Is there still something to look forward to in Ethereum?

Author: Jessy (@susanliu33), Jinse Finance

Vitalik has been absent from X for over 20 days.

During these 20 days, Ethereum's price repeatedly fell below investors' psychological thresholds. On March 12, the ETH/BTC exchange rate hit a new low, dropping to 0.022676, the lowest since June 2020. The ETH/BTC exchange rate continued to decline, with ICO-era whales fleeing, retail investors panicking, and FUD (fear, uncertainty, doubt) rampant.

In February, a quarrel erupted within the Ethereum community, where members wanted Vitalik to lower his noble head and see what the industry is currently engaged in. In response to criticism, Vitalik stated that he does not believe the current PVP (player versus player) trend is the best product for blockchain, and what he and Ethereum strive for is to create better products.

During Vitalik's over 20-day absence from the online space, Binance's two founders, CZ and He Yi, took the lead in playing memes on X, leveraging the investment from Abu Dhabi's investment agency in Binance to spark a "white cloth market" of memes on the BSC chain.

In this cycle, the meme sector is booming, and PVP is prevalent, with a frenzied gambling mentality permeating the crypto community. Additionally, a broader sense of confusion looms over the crypto community, as the true innovations that could lead the industry to thrive have disappeared.

The industry is desolate, and memes have become the main narrative. People begin to reminisce about the summer of 2020 when DeFi was flourishing on Ethereum.

Once called "God V," now called "Little V"

In the past, people referred to him as "God V," treating him as a spiritual leader who pointed the way for crypto development. Now, people call him "Little V," telling him to "get out" of Ethereum.

The last time Vitalik became the focus of public opinion was in early February. At that time, the community was filled with voices of FUD regarding Ethereum. In response to doubts, rational suggestions, or emotional insults, Vitalik ultimately responded on X, stating that he does not agree that the current PVP model is the best product, and he pursues better products. He also expressed his exhaustion regarding the community's demands for reform and responsibilities of the Ethereum Foundation, especially from those who know nothing about the foundation.

Vitalik has become a target of criticism, which was unimaginable two years ago.

Groups often crave strong leaders, eagerly needing someone to worship, thus gaining psychological support and guidance. This drives them to idolize, amplifying an individual's strengths to create an all-powerful "god." Once this constructed "god" fails to meet the public's overly high expectations, the shift in group attitude is swift and brutal. They instantly turn from blind worship to fierce criticism, forcefully pushing the "god" off the pedestal and venting their disappointment and anger through insults and slander.

Vitalik has fully experienced the process of being idolized and then deified by the crypto community. Once, in the crypto community, what Vitalik said and the ideas he proposed pointed the direction for the crypto industry. Vitalik was eager to express various thoughts, such as the SBT (Soulbound Tokens) and digital nations from a few years ago, which were concepts he proposed or strongly supported. It was under Vitalik's vigorous promotion that these new concepts were embraced and practiced by industry projects, becoming a temporary trend.

Especially during bear markets, major projects would strategically position themselves for sectors expected to explode during bull markets. At that time, Vitalik was optimistic about Web3 social, and entrepreneurs flocked to it, but after a brief period of popularity during the bear market, it all fizzled out.

As the bull market arrived, the directions Vitalik "pointed out" during the bear market did not lead to a significant explosion in application levels. Chaos and confusion became the feelings of most project parties.

There is no real innovation, no new narrative to invigorate the industry, and the grand scene of DeFi Summer that once occurred on Ethereum has not reappeared in the crypto industry.

The blockchain infrastructure has been built, the highways are ready, but there are no cars to drive on them. The core contradiction in the current blockchain industry is no longer related to infrastructure. Instead, it is about what changes blockchain can bring to human life or the world. What is the answer to this question?

If the answer is payment, that was already provided by Bitcoin in 2008. If the answer is DeFi, that was given by Ethereum in 2020. Currently, the most practical application in the crypto space can be said to be stablecoins, which are genuinely changing the traditional world in areas like cross-border payments.

