The story of Bitwise Ethereum ETF being approved for staking unfolds like a slowly revealing painting.

Written by: Luke, Mars Finance

In an era where cryptocurrency intertwines with traditional finance, market trends are always unpredictable. Recently, the New York Stock Exchange (NYSE) submitted a proposal to the U.S. Securities and Exchange Commission (SEC) requesting permission for the Bitwise Ethereum ETF to participate in staking. This news is like a spring breeze, opening a new window of opportunity for investors and adding a touch of brightness to the future of Ethereum.

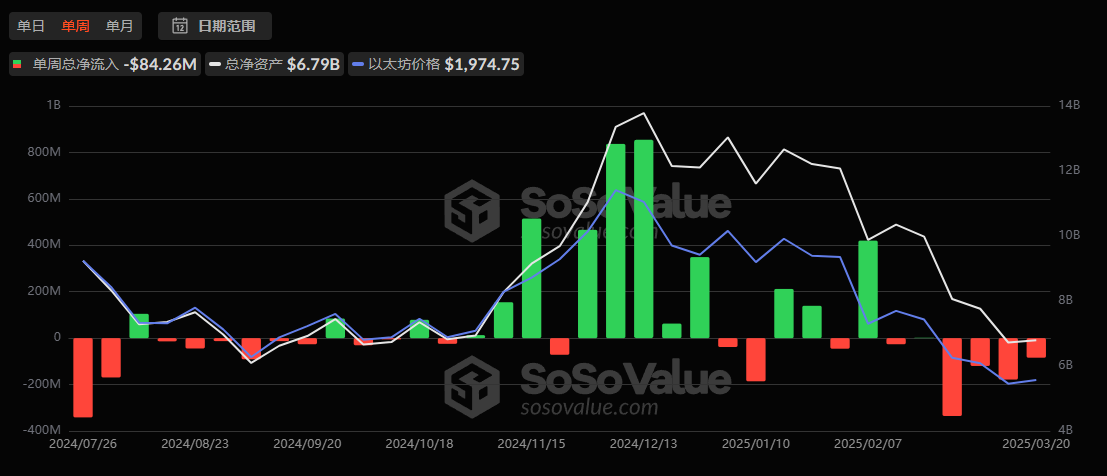

However, the current attitude of the crypto market towards Ethereum is far from optimistic. Ethereum spot ETFs have seen net outflows for four consecutive weeks, with approximately $120 million flowing out in the first week of March 2025 alone, reflecting a lack of investor confidence.

Meanwhile, negative news such as high gas fees and intensified Layer 2 competition has somewhat dimmed Ethereum's halo. With Ethereum facing challenges on all sides, can this proposal bring a turning point to the market?

The Starting Point of a Proposal: The First Handshake Between Staking and ETFs

The Bitwise Ethereum ETF is an exchange-traded fund designed to allow investors to easily access Ethereum through traditional stock markets. Staking, on the other hand, is a core component of Ethereum's transition to a Proof of Stake mechanism since 2020, where holders lock up ETH to support network operations and earn an annual reward of about 4%-6%. Now, the NYSE proposes to combine these two elements, allowing ETF managers to stake on behalf of investors, maintaining the fund's security while providing additional returns to holders.

The proposal was officially submitted on March 20, 2025. According to crypto.news, Bitwise plans to adopt a "point-and-click" staking method, which simplifies the process of locking ETH while ensuring that these assets are always controlled by the fund, avoiding complex technical risks. This design is clearly well thought out, lowering the participation threshold and addressing regulatory concerns about security.

The market is full of anticipation. Some predict that if the new SEC chairman approves it smoothly after taking office, this feature could be implemented in April 2025. However, the approval process is not straightforward. The SEC has been quite cautious regarding cryptocurrencies in the past, especially during Gary Gensler's tenure. But CoinDesk points out that as the U.S. government's attitude towards cryptocurrencies gradually improves, there is a general belief in the industry that the approval of this proposal is just a matter of time.

The Potential Dividends of Ethereum: Multiple Benefits from Supply and Demand to Ecosystem

If the Bitwise Ethereum ETF is approved for staking, it will represent a multidimensional transformation for Ethereum. Let's break down the benefits from several angles.

1. Subtle Push from Supply Tightening and Demand

The core of staking lies in locking up ETH, which directly reduces the circulating supply in the market. Currently, over 32 million ETH are staked on the Ethereum network, accounting for about 27% of the total circulating supply. If the ETF joins the staking ranks, its managers will need to purchase and lock up more ETH, further tightening supply. For example, with a $1 billion ETF, if 50% is used for staking, it would lock up about 250,000 ETH, which is 0.2% of the current circulating supply. While this may seem small, under market sentiment, it could trigger a chain reaction. Coingape.com reported that when the proposal news broke, ETH was fluctuating around $1,977, and traders expected the reduced supply could push the price above $2,100. Looking back at the launch of Ethereum 2.0 in 2020, the surge in staking volume drove ETH prices from $400 to $1,400, and this history may repeat itself.

