Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

The BSC chain has recently been exceptionally hot.

Since CZ called for $Mubarak, a large amount of capital has poured in, giving rise to several astonishingly rising tokens, which has heated up the BSC ecosystem. According to Defillama data, the DEX PancakeSwap on the BSC chain surpassed Uniswap in trading fees over the past 24 hours, jumping to first place.

In addition to the meme coin craze, high-quality projects within the BSC chain ecosystem are also emerging continuously. According to Rootdata, there are currently 201 projects on the BSC chain that have received financing, have not yet issued tokens, and are still operational, including several star projects supported by institutions such as Binance Labs (now YZi Labs) and Polychain. These projects cover multiple fields such as DeFi, cross-chain liquidity, and AI computing, representing the long-term development direction of the BSC ecosystem.

This article will review 7 of the most actively traded meme coins on the BSC chain recently and introduce 5 projects that have received financing but have not yet issued tokens, analyzing their narratives for readers' reference.

Arab Concept Meme

1. $mubarak (mubarak)

Mubarak means "blessed" in Arabic and is often used for holiday greetings.

On the afternoon of March 13, Binance's official Chinese X account retweeted a meme image dressed in Arab attire, and shortly after, CZ himself also retweeted it with the caption "Mubarak." Subsequently, a large number of memes with the same name emerged on-chain.

Perhaps to avoid the mixed contract issues seen in the Broccoli incident, CZ retweeted a tweet from a Mubarak community member on the morning of March 14, indirectly designating the official contract address.

On March 15, CZ posted a meme image of Mubarak in Binance Square with the caption "Going to meet a friend this weekend." The token price then skyrocketed from $0.004 to $0.04. That evening, Binance Alpha listed mubarak, and the market speculated that it might officially land on Binance, causing the token price to fluctuate violently around $0.04.

On March 16, a wallet address marked as CZ bought 1 BNB of $mubarak, and the token subsequently rose continuously, with a market cap peaking over $270 million.

- Market Cap: $3.2 billion

- 24-hour Trading Volume: $82.1 million

- Token Price: $1328

2. $Mubarakah (Mubarakah)

Mubarakah is a "female version" of mubarak launched by the community based on the Mubarak meme image, combined with He Yi's image. It has not yet received the "blessing" from CZ or He Yi and mainly relies on community promotion.

- Market Cap: $5.4 million

- 24-hour Trading Volume: $33.9 million

- Token Price: $0.055

3. $QMubarak (QueenyiMubarak)

QMubarak is also a meme derived from Mubarak, sharing the same concept as Mubarakah, focusing on the "Middle Eastern version of He Yi." The meme image was retweeted by He Yi's own X account, leading to a rise of over 200 times.

- Market Cap: $40,000

- 24-hour Trading Volume: $13.8 million

- Token Price: $0.00044

Community Concept Meme

4. $BNB Card (BNB Card)

Binance's official account posted an early construction card, and someone used this meme to create a token. Later, others shared their own cards, and even He Yi posted in support.

On March 18, He Yi posted an image based on the BNB Card on his X account with the caption "Humble little He is online to listen to advice." The token then rose over 60% in just one hour.

However, due to the largest holder @Wolfy_XBT selling off significantly at the peak, the token price experienced a massive downturn, with the market cap dropping from nearly $10 million to $3 million. After facing collective backlash, this user donated 3% of their holdings to CZ, and after several twists and turns, the community had new expectations for the token.

- Market Cap: $5.4 million

- 24-hour Trading Volume: $42.7 million

- Token Price: $0.053

5. $DDDD (DDDD)

$DDDD was born during the downtime of the Four platform and is the initialism for the Chinese phrases "带带弟弟" (bring along the younger brother) and "懂得都懂" (those who understand, understand). He Yi proposed this term on Twitter. Initially, $DDDD was misunderstood during the FUD process and even misinterpreted by He Yi, but it was later clarified. This twist made it a memorable meme. The repetition of the four letters makes it easy to spread and allows more people to understand the unique style of Chinese memes.

- Market Cap: $2.1 million

- 24-hour Trading Volume: $29.6 million

- Token Price: $0.021

6. $TUT (Tutorial)

$TUT is a meme coin claimed to be built by real builders, and it now has its own website and roadmap. Ten months ago, the developers recorded the first tutorial on how to issue tokens on the BNB chain, which mentioned the $TUT token. Therefore, this token is considered more OG than $TST and has been hyped in the recent BSC craze.

- Market Cap: $21.8 million

- 24-hour Trading Volume: $27.9 million

- Token Price: $0.21

7. $Palu (Binance's Palu)

Palu initially appeared as Binance's mascot, and the official Binance Chinese account had used the #Web3 Palu tag multiple times, but the community's response was tepid.

