Author: Shijun

Introduction

Solana has been around for five years, and Jito (the leading MEV infrastructure on Solana) has developed in less than three years, rapidly increasing its market share from an initial 15% to the current 95%. It can be said that most meme trading on Solana goes through Jito!

No ads throughout, please readers take a seat, bookmark this, and let Shijun delve into the underlying principles, gradually revealing:

- What is Jito-Solana? Why has it dominated the market in just two years?

- The core mechanism differences between Solana and Ethereum.

- Why are your trades always getting squeezed?

- How will the MEV landscape on Solana develop in the future?

1. What is Jito-Solana?

Of course, Jito-Solana (the leader with a 95% market share) is not the only player in MEV infrastructure on Solana; there are others like Paladin, Deeznode, BlockRazor, BloxRoute, Galaxy, Nozomi, etc., each with different entry points.

This article will focus on the development history and technical principles of the core leader, and later comment on the strengths and weaknesses of these other players.

1.1. Jito's Development Timeline

First, let’s look at the remarkable speed of its market share growth through a timeline, paying attention to the staking rate and related partners.

- Established at the end of 2021

- Launched on the Solana mainnet in June 2022, with 200 validators by September, covering 15% of the staking volume

- From 2022 to 2023, through financing, iteration, and collaboration with the Solana Foundation, the Jito client was included in the official recommendations

- In 2023, TGE, staking Jito gained MEV yield boosts, forming a staking and restaking model.

- In Q1 2024, due to strong community opposition, the channel for Jito-Solana to send transactions to Jito-Blockengine was closed.

- In Q2 2024, the number of cooperative validators exceeded 500, covering 70% of Solana's MEV, processing 3 billion transactions in 2024

- By Q1 2025, the staking coverage rate had reached 94.71%. Today, the importance of cross-chain bridges remains self-evident.

【Image source: https://www.jito.network/zh/stats/】

Thus, it can be said that Jito is the leading infrastructure in the current MEV ecosystem on Solana. In the past three years, it has established a solid support base among Solana validators, ensuring that the vast majority of transactions go through Jito's system.

Its system diversion has significantly reduced Solana's downtime,

It has provided high-profit yields for squeezers,

And it has allowed Solana validators to increase their MEV earnings by an additional 30%, and steadily.

Moreover, it has transformed from an initial dragon-slaying warrior into a dragon itself, oscillating between the roles of warrior and dragon, sometimes fierce, sometimes benign.

In today's mainstream meme narratives, it has become a dual-purpose player.

1.2. What kind of system has Jito built?

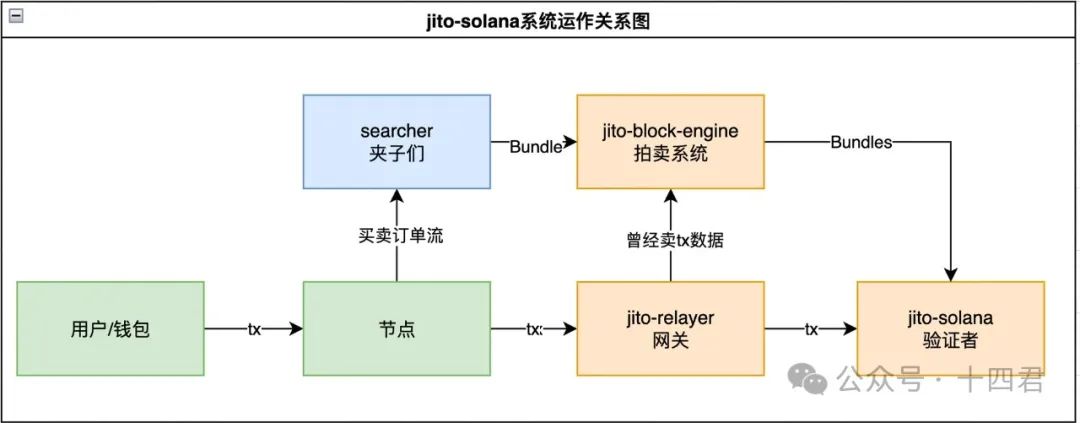

It actually consists of three core services: block-engine, Jito-Solana, and Jito-relayer. Their relationships are illustrated in the following diagram:

[Image source: Created by Shijun]

First is the block-engine, which is an auction system.

Its typical scenario allows squeezers to submit transactions in bundles of up to five in a fixed order for auction, where they can additionally send a transaction called Tips to validators as an extra incentive, encouraging them to prioritize packaging that bundle.

Other scenarios include DEX platforms like OKX, GMGN, and BN Wallet, which can add tips to users' transactions to avoid being squeezed, thus speeding up the process of getting transactions on-chain.

Next is Jito-Solana, which is a client that replaces validators for transaction validation and block production.

Its core function is to allow validators to receive bundles sent from the block-engine, thus prioritizing the processing of these transactions to complete the transaction sequence. At its peak, the number of bundles processed daily could reach 25 million (recently around 10 million), with almost every transaction being profitable.

The tips collected ultimately go to a unified account, which later distributes 95-97% to validators and splits 3-5% with Jito itself.

The most controversial part is the Jito-relayer, which can be understood as a gateway for validators to receive transactions.

