Source: Cointelegraph Original: "{title}"

According to an announcement released by the U.S. Securities and Exchange Commission (SEC) last Friday (April 4), stablecoins that meet specific conditions are classified as "non-securities" under new guidelines and are exempt from trading reporting requirements.

The SEC defines this type of "compliant stablecoin" as tokens that are fully backed by fiat currency reserves or short-term, low-risk, high-liquidity instruments, and can be redeemed for U.S. dollars at a 1:1 ratio.

This definition explicitly excludes algorithmic stablecoins that maintain a dollar peg through algorithms or automated trading strategies, leaving the regulatory status of algorithmic stablecoins, synthetic dollars, and interest-bearing fiat tokens uncertain.

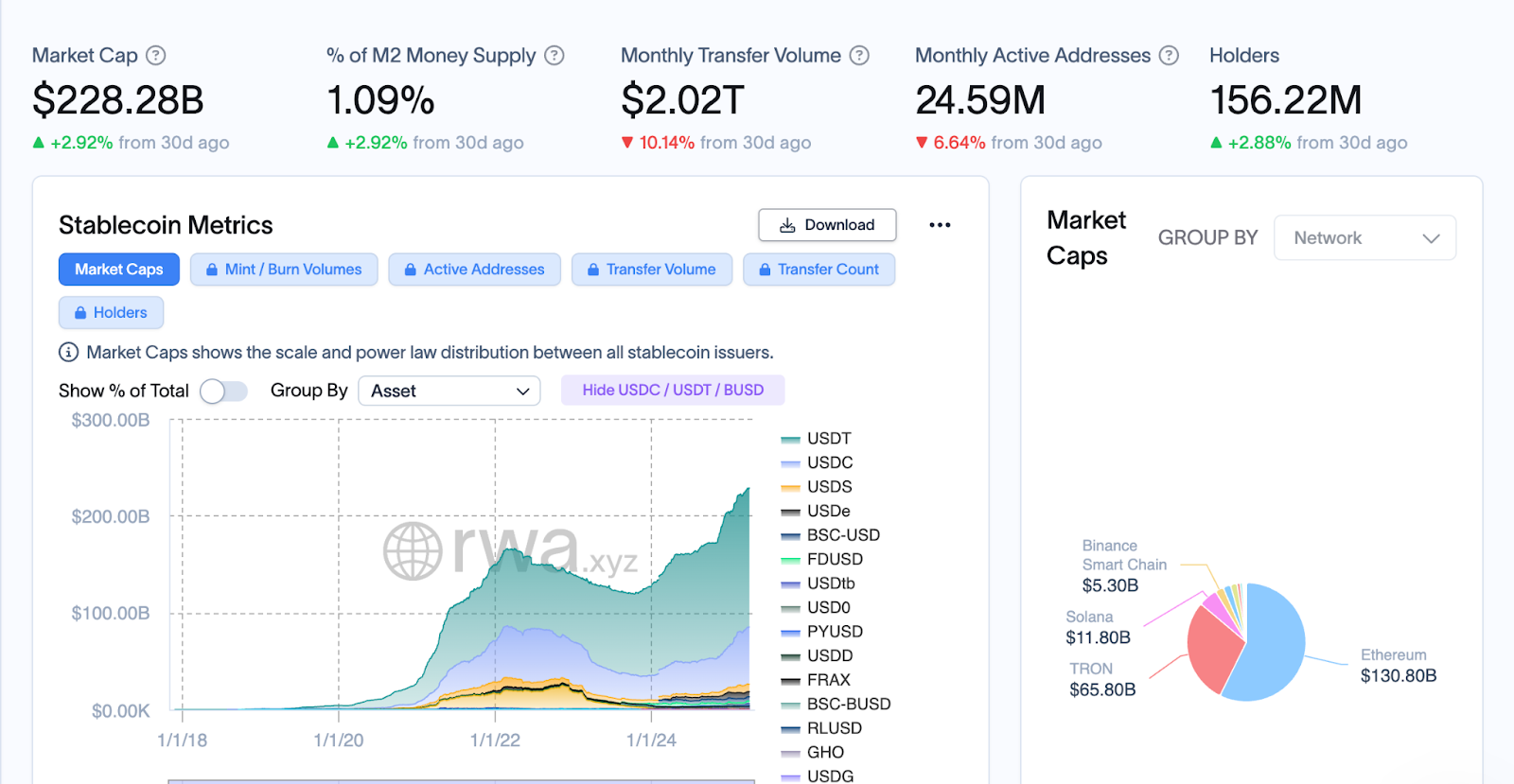

Current Overview of the Stablecoin Market Source: RWA.XYZ

Industry leaders are actively pushing for regulatory reforms to allow stablecoin issuers to distribute earnings to holders and provide on-chain interest.

However, the new regulations explicitly prohibit compliant stablecoin issuers from: mixing reserve funds with operating funds, offering interest/returns/dividends to token holders, and using reserve funds for investments or market speculation.

SEC Definition Aligns with U.S. Policy Goals The SEC's compliant stablecoin standards are highly consistent with the "2025 GENIUS Stablecoin Act" proposed by Senator Bill Hagerty and the "2025 Stablecoin Act" initiated by Representative French Hill.

These legislative proposals aim to reinforce the U.S. dollar's status as the global reserve currency through stablecoins backed by U.S. dollars and government bonds.

"Guidance and Establishment of the U.S. Stablecoin Innovation Act" (GENIUS Act 2025) Source: U.S. Senate

Centralized stablecoin issuers use dollar deposits and short-term U.S. Treasury bonds from regulated financial institutions as reserves, effectively increasing the demand for U.S. dollars and Treasury bonds.

The world's largest stablecoin issuer, Tether, has now become the seventh-largest holder of U.S. Treasury bonds, surpassing countries like Canada, Germany, and South Korea.

U.S. Treasury Secretary Scott Bansen stated at the White House's first digital asset summit on March 7 that the government will leverage stablecoins to extend the dominance of the U.S. dollar.

Bansen emphasized that stablecoin regulation is a core component of the current administration's digital asset strategy and is a top regulatory priority for this legislative cycle.

Related Articles: Former SEC Officials Expect: SEC "Will Lose the Case Against Ripple"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。