Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Last night, community users reported that a recent "wildest" governance attack occurred on Polymarket. A large UMA holder manipulated the oracle using last-minute voting weight in a market that was about to incur losses, causing the market to settle based on a result that had not occurred in reality, successfully turning the tables for profit.

When the rules of gambling become "change the answer if you can't afford to lose," is this still a fair market?

A Brazen Act of "Casino Cheating"

The prediction market issue involved in this incident was: “Will Ukraine agree to sign a mineral agreement with Trump before April?”

By the time the market settled, there was no official statement or decision confirming that the agreement had been reached. On March 25, Trump stated that he "expected to sign" the U.S.-Ukraine mineral agreement "soon," but in fact, this deal had neither been formally signed nor publicly announced.

However, Polymarket ultimately ruled the result as YES.

Image source: Polymarket

How Was the Polymarket Governance Attack Achieved?

According to community users @Web3Marmot and @hermansen_folke, the governance attack on Polymarket was primarily achieved through the manipulation of UMA oracle voting.

Polymarket relies on UMA's decentralized oracle to verify results. UMA has its own arbitration system to resolve disputes, where arbitrators are real people—participants in the UMA ecosystem, particularly UMA token holders. This system is known as DVM (Data Verification Mechanism).

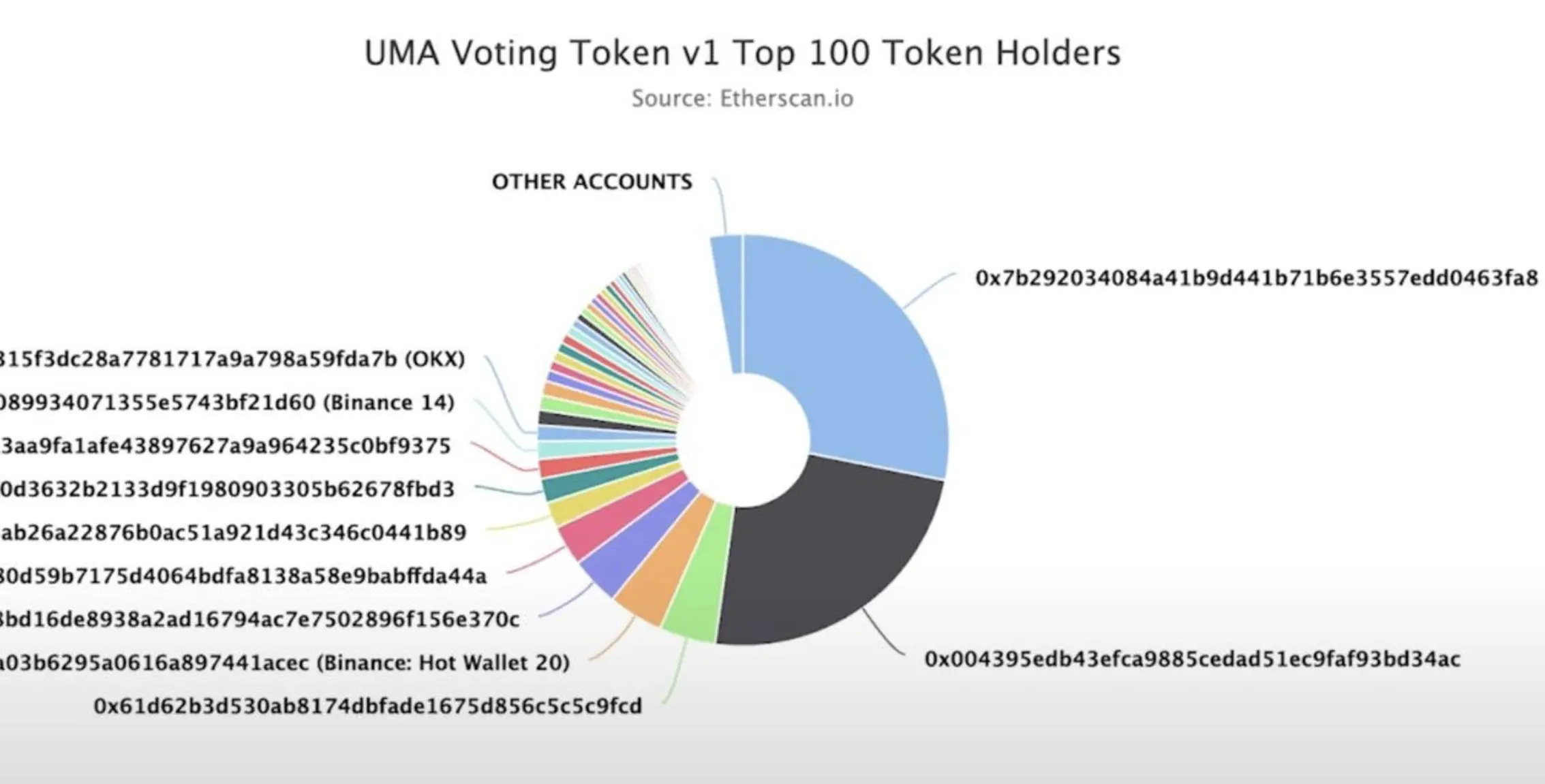

However, the decision-making power of the UMA oracle is concentrated in the hands of a few "whales" holding large amounts of UMA tokens. Community analysis indicates that just two large holders control over 50% of the voting power, and they are not only voters but also players on Polymarket.