Initially, when this relayer received transactions, it would delay for 200ms before sending them to Jito-Solana, while synchronously sending transactions to the block-engine without delay, clearly selling order data. Thus, Jito's early rise was rooted in this user-damaging profit margin.

It is important to note that in March 2024, this rule was officially announced to no longer transmit data, but to this day, the Jito-relayer still has settings for this forwarding switch and the 200ms delay.

So, whether validators are selling user data remains unknown due to the closed-source nature of block-engine.

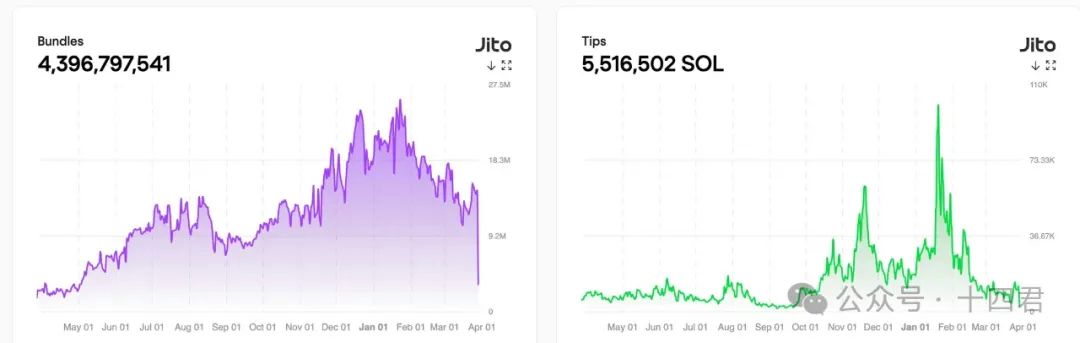

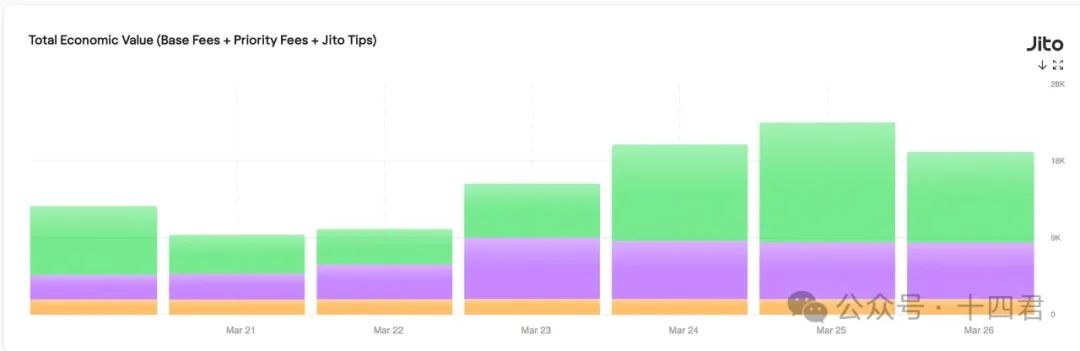

1.3. How much has the Jito system earned?

Clearly, the profit margin from squeezing transactions, combined with the introduction of the tips mechanism, ultimately benefits validators, leading to its skyrocketing market share. Who would refuse an additional 30% in earnings?

In the past year, a total of 4.3 billion bundles have been initiated, generating a total tips revenue of 5.51 million SOL, which, at a market price of 140, corresponds to an additional revenue of 7.7 billion USD from Jito's infrastructure.

[Image source: https://explorer.jito.wtf/]

However, not all of this revenue goes to Jito as the system provider; as mentioned earlier, Jito and validators share a platform profit of 3-5%, so Jito's actual earnings over the past year are about 200,000 to 270,000 SOL, approximately 35 million USD.

This is roughly equivalent to two days' revenue from a popular mobile game, which may not seem high? Not necessarily, because this is a solid platform revenue, especially when most industries in the web3 space cannot specify concrete earnings.

It has achieved oligopolistic dominance, with exclusivity over other competitors (after all, validators can only run one client), and its earnings are influenced by the recent meme fatigue. If Solana explores more trading scenarios in the long term,

Even in the absence of market competitors, the platform could adjust profit sharing from 3-5% to 30% (which is a common platform fee rate after monopolizing a market in internet applications).

Thus, a very high PE estimate can be given; based on a 30 PE for web2 industry leaders, the valuation could reach 1 billion, while a common web3 estimate based on expected monopoly and potential industry growth could reach 10 billion. Similar valuation methods can be referenced in "Super Intermediary or Business Genius? A Look at Cross-Chain Bridge Leader LayerZero from V1 to V2 in the Past Year."

However, today we are not here to outline such macro conclusions, nor merely to understand it through fanciful virtual valuations. Instead, we hope to delve into the details to understand its deeper principles and analyze the future development of the market.

1.4. What demand scenarios can Jito support?

This topic actually relates to the types of MEV attacks currently present.

The most common is the Frontrun type, such as:

- Arbitrage, risk-free trading, similar to Ethereum.

- Sandwich Attack, a typical sandwich attack, with sandwich profits on SOL around $2 each.

- JIT - Just in Time liquidity, providing instant liquidity operations.

