Original|Odaily Planet Daily (@OdailyChina)

"The Bybit $1.5 billion security incident" has temporarily come to a close, and the North Korean hacker organization Lazarus Group has consequently risen to the third position on the Bitcoin holdings leaderboard for government entities, surpassing Bhutan and El Salvador, with holdings only behind the United States and the United Kingdom. Many have jokingly remarked, "North Korea has established a Bitcoin national reserve ahead of most countries in the world and is expected to surpass the United States to become the largest holding government entity." Odaily Planet Daily will provide a brief introduction to the top 5 government entities by BTC on-chain holdings based on relevant data from the Arkham platform for readers' reference. (Recommended reading: “Overview of BTC National Reserve Rankings, Who Holds the Most Between China and the U.S.?”_)

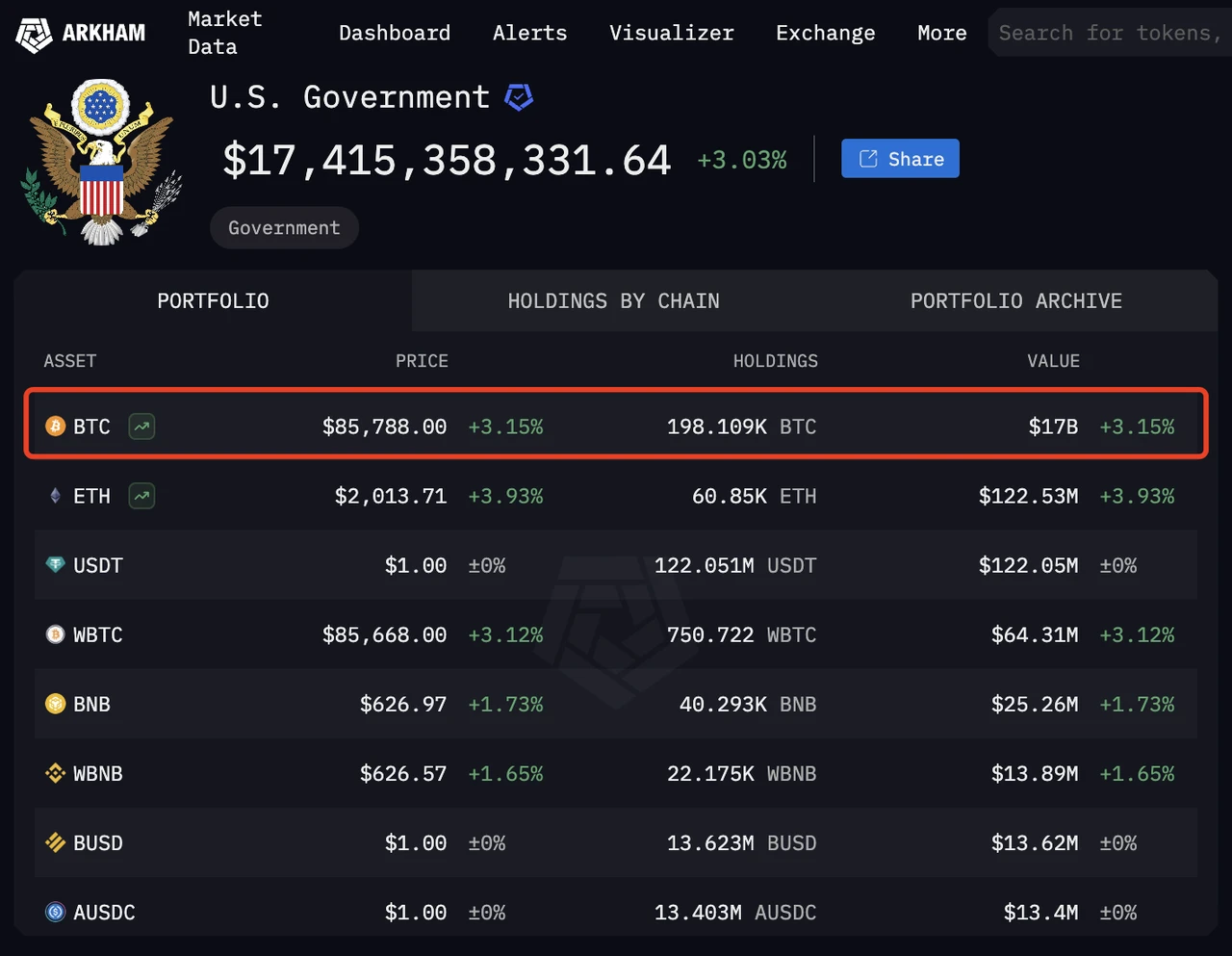

United States: Nearly 200,000 BTC, the undisputed "number one in national reserves"

Consistent with our previous mentions, according to Arkham data, the U.S. government currently holds around 198,000 BTC. Due to the decline in BTC prices, the value of these holdings has shrunk from approximately $2.01 billion in January to about $17 billion now.

At the same time, two developments have changed the U.S. government's BTC holding situation: first, Trump signed a presidential executive order to establish a BTC strategic reserve through the confiscation of BTC and other assets (see “Trump Fulfills Promise to Establish BTC Strategic Reserve, But Is Funding Solely from Confiscation?”); second, the "1 million BTC new Bitcoin reserve bill" is ready to go, awaiting a new round of voting and review by U.S. government departments (see “New Bitcoin Bill Submitted, Is a 1 Million BTC Purchase on the Way?”).

Additionally, various U.S. states have been promoting BTC investment reserve plans, with Texas being the most aggressive, as detailed in “$500 Million Investment in Bitcoin Reserves, Is Texas Leading the Way to Build a Crypto Utopia?”.