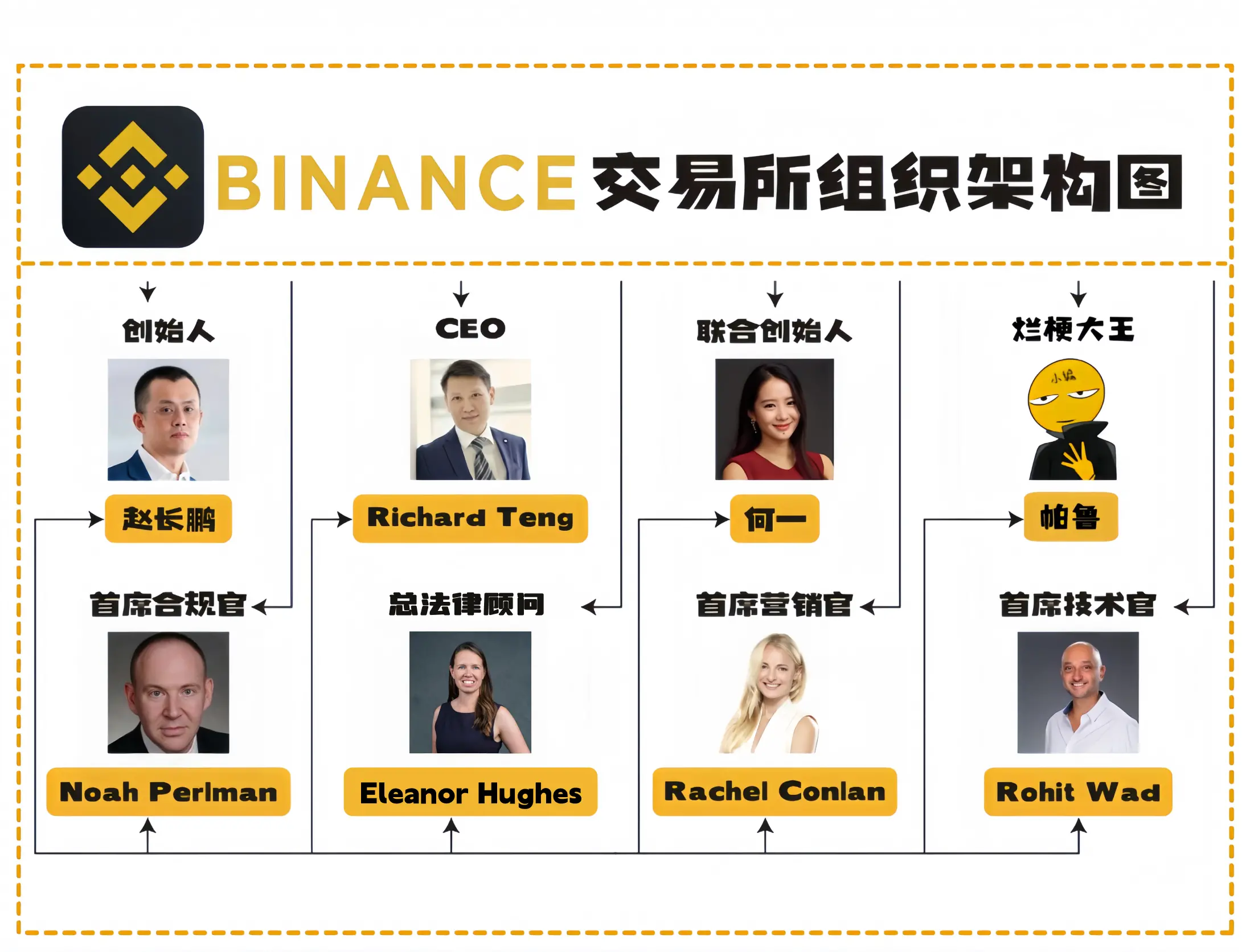

It wasn't until March 14 that Binance released an organizational chart of the exchange, where the "mysterious eighth person" was identified as the meme king Palu, symbolizing all Binance users. He Yi's comment further boosted its popularity, and the meme quickly went viral.

- Market Cap: $1.8 million

- 24-hour Trading Volume: $7.4 million

- Token Price: $0.018

Projects That Have Received Financing but Not Yet Issued Tokens

According to Rootdata, there are currently 201 projects on the BNB Chain that have received financing, have not yet issued tokens, and are still operational. This article selects 5 representative projects from these sectors for review.