Another major category is the Backrun type:

This refers to inserting arbitrage trades after target transactions (such as large DEX trades or liquidation events) to profit from market fluctuations caused by the target transaction. Specific scenarios include:

- DEX arbitrage: You can understand that any transaction will create profit margins between different DEXs. Thus, following closely to eliminate the margin.

- Liquidation follow: After a user's collateral is liquidated, a follow-up trade purchases assets at a discount and resells them.

- Oracle delay: Executing reverse operations based on outdated prices before the oracle updates the price.

Aside from obvious attack scenarios, there are other acceleration scenarios suitable for Jito, so objectively speaking, it cannot be said that Jito only serves MEV; rather, it serves all scenarios with acceleration and batch trading bundling needs.

For example, during the lively opening activities on Solana, market makers will utilize the bundling and acceleration mechanisms to open and deploy chips.

For instance, major exchanges can also avoid being attacked by bundling tips for large user transactions. However, it should be noted that these measures cannot prevent validators from acting maliciously (in fact, you cannot determine which validator is acting maliciously).

2. In-depth Differences Between Solana and ETH Systems

Why is Jito so suitable for Solana?

Why is there no similar head-to-head competition like ETH in this market?

We need to start from the system differences between the two; you may have heard of the POH consensus many times, but the transaction lifecycle of Solana is different from that of ETH, which has led to their completely different ecosystems.

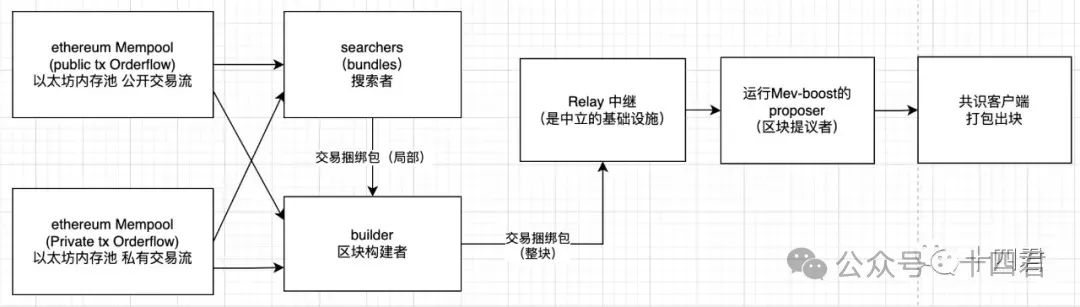

2.1. MEV Landscape of ETH

Two years ago, on the first anniversary of Ethereum's merge, I systematically analyzed: "The MEV Landscape One Year After Ethereum's Merge."

In it, the lifecycle of Ethereum's system is very clear:

[Image source: https://mp.weixin.qq.com/s/IepFvVpIxLpkXV5qgF68Rw]

This is due to the emergence of two very important points for MEV after the merge:

The block interval of Ethereum has become stable. It is no longer the previously random and discrete situation of 3-30 seconds, which has both advantages and disadvantages for MEV. Although Searchers no longer need to rush to send out slightly profitable transactions, they can continuously accumulate a better overall transaction sequence to hand over to validators before block production, this has also intensified competition among Searchers.

Miner incentives have decreased. This has encouraged validators to be more willing to accept MEV transaction auctions, allowing MEV to reach a market share of 90% in just 2-3 months.

Thus, there are roles such as Searchers, Builders, Relayers, Proposers, and Validators.

The lifecycle of each block is as follows:

- Builders create a block by receiving transactions from users, Searchers, or other (private or public) order flows.

- Builders submit the block to the Relayer (i.e., there are multiple Builders).

- The Relayer verifies the validity of the block and calculates the amount it should pay to the block producer.

- The Relayer sends the transaction sequence package and revenue price (which is also the auction bid) to the current slot's block producer.

- The block producer evaluates all the bids they receive and selects the sequence package that offers the highest profit.

- The block producer sends this signed header back to the Relayer (completing this round of auction).

- After the block is published, rewards are distributed to Builders and Proposers through the transactions within the block and the block reward.

Therefore, the author believes that the MEV on Ethereum is inevitably characterized by high internal competition between Searchers and Builders.

The actual data supports this: the overall yield has significantly decreased by 62%.

- In the year before the merge, the average profit calculated from MEV-Explore was 22 MU/M (from September 2021 to September 2022 before the merge, the figures included Arbitrage and liquidation modes).

- In the year after the merge, the average profit calculated from Eigenphi was 8.3 MU/M (from December 2022 to the end of September 2023, the figures included Arbitrage and Sandwich modes).