According to @hermansen_folke's analysis, UMA is theoretically a neutral oracle, but in practice, it tends to "follow the crowd." In the UMA oracle, voters need to stake tokens to vote, and if their vote differs from the majority, they will lose those tokens. This means that voters do not necessarily choose the true result but tend to follow those large holders with substantial tokens and a history of profitable outcomes.

Additionally, to propose a market resolution of "yes" or "no," a margin (usually $750 USDC) must be paid, and raising an objection also requires the same amount. If the voting result is unfavorable to the challenger, they will lose this margin, and even if they are correct, the final reward is minimal. This mechanism leads to a severe asymmetry: whales holding large stakes and UMA voting rights can easily pay the margin and sway market decisions, while ordinary users are deterred from challenging due to fear of losing funds.

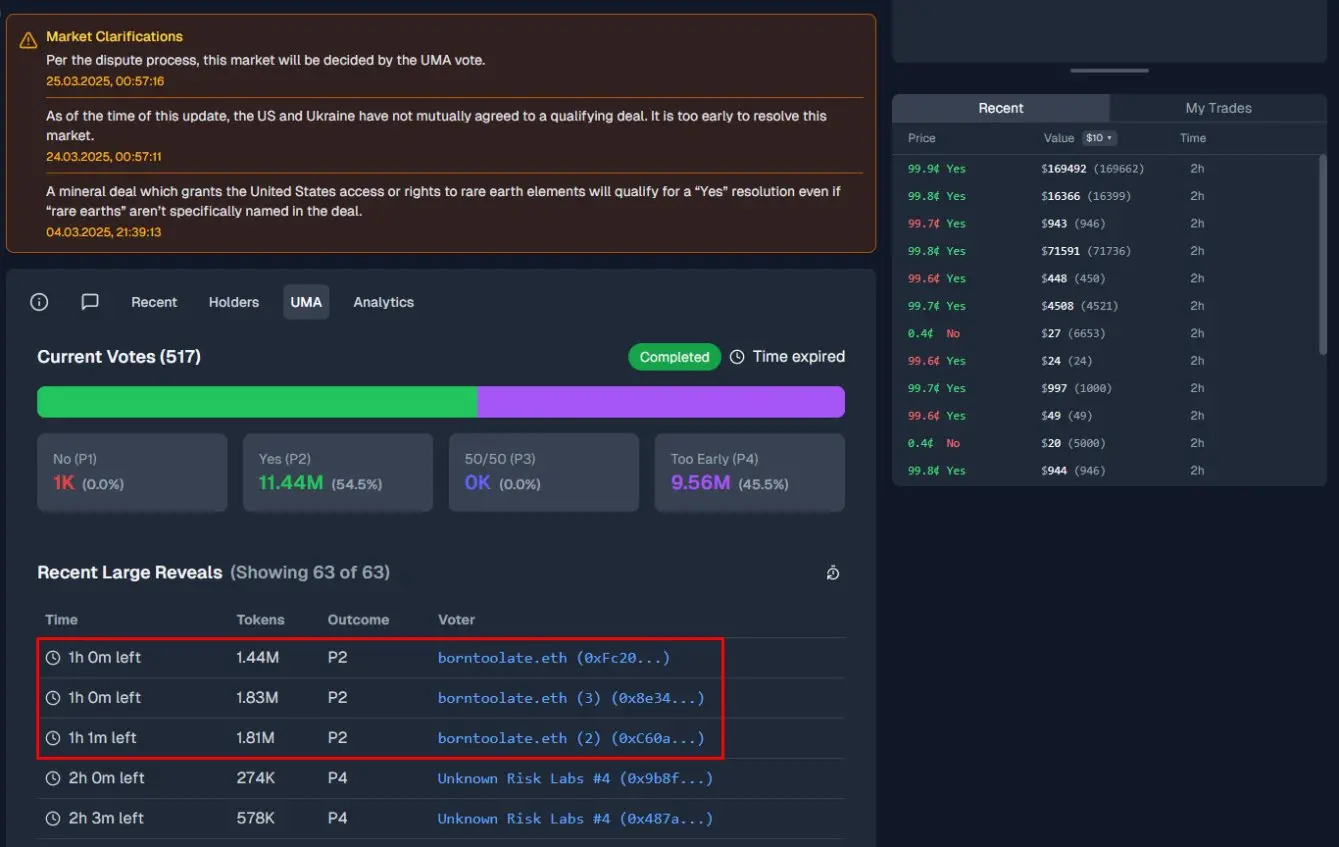

In this incident, a large holder of UMA tokens manipulated the voting to tilt the result in their favor just before the market was about to settle.

