The reason Walrus can still secure significant funding while distributing a small amount of tokens to investors may lie in the fact that the protocol is almost entirely built using resources from Mysten Labs, further proving the strong internal capabilities of Mysten Labs.

Author: @Steve_4P

Key Points Summary

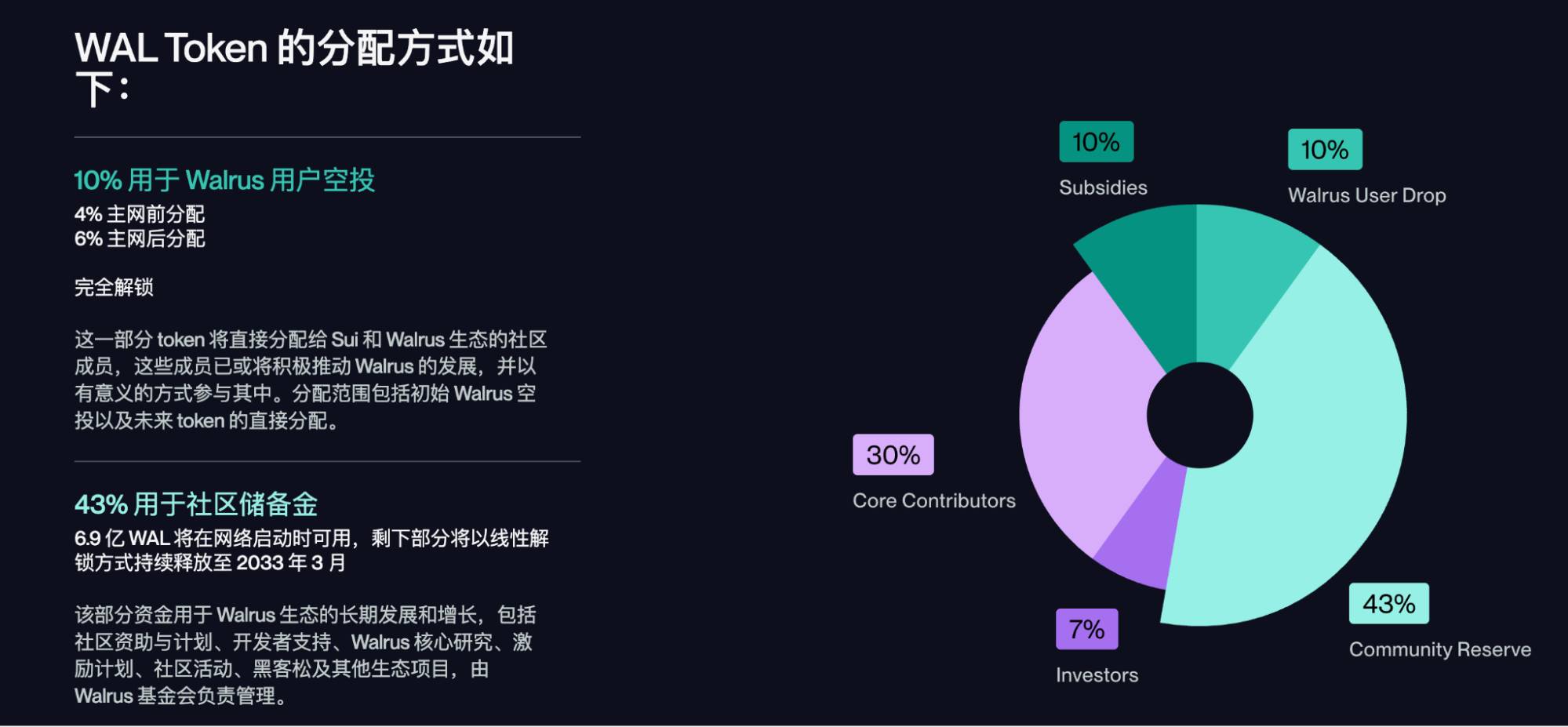

1️⃣ On March 20, 2025, the Walrus Foundation announced successful funding of approximately $140 million, with investors including Standard Crypto, a16z, and other institutions. Walrus is currently valued at around $2 billion, with 7% of the token supply allocated to investors and 10% for initial community airdrops, reflecting a community-centric distribution strategy.

