China vs US: Gold and Bitcoin Reserves Battle for Economic Dominance

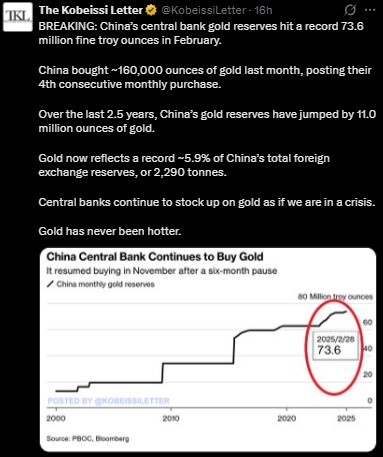

Recently, China has made headlines by significantly increasing its gold and Bitcoin reserves. As of February 2025, its gold holdings reached an all-time high of 2,279.56 tonnes, which accounts for approximately 5.9% of its total foreign exchange reserves. According to The Kobeissi Letter , the country bought around 160,000 ounces of GC in just the last month, marking its fourth consecutive monthly purchase. Over the past two and a half years, it has added around 11 million ounces of gold to its reserves.

Source: Twitter

The United States, however, remains far ahead, holding approximately 8,133.46 metric tonnes of gold, according to the World Gold Council. This renders the United States the world's biggest t raditional asset holder. In spite of China's GC reserves' dramatic rise, the US is still way ahead. However, the persistent rise in China's GC reserves signals their efforts to curtail reliance on the dollar and consolidate their economic influence.

China and US Bitcoin Holdings: The Virtual Race

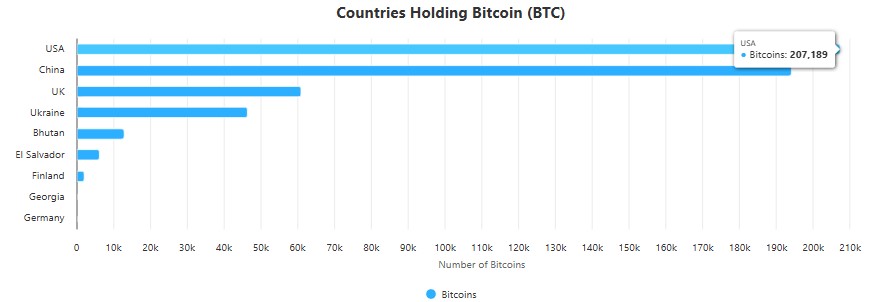

Besides GC, Bitcoin has become an important digital currency for nations. As per Bitcoin Treasuries by BitBO report, Both countries are the two biggest government holders, primarily acquired from law enforcement seizures. Presently, the United States possesses about 207,189 BTC, worth about $17.2 billion. The U.S. seized the majority of this cryptocurrency through enforcement against illicit online platforms such as Silk Road and the Bitfinex hack in 2016.

Source: BitBO

China, although officially prohibiting digital assets trading and mining, possesses approximately 194,000 BTC worth about $16.1 billion. Its cryptocurrencies were predominantly obtained through the government's confiscation of cryptocurrencies from illicit operations, especially the PlusToken Ponzi scheme in 2019. The assets are still held in state accounts, indicating the country's conservative but calculated stance on cryptocurrency.

Is China Overtaking the US in the Asset Market?

China's increasing t raditional asset reserves and crypto holdings have raised eyebrows about its economic ambitions. While the country strategically builds up gold to diminish dependence on the dollar and holds digital assets despite local restrictions, the United States continues to dominate both assets. China's moves signal financial prudence, but the US remains on top with the world's biggest GC and Bitcoin reserves and is also factoring in national Bitcoin reserves .

While China is quickly closing the gap, it has not yet overtaken the US economically. Rather, both countries are hedging against economic uncertainty by diversifying into traditional and digital assets. If the Red Dragon continues to build its holdings, it might pose a challenge to United States economic dominance in the future, so the competition between these superpowers is something to keep an eye on.

Bitcoin Price Prediction : Will Crypto King Surpass T raditional Asset in the Future?

A comparison of gold and king of cryptocurrency helps to understand which asset is better. Based on the Companies Market Cap report, t raditional asset dominates the world asset market with a market capitalization of around $20.335 trillion. It is the most important and stable asset in the world, particularly in times of economic uncertainty.

In contrast, BTC is a fast-evolving crypto. As of writing, it costs approximately $84,312.82 per coin, with a market cap of approximately $1.67 trillion, making it 8th in global assets.

BTC would have to achieve a market cap of approximately $18.665 trillion in order to exceed gold. Although it offers security and stability, the crypto King offers high potential for expansion, which draws nations such as the U.S. towards exploring strategic national BTC reserves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。