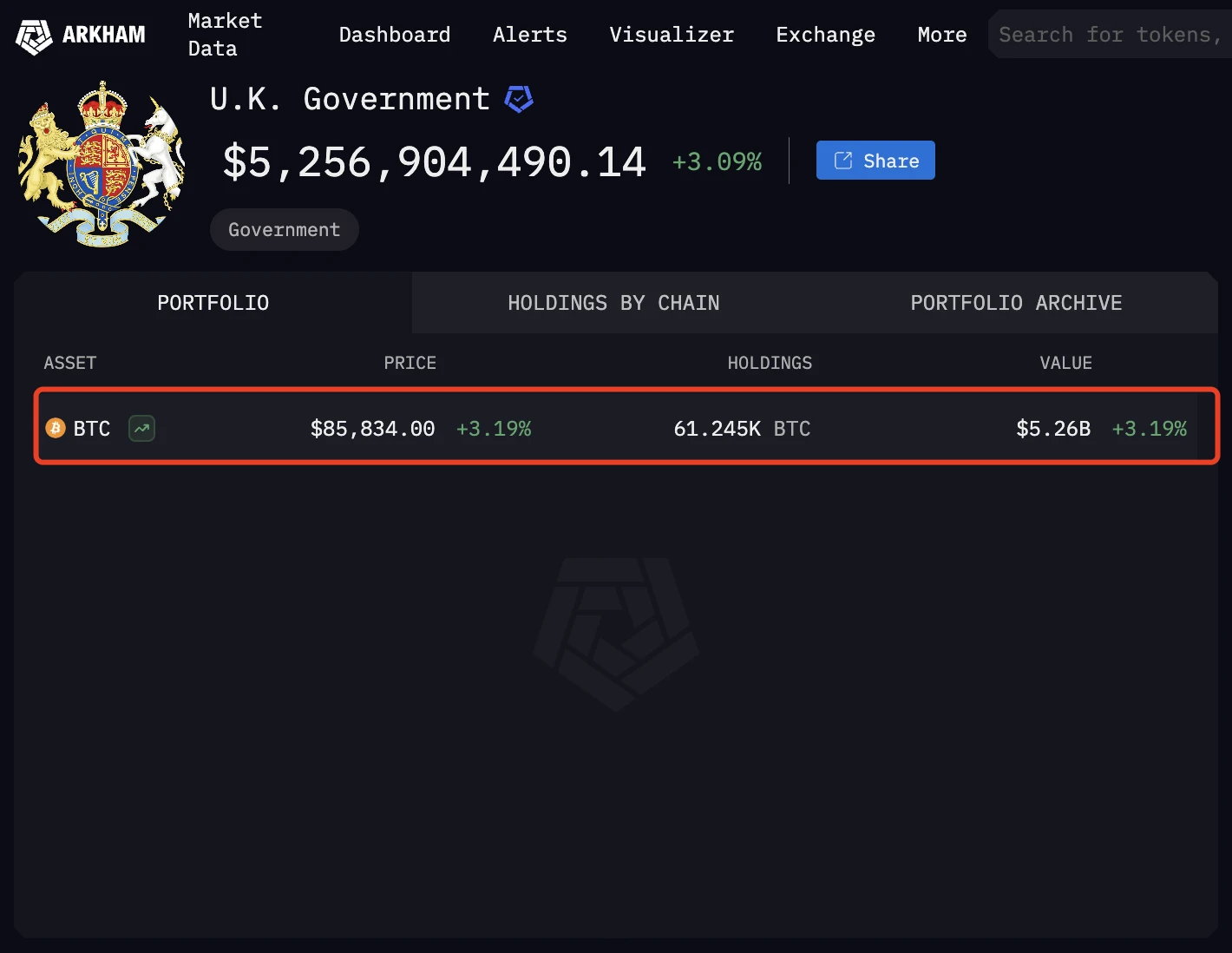

United Kingdom: Over 60,000 BTC, second in verifiable on-chain holdings

According to Arkham data, the UK government holds 61,245 BTC, and similarly, the value of these holdings has decreased from $6.24 billion in January to $5.26 billion now.

However, unlike the U.S. government's ambitious plans for BTC strategic reserves, the UK government is not interested in establishing a BTC strategic reserve.

Previous reports** indicate that the UK Treasury has stated there are "no plans" to introduce a U.S.-style Bitcoin reserve. This is evident as the UK government's holding address does not include other cryptocurrencies.**

