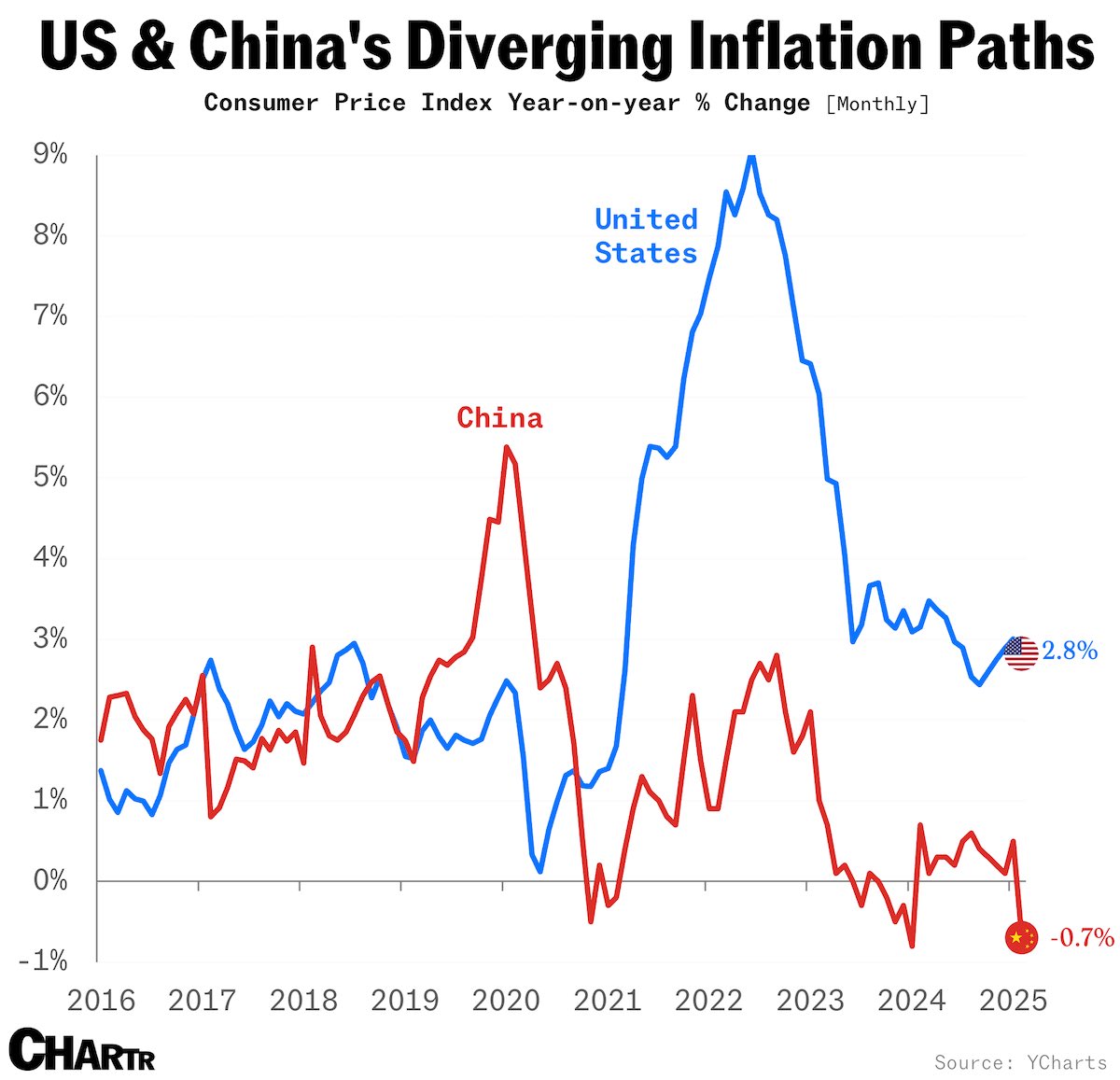

China 🇨🇳 is experiencing deflation, while the United States 🇺🇸 is facing inflation!

The benefit of counter-cyclical strategies is that you can arbitrage across cycles.

The downside is that uncontrollable risks are increasing, especially recently with Indonesia and Turkey facing a triple whammy of stocks, bonds, and currency. China has a trade surplus with both countries, with a surplus of over 30 billion USD with Turkey. If there are no more channels to borrow additional USD, imports will have to be reduced. It is expected that this year, China's export difficulties will increase because countries with high debt and leverage like Indonesia and Turkey are just the beginning. There are also Argentina, Vietnam, Thailand, Brazil, Egypt, etc. A lack of demand along the Belt and Road will be a heavy blow!

The only solution is to stimulate domestic demand. In a deflationary context, how to open up domestic demand? Today, banks have launched a 300,000 RMB consumption loan for 7 years, and the approval process is not difficult, but this is just a temporary fix! The best channel is to stimulate the A-shares, leading to a bull market, so that nearly 300 million stockholders in China can make money, which in turn will stimulate consumption and the real estate market! 🧐 This is just a wild guess, my personal opinion! Still, it is essential to firmly hold onto the "all-weather allocation strategy"!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。