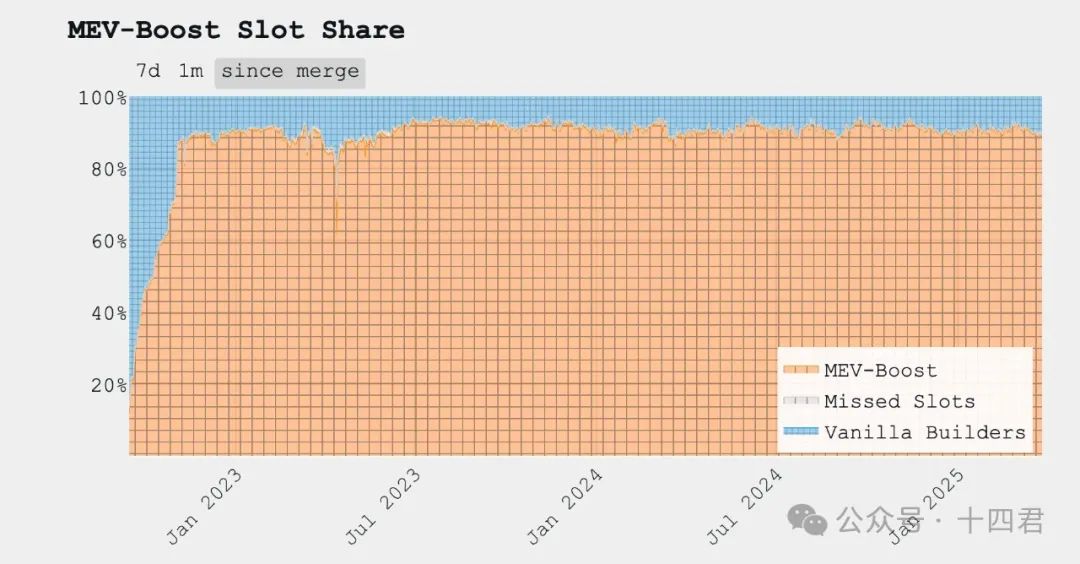

Of course, you might think that the MEV-boost on ETH is growing faster, right? Indeed!

But rapid growth does not mean high profits. We have already analyzed what the profits are, and the rapid growth of Ethereum stems from decreased miner incentives, which encourages validators to be more willing to accept MEV transaction auctions, allowing it to reach a market share of 90% in just 2-3 months.

【Image source: https://mevboost.pics/】

Moreover, the most significant difference between ETH and Solana is that there are also multiple Builders, and their different final profits influence the decisions of validators, thus creating competition among Builders.

Due to competition, the profits of Searchers are continuously compressed. Because of competition, aside from algorithms, the only factor influencing Builders is the volume of data.

Searchers that cannot compete will exit the market, while Builders that can access large amounts of data often have their own infrastructure and market reputation, forming a stable total order flow, rather than relying on the propagation of the Mempool between nodes.

This leads to the conclusion that the MEV market on ETH is, in fact, more market-oriented compared to Solana's purely oligopolistic platform system, thus providing users with a bit of breathing room.

2.2. Solana's Block Mechanism

After understanding the ETH system, please clear your mind, as many aspects of Solana are different from Ethereum, even the traditional blocks are different.

It is precisely these mechanisms that are the root cause of rampant MEV in the Solana system.

We can quickly compare these four core characteristics using a table.

The key lies in the characteristics of having no memory pool and directly connecting to the leader. The former leads to transaction delays, while the latter allows for validator malfeasance.

2.2.1. Solana Actually Has No Memory Pool

The 200ms delay mentioned earlier regarding Jito and its synchronous transmission to the block engine can be considered a form of monetized memory pool. Objectively speaking, how would the absence of a memory pool mechanism (which is actually an optimization feature for speed and privacy protection in Solana) affect the transaction block production mechanism?

If you are an ordinary user initiating a transaction to a certain node, it is equivalent to broadcasting.

Under default configurations, this node will immediately look for the current leader and the next leader (a total of two validators) to submit your transaction.

As for where the transaction order will be? This needs to distinguish between native Solana and Jito-Solana:

- Native Solana: After the leader receives the transaction, theoretically, it will follow FIFO (First In, First Out) — whoever arrives at my leader first will be included in the transaction sequence. Combined with the POH mechanism, it effectively divides a block into many small ticks for synchronization.

- Jito-Solana: Normal transactions reaching the leader have a queue for calculating the current gas limit (in the SVM system, this is called CU, computational resources), which has a lower weight than Bundle transactions. Therefore, ordinary transactions will be behind Bundle transactions. If it is the same transaction (i.e., someone is attacking you), then Jito-Solana will prioritize packaging the transactions that are attacking you. Here, 80% goes to Bundles, while only a mere 20% goes to traditional ordinary transactions.

Thus, Solana has no memory pool; it merely reduces public transmission rather than completely eliminating (which is impossible) it.

This characteristic, in turn, makes Searchers on Solana exclusive to high-end players.

2.2.2. The Subsequent Block Leader Can Be Predicted

Validators are randomly sampled from 1,300 validators every epoch (approximately 2-3 days), using the VDF algorithm, and there is a staking-weighted effect.

For example, if the total staked SOL is 2 million, and you stake 200,000 SOL, then you will have a 10% chance of being selected each time.

If selected, you will be responsible for producing blocks for the next four slots (the corresponding concept of blocks in Solana) for about 1.6 seconds.

This speed is very fast, so any effective node can calculate who the subsequent validator is and attempt to connect with them to submit user transactions. Due to network delays, it is also easy for transactions to miss the current leader and be delivered to the next leader.

2.2.3. The Leader's Connection Strategy Also Has Staking Weighting

This is the SWQoS mechanism, where the current leader's p2p connection total capacity is 2,500, of which 80% (2,000 connections) are reserved for SWQoS (i.e., nodes that have staked).

The remaining 20% (500 connections) are allocated for transaction messages from non-staking nodes.

