Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

"The chain is fast, the heart is pained, and the money is scarce." This mocking remark captures the helplessness of many early supporters of Aptos.

As Sui rises with the wind, another "Move twin star" finds itself in a completely different situation. At its inception, Aptos entered the market with high TPS, the Move language, and strong capital support, but while capital can hasten the maturity of a public chain, it cannot endow it with true vitality.

What kind of predicament has Aptos fallen into?

Halo Fades, Ecological Growth Stalls

Aptos was born in 2022, backed by the former Meta team, and emerged as a star project under the halo of "next-generation L1." With the backing of institutions like a16z, YZi Labs, and Jump Crypto, Aptos initially enjoyed the fervent pursuit of the capital market. However, as market sentiment cooled, its once-proud technical narrative is gradually losing its appeal.

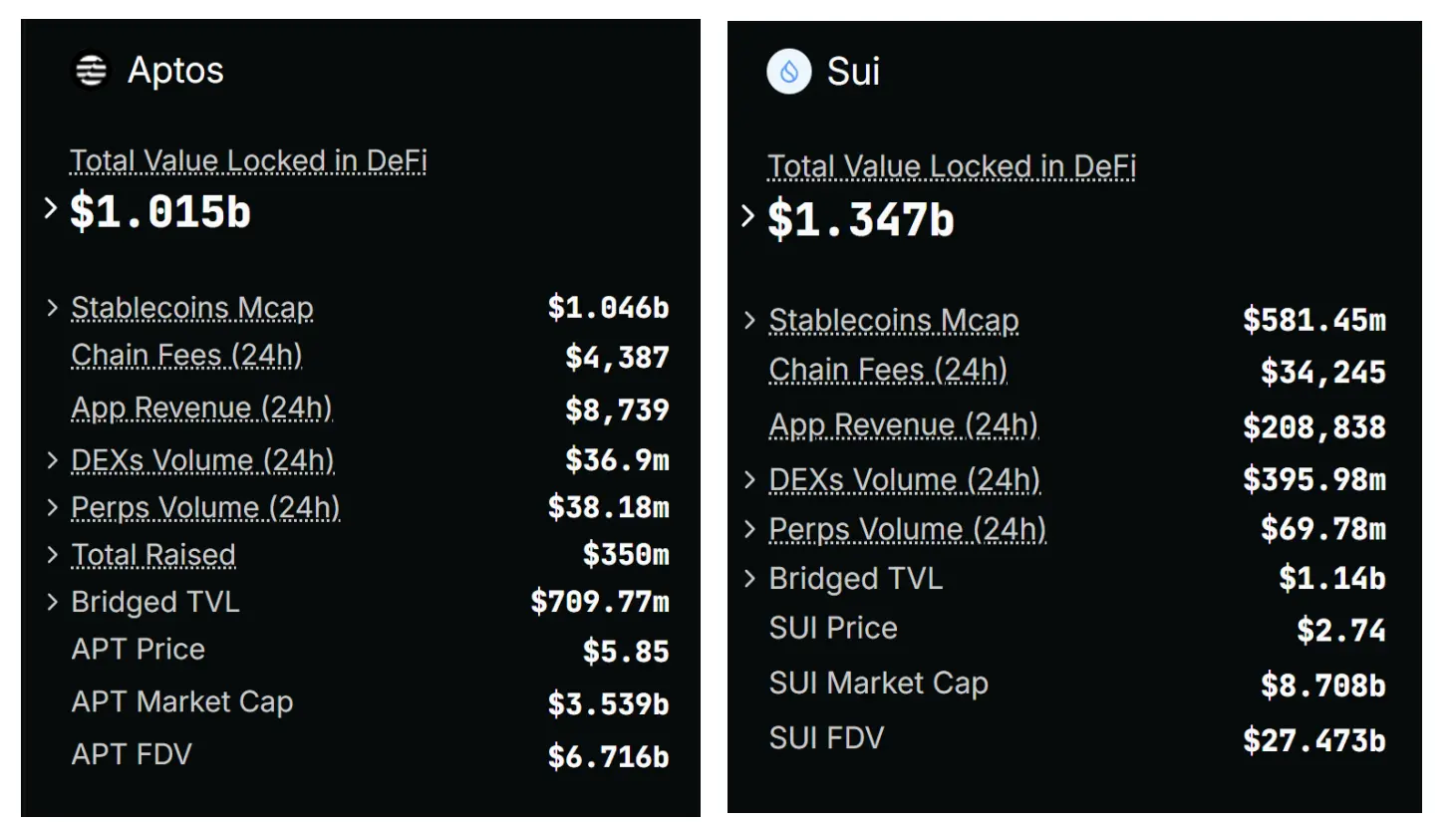

According to Dune data, the number of daily active addresses on Aptos has dropped to about 1 million, with daily transaction counts between 3-4 million, while Sui, also based on the Move language, has surpassed 10 million daily transactions, with DEX trading volume and application revenue far exceeding Aptos.

