The rapid release of early tokens may lead to a lack of sufficient token reserves for the project team to incentivize the community or attract new users in subsequent development.

Author: Tokenomist_ai

Compiled by: Deep Tide TechFlow

Token economics, as a core element of cryptocurrency project design, is continuously evolving with changes in market trends and investor sentiment.

As we enter 2025, an interesting trend is emerging—projects are beginning to slow down the pace of token releases instead of rushing to unlock them immediately.

Tokenomist (formerly known as TokenUnlocks) recently released a series of comparative analyses on token release patterns for the first quarter of 2024 and 2025, revealing a significant shift in project token design from aggressive releases to long-term stability based on different projects that emerged at various points in the crypto market.

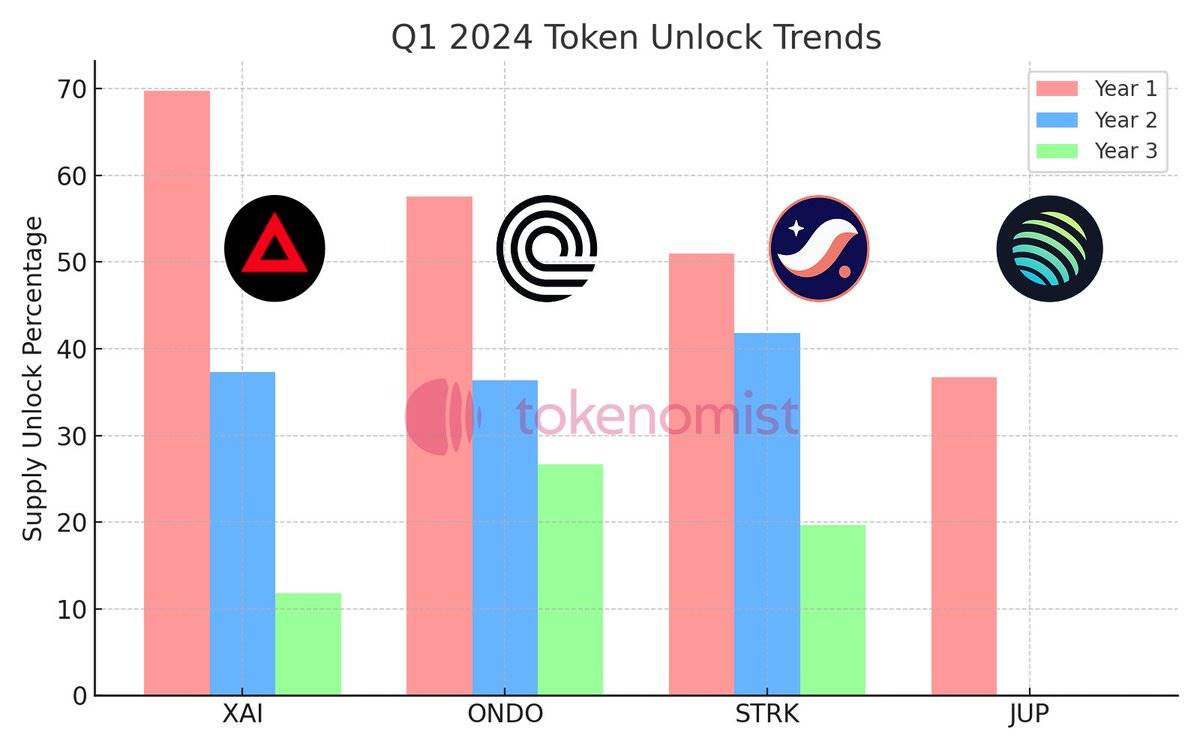

Token Unlocking Trends in Q1 2024

Looking back at the first quarter of 2024, most projects adopted a relatively aggressive unlocking model, characterized by:

High Initial Unlock Ratio: Many projects unlocked 50%-70% of their tokens within the first 6 to 12 months.

Short Lock-up Period: The lock-up period for project tokens in 2024 was generally short, typically lasting 3 to 4 years, leading to rapid market supply expansion.

High Inflation Pressure: A large number of tokens unlocked in a short time created significant inflation pressure in the market, making it difficult for market demand to keep up, thus putting pressure on prices.

Liquidity Risk: The rapid unlocking of a large number of tokens held by early investors and teams could easily trigger concentrated sell-offs, leading to price volatility and decreased market confidence.

In retrospect, the choice of this aggressive model largely stemmed from intense competition following the market recovery in 2024. The crypto market in 2024 was in a relatively recovering phase, and project teams hoped to capitalize on market enthusiasm by quickly releasing tokens and meeting the liquidity needs of early investors.