It sounds confusing, but this is a new mechanism to prevent spam and enhance Sybil resistance, aimed at allowing the leader to prioritize processing transaction messages that are relayed through other staked validators.

2.3. Why Is It Easy to Be Attacked on Solana?

Many ordinary users, in order to prevent their transactions from being squeezed, wonder if they can also offer high Priority Fees (transaction priority fees) to ensure that miners package their transactions first and avoid being squeezed.

The truth is, it has a slight effect, but not much; in extreme cases, it can even have the opposite effect.

[Image source: https://explorer.jito.wtf/feestats]

From the above image, we can see that users offering Priority Fees have a similar proportional probability, while tips can fluctuate and compete, and tips are essentially a separate transaction. From an external perspective, it is actually unknown which transactions are in the Bundle.

Therefore, no matter how high your priority fee is, it only ranks in the last 20% queue of validators for this slot. However, for Searchers who can discover your order from the beginning and launch squeeze attacks against you, having a Bundle with high Priority Fees actually results in a higher average CU unit price, naturally leading to it being prioritized in the validators' Bundle consumption queue, and broadcast synchronously.

Similarly, other mechanisms in Solana, at first glance, seem to be designed to prevent users from being easily squeezed. So why is MEV even more rampant on Solana? The key points include:

Leader Malfeasance Is Hard to Prove

Both leaders A and B can access all user transactions, so the cost and ambiguity of leader B's malfeasance are lowered.

Imagine, as the second leader, I see a profitable transaction, so I quickly construct a squeeze attack to send to the block engine for auction. Then, under the 80% Bundle priority mechanism, my attack will naturally take effect first, while the one being packaged is leader A.

So how do you determine that I, leader B, am the attacker?

Of course, you could say that ultimately leader A packaged the attack transaction, so he is the attacker. However, under default logic, 95% of validators would do the same thing, which reduces the chances of intervening with them.

Punishing A is indeed unreasonable, as there are other links in between, which could also lead to information leakage, as follows.

Transaction Retrying, Long Wait Times

Clearly, each slot only lasts about 400ms, but have you ever experienced transactions on Solana inexplicably lingering for over 23 seconds?

You might hastily think that the node you connected to is underperforming, but that is not the case.

Due to the SWQoS mechanism, if you connect to a regular node, it will calculate and find the leader to submit the transaction. However, during network congestion, it only has 500 connection pools available for regular nodes. If it fails to connect and submit, it will retry all transactions for that node every 2 seconds.

The above parameters are the default underlying parameters for Solana nodes, and different nodes can have different settings (for example, changing the retry to 1 second).

For ordinary users, how can the probability of encountering a retry be measured?

As of March 2025, Solana currently has approximately 1,300 validators and 4,000 RPC nodes.

So once it gets crowded, within 1.6 seconds (4 slots), 2,700 nodes compete for 500 connection pools. If the leader's space is not filled, it keeps looking for the next one.

So under this illusion, how will your transaction be treated if it lingers for a long time at a node? If your CU price is not high enough and the leader is already full, what should he do?

Yes, sell data. For high-traffic nodes, some Searchers may buy order flows for $10,000 a month.

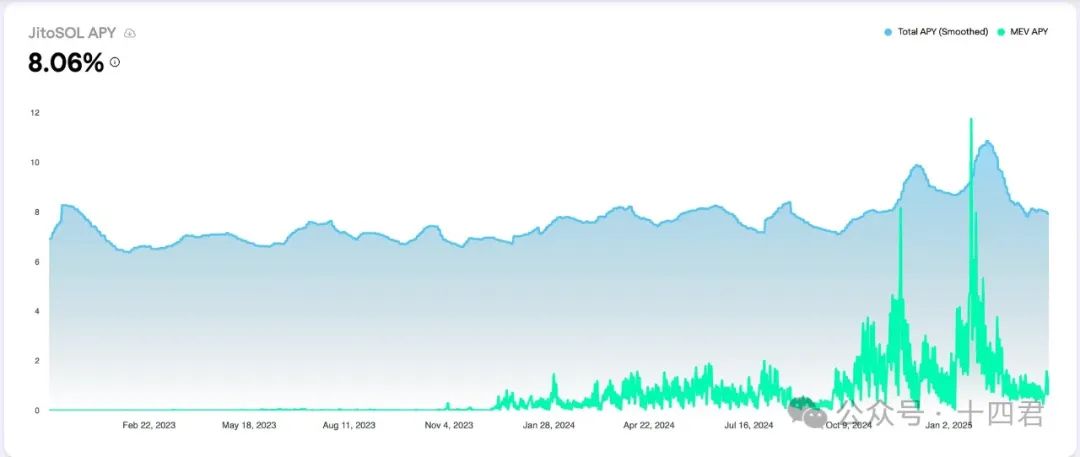

Meme Narrative and Staking Revenue Scale

First, regarding the meme market phase, since the current mainstream narrative on Solana is the Meme ecosystem, the liquidity on-chain is shallow, making it easy for users to set wider slippage for transactions to succeed, which amplifies the attack profits for Searchers (currently, several samples show profits reaching $2, compared to nearly $0.1 on ETH, which is quite high).

[Image source: https://www.jito.network/zh/stats/]

Secondly, the staking yield for Solana validators is about 8% annually, a relatively stable figure over the years.

