Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.68 trillion, with BTC accounting for 61.9%, valued at $1.66 trillion. The market cap of stablecoins is $235 billion, with a 7-day increase of 0.49%, of which USDT accounts for 61.57%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $82,687; ETH has also shown range-bound fluctuations, currently priced at $1,769.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: EOS with a 7-day increase of 24.27%, PENDLE with a 7-day increase of 17.96%, and COMP with a 7-day increase of 12.12%.

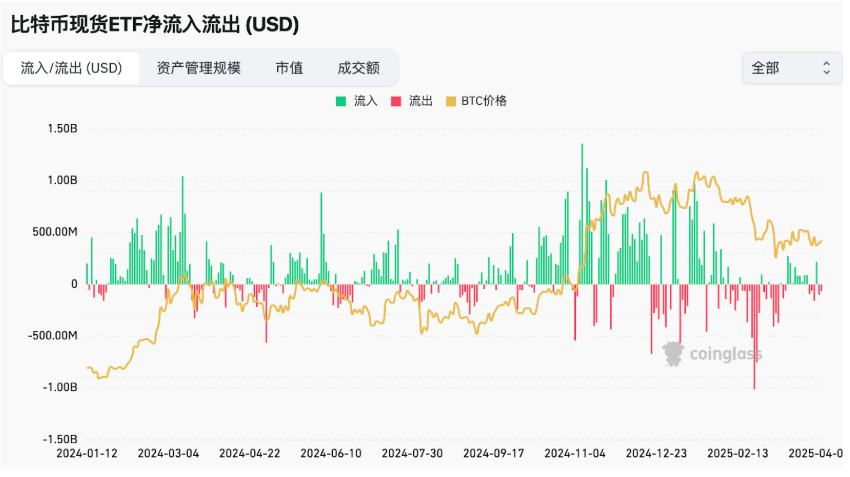

This week, there was a net outflow of $165.3 million from Bitcoin spot ETFs in the U.S.; a net outflow of $50 million from Ethereum spot ETFs in the U.S.

On April 4, the "Fear & Greed Index" was at 34 (higher than last week), with the sentiment this week being: 6 days of fear and 1 day of neutrality.

Market Prediction: The market has shown range-bound fluctuations this week, with sentiment still in fear. On-chain stablecoins have seen a slight increase in issuance, and both U.S. spot Bitcoin and Ethereum ETFs have experienced net outflows. Currently, assets linked to gold are actively traded on-chain, and the equal tariffs announced on April 2 exceeded market expectations, leading to significant declines in global stock markets due to heightened risk aversion. The probability of a 25 basis point rate cut by the Federal Reserve in May is 33.3%, which is higher than last week. It is expected that the market will maintain fluctuations during this period (April-May), with potential opportunities in popular projects on the SOL chain, as well as focusing on the “Hotcoin New Coin List” to unlock more wealth opportunities.

Understanding Now

Review of Major Events of the Week

The Trump family holds at least 60% of WLFI through a new holding company;

On March 31, Bitcoin Magazine reported that BlackRock CEO Larry Fink stated that the dollar "risks losing" its status as the global reserve currency and may be replaced by "digital assets like Bitcoin";

On April 1, Tether increased its holdings by 8,888 BTC ($735 million) in the first quarter of this year;

On April 2, it was reported that stablecoin issuer Circle has submitted an S-1 filing to the U.S. Securities and Exchange Commission (SEC), officially starting the initial public offering (IPO) process. The company plans to list on the New York Stock Exchange under the ticker "CRCL";

On April 2, according to Coinglass data, the funding rates for mainstream CEX and DEX indicate that the crypto market is still in a bearish trend;

