Source: Cointelegraph Original: "{title}"

The cryptocurrency industry is set to launch the first Solana (SOL) futures exchange-traded fund (ETF). According to industry observers, this is a significant development that could pave the way for the launch of the first Solana spot ETF, as the introduction of a spot ETF is the "next logical step" for trading products based on cryptocurrencies.

Volatility Shares will launch two Solana (SOL) futures ETFs on March 20, namely the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2x Solana ETF (SOLT).

According to Ryan Lee, Chief Analyst at Bitget Research, the launch of the first Solana futures ETF could lead to substantial institutional holdings of SOL tokens.

Documents submitted by Volatility Shares Solana ETF to the SEC. Source: SEC

The analyst told Cointelegraph: "The launch of the first Solana ETFs in the U.S. could significantly enhance Solana's market position by increasing demand and liquidity for SOL, potentially narrowing the gap with Ethereum's market capitalization."

Lee stated that the Solana ETF will "provide a regulated investment vehicle that attracts billions of dollars in capital and enhances Solana's competitiveness relative to Ethereum," thereby promoting institutional adoption. He also added, "Ethereum's entrenched ecosystem remains a significant barrier."

However, other industry participants are concerned that the Solana futures ETF may disappoint investors due to a lack of capital inflow. As seen with the launch of the Ethereum (ETH) spot ETF, as predicted by Bloomberg's senior ETF analyst Eric Balchunas, the capital inflow for the Ethereum spot ETF was merely a "sidekick" to the Bitcoin ETF.

While the Solana futures ETF may disappoint, the Solana spot ETF could be the next step.

Although the futures ETF may not bring in substantial capital inflow, it legitimizes Solana's status as a top cryptocurrency, especially after U.S. President Trump announced that his digital asset working group would include Solana alongside Cardano (ADA) and Ripple (XRP) in the U.S. cryptocurrency strategic reserve.

"The Solana ETF is driving the possibility of broader adoption," said Anmol Singh, co-founder of the Solana-native perpetual futures decentralized exchange Bullet.

Singh told Cointelegraph: "The Solana spot ETF has not yet been approved, but given the increasing market awareness of Solana and futures ETFs, launching a spot ETF would be the next logical step."

He also added, "We can expect moderate capital inflow for the futures ETF — spot ETFs are generally a better investment vehicle, and the approval of a spot ETF would be a significant milestone."

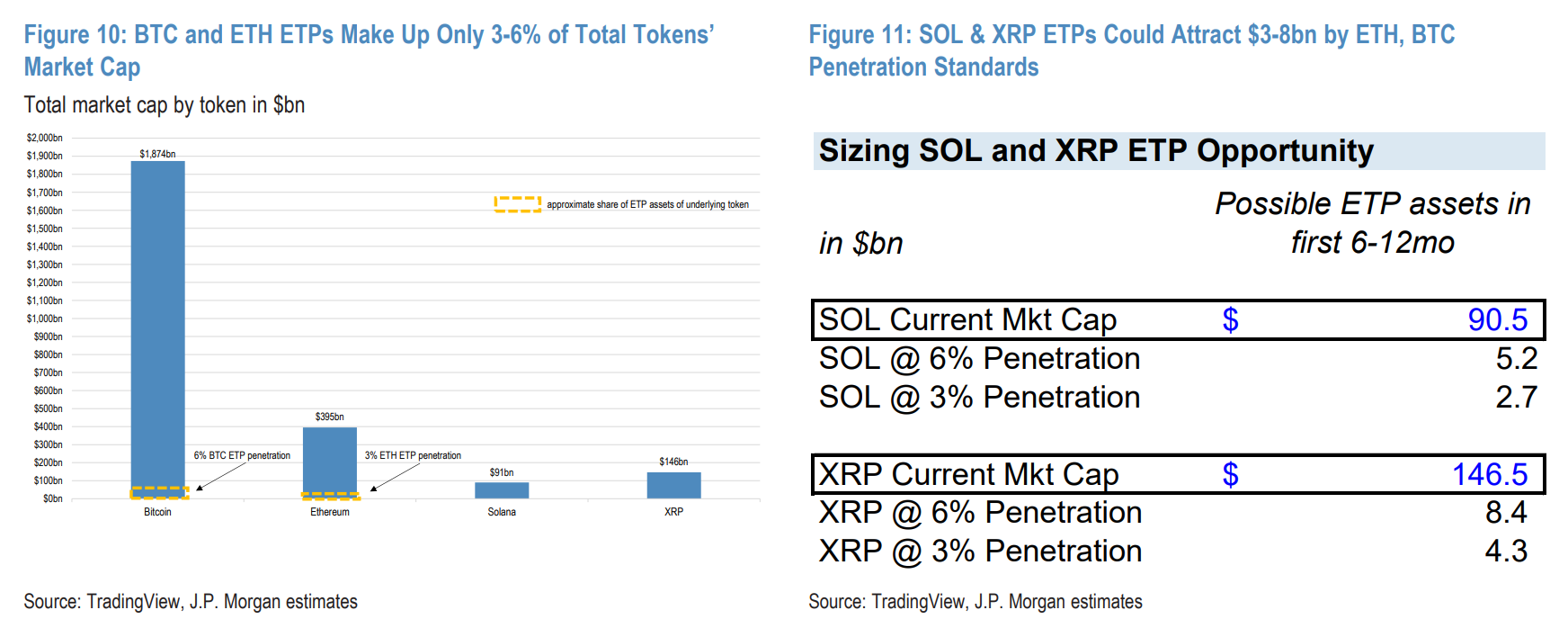

According to a report from JPMorgan seen by Cointelegraph, while the adoption rate of futures ETFs is difficult to measure, the Solana spot ETF could attract $3 billion to $6 billion in net assets within the first six months of its launch, surpassing the adoption rate of the Ethereum ETF.

Exchange-traded products (ETPs) for Solana and Ripple could attract $3 billion to $8 billion. Source: JPMorgan

The report stated: "When applying these so-called 'adoption rates' to Solana and Ripple, we expect Solana to attract about $3 billion to $6 billion in net assets, while Ripple will attract $4 billion to $8 billion in new net assets."

However, Bloomberg Intelligence analyst James Seyffart stated on January 16: "Due to the SEC's previous review timelines typically taking 240 to 260 days, the timeline for (the approval of the Solana spot ETF) could extend to 2026."

Related: Volatility Shares to launch Solana futures ETF on March 20

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。