2️⃣ The reason Walrus can secure significant funding while distributing a small amount of tokens to investors may lie in the fact that the protocol is almost entirely built using resources from Mysten Labs, further proving the strong internal capabilities of Mysten Labs.

3️⃣ Unlike existing storage protocols, Walrus adopts a PoS (Proof of Stake) mechanism, meaning that the $WAL token will play a key role in ensuring the trustworthiness of the Walrus protocol in the long term. Therefore, $WAL is considered to have high potential value as an asset.

01 Background Why is Walrus's funding surprising?

1.1 What does it mean to raise $140 million with a $2 billion FDV?

Source: Walrus

On March 20, 2025, Mysten Labs announced the funding amount, valuation at the time of investment, and the list of investors for its next-generation decentralized storage protocol, Walrus.

Total funding: $140 million

Valuation: Approximately $2 billion

Investors: Including well-known crypto funds such as Standard Crypto, a16z crypto, Electric Capital, etc.

Mysten Labs CEO Evan stated that the market demand for Walrus during the funding process was "extremely strong."

The funding amount and valuation of Walrus shocked me. In the blockchain industry, while a $2 billion valuation and $140 million funding are not unprecedented (for example, projects like Story, Berachain, and Monad have also achieved similar valuations), such a situation is extremely rare in the highly specialized field of "decentralized storage layers."

Comparison of Walrus's Valuation

To more intuitively showcase Walrus's unique position in the decentralized storage field, we can make a comparison:

🔹 Currently, the highest market cap storage network in the blockchain market is Filecoin, with a market cap of about $2 billion and an FDV of about $6 billion.

🔹 Walrus has achieved a valuation that is already 1/3 of Filecoin's before launching its mainnet, making it the second highest valued decentralized storage protocol in the blockchain market.

🔹 This means that Walrus is writing a new history in the decentralized storage field.

Specialty of Investment Institutions

Another noteworthy highlight of this round of funding is that almost all the investment institutions participating in the Walrus token round are early investors in Mysten Labs.

For example:

✅ Standard Crypto (the lead investor in this round) is also an investor in Mysten Labs's Series A.

✅ a16z (Andreessen Horowitz) participated in both Series A and Series B investments.

✅ Electric Capital participated in Series A investment.

✅ Franklin Templeton participated in Series B investment.

This is similar to the concept of $WAL airdrops, further reflecting the alignment of interests between Walrus and long-term supporters of the Sui ecosystem.

Given the relationship between Walrus and Sui (details can be found in my related article), this investment structure can be considered the most ideal model. Because as Walrus grows, the Sui ecosystem will also benefit.

Walrus may have created the first case in the blockchain industry

To my knowledge, this may be the first protocol incubated by an L1 public chain team that has successfully secured such large-scale funding. This undoubtedly makes Walrus's funding a major focus in the crypto market.

1.2 How much share do investors receive?

Source: Walrus Token Economics

1.2.1 Airdrop Amount > Investor Allocation Amount

One advantage of Walrus is that the protocol is fully prepared for the mainnet launch after validation on the testnet. Typically, many blockchain infrastructure projects require 1-2 years, or even 3-4 years, to be ready, so they raise funds in stages and receive investments at different stages. Naturally, their valuations in the early stages are lower, leading to a need to allocate more tokens to investors.

However, Walrus has taken the completely opposite strategy—since the protocol is close to completion, they were able to achieve a higher valuation in the first round of funding. Therefore, despite Walrus securing large-scale investments from investors, the number of tokens allocated to investors is relatively small.

According to Walrus's token economics, only 7% of $WAL is allocated to investors, which is even lower than the 10% for user airdrops. This indicates that the Walrus team is very aware of the negative sentiment in the market regarding "over-allocation to investors."

I believe the feasibility of this strategy comes from Mysten Labs having sufficient internal resources to complete the development and evolution of Walrus without relying on external funding. With fewer investor allocations and more community incentives being more attractive in today's market, Walrus's token economics, investment strategy, and valuation model appear particularly interesting and ideal.

1.2.2 How will the remaining 6% airdrop be allocated?

Source: Adeniyi

After reviewing the token distribution chart of Walrus, many retail investors are most concerned about the question: "Who will receive the remaining 6% of the 10% airdrop?"

