Author: Zen, PANews

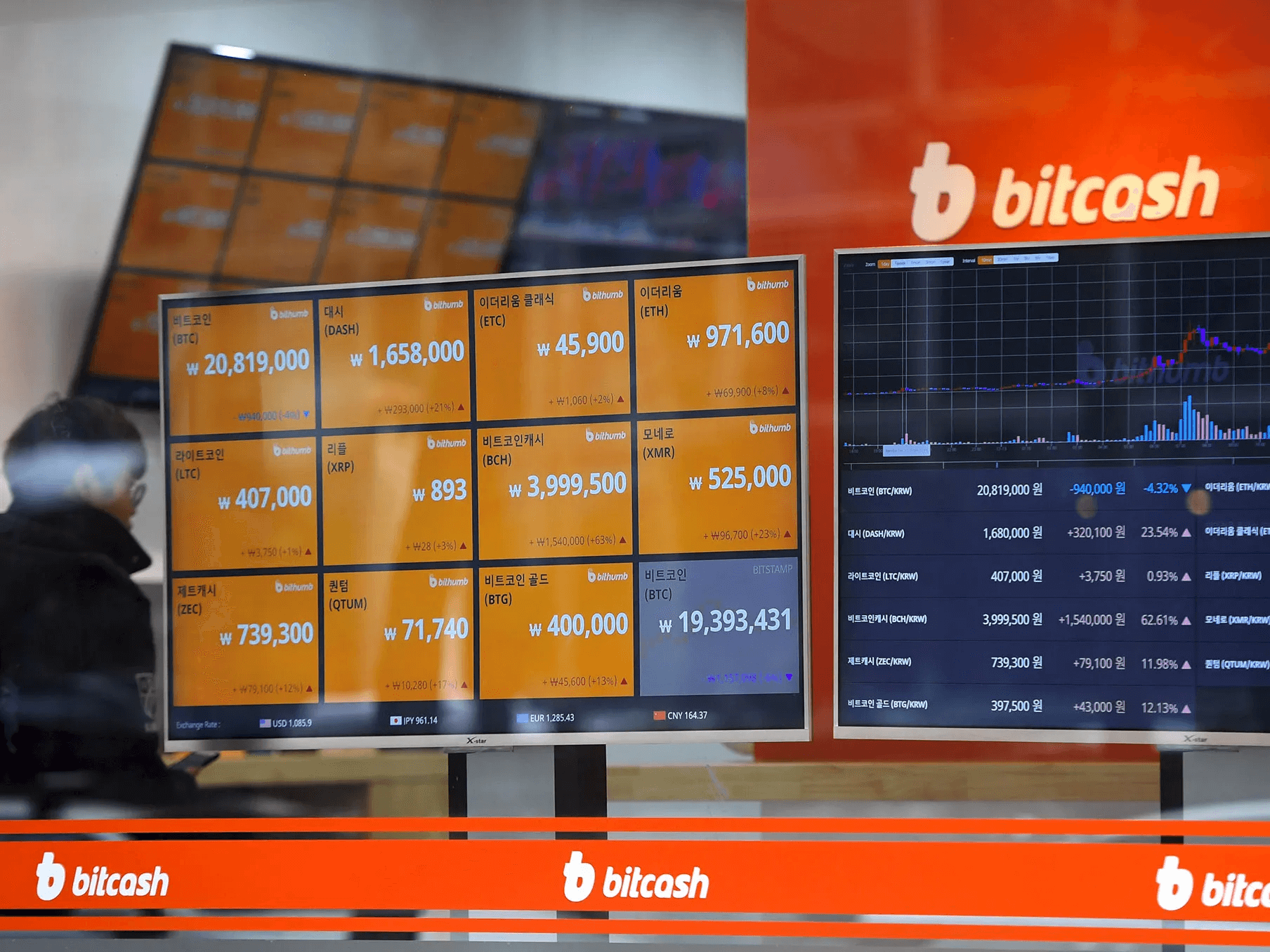

Looking at the global cryptocurrency market, few markets can compare to the frenzy exhibited by South Korean investors. They have repeatedly driven up the prices of coins on local exchanges, even giving rise to the unique phenomenon known as the "kimchi premium"—the same Bitcoin often costs 3-5% more in South Korea than in the global market.

On February 3 of this year, influenced by concerns over Trump's tariff war, the South Korean Bitcoin "kimchi premium" soared to 9.7% at 2 AM, marking a 10-month high since April 2024. The kimchi premium typically rises during bull markets but can also spike during panic sell-offs, as the selling pressure on South Korean exchanges is lower than that of the global market.

In the altcoin market, which is more favored by South Korean investors, this premium is even more extreme. Last July, the AVAIL token surged 1,300% on its listing day on the South Korean crypto exchange Bithumb, a stark contrast to the increases seen on most other centralized exchanges, with premiums exceeding 200% at times.

