Author: yoyo

The MEME track is like a never-ending "relay race" — from BOME igniting the MEME craze in the Solana ecosystem, GOAT sparking the AI MEME bull market, to the political coin frenzy triggered by TRUMP that pressed the pause button on the Solana market, and then BROCCOLI and MUBARAK breaking the silence of the BSC ecosystem, attempting to reshape the glory of MEME. From Solana to the BSC ecosystem, the market continues to evolve, with new coins always "coming fast and going faster."

However, regardless of how the ecological hotspots shift, as an exchange, the key to seizing wave after wave of opportunities lies in how quickly it can list new coins, by screening and providing purchasing opportunities for users in the early stages of assets, thus helping users grasp the time difference in wealth accumulation. In this wealth creation game, speed is almost the only pass. Binance launched Alpha 2.0, and MEXC launched DEX+ on the same day, competing to provide on-chain opportunities for users at the fastest speed, indicating that exchanges are beginning to compete for the discourse power of the "wealth creation effect."

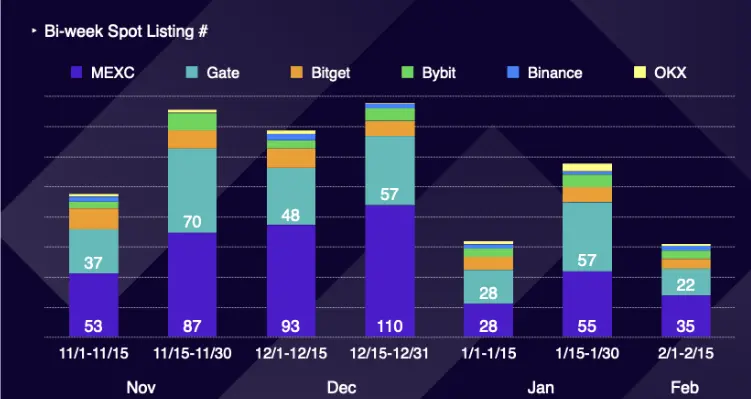

This article analyzes the performance of several popular on-chain assets listed on six major exchanges (Binance, OKX, Bybit, Bitget, MEXC, Gate) between 2024 and 2025, among which MEXC stands out with its advantage of "fastest launch and most listings." During the statistical period from November 1, 2024, to February 15, 2025, MEXC led with an astonishing total of 461 spot listings, about 1.5 times that of Gate and 4.5 times that of Bitget, showcasing the three major killer features of "speed, accuracy, and decisiveness," which not only tore apart the traditional pattern of centralized exchanges but also sparked waves of wealth. So, how did MEXC seize opportunities and win the market? This article will delve into the operational secrets behind this "wealth expressway" from three dimensions: data, strategy, and users, revealing the path to MEXC's success.

1. MEXC Becomes an Important Battleground for Deploying Binance Alpha

In the past month, the BSC ecosystem has rapidly risen, becoming a new hotspot for on-chain assets. With the popularization of tools and the maturity of player methodologies, the lag in funds and information has significantly decreased, the on-chain rhythm has accelerated, and the window of dividends has narrowed. Against this backdrop, an effective MEME investment strategy has gradually emerged: exchanging time for space, lurking in low market cap assets, patiently waiting for project growth, and aiming to reap the dividends of being listed on Binance Alpha or Binance spot. Although this strategy may not replicate the myth of a hundredfold surge, it can effectively avoid fierce PVP competition and steadily accumulate returns with lower risk.

So, how can one seize the time difference and layout in advance to welcome the explosive period of Binance Alpha or spot listings? Many investors choose to filter potential tokens through MEXC's MEME+ section, building positions at the bottom and waiting for value to be released.