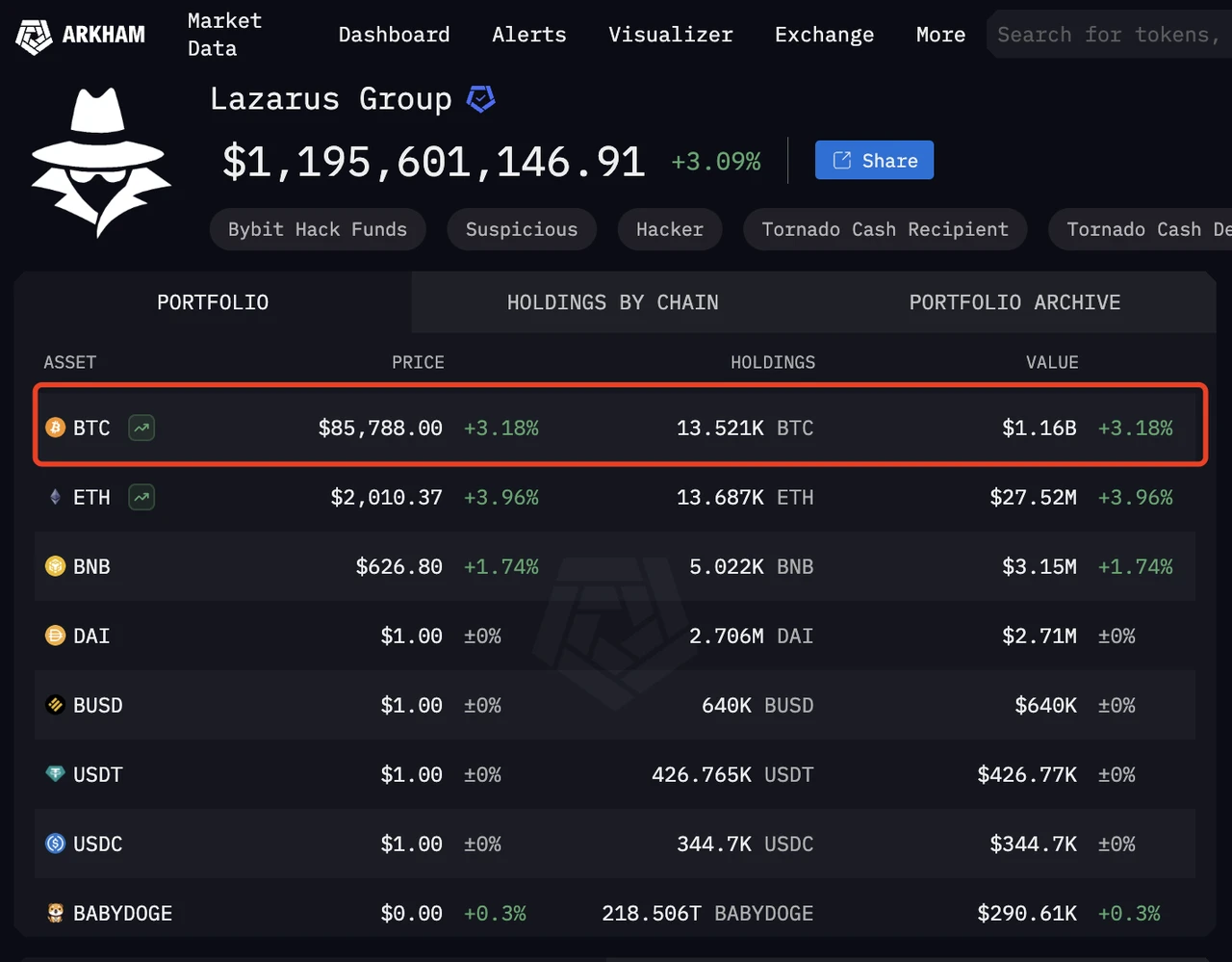

North Korean Hacker Organization Lazarus Group: Holdings exceed 13,500 BTC, primarily from stolen funds

As a well-known hacker group in the industry, Lazarus Group is a batch of on-chain hackers "nurtured" by the North Korean government, and for over a decade, they have been delivering various stolen funds to the North Korean regime. In February of this year, they successfully stole over 400,000 ETH from Bybit's cold wallet and quickly laundered it into BTC through various mixers and cross-chain bridges within a few days.

According to Arkham data, Lazarus Group currently holds approximately 13,500 BTC, valued at $1.16 billion.