The annualized yield from enhanced MEV is around 1.5%.

Combining the two, it means that stakers running the Jito-Solana client can increase their staking yield by an additional 15-30%. In cases of local market surges, the MEV yield can even exceed the staking yield itself.

2.4. Why Are Solana Validators Prone to Betrayal?

The profits are simply too high, and the costs are also significant, forcing validators to continuously expand their revenue sources.

Validators incur an annual voting cost of about 300-350 SOL (estimated at $42,000 based on a market price of $140) and $4,200 in hardware costs (not including dynamic network costs).

Moreover, the substantial node configuration burden on Solana requires node performance to be at least 24 cores, 256GB of memory, and 2*1.9TB NVMe.

Among the commonly seen customized Latitude models, currently, 14% of validators are using them, which costs about $350 per month.

Ultimately, this has resulted in only 458 out of 1,323 Solana validators being profitable. This is also why the "SIMD-0228 proposal" was voted down.

From the results, this proposal would further reduce block production incentives, inevitably forcing smaller validators to exit, leading to irreversible centralization of the platform. And when MEV profits increase while the essential work profits decrease, what do you think will happen?

Let’s take a look at the strategies of competitors outside of Jito.

3. Other Competitors of MEV on Solana

3.1. Paladin: VIP Front-Running and Transaction Protection

Current market share: 5%. Launched at the end of 2023, as of March 2025, the official claim is that 205 validator nodes have deployed Paladin, staking 53M SOL, and using the Paladin client can increase node revenue by about 12.5%.

In essence, it is a forked modified version based on the Jito-Solana client.

The core selling points are:

- P3 Priority Port: Allows the block-producing leader to open this fast VIP channel, processing transactions according to the original FIFO rules.

- Identifying and Excluding Sandwich Attacks: Although this initially seems disadvantageous for validator rewards, Paladin validators receive compensation through a trust-based mechanism. Validators that avoid "sandwich" attacks can attract direct transactions, thereby creating a trust ecosystem and increasing profits.

- Paladin Bot: This is an open-source high-frequency arbitrage bot that runs directly on the validator node locally and only activates when that node is elected as Leader. When the Leader has the Paladin Bot, it quickly executes simple and risk-free MEV strategies (such as DEX price arbitrage, centralized exchange and on-chain price arbitrage, etc.) and directly counts the profits into validator earnings.

As of December 3, 2024, this bot has been officially announced to be removed.

3.2. bloXroute: Network Layer Optimization + Private Channel Assurance

bloXroute Labs is an infrastructure company providing a blockchain data distribution network (BDN), previously accelerating transaction broadcasting and reducing latency on chains like Ethereum.

bloXroute does not directly participate in MEV distribution but helps front-running transactions reach the Leader faster by providing faster channels.

Unlike Jito/Paladin, bloXroute does not directly modify the Solana validator client or introduce transaction auction mechanisms; instead, it provides faster messaging channels for all nodes at the network layer.

Its main idea is to relay Solana's block "shreds" more quickly to all validators through a globally distributed network of acceleration nodes, reducing the latency of data broadcasting when the Leader produces blocks and preventing forks caused by poor network conditions. Therefore, the services provided are:

- Solana BDN Acceleration: According to official documentation, bloXroute Solana BDN can reduce block shard propagation delays by 30-50 milliseconds.

- MEV-Protect RPC service, similar to Ethereum's protective private transaction ports, indicating that bloXroute plans to allow users to privately send transactions to the Leader through its RPC, avoiding visibility from third parties, thus preventing front-running or back-running.

3.3. BlockRazor: Network Layer Optimization + Private Channel Assurance

BlockRazor is a newly established MEV infrastructure project in 2024, with a team background primarily from Asia. It positions itself as an "intention-centered network service provider," planning to offer MEV Protect RPC, high-performance network acceleration, MEV Builder, and other services on mainstream blockchains.

Scutum MEV Protect RPC: This is a private transaction gateway service launched by BlockRazor, similar to Flashbots Protect. Users can submit transaction Bundles through Scutum RPC.

BlockRazor ensures that these transactions are not published through the public mempool but are sent directly to block producers to avoid being front-run or sandwiched.

4. Conclusion

4.1. How to View the MEV Competitive Landscape on Solana?

Just the day before yesterday, a new competitor entered the market.

Warlock Labs raised $8 million on March 27, 2025, aiming to reshape on-chain order flow.

However, it focuses on the Ethereum track, planning to provide some proof of order flow data and register it on-chain to ensure they are accurate and responsible for processing user transactions.

This is my viewpoint: a truly good market will continuously see new competitors entering, while an oligopolistic market will lead to challenges being stifled. What kind of market does the platform layer hope to become?

Let’s think deeper about what is truly important in this MEV infrastructure.

Paladin is built on Jito-Solana, which means that Jito can upgrade to a version that no longer supports the so-called P3 channel. This is similar to the 3Q battle of the past, where the one with the more essential need (clearly social) wins. The same happened when WeChat banned sharing of NetEase Cloud Music in Moments; if there were not larger regulatory machines in place, this exclusive competitive strategy could be applied indefinitely across any track. Moreover, Paladin's 5% market share is also due to early enhancements to validator profits through built-in bots, although its open-source bot only focused on non-aggressive strategies (i.e., doing arbitrage without engaging in obvious sandwich attacks that harm user interests), it was still suppressed by market opinion.