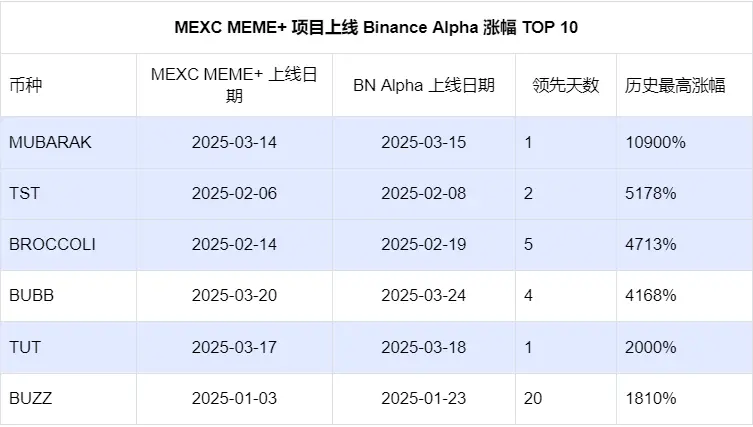

Since December 2024, MEXC MEME+ has successfully launched over 20 projects that later went live on Binance Alpha, with the top ten projects seeing an average increase of 3237% on MEXC. The most eye-catching, MUBARAK, reached an astonishing peak increase of 10900%. For users who laid out early on MEXC and profited from diversified holdings, this is undoubtedly a safer and more efficient path to wealth.

Another example is TUT, which officially launched on MEXC MEME+ on March 17, 2025, and performed impressively post-listing, with a peak increase of 2000%, fully demonstrating its strong market potential. Just one day after TUT was listed on MEXC, it quickly landed on Binance Alpha, with its opening price on Binance Alpha being four times that of its opening price on MEXC. This means that if investors bought TUT when it launched on MEXC, they only needed to wait one day until it landed on Binance Alpha to reap a fourfold increase. Subsequently, TUT successfully entered the Binance spot section on March 27, further validating its value potential.

Similar situations are not isolated. Just yesterday (March 27, 2025), three other projects that emerged from Binance Alpha — MUBARAK, BROCCOLI, and BANANAS31 — all successfully obtained entry tickets for Binance spot. These projects had already launched on MEXC MEME+ in advance, and savvy investors who laid out early on MEXC had already seized the market opportunity and enjoyed the dividends. MEXC MEME+ undoubtedly provides users with a precise window to capture potential projects, helping them stay ahead in the rapidly changing market.

It can be said that MEXC MEME+ has become the "strictly selected list" for Binance Alpha and even the spot section. Its keen project screening ability and rapid listing efficiency provide users with an excellent platform for early deployment, helping investors win time and returns in the ever-changing on-chain market.

2. Data Comparison: Unveiling the Listing Speed of Six Exchanges, MEXC Stands Out

According to statistics from TokenInsight, from November 1, 2024, to February 15, 2025, MEXC's total number of spot listings reached 461, about 1.5 times that of Gate and 4.5 times that of Bitget, far exceeding other major exchanges like Binance, OKX, and Bybit. During the bi-weekly segmented periods, MEXC consistently maintained a high-frequency listing rhythm, firmly holding the top position among the six major exchanges, providing users with a rich variety of asset trading options.

In terms of market hotspot and trend judgment capabilities, MEXC also demonstrates exceptional strength. For the four core narratives of this bull market — Meme, DeSci, AI Agent, and celebrity coins — MEXC was the first to list related popular tokens, such as PNUT, CHILLGUY, AIXBT, BIO, RIFSOL, TRUMP, and VINE. These tokens generally experienced a surge in price after listing, effectively validating MEXC's precise predictive ability regarding market trends.

Notably, MEXC was the first in the industry to list TRUMP, becoming the first well-known exchange to support this token. On January 18, 2025, at 03:20 (UTC), MEXC listed TRUMP in its MEME+ section, just 2 hours and 20 minutes after the token's initial liquidity pool configuration was completed at 01:01 (UTC). In contrast, other exchanges generally listed it only after 10:00 (UTC+) that day. This fully reflects MEXC's keen insight and rapid response capability to popular projects and market hotspots.

