On March 24, 2025, according to the latest data from Coinglass, Ethereum's performance in the first quarter (Q1) of 2025 is considered one of the worst starts in recent years. For the first time since 2017, when complete data records began, Ethereum experienced three consecutive months of negative returns in a single quarter. This phenomenon not only breaks its historical performance pattern but also sparks widespread discussion and deep reflection in the cryptocurrency market regarding Ethereum's future trajectory. This article will comprehensively analyze the reasons behind Ethereum's rare downturn and its potential impact on the entire crypto ecosystem, based on data provided by Coinglass, along with historical performance, market dynamics, and industry analysis.

Q1 2025: Ethereum's "Darkest Hour"

According to Coinglass data, Ethereum's monthly returns in the first quarter of 2025 are as follows:

- January: -1.28% (Historical average return: +20.63%, Median: +31.92%)

- February: -31.95% (Historical average return: +11.68%, Median: +8.78%)

- March: -10.16% (Historical average return: +19.55%, Median: +9.96%)

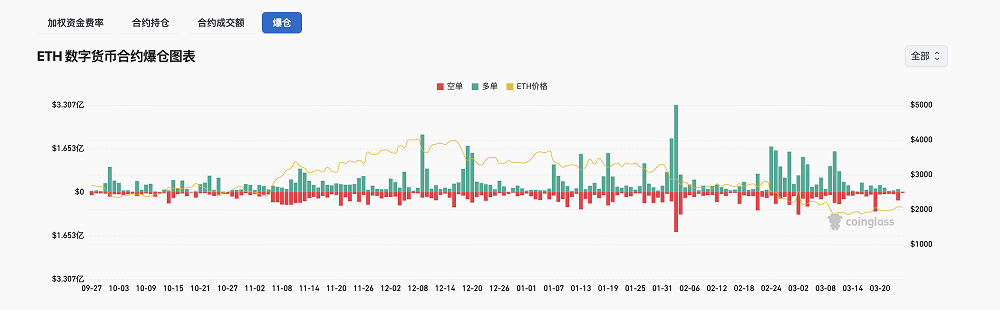

This data indicates that Ethereum not only failed to continue its strong growth trend typically seen in the first quarter over the past few years but also faced three consecutive months of negative returns, totaling a decline of over 43%. Notably, February's drop reached 31.95%, marking one of the largest monthly declines in recent years, contrasting sharply with the historical average return of 11.68%.

Comparing Ethereum's first-quarter performance since 2017, this continuous negative return situation is unprecedented:

- 2024: Two increases and one decrease (-0.13%, +46.28%, +9.33%), overall strong performance, especially significant growth in February and March.

- 2023: Positive returns for the entire season (+32.44%, +1.26%, +13.46%), demonstrating stable upward momentum.

- 2022: Two increases and one decrease (-26.89%, +8.78%, +12.2%), despite a significant pullback in January, the following two months rebounded quickly.

- 2021: Positive returns for the entire season (+78.51%, +8.41%, +34.74%), marking the peak period for Ethereum in the first quarter.

Historically, Ethereum typically sees an upward trend in the first quarter, with both average returns and medians showing positive growth. However, the performance in 2025 completely deviates from this pattern, becoming the first quarter since 2017 to record negative returns. This abnormal performance has not only shocked investors but also prompted market analysts to delve into the driving factors behind it.

Why Did Ethereum Fall into a Low Point?

Ethereum's dismal performance in the first quarter of 2025 is not due to a single factor but rather the result of multiple structural and external factors. Here are several key reasons analyzed:

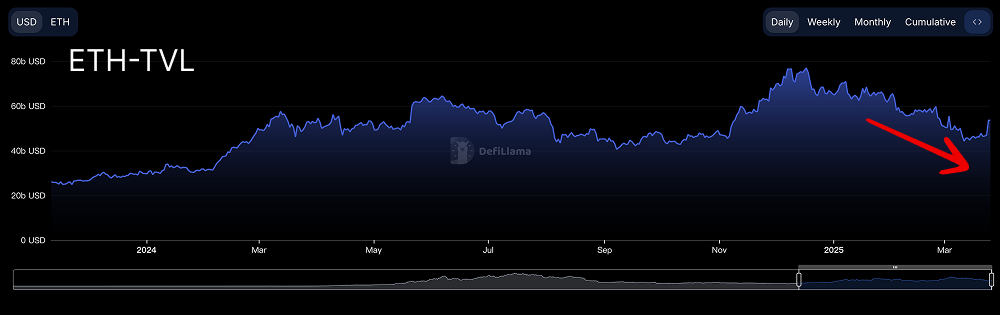

The rise of Layer-2 networks weakens the mainnet's appeal. According to analysis by X platform user @WiseCrypto_, Ethereum's market dominance has fallen to its lowest point since 2020, partly due to the rapid development of Layer-2 networks (such as Arbitrum, Optimism, etc.). These scaling solutions significantly reduce transaction costs and improve efficiency, leading to Ethereum's mainnet Gas fees dropping to historical lows (as @defaixbt noted, Gas fees fell to 1.12 GWEI in 2025, 50 times lower than in 2024). While this is beneficial for users, it also reduces the mainnet's revenue and token burn rate, further weakening the attractiveness of Ethereum's economic model. Lack of compelling narratives

In the past, Ethereum attracted significant funds and attention through trends like decentralized finance (DeFi) and non-fungible tokens (NFTs). However, in the first quarter of 2025, the market seems to lack new "killer applications" or narratives to drive Ethereum's price upward. In contrast, Layer-1 networks such as Solana and BSC have attracted more developers and users due to their high throughput, low costs, and highly engaged communities, further siphoning off Ethereum's ecosystem vitality. Increasing regulatory uncertainty

The unclear regulatory environment is also one of the challenges facing Ethereum. Especially in the United States, the repeated adjustments in cryptocurrency policy have led investors to doubt Ethereum's long-term value. X user @WiseCrypto_ pointed out that regulatory uncertainty may be one of the significant reasons for the continued pressure on Ethereum's price.

Return of inflation and outflows from staking: Since Ethereum transitioned from proof-of-work (PoW) to proof-of-stake (PoS), its deflationary model has been a focal point for the market. However, early 2025 data shows that Ethereum's inflation rate has returned to 0%, erasing the deflationary effects brought about by previous token burns. According to analysis by Tuoluo Technology (tuoluo.cn), the reduction in on-chain token burns after the Dencun upgrade is one of the main reasons. Additionally, since mid-November 2024, Ethereum's net inflow from staking has remained negative, with the staking amount dropping from 34.95 million to 34 million by February 5, and the number of stakers decreasing from 1.09 million to 1.06 million, indicating a shake in investor confidence.

Historical Comparison and Future Outlook

Compared to historical data, the performance in the first quarter of 2025 is undoubtedly abnormal. In the past, even during bear markets (like in 2022), Ethereum managed to achieve some rebound in the first quarter. However, this time, the three consecutive months of negative returns indicate a fundamental change in market confidence regarding its fundamentals.

Nevertheless, Ethereum is not without opportunities for a turnaround. Historically, Ethereum has often seen strong rebounds after hitting lows, such as the 78.51% monthly increase in 2021. Currently, the maturity of the Layer-2 ecosystem may bring new growth points for Ethereum, and upcoming technological upgrades (such as the potential "Verkle Trees" or more efficient rollup solutions) may also restore market confidence. Furthermore, if the macroeconomic environment stabilizes and risk-averse sentiment diminishes, Ethereum could still attract capital back.

However, the challenges Ethereum faces in the short term cannot be ignored. X user @usblockchaincap pointed out that Ethereum has fallen over 50% this year, with prices dropping from around $4,100 to around $2,000. Although March is not yet over, reversing the downward trend of the first quarter will be extremely difficult.

Market Sentiment and Investor Response Strategies

The current market sentiment can be described as "extremely apathetic." Glassnode previously pointed out that the depletion of liquidity and low trading volume in the crypto market often accompany narrow price fluctuations, and Ethereum in the first quarter of 2025 seems to be in this state. How should investors respond?

Short-term strategy: Given the current downturn, aggressive bottom-fishing may carry high risks. X user @Crypto_BYX (March 24, 2025) believes that the conditions for bottom-fishing Ethereum are not yet in place and suggests a wait-and-see approach. Long-term perspective: For long-term holders, Ethereum, as the core infrastructure of the blockchain ecosystem, remains difficult to shake. Historical data shows that its rebound potential after bear markets should not be underestimated.

Conclusion

Ethereum's performance in the first quarter of 2025 is undoubtedly a low point in its history, with three consecutive months of negative returns not only breaking past patterns but also exposing its vulnerabilities amid intensified competition, technological evolution, and changes in the external environment. However, as a pillar of the cryptocurrency field, Ethereum's future trajectory remains worth looking forward to. The upcoming second quarter will be a critical juncture, and the market will closely watch whether it can leverage technological innovation and ecosystem recovery to emerge from this low point. For investors, this presents both a challenge and an opportunity.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。