Is there no more innovation in the blockchain industry besides these? In this cycle, asset launch platforms on various chains are thriving, which is merely an innovation in asset issuance methods, a new facade for the casino's core. Another area that has garnered attention is the blockchain AI sector, which has attracted significant funding, but the bubble was burst by the emergence of Deepseek. A more prominent issue in this sector is that the narrative's subject remains AI; blockchain technology can help AI agents obtain on-chain identities and build economic systems, but it is always serving AI. This sector is not a crypto-native sector.

Amidst this wilderness, the casino is considered the best product in the crypto industry. Faced with many people's advice, there are calls for Vitalik and Ethereum to engage more in the "casino" gameplay. Vitalik refused, stating, "If I look into my heart, I will find something worth fighting for."

Vitalik has also enjoyed the feeling of being idolized, and when he was pulled down from the pedestal, people saw his human side. This human side, in the eyes of some, is stubborn, arrogant, and unwilling to listen to others' opinions. But it is also these traits that allowed him to create Ethereum.

The passion that made time fly in youth can change the world

Jung once said, "When you are young, what makes time fly and brings you joy is the answer to your pursuit in the world."

For Vitalik, what is worth fighting for has long been written in his childhood experiences. At the age of 4, Vitalik received a computer from his father. While other children played computer games, he became obsessed with Excel software and soon could write automated calculation programs using Excel; at 7, he created a "Rabbit Encyclopedia" document filled with charts and mathematical formulas, soon recognized for his talent in mathematics and programming; by 10, his mental arithmetic speed was already more than double that of his peers; at 11, he began studying subjects like mathematics, programming, and economics in a "genius class" ahead of his age…

Programming itself brings joy to Vitalik, and using technology to change the world is his pursuit. Compared to some speculators in the crypto space, he is relatively conservative.

In 2018, when Ethereum plummeted and faced community skepticism, Vitalik issued a warning—do not let Ethereum become a "tulip" for speculators to profit from. At that time, just like now, Vitalik also considered leaving Ethereum, asking himself, "Should I drop Ethereum and work for Google?"

Doubts about Ethereum arise whenever the coin price is low. Faced with community skepticism and insults, Vitalik often thinks about "leaving."

Vitalik has always held onto his beliefs. His commitment to technology and vigilance against "bubbles" has never changed. It is these commitments that have brought transformation and innovation to the crypto world.

Looking back at the history of crypto development, the most important innovations leading the industry over the past decade have mostly occurred on Ethereum, the "world computer": Ethereum widely adopted smart contracts, providing a platform for the prosperity of innovative financial mechanisms like DeFi and liquidity mining, the establishment of various layer two solutions like Rollups and Plasma, and the practice of DAO governance models, among others.

Currently, more and more major institutions, such as the Trump family's DeFi project, Sony's Layer 2, and Deutsche Bank's Layer 2, are building Web3 applications and infrastructure solutions on Ethereum. The Ethereum ecosystem is mature and leading in terms of technical resource reserves, developer team support, on-chain capital volume, and client security.

Moreover, Vitalik is not only realizing his technical ideals through Ethereum; he also places his social ideals on Ethereum, which are not limited to Ethereum alone. His advocated concepts of decentralization, resisting censorship, and quadratic voting involve democratic practices, internet structures, and commercial and public welfare organizations. This makes his influence extend beyond the crypto community.

Is Ethereum really beyond saving?

Is there still something to look forward to in Ethereum? The answer is yes.

In April, Ethereum will welcome the mainnet launch of the Pectra upgrade. This upgrade integrates changes to the execution layer (Prague upgrade) and the consensus layer (Electra upgrade). Pectra introduces 11 key Ethereum Improvement Proposals (EIPs) aimed at enhancing scalability, staking flexibility, and user experience. Overall, this upgrade will improve the performance and stability of the Ethereum network on a technical level; on an economic level, it will change Ethereum's staking economic model, affecting the supply-demand relationship and market price; on an application level, it will attract more developers and users into the Ethereum ecosystem, promoting innovation and development of decentralized applications, among other things.