Additionally, other competitors like bloXroute and BlockRazor are following the acceleration + privacy channel route. The so-called privacy can only ensure that the leader receives only the current transaction, thus avoiding the next party from committing malfeasance and providing a direct countermeasure against malfeasance.

The acceleration capability is indeed a solid technical strength today. It will also be the focus of the next wallet/DEX market battle.

Objectively speaking, the original client code of Solana has some historical debts, so there have been instances where people modified the client to lower configurations and speed up synchronization. Additionally, combined with the SWQoS mechanism, validators can also enhance connection stability and success rates.

Furthermore, the Jito block engine system is actually a multi-centralized system, but even if it is multi-centralized (not completely decentralized), single points of failure can still occur. Since it is a core upstream link, once it goes down, it is equivalent to Solana going down.

Therefore, to achieve multi-node disaster recovery acceleration, it still needs to go through systems that have previously undergone rigorous testing challenges. This is also why bugs in Binance wallets seem to be more frequent; many historical technical debts have yet to be resolved.

However, the issue of technical strength will ultimately be resolved.

Any entity can perform multi-node global optimization, and wherever the leader is located, they can establish the shortest path to ensure their transactions reach the leader quickly. They can also establish multicast strategies to cater to different user needs. The future competitive outcome will inevitably be a result of refined operations.

But what cannot be resolved is the issue of market competition squeezing.

If Jito-Solana uses its oligopolistic advantage to modify the Bundle priority strategy from 80% to 90%, or even 95%, then ordinary users will have to infinitely raise Priority Fees to compete for the 5% CU space that is left out.

However, when the total CU utilization is insufficient, it will ultimately affect the total earnings of validators (and due to a large number of transactions piling up in the unprocessed queue, the motivation for validator malfeasance will be stronger), so Jito will not initiate such a competitive model unless absolutely necessary.

So why is the market competition on ETH more open while Solana's competition is more exclusive?

The author believes the root cause is the lack of a Builder bidding role.

ETH can have multiple Builders generating multiple final block sequences, while validators only verify and choose which one to accept.

However, Solana only has multiple block engines (and they are all from the same entity), and the transaction queue provided to validators is essentially a single Bundle (5 transactions), which lacks the competitive element of multiple Builders.

Objectively speaking, the development history of ETH shows that this competition will significantly increase validator profits while reducing Searcher profits. When Searcher profits decrease, the incidence of attacks will also diminish, ultimately achieving a balance.

In a future where both technology and market are balanced, what will true competitiveness be?

I believe that when the technological gap is bridged along with talent competition and investment, and when the market's centralization and decentralization ultimately affect the overall SOL ecosystem, these issues will be resolved. Now, Solana has already initiated discussions on multiple Builders and even further discussions on multiple leaders for random block production.

Although multiple leaders also mean that more people will access your orders, since the final block producer is a random one from multiple simultaneous queues, it indirectly achieves competition among multiple Builders, and the market impact will follow a similar trajectory as before.

Thus, true competitiveness will shift to the data islands of order flow.

For example, Jupiter has already captured over 80% of the DEX market share, making its order flow the most sought-after. It will depend on how it balances providing the best price versus randomly selecting "lucky geese" to extract profits, even at the cost of some brand reputation.

I think the reason they do not engage in building MEV infrastructure themselves is that in a developing market phase, no one can claim to be as unassailable as traditional giants. Therefore, focusing solely on profits could give competitors the opportunity to overtake.

Moreover, MEV is fundamentally a game theory problem. Once it reaches a monopoly position, the support from the validators that underpin the monopoly will push the infrastructure to provide profits.

Any dragon-slaying warrior seems to have an unstoppable potential to become the evil dragon, embodying both the dragon and the warrior.

Of course, you might say that Jito was initially built as an MEV infrastructure, so how could it be a dragon-slaying warrior?

4.2. The Merits and Demerits of Jito for Solana

Much of what has been discussed earlier focuses on Jito's shortcomings, but does Jito have merits?

Objectively speaking, Jito does have merits.

When I started looking at Solana three years ago, I scoffed at it (okay, I admit I was too loud back then), but the root of this analysis was its high downtime rate.

So why was there such a high downtime rate?

On one hand, there were too many pitfalls in the early code, and later it was found that money could solve most problems (machine configurations kept increasing).

On the other hand, there was the FIFO strategy. When a highly profitable transaction appeared on-chain, even if it was just a backrun attack, the closer someone was behind, the higher the transaction profit would be.

Clearly, every Searcher would establish a set of facilities to send transactions to the leader as quickly as possible, so early leaders were often subjected to flood attacks.

With the emergence of the block engine, Jito further introduced a bidding mechanism. When you see profits, you can bid first, which diverts the traffic.

This auction also has a function to intercept failed transactions because if your transaction conflicts with someone else's and their price is higher, since both Searchers are sandwiching the same person's transaction, there will inevitably be storage conflicts. Therefore, if you cannot outbid, the block engine will directly reject you, and you will have to raise your price and continue bidding (it may also randomly reject you, leading you to mistakenly believe you must further bid, ah, big data killing familiarity is so friendly).

Of course, you might retort, why do we still see many failed transactions on Solana?

