Exclusive TGE is expected to roll over to a single number of 16.8 U, with a reasonable price for GUN being 0.13 USDT.

Written by: Nan Zhi, Odaily Planet Daily (@OdailyChina)

Since February, Binance has launched five rounds of Exclusive TGE through Pancake, characterized by short duration and high single-account yield. Additionally, multiple BNB Holder airdrops and Launchpool have been launched, providing Binance users with a large amount of "pork trotter rice."

However, due to the outstanding yield of Exclusive TGE, many users have begun an arms race to increase their accounts, with the amount of BNB invested and the oversubscription rate climbing steadily. Therefore, this article aims to review the data from the past several rounds of Exclusive TGE and Launchpool to infer reasonable prices and participation strategies.

Exclusive TGE

Yield Situation

The past five projects were MyShell, Bubblemaps, Bedrock, Particle Network, and KiloEx, with the least amount of BNB invested in the first round of MyShell, totaling 145,106 BNB, and the most in the latest round of KiloEx, totaling 442,985 BNB, an increase of 205%.

The yield situation for each account in each round is shown in the figure below:

Currently, the minimum yield per account is still around 50 USDT, with a principal yield rate of 2.6% for 3 BNB. Even considering the loss of BNB in the IDO circulation, it is still very worthwhile to participate.

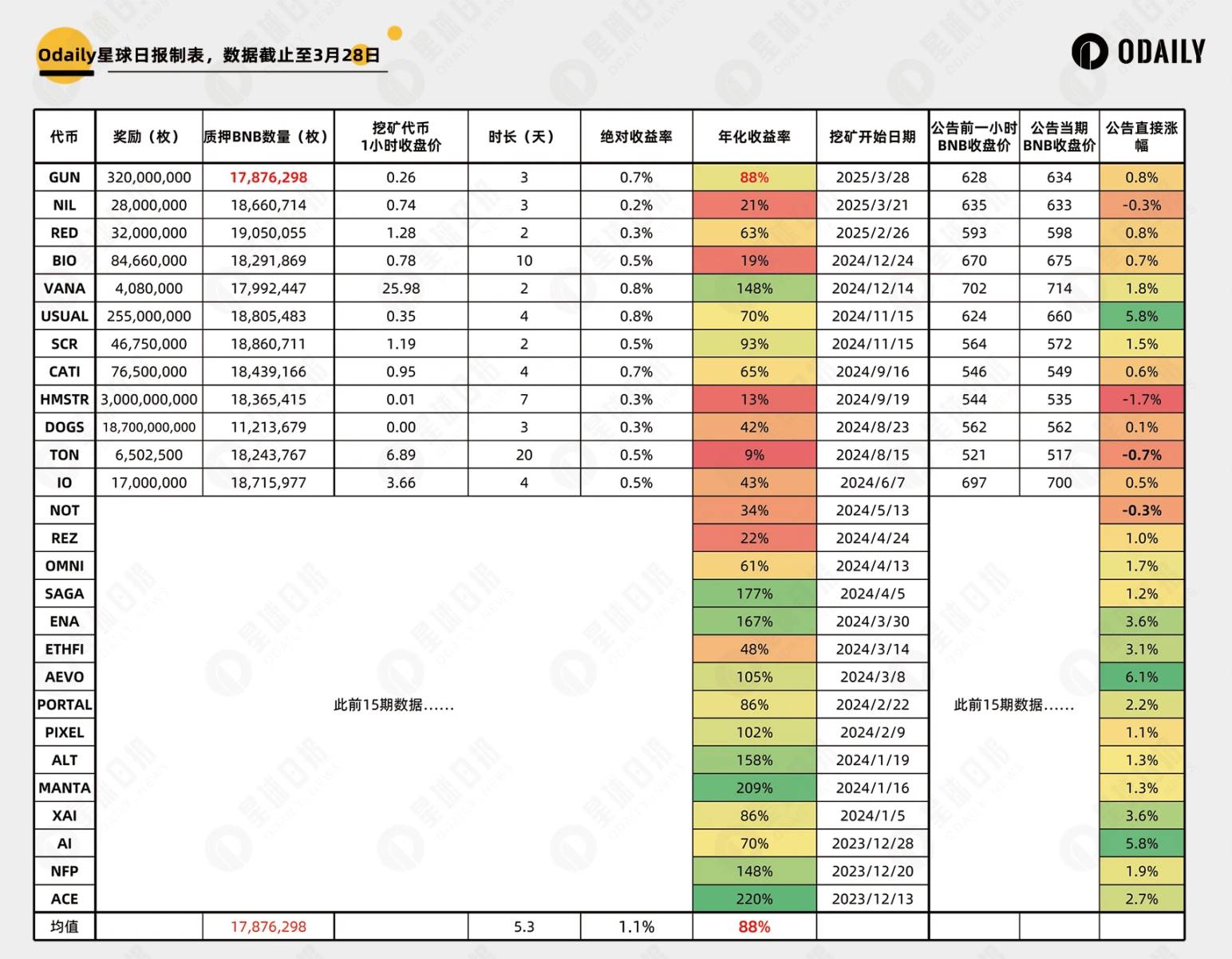

The amount of BNB raised continues to rise, and here we refer to a key data point—the amount of BNB invested in Binance's main site Launchpool, which has averaged 17.87 million BNB over the past 16 months. It is evident that the amount of BNB is not an issue; the variable lies in the number of real-name accounts. However, since Binance has announced that the number of users has exceeded 200 million, it is impossible to estimate the upper limit of participating accounts.

Therefore, assuming the ultimate investment amount is 10% of Launchpool, with a circulating market value of 50 million USD, allocating 20% to Exclusive TGE, the final theoretical yield per account would be 3 ÷ 1787000 × 50000000 × 20% = 16.8 USDT.

Is it feasible to short BNB on news?

In the second part of the above figure, we have compiled the decline in BNB from the start to the end of the IDO. From past data, BNB has consistently declined during this period, and typically, after the announcement of Exclusive TGE news, the price of BNB is often higher than at the start of the TGE. Therefore, the current shorting strategy has a certain, clear profit margin.

Launchpool Yield Estimate

The data from the past 27 rounds of Launchpool is shown in the figure below, clearly indicating a significant downward trend in the yield rate. The average annualized yield rate for the 27 rounds is 88%. Based on this yield rate, the price of GUN would be 0.26 USDT. However, considering the poor performance in the previous rounds, it is advisable to conservatively estimate, and at half the yield rate, the reasonable price would be 0.13 USDT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。