1. APRO

Keywords: Polychain investment; MVB Season 8; AI infrastructure

Introduction: APRO is the industry's first data communication infrastructure serving the AIAgent ecosystem, aimed at solving the lack of secure, verifiable, and real-time communication between AIAgents. Its core products include the AI data transmission standard protocol ATTPs (AgentTextTransferProtocolSecure) and trusted data feeding AI Oracle. Through technologies such as large models, zero-knowledge proofs, and consensus mechanisms, it acts as a data hub for AIAgents, providing multi-source, verifiable, and tamper-proof information, including price data, social media data, game data, etc., ensuring data authenticity. It provides decentralized data transmission support for important application scenarios such as DeFi, DAO governance, and token launches, enabling efficient collaboration between AI agents to make smarter decisions in autonomous trading and governance.

The project completed a $3 million seed round of financing on October 7, 2024, led by well-known investment institutions Polychain, Franklin Templeton, and ABCDE. Additionally, APRO's AI landscape has integrated multiple AI agent frameworks such as DeepSeek, ElizaOS, and Virtuals Protocol (G.A.M.E), and operates supporting over 20 public chains including BNB Chain, Base, and Solana. The project has not yet disclosed its token economics.

2. Astherus

Keywords: Yzi Labs investment; MVB Season 7; re-staking

Introduction: Astherus is a multi-asset liquidity center focused on enhancing the yield and utility of crypto assets. Its core products include AstherusEarn (yield generation) and AstherusEX (on-chain perpetual trading), supporting cross-chain assets and providing users with stablecoin yields, derivative trading, and efficient asset utilization. Astherus consists of a dApp layer, DeFi infrastructure layer, and the future L1 public chain AstherusLayer, building a complete decentralized financial ecosystem.

On July 30, 2024, Astherus was selected as one of the first projects in Binance Labs' (now YZi Labs) seventh incubation program, and on November 28 of the same year, it received strategic financing from YZi Labs.

According to official information, the project's TVL has reached $275 million. On January 7, 2025, Astherus launched the first phase of its competition, where users can earn Au points by forming LP pools and minting USDF, and can earn Rh points by participating in trading. The project team clarified that these points can be used for the allocation of the token $ASS during the TGE.

3. KiloEx

Keywords: Yzi Labs investment; MVB Season 6; DeFi derivatives

Introduction: KiloEx is an innovative perpetual contract DEX designed for multi-asset trading, aiming to solve the bottlenecks in risk management and capital efficiency faced by traditional decentralized derivatives platforms. Its core mechanisms include a dynamic margin system and an intelligent liquidity aggregation engine, significantly improving user capital utilization while reducing the risk of liquidation in extreme market conditions. The platform supports one-stop trading of various asset classes, including cryptocurrencies, foreign exchange, and stocks, providing seamless hedging, cross-market arbitrage, and asset allocation capabilities for individual traders and institutional users.

KiloEx adopts a modular architecture design, compatible with both EVM and non-EVM public chain ecosystems, and has been deployed on Ethereum, BNB Chain, and Solana networks. In the future, it will achieve full-chain liquidity sharing through cross-chain communication protocols.

In March 2024, it announced strategic investments from Binance Labs (now YZi Labs), Foresight Ventures, and other institutions. Recently, the official announcement stated that its originally scheduled TGE on March 17 will be postponed, with the new date to be determined.

4. LoopCrypto

Keywords: a16z investment; payment infrastructure

Introduction: LoopCrypto is a protocol that supports automatic cryptocurrency payments, designed specifically for subscription services, DAO fund management, and corporate payroll payments, addressing the cumbersome nature of Web3 transactions and high churn rates. Through APIs and smart contracts, Loop enables businesses to seamlessly integrate automatic payments, supporting various billing models and being compatible with existing payment systems, thus achieving an efficient and convenient cryptocurrency payment experience.

The project completed a $4 million seed round of financing on April 14, 2022, led by the well-known investment firm a16z. The project has not yet disclosed its token economics.

5. Sign Protocol

Keywords: Yzi Labs investment; full-chain certification infrastructure

Introduction: Sign Protocol is the first verifiable statement protocol aimed at the full-chain ecosystem, designed to address the core pain points of the lack of authenticity and legal validity of on-chain information. Its core components include: Signatures, a compliance certification framework based on digital signatures and zero-knowledge proofs, allowing users to sign legally binding smart contracts with private keys and generate tamper-proof on-chain evidence; TokenTable, a lifecycle management tool designed for token distribution, providing standardized solutions from lock-up rule setting, vesting period allocation to automatic execution of defaults.

By integrating decentralized storage and verifiable credential (VC) technology, Sign Protocol builds an end-to-end trusted certification infrastructure for scenarios such as DeFi protocol audits, DAO governance voting, and NFT copyright declarations.

On January 28, 2025, the project announced it had secured $16 million in financing led by Yzi Labs, with participation from HackVC, Amber Ventures, and others.

(This article is for reference only and does not constitute investment advice)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。