So, what went wrong with Aptos's ecological growth?

Image Source: Defillama

False Prosperity from Resource Accumulation

Aptos's previous ecological expansion heavily relied on a "resource-driven" model rather than genuine market demand. Crypto KOL @cryptobraveHQ pointed out that Aptos distributed a large number of tokens to partners, introduced well-known DeFi projects to enrich infrastructure, and brought top institutions like Binance and OKX into ecological construction through OTC refinancing. However, this "quick-fix approach" did not lead to real user migration, but rather resembled a "resource arbitrage game":

- After top DeFi projects landed on Aptos, real user growth was limited, and tokens were quickly sold off after unlocking;

- TVL appears to grow, but most funds may just be for earning subsidies through "market making," without forming real liquidity;

- Ecological resources are skewed towards "airdrop" projects rather than supporting native developers, leading to limited development of Aptos's native projects and difficulty in forming self-sustaining ecology.

Aptos's "Ecological Support" is More Form than Substance

In mid-March, Aptos launched the LFM program aimed at helping ecological projects prepare for TGE. However, the first batch of LFM members, Amnis Finance, which received strong community support, faced issues with its airdrop.

Community member @KuiGas pointed out that the airdrop distribution of Amnis Finance was highly centralized: out of 440,000 addresses, only 10,000 received airdrops, leaving many real users empty-handed. In this "ecological support" airdrop farce, Aptos's shortcomings in project review and community governance were exposed.

Aptos's "ecological support" resembles nominal cooperation rather than true ecological co-construction.

Aptos provided Amnis with substantial resource support, including token rewards, and the latter spent a year on marketing and giveaways. However, the entire process was more about form than substance, ultimately resulting in a failed PR rather than ecological growth:

- No synergistic effect with the core ecology.

- No reasonable suggestions or community guidance on airdrop logic before distribution.

@KuiGas stated that the controversy surrounding Amnis Finance's airdrop was rampant, while Aptos chose to remain silent and withdraw, repeating a series of past inactions.

Image Source: @KuiGas

Core Executives Leaving in Droves

In the past year, Aptos has experienced constant turmoil at the executive level, with CEO Mo Shaikh, Head of Product Design Jessica Anerella, and Product Head Cathy Sun all leaving, raising concerns about internal governance chaos.

Crypto KOL @cryptobraveHQ revealed that last year, Aptos conducted OTC trading of APT at prices far below market value. At that time, the market price of APT was in the range of $10-13, but some investors could participate in OTC at about 40% of that price. Coincidentally, shortly after this incident was exposed, co-founder and CEO Mo Shaikh and several employees with venture capital backgrounds left one after another.

It is speculated that the direct reason for the personnel changes may involve the transfer of OTC interests, with the fundamental reason being that Aptos's overall performance after issuing tokens did not meet expectations.

Community Frustration: Is Aptos Heading Towards Decline?

Aptos was once highly anticipated, but now it is deeply mired in community skepticism and disappointment. "Lack of market sensitivity, unclear strategic direction, internal corruption…" Many community members express their frustration, as the once bright expectations are being gradually eroded by reality.

Community member @yi_juanmao bluntly stated that both Aptos and Sui's core teams come from large companies, but their development trajectories are completely different. He criticized Aptos for not being on the Web3 path in terms of market sensitivity, strategic layout, user maintenance, and ecological co-construction. Instead, it seems to be obsessed with boasting about its high TPS, increasingly resembling a rigid traditional Web2 enterprise. He further pointed out that the Aptos ecosystem is filled with parasitic projects, overly reliant on financial infusion, resulting in a lack of vitality and a stagnant system.

Community member @Cary_Zz reflected on the changes over the past year, stating, "Last year, the Move twins were at the same starting line, and at that time, Aptos's voice was even higher than SUI's. The entire community was full of confidence, ready to welcome the feast of the Aptos ecosystem. However, a year has passed, and things have changed. One Move twin has become a hero, while the other has become a loser. SUI's token price has soared, while the Aptos team has been busy selling tokens at low prices through OTC, internal corruption, and interest transfer, ultimately leaving behind a mess with the CEO's departure."

Community member @imsongshu pointed out the inefficiency and rigidity of Aptos's internal staff. @cryptobraveHQ echoed this, stating that Aptos uses "compliance" as a shield, causing processes to drag on for three months.

The halo of capital may bring temporary prosperity, but what truly determines whether a public chain can stand the test of time is the accumulation of users and sustainable ecological development.

The competition in the L1 track remains fierce, and whether Aptos can break through will only be answered by time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。