The high initial unlock ratio also provided projects with more funds for technological development and market promotion. Additionally, with the market recovering, investors were often more willing to trade. High initial unlock ratios typically accompanied higher market liquidity, making this model more attractive to investors, allowing them to participate in trades and realize potential gains more quickly.

However, the drawbacks of the aggressive model are also significant, such as: the aggressive unlocking model increases the selling pressure in the market, leading to significantly higher price volatility, which can easily trigger price declines and chain reactions. Furthermore, the rapid release of early tokens may result in the project team lacking sufficient token reserves in subsequent development to incentivize the community or attract new users.

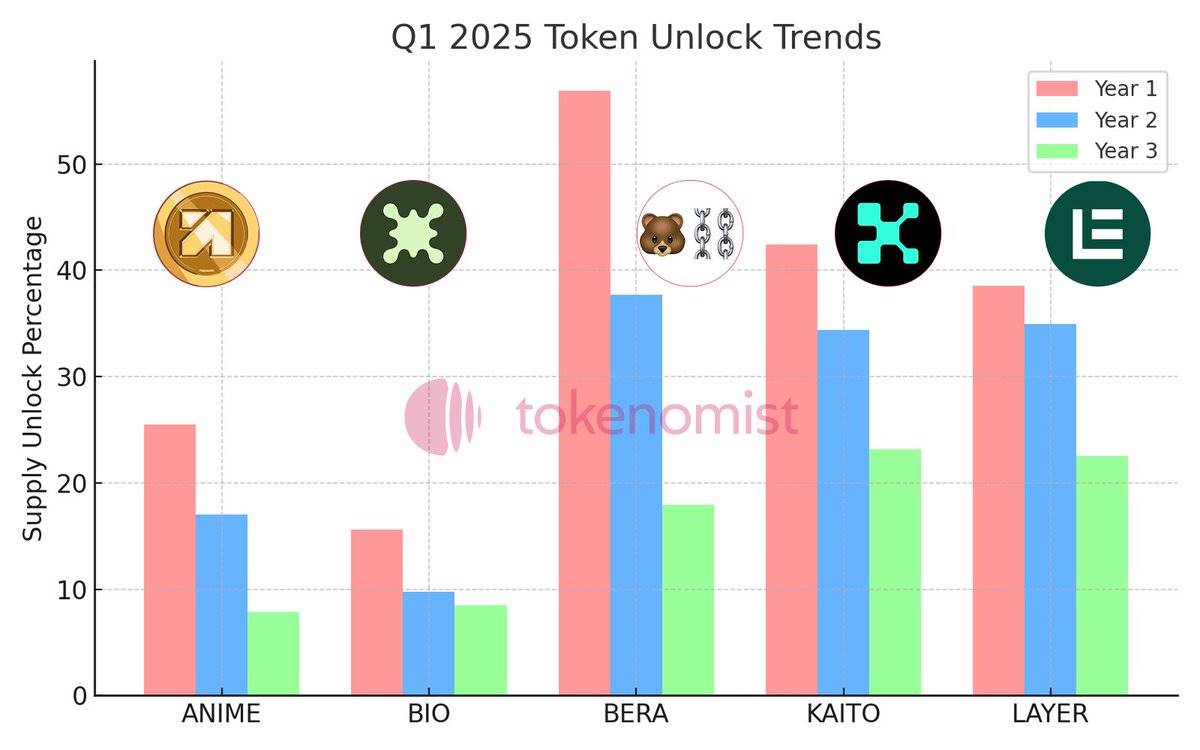

Token Unlocking Trends in Q1 2025

As we enter the first quarter of 2025, there has been a significant change in token release patterns, characterized by:

Slower Release Pace: Projects in 2025 generally adopted longer unlocking cycles, gradually releasing tokens over 5 years or more.

Longer Lock-up Periods: The lock-up periods for tokens held by teams and early investors have been significantly extended, with many projects choosing to extend the lock-up period to 4 to 6 years.

Lower Initial Unlock Ratios: Some projects unlocked less than 30% of their tokens in the first year.

This model theoretically helps alleviate market sell-off pressure, reduce price volatility, and stabilize market sentiment. The extended lock-up periods also align the interests of project teams and investors, enhancing commitment to long-term development and reducing market concerns about teams quickly cashing out.

From the rapid releases in 2024 to the long-term stability in 2025, this trend reflects the market's emphasis on liquidity management.

But does the slowdown in releases truly lead to better price stability and stronger investor trust? This question still requires further observation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。