seamless connectivity across four million OpenRoaming™ hotspots worldwide and find Roam's self-built network nodes in remote areas such as Siberia and northern Canada, significantly expanding network coverage and enhancing user experience.

Through global free access via Wi-Fi+eSIM and a diversified project network incentive mechanism, Roam promotes the rapid development of decentralized networks. The ideal state of a Network State needs to be built on a communication network, and Web3 decentralized telecom operators like Roam may become the digital foundation of this ideal state.

In conjunction with the narrative of the Fourth Industrial Revolution, project networks like Roam can clearly serve as the communication foundation for AI silicon-based civilization and bring internet-like speeds to the global transmission of value. This new economic model of Web3, which has risen in just two years, can be seen as a disruption of the traditional economic model of Web2, with the token economic engine being crucial.

### V. Final Thoughts

Teacher Yang Peifang said: "Looking back at human history, the Huaxia nation once dominated the agricultural civilization era with agriculture, mulberry, silk, and a vague holistic philosophy; Europe and America, on the other hand, dominated the industrial civilization era with machinery, electricity, and a philosophy of precise reductionism."

In this Fourth Industrial Revolution, despite the waves of de-globalization caused by geopolitical factors, we will still be aligned by the unified ledger of blockchain, and you will find that this world is indeed flat. As mentioned in a book: "We wanted transoceanic planes, but we invented Zoom."

In this parallel globalized market, we can illuminate global momentum through the token economic engine, achieve instant global value transmission through blockchain settlement networks, and realize global financial inclusion and financial equality through new financial infrastructure. Of course, there are many more things we can achieve and much more to be done.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。