Source: Cointelegraph Original: "{title}"

The Brazilian Superior Court of Justice (STJ) unanimously passed a resolution authorizing judges to notify cryptocurrency brokers that they will seize the assets of account holders to pay creditors.

The resolution has been confirmed by an announcement on the official website of the Superior Court of Justice.

The Third Chamber made this ruling unanimously after reviewing a lawsuit from creditors.

The Superior Court of Justice clearly stated in a memorandum: "Although cryptocurrencies are not legal tender, they indeed possess the dual functions of a means of payment and a store of value."

Source: STJnoticias

According to current Brazilian regulations, judges have the authority to freeze bank accounts and forcibly deduct funds without the debtor's knowledge once a debt relationship is established.

Now, cryptocurrency assets are also included in the same enforcement scope.

Judge Ricardo Villas Bôas Cueva, who participated in the vote, pointed out that although Brazil has not yet established a formal regulatory framework for cryptocurrencies, some legislation has recognized them as assets representing "digital value."

In a regulatory vacuum, although the Brazilian Central Bank has adopted a phased regulatory strategy and has not yet introduced a comprehensive digital asset framework, the popularity of cryptocurrencies in the country continues to rise.

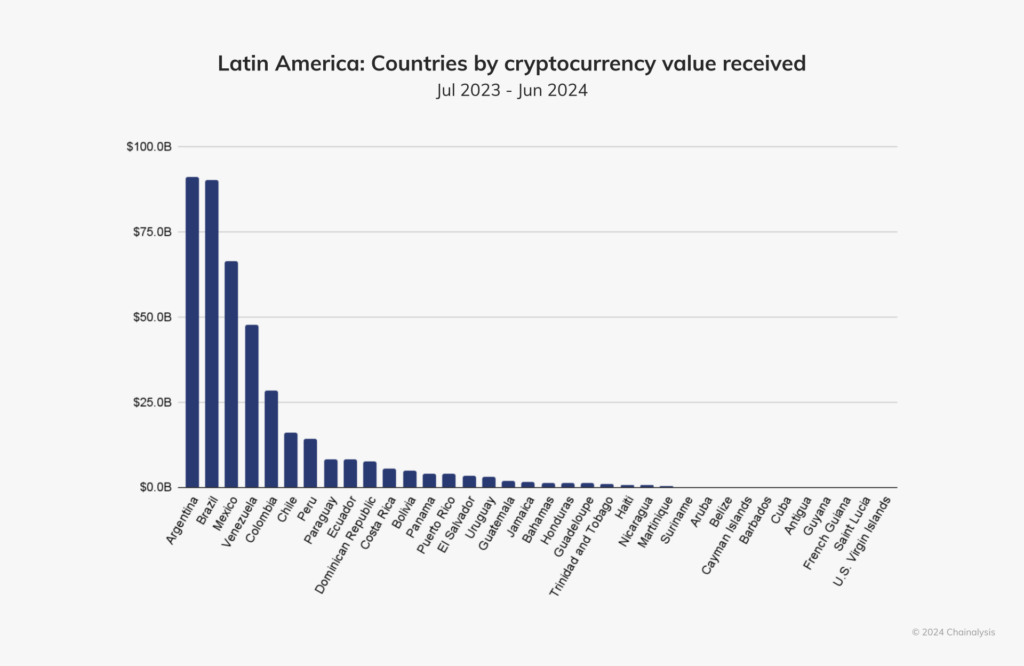

A report from Chainalysis in October showed that Brazil ranks second in Latin America for the "receiving cryptocurrency asset value" metric, only behind Argentina.

In Latin America, as of June 2024, only Argentina has a higher cryptocurrency penetration rate. Source: Chainalysis

Earlier this year, Binance obtained local operating licenses through the acquisition of a São Paulo investment firm.

Its executives told Cointelegraph that Brazil's regulatory "progress is significant," and they expect the comprehensive framework to be completed "by mid-year."

However, not all regulatory trends are favorable for the industry.

In December last year, the Brazilian Central Bank proposed banning stablecoin transactions from self-custody wallets—at that time, more people were using dollar-pegged stablecoins to hedge against the depreciation of the real.

Industry observers told Cointelegraph that such bans may be difficult to enforce.

"The government can regulate centralized exchanges, but P2P trading and decentralized platforms are harder to control; the ban may only affect part of the ecosystem," noted Trezor analyst Lucien Bourdon.

Related articles: Bitcoin mining company Bitfarms secures up to $300 million loan from Macquarie.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。