The homework has been submitted, and it seems there isn't much to look forward to in the short term. The dot matrix chart has also concluded, and Trump's speech has ended. The only anticipated positive outcome seems to be the cessation of the Russia-Ukraine war. There are many key events to pay attention to in April; starting from the 2nd, reciprocal tariffs will be implemented, and mid-month will bring the first quarter GDP. There will be no interest rate meetings in April, and it is still highly likely that there will be no rate cuts in May.

So, the viewpoint I've been describing in recent days is whether the current market, if it rises, is entering a rebound or a reversal. I also feel that it doesn't make much sense to dwell on bull or bear markets; the focus should be on the current investment strategy. If it is a reversal, then one should buy on dips; if it is just a rebound, caution is needed to avoid potential pitfalls ahead.

Ultimately, investment decisions must be made by oneself. If you cannot take responsibility for yourself, how can you expect anyone else to take responsibility for you? I've already made everything clear in the pinned tweet.

The market is not only targeting cryptocurrencies; the same logic applies to the U.S. stock market. Whether the current market is a rebound or a reversal, one should first ask themselves this question when making investment decisions.

Looking back at Bitcoin's own data, after the Federal Reserve's interest rate meeting concluded, the turnover rate began to increase, which was an expected outcome. After all, the Federal Reserve did not provide the answers the market anticipated. This has been a long-standing game between the market and the Federal Reserve, which has never been won. Some investors are choosing to exit in the face of strong uncertainty starting in April.

The data shows that short-term investors are still the main force exiting, especially in the last two days, where investors who bought the dip have intensified their exit. Some high-position investors who are still observing and facing losses have also chosen to cut their losses and exit, as there are indeed fewer positive expectations for April.

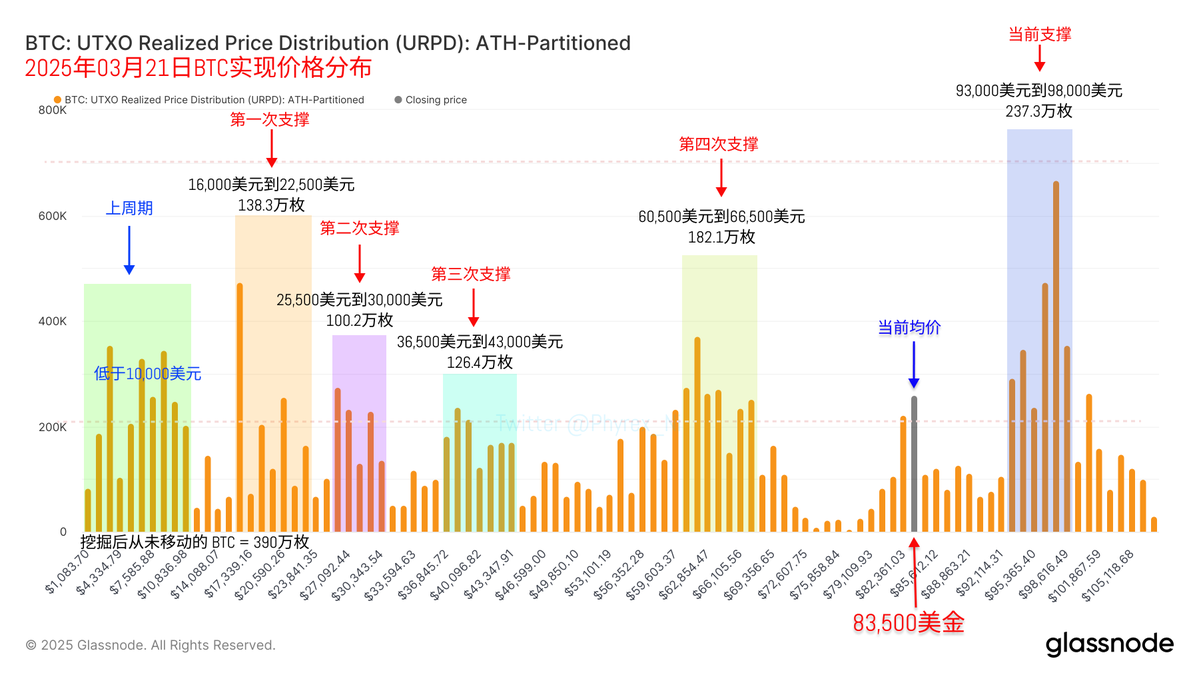

Although the dense chip area between $93,000 and $98,000 remains very strong, a large amount of chips is also beginning to gather around $83,000, and no significant risks have been seen in the short term.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。