From a percentage perspective, 6% may not seem much, but based on Walrus's $2 billion valuation, the value of this portion of tokens is approximately $120 million, which is undoubtedly a significant incentive.

Currently, specific information about this 6% airdrop has not been disclosed, so I cannot make a definitive conclusion. However, based on my research on various airdrop strategies in the industry, I speculate that this allocation may be related to the previous 4% airdrop.

When the initial 4% airdrop was distributed, Walrus seemed to have carefully examined whether users held tokens from the Sui ecosystem (such as $DEEP or $NS) and whether they immediately sold after receiving the airdrop. This approach is reasonable, as both $DEEP and $NS tokens were distributed to the community through airdrops, and users who hold these tokens for the long term are more likely to have long-term confidence in the entire Sui ecosystem.

Therefore, I speculate that the remaining 6% may also consider users' initial holdings of $WAL. For example, if a user stakes immediately after receiving the 4% airdrop, they may receive additional rewards. Of course, the final answer is known only to the internal staff of Mysten Labs, but if you have a long-term positive outlook on Walrus, holding and further staking may be a wise strategy.

1.3 In-depth Analysis of Walrus Token Economics

After understanding Walrus's valuation and token distribution strategy, it is time to delve into its token economics. The most important point in Walrus's token economics is that Walrus is both a decentralized storage protocol and adopts a PoS (Proof of Stake) mechanism.

In this section, we will explore the reasons why Walrus chose PoS, how Walrus nodes determine storage prices, and the token governance mechanism.

1.3.1 Why did Walrus choose PoS?

While continuously focusing on Walrus and writing comparative analyses with existing storage protocols, I overlooked a key differentiating factor: Walrus adopts a PoS mechanism.

From the user's perspective, the most important question when using a storage protocol is: "How does Walrus ensure that the storage contract I signed is fulfilled?" Essentially, Walrus needs to ensure that nodes store specific data within a specified time. However, storing data is a high-cost operation, and nodes may stop fulfilling their storage obligations after a period.

In the worst-case scenario, nodes may leverage data access rights to demand higher rewards or even "kidnap" user data for ransom. Additionally, since Walrus is a decentralized protocol, there may also be a "tragedy of the commons" situation.

Therefore, Walrus introduces the PoS mechanism to address these risks. PoS acts as a minimum protection system to punish malicious behavior and safeguard user rights.

The role of the PoS system: ✅ Reward honest nodes (i.e., nodes that store data according to the contract) ✅ Punish malicious nodes (i.e., nodes that violate the contract). In a sense, the PoS mechanism ensures the continuity and reliability of storage services.

1.3.2 How does Walrus determine storage fees?

First, the costs in Walrus are mainly divided into storage costs and writing costs. Storage costs refer to the rental fees required to store data over a specific period, while writing costs refer to the one-time fees paid when registering new data. In other words, users incur writing costs when uploading data, and thereafter must pay storage costs. So, how does Walrus calculate these costs?

In simple terms, in the Walrus ecosystem, storage and writing costs are determined by the nodes, but not through consensus among the nodes. Instead, each node submits what it considers to be appropriate costs, which are then sorted, and the price proposed by the nodes at the 66.67% percentile (the lower 2/3 position based on the amount staked) is adopted. Sui has already employed this pricing determination mechanism when calculating transaction costs. If this seems difficult to understand, we can illustrate with an example:

Each node proposes a "price":

Node A: $0.9

Node B: $1.0

Node C: $0.5

Node D: $1.2

Sort the prices from low to high (listing the nodes with lower prices first):

Node C → Node A → Node B → Node D

Calculate the amount of staked tokens for each node:

Node A: 10

Node B: 20

Node C: 15

Node D: 5

The total staked amount for all nodes is 50, of which 2/3 is 33.3. When the staked amounts of the nodes are cumulatively added in order of price, the position where the total staked amount reaches 33.3 is Node B (since Nodes C and A together only add up to 25). Therefore, the $1 price proposed by Node B is ultimately adopted as the cost in the Walrus ecosystem.