In a paper titled "Research on the South Korean Virtual Asset Market and Price Manipulation Phenomenon," researcher Baek Yeon-joo from the Korea Financial Research Institute pointed out, "The trading proportion of assets outside the top ten global virtual assets in South Korea is relatively high, making them susceptible to price manipulation." These manipulated investors resemble the players in the hit Netflix series "Squid Game"—driven by the lure of money, they plunge into the game without understanding the rules.

Crypto Craze Sweeps South Korea, Surge in Investors Across All Classes

According to a report by The Dong-A Ilbo, Democratic Party lawmaker Ahn Doo-jae revealed on March 21 that data from five domestic virtual currency exchanges, including Upbit, Bithumb, Coinone, Korbit, and Gopax, showed that by the end of last year, there were 9,667,023 investors with tradable accounts on these exchanges, accounting for approximately 18.7% of South Korea's total population, a staggering 52.6% increase from the previous year. The total scale of crypto assets held by these investors reached 105.01 trillion won (approximately $71.5 billion).

This cryptocurrency craze has not only swept ordinary investors but has also shown a widespread penetration among public officials. According to a report released by the South Korean government’s ethics committee on March 27, over 20% of the 2,047 public officials surveyed held cryptocurrencies, slightly above the national average. The 411 officials who invested in crypto held a total of 14.4 billion won (about $9.8 million) in cryptocurrencies, with an average investment of nearly $24,000.

The explosive growth in the number of investors has also brought considerable profit growth to South Korean cryptocurrency exchanges. The Korea Herald reported that Dunamu, the operator of South Korea's largest cryptocurrency exchange Upbit, saw its operating profit increase by 85% year-on-year in 2024, reaching 1.19 trillion won (approximately $811 million).

In fact, the trading scope of South Korean crypto investors is not limited to domestic platforms; in recent years, there has been a noticeable trend of funds flowing to overseas exchanges. According to a report from the Financial Intelligence Unit (FIU) of South Korea, as of November last year, the total amount of crypto assets transferred from domestic exchanges to overseas exchanges in the first half of 2023 reached 52.3 trillion won, with 203,000 users choosing Binance or Coinbase.

In addition to the large number of participants and the scale of funds, South Korean investors also exhibit a more aggressive risk appetite, preferring to invest in highly volatile altcoins. Approximately 80% of the crypto assets traded on Upbit are tokens other than Bitcoin and Ethereum, making the South Korean cryptocurrency market a "speculative playground."

So, what exactly drives South Koreans to be so enthusiastic about crypto investments? According to a report released by Presto Labs last year titled "Current State of the South Korean Cryptocurrency Market," South Korea has been one of the largest markets in the cryptocurrency field since 2017, with the won consistently ranking second in global fiat currency trading volume. The report states that the crypto investment boom in South Korea is attributed to a very high internet penetration rate, a tech-savvy population, a risk-preferring investment culture, and cultural factors such as the rapid spread of trends in a homogeneous society.

Moreover, the extreme desire for money and material wealth in South Korean society has also become a breeding ground for speculators.

Materialism and "Money Over Everything"

In recent years, among young office workers in South Korea, the term "financial therapy" (금융치료) has become popular, referring to using money to heal wounded souls, alleviate depression, or relieve stress. It is easy to imagine that when overworked and exhausted workers receive their salary or bonus unexpectedly, the joy that arises can instantly dilute their stress, even significantly alleviating physical discomfort.

From a scientific perspective, this "financial therapy" may be feasible. Humans are inherently driven by a reward psychology, desiring that their efforts yield corresponding returns. For the M generation born between 1981 and 1996, who grew up in the era of globalization and the internet, and the Z generation born between 1997 and 2010, they view money as an important measure of personal value while also bearing significant economic pressure and placing a high value on returns. Therefore, when they receive corresponding economic rewards, their psychological stress is alleviated.

To some extent, the widespread acceptance of "financial therapy" among South Korea's M and Z generations indicates that in an environment with minimal economic systems and social security, the notion of accumulating wealth as a primary goal has become deeply ingrained. The World Values Survey (WVS), an international research project, confirmed this phenomenon in its last round of surveys completed in 2018. The organization found that 45% of South Koreans consider themselves "materialists," a significantly higher proportion than in Japan (21.6%), France (19.2%), and the United States (14.4%).

Additionally, a survey released by the Pew Research Center in November 2021 showed that South Koreans prioritize economic stability, with the highest proportion choosing "material happiness" as the source of life's meaning, followed by physical and mental health and family relationships. This stands in stark contrast to the other 14 surveyed countries, where "family and children" were listed as the primary sources of meaningful life. Based on this mindset, many South Koreans often find that money dominates even in interpersonal relationships.

This intense desire for money has also led many South Koreans, especially the younger generation, to choose leveraged investments. According to statistics from the Financial Supervisory Service (FSS) of South Korea, as of October 2024, the accumulated debt of South Koreans reached 476.9 trillion won, with nearly 28% (134 trillion won) borrowed by individuals in their 20s and 30s.

