At press time, the broader cryptocurrency sector—excluding bitcoin ( BTC)—now holds an aggregate market value below $1 trillion, a reflection of the recent volatility reshaping investor sentiment. The global crypto market currently holds a valuation of $2.53 trillion, with bitcoin ( BTC) commanding a 62% majority at $1.58 trillion. Conversely, ethereum ( ETH) accounts for 7.44% of the sector, valued at $188.23 billion.

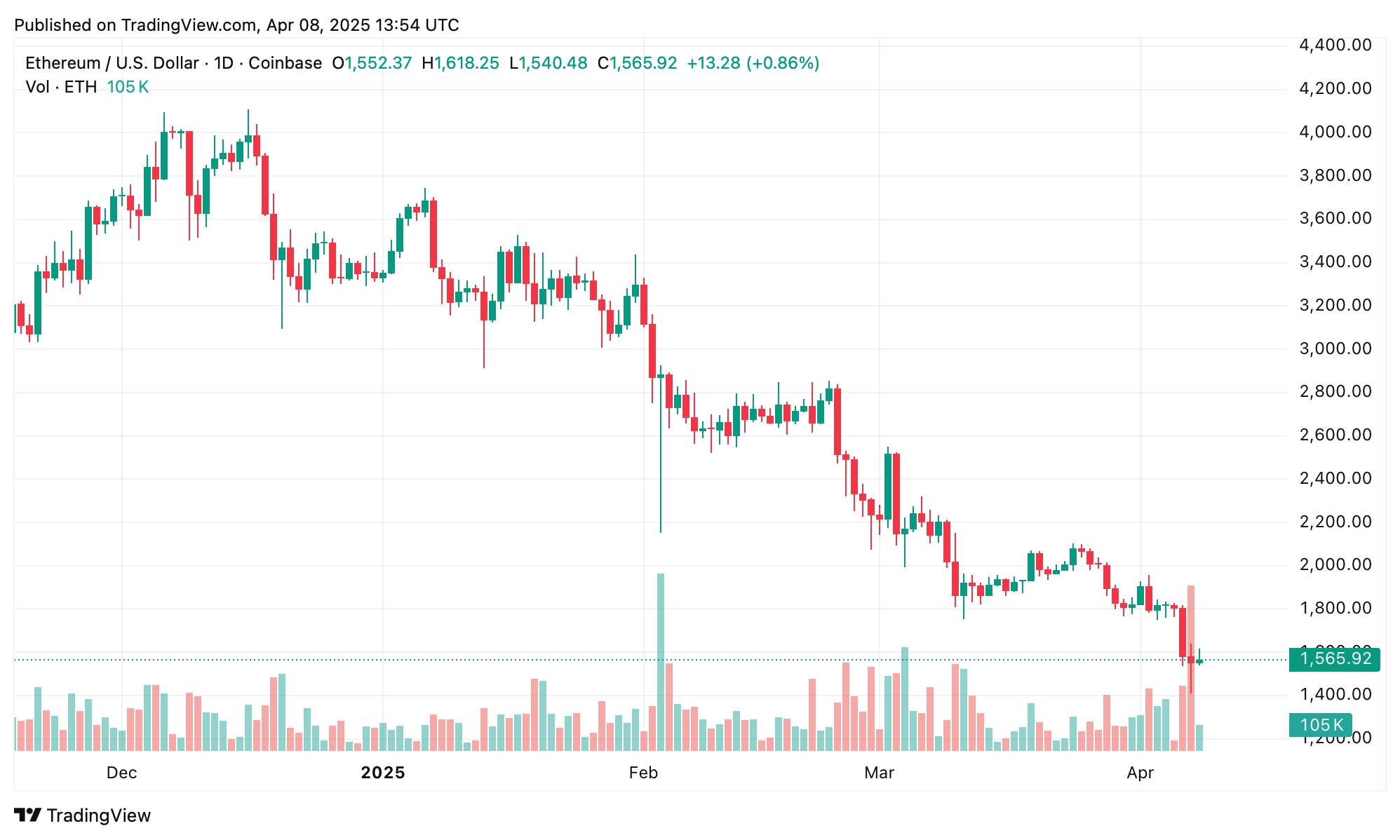

Notably, tether ( USDT) holds a $144.21 billion market cap—5.7% of the digital asset sector—steadily narrowing the gap with ethereum’s position. It’s been rough time for ETH in 2025, and this past month, it has shed 29.6% against the U.S. dollar. Year-to-date, ether is down more than 53%. While ETH dominance has slipped to 7.44%, other coins besides USDT have seen increased dominance, like XRP. While ETH briefly touched a multi-year trough against BTC and sank to $1,409 midday yesterday, it has since rebounded, climbing to $1,563 per coin.

Notably, tether ( USDT) holds a $144.21 billion market cap—5.7% of the digital asset sector—steadily narrowing the gap with ethereum’s position. It’s been rough time for ETH in 2025, and this past month, it has shed 29.6% against the U.S. dollar. Year-to-date, ether is down more than 53%. While ETH dominance has slipped to 7.44%, other coins besides USDT have seen increased dominance, like XRP. While ETH briefly touched a multi-year trough against BTC and sank to $1,409 midday yesterday, it has since rebounded, climbing to $1,563 per coin.

Ether’s value relative to bitcoin, however, has plummeted to 0.020 BTC, marking its low since 2020. Ethereum’s downturn stems from multifaceted pressures, including competitive pressures from layer one (L1) chains and large-scale divestments by whales. Further, ethereum exchange-traded funds (ETFs), introduced in mid-2024, have lagged behind their bitcoin counterparts in performance. Onchain metrics for Ethereum have exhibited weakness, exacerbating the asset’s valuation decline.

Simultaneously, engagement with Ethereum-based decentralized applications has diminished, coinciding with rival blockchains presenting compelling alternatives. Compounding these challenges, the theft of $1.4 billion in ETH during the Bybit breach in mid-2024 intensified existing woes. Much like an avalanche gathering mass, the bearish sentiment surrounding ETH has snowballed, amplifying its downward trajectory.

Ethereum’s trajectory remains malleable, buoyed by its foundational ingenuity and capacity for reinvention in an industry defined by rapid metamorphosis. Upcoming protocol enhancements like Pectra and a steadfast developer cohort could spark renewed vigor, leveraging Ether’s entrenched ecosystem to address scalability. While challenges persist, the network’s historical resilience and deep integration across decentralized finance (DeFi) positions ETH to potentially reclaim momentum as market conditions stabilize and innovation priorities crystallize.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。