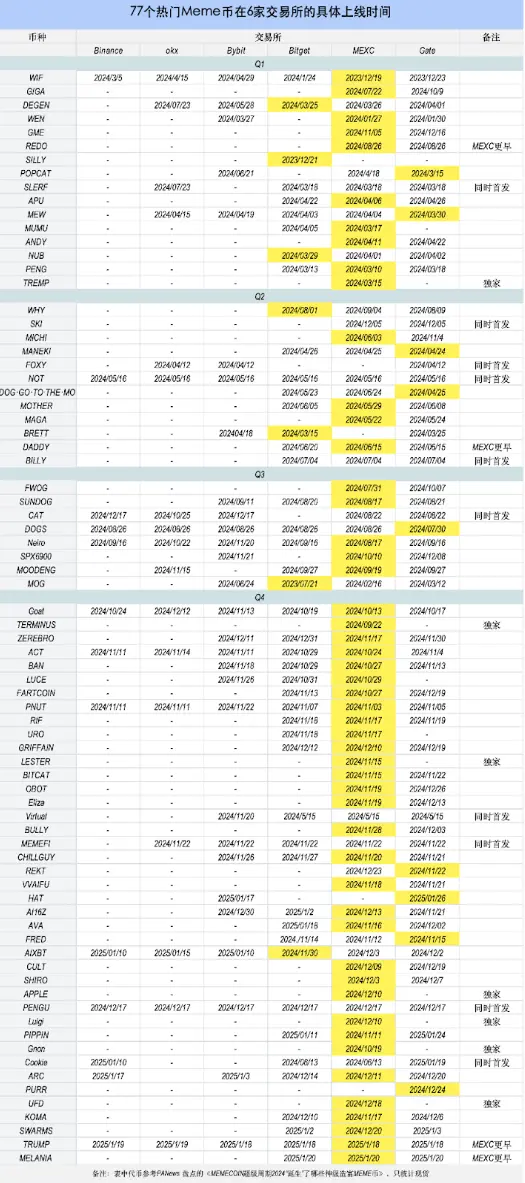

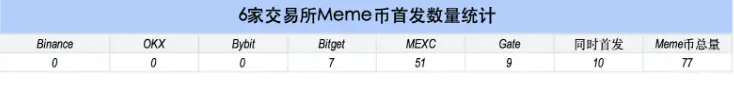

To further validate the speed advantage, this article references PANews' review of "What Legendary Wealth-Creating MEME Coins Were 'Born' in the MEMECOIN Super Cycle 2024," which compiled the listing times of 77 popular MEME coins across six major exchanges (with first listings highlighted). The data indicates that the fourth quarter of 2024 was a peak period for token listings, with over half of the tokens listed during this time.

Statistics on the number of first listings of MEME coins across these six exchanges show that MEXC leads with 51 first-listed tokens, followed by Gate (9) and Bitget (7), while Binance, OKX, and Bybit have none. Additionally, among the 77 popular tokens, 7 were exclusive to MEXC.

In terms of the total number of MEME coins listed, MEXC listed 72 out of the 77 popular MEME coins (93.5%), while Gate listed 66 (85.7%), far exceeding Binance (13), OKX (17), and other major exchanges.

Overall, among the 77 popular MEME coins of the year, MEXC listed 72, including 51 first listings and 7 exclusive listings, surpassing the other five exchanges. In contrast, top exchanges like Binance and OKX listed fewer than 20 tokens, most of which were listed only after their popularity had waned.

Behind this is a fundamentally different strategic logic.

Large exchanges are constrained by high FDV controversies and are relatively cautious in listing, while smaller exchanges use MEME coins to avoid valuation bubbles, directly meeting users' speculative demands. While large exchanges are still entangled in the fundamentals of tokens, MEXC has compressed its listing decision-making to an hourly level using a set of "intelligent systems + aggressive strategies," pushing efficiency to the limit.

3. Why Can MEXC Become the "Golden Hunter of On-Chain Assets"?

MEXC has become the "golden hunter" in the MEME coin wave with its three-pronged approach of "more listings, more airdrops, and lower fees," and the answer lies in its core strategy — "More, Fast, Good, Save, Give."

