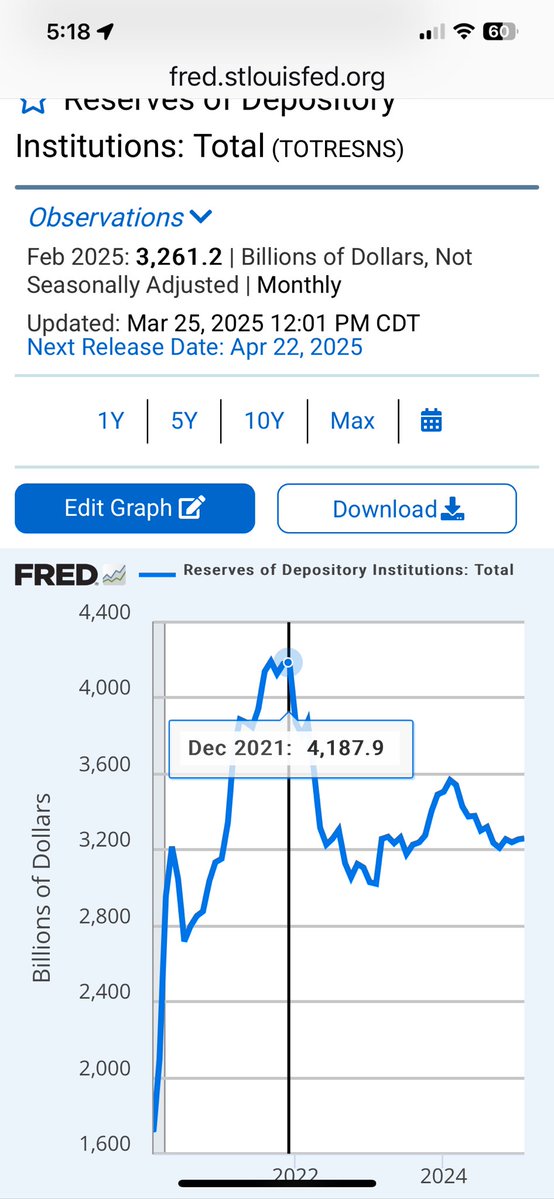

The core reason for the significant decline in the stock and cryptocurrency markets in 2021 was the rapid tightening of liquidity. More specifically, in December 2021, the U.S. debt ceiling was raised again, and the TGA was subsequently expanded quickly, extracting liquidity from the market.

At the same time, reverse repos began to increase from February 2021, while the Fed's total assets did not peak and start to decline until May 2022.

Therefore, the decisive factor at that time was the TGA.

However, even so, why did the market peak and turn bearish a month before the liquidity shift (in November 2021)?

This requires attention to the news in November, when several factors came together: one was the discovery of a new variant in South Africa, and then JP Morgan indicated that it would begin to reduce QE (which is often a precursor to stopping QE).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。