2. A Steady Stream of Liquidity

The essence of an ETF is to serve as a bridge for bringing cryptocurrencies into traditional finance. With staking allowed, traditional investors can enjoy ETH staking rewards indirectly through their stock accounts without needing to open crypto wallets or learn complex blockchain operations. This convenience will attract more institutions and retail investors. FXStreet noted that after Fidelity submitted a similar proposal, ETH prices rose 3% in one day, from $1,950 to $2,008, highlighting the market's enthusiasm for this feature. In the long run, the increase in liquidity could not only stabilize ETH price fluctuations but also allow Ethereum to secure a place in the boardrooms of Wall Street. Data shows that the total trading volume of Ethereum spot ETFs exceeded $5 billion in 2024, and if the staking feature is implemented, this number is expected to reach new heights.

3. A Win-Win for the Network and Investors

Staking not only affects market supply and demand but also brings tangible benefits to the Ethereum ecosystem and investors. First, it enhances network security. The Ethereum Foundation has pointed out that for every 10% increase in staking volume, the network's ability to resist attacks improves by an order of magnitude. The participation of the ETF will further increase the total staking volume, contributing to the decentralization and stability of the network. Secondly, investors can also benefit from this. The annual yield from staking typically ranges from 4% to 6%. For instance, if Bitwise's ETF reaches a size of $1 billion, with a 5% yield, it could generate about $50 million in returns for investors each year. This income can be received through ETF dividends without requiring investors to operate personally. Robert Mitchnick, head of digital assets at BlackRock, stated in an interview with The Block: "If the Ethereum ETF can provide staking functionality, it will unleash the potential demand for ETH in traditional markets." This win-win situation for the network and investors is precisely the charm of the integration of staking and traditional finance.

4. The Spring Breeze of Regulatory Environment Approaches

If the SEC approves this proposal, it will send a supportive signal for innovation in cryptocurrencies. In the past, the SEC under Gensler faced controversy due to strict regulations, such as the lawsuits against Coinbase and Binance in 2023. However, the government transition in early 2025 seems to bring a turning point for the industry. Notably, the new SEC chairman is expected to take office in April 2025, and their attitude towards cryptocurrencies may determine the final direction of the approval. CoinDesk analyzes that the new government's pro-crypto stance, combined with the new chairman's appointment, may prompt the SEC to adjust its policies and greenlight more similar products. This would not only benefit Ethereum but also inject confidence into the entire crypto market. Bitwise's proposal may just be the precursor to this wave.

Market Response and Concerns

After the proposal was announced, the market did not remain silent. Coingape.com observed that when ETH was hovering around $1,977, trading volume significantly increased, indicating investors' attention to staking expectations. FXStreet recorded the market reaction after Fidelity's proposal—ETH prices surged 3% in a short time, from $1,950 to $2,008, reflecting the market's sensitive nerves. Experts' voices are also abundant. Crypto analyst James Seyffart tweeted: "If ETF staking is approved, it could be a milestone for Ethereum's move towards the mainstream." Companies like Grayscale and 21Shares have also submitted similar proposals, showing the industry's collective enthusiasm for this trend. Robert Mitchnick's optimistic outlook also adds some confidence to the market, as he believes that the implementation of the staking feature will help Ethereum find a more solid foothold in traditional finance.

However, beneath the transformation lies hidden concerns. While staking can bring returns, it may also face the risk of price volatility. If ETH prices drop significantly during the staking period, the ETF's net asset value may be affected. For example, in 2022, ETH prices fell from $3,000 to $1,000; while stakers earned returns, it was difficult to offset capital losses. Additionally, the SEC's regulatory details regarding staking remain unclear, such as whether additional disclosure requirements are needed or how staking returns will be taxed. These issues need to be clarified one by one before implementation. However, these risks are not uncontrollable. The Ethereum network has been operational for many years and has proven its stability, while Bitwise's "point-and-click" method aims to reduce operational risks. If regulators can work hand in hand with the market to balance returns and security, the prospects for this plan remain promising.

Conclusion

The story of Bitwise Ethereum ETF being approved for staking unfolds like a slowly revealing painting. It brings supply tightening momentum, liquidity enhancement, network security consolidation, and deeper integration with traditional finance to Ethereum. Although the approval process has not yet materialized, the market's expectations have already sprouted like spring buds, ready to take off.

Perhaps, as James Seyffart said, this will become a milestone for Ethereum's move towards the mainstream. Whether investors, network participants, or industry observers, we all have reason to hold our breath in anticipation of this moment. At the intersection of cryptocurrency and traditional finance, Ethereum is writing its own new chapter, and this proposal is just a prelude. Let us wait for the spring to bloom and see how it unfolds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。