1. More: A Vast Token Library, Creating a MEME+ "Super Shelf"

MEXC's "more" is not only reflected in quantity but also in its precise coverage of market demand. In 2024, the platform cumulatively launched 2,376 new tokens, of which 605 were MEME coins, covering all popular tracks from DOGE series to celebrity meme culture. This "super shelf" model not only meets users' demand for diversity but also firmly controls the traffic entrance through its first listing mechanism.

2. Fast: Lightning Listings, Seizing On-Chain Hotspots in 48 Hours

If "more" is the result, then "fast" is MEXC's core methodology. The platform launched 1,716 globally first-listed tokens in 2024, with an average time from community hype to official listing of only 2-3 days. Behind this speed is a mature "hotspot catcher" system: MEXC continuously monitors on-chain activities, including evaluating factors such as the number of wallet addresses, trading volume, liquidity, and market cap, to discover potential tokens and open trading multiple times before the peak of hype, allowing early players to enjoy the maximum increase. For example, MUBARAK reached a peak increase of 10900% after listing, and BUBB reached a peak increase of 4167.9% after its launch.

3. Good: Industry-Leading Trading Volume and Depth Rankings

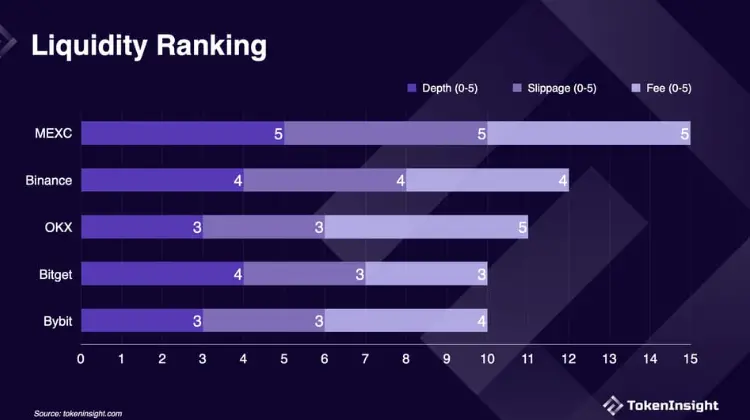

According to TokenInsight's 2024 annual report, MEXC ranks 6th globally in spot trading volume and 5th in contract trading volume, while its liquidity depth ranks first. In terms of depth, MEXC's spot depth is $31.1 billion, the highest ranking. The total futures depth exceeds $9.1 billion, surpassing the collective total of other major exchanges. The chart below shows the specific rankings.

For retail investors, this means "slippage-free" trading — even if tens of thousands of dollars worth of obscure tokens are sold off at once, price fluctuations can be controlled within 1%.

4. Save + Give: Ultra-Low Fees and Airdrop Frenzy

MEXC understands the psychology of retail investors — they want low thresholds and high returns. To this end, it has built a "Save + Give" combination:

- Save: Spot trading fees as low as 0.05% (Maker 0%, Taker 0.05%), and contract fees only 0.02%, both of which are the lowest in the industry (TokenInsight data). For high-frequency traders, the fee difference can save tens of thousands of dollars a year.

- Give: In 2024, the platform held a total of 1,886 airdrop events, distributing rewards exceeding 107.8 million USDT, equivalent to an average of 5 "money-splashing feasts" per day. MX token holders enjoy additional benefits — by staking to participate in Launchpool projects, they can achieve an annualized yield of up to 62.6%.

Conclusion

MEXC's rise is a victory for the "traffic-first" strategy — attracting retail investors with a vast array of tokens and extreme speed. Like a bull charging into a china shop, MEXC has rewritten the survival rules of exchanges with a 93.5% listing rate, $100 million in airdrops, and floor-price fees. The MEME+ section has become a forward base for Binance Alpha, helping users capture dividends from MUBARAK (10900% increase), TUT (4 times premium), and more.

This game of "fast fish eating slow fish" may continue, and for retail investors, the criteria for choosing a platform are clear: to seize early dividends, one must bet on exchanges that offer "lightning listings"; for stable returns, one must endure delays and high costs.

Perhaps this is the charm of the industry: there are no eternal giants, only eternal disruption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。