Both storage costs and writing costs are determined in this manner, but in the calculation of writing costs, an additional Hardcoded Factor is applied, requiring users to pay an extra deposit when uploading data. This mechanism aims to incentivize users to store data across as many nodes as possible.

In the Walrus ecosystem, users do not need to upload data to all nodes; as long as the data is stored on at least (f+1)~(2f+1) nodes, it can be claimed to have been uploaded to the chain. However, if another node needs to access that data later, it may incur additional recovery or data transfer operations, thereby increasing the overall network costs.

To address this issue, Walrus collects an additional deposit when users upload data and refunds this deposit when users actively upload data to as many nodes as possible, thereby encouraging widespread data storage. This Hardcoded Factor is a fixed value but can be adjusted through token governance.

Summary:

Storage Costs: Selected directly from the prices submitted by nodes, with the final price determined based on the 66.67% percentile of the staked amounts.

Writing Costs: Calculated in the same way, but the final fees paid by users also include an additional Hardcoded Factor deposit to encourage data storage across more nodes.

1.3.3 Token Governance Mechanism

Walrus adopts a governance mechanism similar to other PoS networks. Although the mainnet has not yet launched, the specific implementation of governance is still unclear. However, according to the white paper, the Walrus governance mechanism will adjust several key parameters, such as:

The penalty mechanism for nodes

Compensation that affected nodes should receive

Adjustments to key parameters of the protocol

The Walrus governance mechanism follows the 2f+1 storage node approval principle, and voting rights are proportional to the amount of $WAL held and the amount delegated.

02 Conclusion No Airdrop, No Community

2.1 Only Mysten Labs Can Do This

The token distribution method of Walrus is indeed impressive. They allocated only 7% of the total supply while securing a $140 million investment, which is surprising. But it is worth considering, how many teams besides Mysten Labs can execute such a strategy?

From the very beginning, Mysten Labs has been a company that thoughtfully considers blockchain infrastructure. Although Mysten Labs has a relatively short history, their research into blockchain technology dates back to the Diem era, which is quite a long span. This has enabled them to create Walrus—a product that is distinctly different and efficient compared to existing storage protocols. Because the product itself is already highly mature, they were able to successfully secure funding with minimal token distribution.

I do not know how many more protocols and products Mysten Labs will launch in the future, but with their own resources, they are already well-positioned to stand out in the blockchain industry.

2.2 Which Ecosystem Truly Cares About Its Community Now?

Source: Adeniyi

Whether people remember or not, Sui is known for launching its mainnet as a Layer 1 blockchain without an initial airdrop. At that time, many mocked Sui as a "scam," criticizing Sui and Mysten Labs, claiming that "without an airdrop, there is no community." However, now that the Sui ecosystem is approaching the two-year anniversary of its mainnet launch, the negative public opinion about Sui has long dissipated.

It turns out that Sui may be the Layer 1 that has provided the most rewards to its community so far. From $DEEP, $NS to $WAL, Deepbook airdropped 10% of its $1 billion FDV (i.e., $100 million), and the Sui Naming Service airdropped 10% of its $100 million FDV (i.e., $10 million). In other words, if a user has been active and contributed to the Sui ecosystem, they may have received substantial economic benefits.

Returning to Walrus, Adeniyi once stated that "Walrus will become one of the largest airdrops in crypto history," and this statement seems quite accurate. Because Walrus's FDV valuation is approximately $2 billion, if 10% is airdropped, it means that tokens worth about $200 million will be distributed to the community.

Upon careful consideration, Mysten Labs' "post-mainnet airdrop" strategy seems to be more conducive to shaping a truly passionate community. If an airdrop were conducted at the time of the mainnet launch, it would be difficult to distinguish between genuine loyal users and those merely looking to take advantage. However, if the airdrop is delayed until after the mainnet has been running for a while and user behavior is observed, it becomes clearer which users deserve to be rewarded.

Moreover, by airdropping multiple ecosystem tokens, users will continuously engage in ecosystem activities and look forward to new "rewards," which not only attracts new users but also enhances the loyalty of existing users.

Recently, the Sui community, along with Hyperliquid, has been referred to as a "highly enthusiastic community," which also explains why some projects can gather such active communities.

So, which project truly cares about its community now?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。