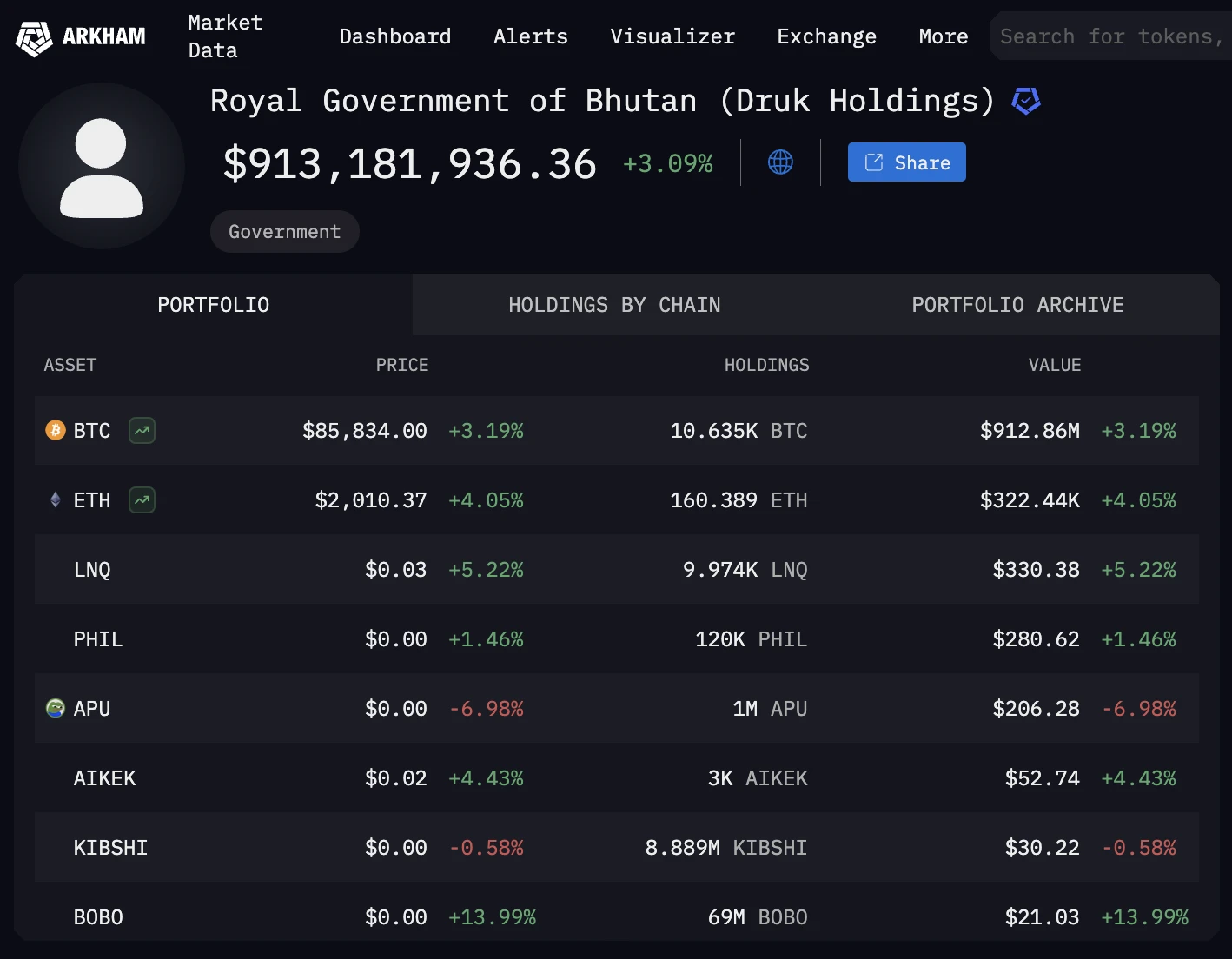

Bhutan Royal Family: Earnings from mining, sold on the market, holding over 10,000 BTC

Compared to the U.S. and UK governments, the Bhutan royal family acquires BTC in a more "Crypto Native" manner—primarily through mining, and they sell at market peaks or opportune moments for profit. It is evident that the Bhutan royal family's BTC is not a national strategic reserve but rather resembles financial transactions conducted by an investment company, buying low and selling high.

Similarly, the value of the Bhutan royal family's BTC holdings has decreased from 11,900 BTC valued at $1.19 billion in January to the current 10,635 BTC, valued at approximately $912 million.

El Salvador: Daily dollar-cost averaging of one BTC, increasing holdings for dreams

Compared to the previous government entities, El Salvador's attitude towards BTC is more akin to that of "believers"—in addition to the usual daily purchase of one BTC, they occasionally increase the amount of BTC purchased and publicly announce it through national websites and on-chain. It must be said that El Salvador is undoubtedly a "BTC diamond hand."

Previously, El Salvador had a strong argument with the International Monetary Fund (IMF) regarding the "use of the $1.4 billion loan not including the purchase of BTC," ultimately securing a critical window period—the effective date of the IMF-related loan agreement is April 30, before which El Salvador can still purchase BTC, and BTC remains recognized as legal tender by the government. For more on El Salvador's love-hate relationship with BTC, see “Awakening: Why is El Salvador, which regularly buys the dip on Bitcoin, getting poorer?”.

As of March 20, El Salvador holds 6,121.18 BTC, valued at $525.9 million, with a total increase of 41 BTC in the past 30 days; compared to the 6,010 BTC holdings in January, it has increased by about 111 BTC, but the overall asset value has decreased by about 16% from $612 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。