As shown in the image below, this large holder cast 5 million tokens through three accounts, accounting for 25% of the total votes.

Image source: betmoar.fun

Official Response: Acknowledging the Dispute but Refusing Refunds

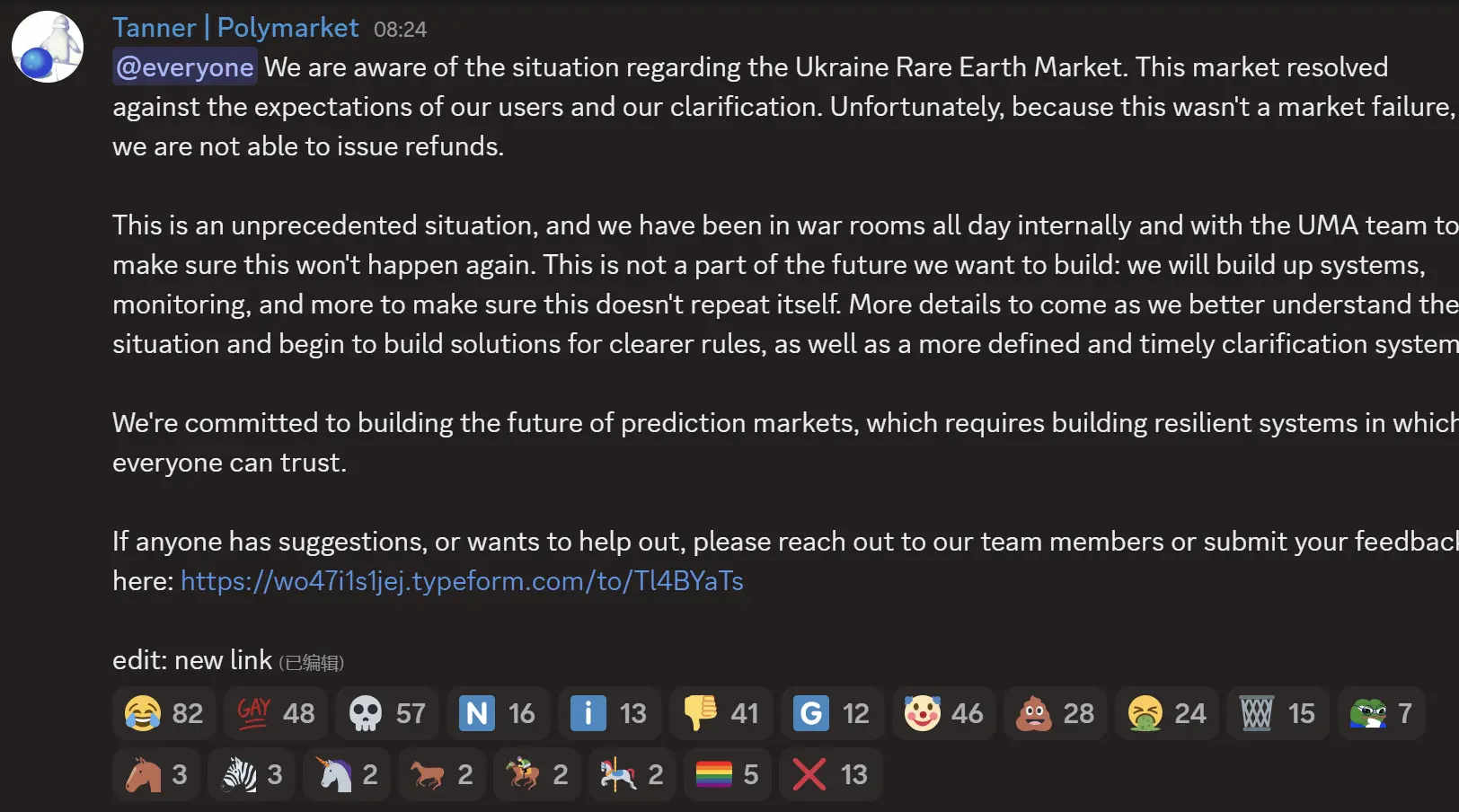

After the incident, Polymarket officially announced on Discord that they acknowledged the discrepancy between the ruling result of the Ukrainian rare earth market and user expectations and official clarifications, but since this was not a failure of the market mechanism itself, the platform cannot provide refunds.

Polymarket stated that they have initiated urgent discussions with the UMA team and promised to enhance system monitoring and improve rules to prevent similar situations from occurring again. They will further optimize the arbitration mechanism in the future to ensure clearer rules and more transparent and timely clarification processes, with more details to be announced later.

Oracles should be impartial referees, but ultimately they have become tools of capital manipulation.

Although Polymarket officially acknowledged that the ruling result did not align with user expectations, they insisted that this was not a failure of the market mechanism and refused refunds. This decision not only caused losses for affected users but also plunged the trust in the entire market to a freezing point.

When ordinary players realize that even if they bet correctly, they cannot compete against the large holders' ability to change the outcome with a click, who can continue to play the role of a lamb to be slaughtered in this manipulated game?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。