That’s because the block engine is multi-centered, and the rapid block production speed of 400ms makes it impossible to achieve fast data synchronization, thus excluding auction error situations arising between different block engines.

Therefore, I believe Jito also has merits, as it has significantly reduced Solana's downtime rate.

In addition to downtime, its bundled transactions have created various application scenarios in the market.

For a market to thrive, it actually needs to serve market makers well. The most explosive market for Solana is the Meme market, which relies on the opening groups that need to "subtly" start collecting low-priced chips at launch. This is a highly targeted scenario; if the operator of the market cannot collect enough profitable low-priced chips, they may directly abandon the pump and reopen.

In fact, it is mutually detrimental, as they would waste an opportunity to launch.

Moreover, there are other needs for accelerated transactions, such as various DEXs. Nowadays, they also trust that Jito-Solana will not sell data as blatantly as before, so for high-value transactions, users will give an extra tip fee to take the fast route through the block engine, occupying 80% of the CU processing queue, thus improving transaction speed and avoiding being sandwiched.

Enhancing the earnings of Solana stakers increases the overall degree of decentralization.

As previously analyzed, Solana's staking yield is around 8% annually, and through Jito's MEV tip earnings, it can reach about 10%, which is a decent margin.

Among Solana's 1,323 validators, only 458 are profitable. The others are not entirely unprofitable (otherwise, who would still be doing it?). In fact, the others are either directly malicious, indirectly malicious, or not motivated by profit (for example, just for SWQoS acceleration). Essentially, the aforementioned statistics are based on staking earnings and do not fully incorporate MEV earnings.

Thus, it is because of Jito's existence that the remaining 800 validators can be profitable, allowing Solana to be less centralized.

So, overall, Jito-Solana does have merits; at least it has not fully adopted exclusive competitive strategies yet, allowing for third-party entry opportunities.

4.3. How Will the Future MEV Landscape Develop?

I have already mentioned several key points earlier. I believe that what seems like a dominant player now is actually a moment of latent opportunity.

First, because MEV profits on Solana are generally high (around $2, compared to ETH's $0.1), the meme trend will continue to accompany different narrative scenarios, leading to perpetual trading. Therefore, new Searchers will enter, although the high cost of acquiring order flow on Solana has blocked some small players, competition among large players will also increase their investment alongside profits.

Second, there are many opposing voices on Solana that challenge MEV infrastructure. This has forced Jito to announce the closure of data selling channels and has compelled Paladin to remove the built-in bot functionality. In proposals like SIMD-228, there is also the already passed SIMD-96 proposal.

Originally, half of the rewards earned by validators, which consisted of the sum of base fees and priority fees, would be destroyed, but now only half of the base fee will be destroyed. This indirectly increases the earnings of validators packaging normal user transactions, thus enhancing their motivation to counter Jito's reduction of ordinary transaction weights. New proposals are continuously participating in the macro decision-making game of Solana.

Third, the overall profit margin of MEV is substantial. For example, last year, Jito Labs' revenue in October was $78.92 million, double the record of $39.45 million set in May, surpassing established DeFi protocols like Lido and Uniswap. Even if Jito itself has to share profits with validators, the overall profit margin represents the lower limit of user losses.

The greater the loss, the greater the motivation. Users' expectations for reliable services can also be quantified from this. This is where BlockRazor and bloXroute find their opportunities.

Moreover, what excites me is some more cutting-edge explorations:

- Starting from private transactions: There are threshold encryption, delayed encryption, and SGX encryption, which fundamentally require conditions for decrypting transaction information, whether through time locks, multi-signatures, or trusted hardware models.

- Starting from fair transactions: There are fair sorting (FSS) and order flow auction MEV Auction, as well as MEV-Share and MEV-Blocker, differing in that they range from completely profitless to profit-sharing to profit balancing, allowing users to decide what cost to incur for relative fairness in transactions.

- Protocol-level improvements to PBS. Currently, PBS is actually a proposal from the Ethereum Foundation, but it has achieved separation through MEV-boost. In the future, this core mechanism will transition to Ethereum's own protocol mechanism.

Most of these have already been proposed within Ethereum itself, but the differences in compatibility have prevented them from surfacing in users' views. However, these are also areas that Solana can learn from.

5. Final Thoughts

The ultimate outcome of competition is often not surpassed by efforts within the same track. What will take down Jito will not be the next Jito (which has its merits and demerits) but a completely new application form.

In my previous research titled “[Interpretation of the UniswapX Protocol]”, I summarized the operational flow and profit sources of UniswapX, aiming to fully depict the specific yield of MEV, as this is the source of its competition and profit-sharing with users (essentially sacrificing the real-time nature of transactions for better exchange rates).

Similarly, order book-based exchanges (and even decentralized exchanges) are also good tools to combat MEV. One can imagine that as computing power further increases and daily transactions expand, the AMM mechanism and the corresponding derived MEV attack scenarios will dissipate. However, the order book will face other challenges that are not smaller than the MEV issue.

From the recent turbulence of Hyperliquid, we can see that aside from the concerns of centralization, as Web3 moves towards compliance regulation, the players at the table have already donned suits and stepped into the international hall.

At this moment, compliance is an all-encompassing sword, as it stands on the side of the users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。