Moreover, there is a strong sense of jealousy and comparison in South Korean society, as evidenced by the saying "When a cousin buys land, my stomach hurts" (사촌이 땅을 사면 배가 아프다). In such an environment, people are more likely to feel envy and jealousy towards those who possess wealth. Especially when money is viewed as the most important measure of success, the desire for wealth among some South Koreans becomes even more intense.

The desire for financial wealth also drives ordinary investors to flock to so-called successful investors, leading to significant influence for crypto KOLs (Key Opinion Leaders) in South Korea. They disseminate information through YouTube or Telegram communities, guiding fans to purchase certain projects or register on exchanges using their referral links. The top KOLs can earn millions of dollars in commissions each month. Notable streamer Inbeom even launched his own meme coin, BugsCoin. However, KOLs often come with significant controversies surrounding "cutting leeks," and South Korean retail investors, like weeds, continue to sprout even after experiencing major crises like Terra and FTX.

Regarding this phenomenon, Professor Jeon Hong-jin from the Department of Mental Health Medicine at Samsung Seoul Hospital stated that if one becomes accustomed to "financial therapy," they will develop a stronger desire for money. Over time, to achieve the same psychological satisfaction, they will need to acquire more and more money. However, material resources are ultimately limited, so financial therapy cannot be a permanent solution. He added, "If one becomes addicted to cryptocurrency or stock investments for the sake of 'financial therapy,' it may lead to even more severe psychological issues."

Under a Solidified Wealth Order, the Crypto Market Becomes a Breakthrough

In South Korea, where class and wealth are severely solidified, opportunities for the younger generation to accumulate assets are often limited. However, influenced by the "money-first" ideology, the intertwining of the failure of traditional investment methods and the scarcity of wealth growth channels has, to some extent, formed a driving force for the prosperity of the South Korean crypto market.

In South Korea, wealth accumulation has long relied on the real estate and stock markets. Particularly, real estate, which was once viewed as a primary investment, has become a significant factor dragging down economic growth and exacerbating social inequality. The commonality of these two asset classes is that wealth accumulation often depends on early market entry and long-term holding, thus forming a large vested interest group. These groups control asset prices, influence policies, and set market access thresholds, creating a "Matthew effect" in wealth growth, which is increasingly widening the gap for ordinary citizens, especially the younger generation.

Due to the extremely high entry barriers in the real estate market, young people find it difficult to achieve wealth growth through this traditional channel, even with stable incomes. While the stock market has seen the emergence of "Donghak ants" (referring to South Korean retail investors), this market is still fundamentally dominated by large capital, i.e., institutional investors, limiting the influence of individual investors.

Han Yong-seop, director of the Korea Financial Research Institute, stated, "South Korean society has shifted to a survival-of-the-fittest mentality. This country does not have a strong social security system like the Nordic countries. There is much debate surrounding issues like the depletion of the national pension. The older generation mainly discusses these issues from their perspective, while the younger generation has little voice."

Amid anxiety about reality and the future, the cryptocurrency market offers an alternative path for wealth accumulation. Due to its decentralized nature, it is relatively less controlled by vested interest groups. For traditional wealth system beneficiaries, the cryptocurrency market may represent a strange and incomprehensible set of rules, as it does not follow the operational logic of traditional financial markets and is filled with multiple factors such as technology, community-driven initiatives, and market sentiment.

Moreover, the cryptocurrency industry itself is still in its infancy, allowing young people with limited funds to enter. Even though many anticipate that the cryptocurrency market will undergo a process similar to the internet bubble, potentially facing a bubble burst, there is still optimism that it will eventually grow and lead to asset appreciation.

In the context of unstable employment, stagnant incomes, and declining social mobility, cryptocurrency has become a "symbol of hope" for those who find it difficult to improve their economic status through traditional means, providing a new opportunity for wealth accumulation. In other words, the cryptocurrency market may be a new market born out of the inequalities caused by South Korea's traditional wealth accumulation model.

Of course, this hope comes with risks.

It is noteworthy that, contrary to the common perception of the age distribution of investors, the latest disclosure by Democratic Party lawmaker Ahn Doo-jae shows that the number of middle-aged and elderly cryptocurrency investors in South Korea is significantly increasing, with about a quarter of cryptocurrency investors being over 50 years old. Among the "big players" holding over 1 billion won in virtual currency, half of the investors are already over fifty.

Professor Zhao Yan-cheng from Dejeong Women's University believes that before the cryptocurrency market frenzy in South Korea evolves into a mania, society must seriously consider reasonable solutions. The core of these solutions should be strong regulation of the long-standing monopolistic behaviors of vested interest groups that have transcended legal boundaries, fundamentally correcting the severely skewed wealth distribution system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。