In the U.S., a stakable Ethereum spot ETF may also be approved. In the first quarter of 2025, asset management company 21Shares submitted an application on behalf of the CBOE BZX exchange, planning to introduce staking functionality into its spot Ethereum ETF. Additionally, Fidelity has submitted an S-1 form for a proposed Ethereum spot ETF, which includes staking functionality. Grayscale has also applied to provide staking functionality for its spot Ethereum ETF.

The implementation of the Pectra upgrade is expected to shorten the unbinding period for Ethereum staking, which was a significant obstacle when introducing staking for spot ETFs.

This upgrade may become a catalyst for the approval of staking ETFs.

There is a consensus in the industry that one major reason for the current weak appeal of Ethereum spot ETFs is that the existing ETFs do not have staking functionality. The launch of staking functionality will allow holders of Ethereum spot ETFs to receive rewards for staking Ethereum. After staking, investors will receive an annualized return of 3-3.5%. With the launch of stakable Ethereum spot ETFs, there may be a significant increase in capital inflow into Ethereum spot ETFs, thereby driving up Ethereum's price.

Both of these factors represent substantial positive developments for Ethereum's price that can be anticipated this year.

However, another truth is that the upcoming changes in Ethereum that are worth looking forward to are merely improvements along a foreseeable path. These changes are just making the highways wider and smoother. They do not represent any disruptive industry innovation or groundbreaking products or applications.

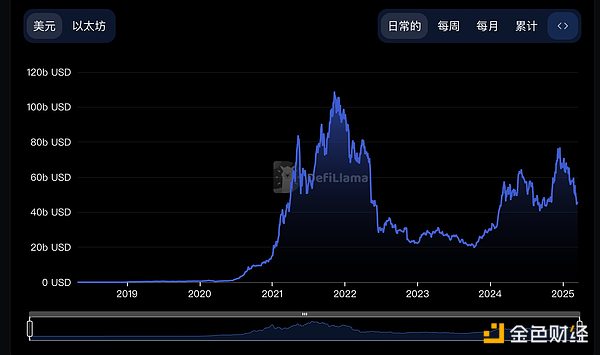

The use cases of Ethereum have actually reached their peak. In this cycle, there have been no projects on the Ethereum main chain that have garnered widespread participation, and its price has not exceeded previous highs. Its TVL (Total Value Locked) remains at its highest level from 2021.

Once the preferred platform for building smart contracts, Ethereum is no longer the only option now that the infrastructure of the blockchain world has been fully developed, with more and better public chains available at lower costs. In this cycle, public chains like Solana, Sui, and TON have each developed their own ecological characteristics. Leading Ethereum Layer 2 solutions like Base have also achieved their own successes.

Vitalik's demystification is a good thing for the industry; it indicates that the industry has matured. Ethereum is no longer the sole leader, and more emerging players can compete with it, which can stimulate a richer ecosystem. As a diverse blockchain ecosystem is established, Ethereum's importance in the industry will inevitably decline.

In an interview with端传媒, Vitalik once said, "My life is about being a bridge for everything." Since 2015, the Ethereum Foundation has spent more on external funding than on internal operations. These grants have allowed Ethereum to connect more teams and promote the development of various projects in the crypto industry. Both Ethereum itself and what Vitalik has done are foundational efforts for crypto.

Neither Ethereum nor Vitalik should bear the confusion and anger of people regarding the lack of innovation in the entire industry.

“If you look inside yourself, you will find things worth fighting for too.” Knowing what he should strive for, Vitalik will return after a brief disappointment.

Those in the crypto community who feel confused and angry will also make a choice after introspection: to stay and be a "builder," creating something new amidst the desolation, or to leave and rush to the next opportunity, continuing to be a savvy "speculator."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。