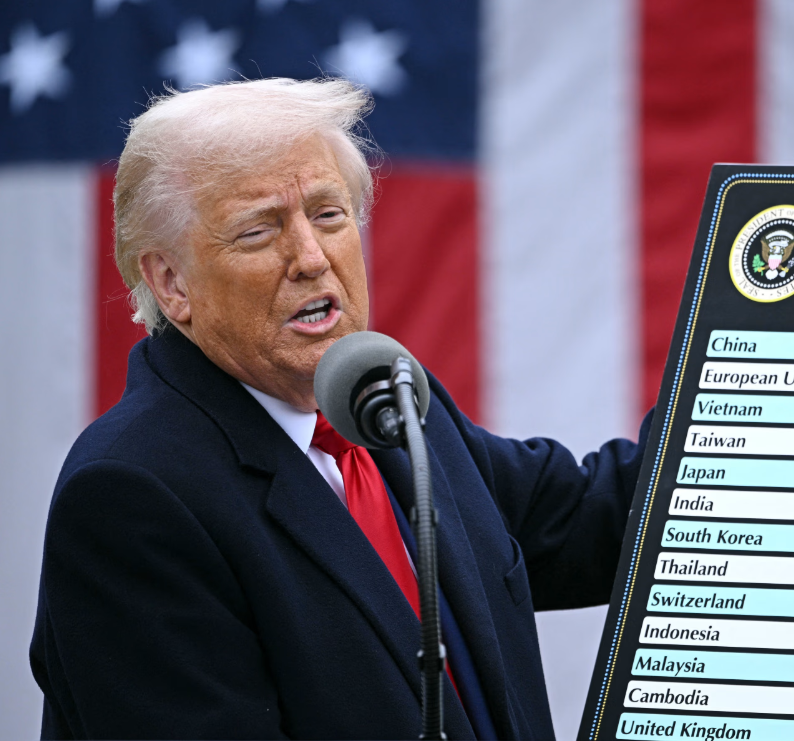

On April 3, after U.S. President Trump signed an executive order on April 2 announcing "equal tariffs" on trade partners, major U.S. stock index futures experienced a sharp decline in after-hours trading;

On April 2, Justin Sun posted on social media stating that FDUSD issuer First Digital Trust (FDT) has effectively gone bankrupt and is unable to fulfill customer fund redemption obligations;

On April 3, China International Capital Corporation (CICC) analyzed that Trump's announcement of "equal tariffs" on April 2 exceeded market expectations.

CICC believes that equal tariffs may increase uncertainty and market concerns, exacerbating the risk of "stagflation" in the U.S. Calculations show that tariffs could raise U.S. PCE inflation by 1.9 percentage points and reduce real GDP growth by 1.3 percentage points, although they may also bring in over $700 billion in fiscal revenue. Faced with the risk of "stagflation," the Federal Reserve can only choose to wait and see, making it difficult to cut rates in the short term. This will further increase the risk of economic downturn and add downward pressure on the market;

- On April 4, the three major U.S. stock indices opened lower and closed lower, with the Dow Jones initially down about 1,700 points, the S&P 500 down 4.8%, and the Nasdaq down nearly 6%.

Macroeconomics

On April 4, Federal Reserve Chairman Powell stated in a keynote speech regarding the economic outlook that weak economic growth and rising inflation will offset each other, leading the Fed to maintain expectations of two rate cuts in 2025;

On April 6, according to CME "FedWatch" data, the probability of a 25 basis point rate cut by the Federal Reserve in May is 33.3%, while the probability of maintaining the current rate is 66.7%;

On April 4, the U.S. non-farm payrolls for March were adjusted to 228,000, with expectations of 135,000, and the previous value was revised from 151,000 to 117,000. The non-farm numbers exceeded expectations, with an increase higher than the market's expectation of 135,000.

ETF

According to statistics, from March 31 to April 4, there was a net outflow of $165.3 million from U.S. Bitcoin spot ETFs; as of April 4, GBTC (Grayscale) had a total outflow of $22.575 billion, currently holding $16.162 billion, while IBIT (BlackRock) currently holds $48.241 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $96.288 billion.

There was a net outflow of $5 million from U.S. Ethereum spot ETFs.

Envisioning the Future

Event Preview

TOKEN2049 Dubai 2025 will be held in Dubai from April 30 to May 1, 2025;

Canada Crypto Week will take place in Toronto, Canada from May 11 to 17, 2025;

Paris Blockchain Week 2025 will be held in Paris, France from April 8 to 10, 2025;

YZi Labs will collaborate with AGI House in Silicon Valley to host an offline hackathon on April 12, focusing on AI and blockchain-driven fintech solutions.

Project Progress

The incentive testnet for the Initia lending protocol INERTIA will continue until April 8, during which users can mint testnet LST (nINIT and sINIT) and engage in lending;

Bybit Web3 will streamline its product line to enhance user experience. Bybit Web3 will close the NFT market, inscription market, and IDO product page at 00:00 on April 9, 2025;

Binance's second round of voting for listing activities will end at 07:59 on April 10, 2025, with participating projects including VIRTUAL, BIGTIME, UXLINK, MORPHO, GRASS, ATH, WAL, SAFE, ZETA, IP, ONDO, PLUME;

The first season of the reward program for the Sonic SVM mainnet, based on Solana's Layer 2 expansion network, will last until April 10;

The snapshot time for the Season 3 airdrop of the Web3 social platform and infrastructure UXLINK is April 10, with the claiming period starting on April 18. The total amount of this airdrop is expected to be no more than 3.077% of the total supply, targeting community users using the OAOG protocol, developers and partners of the testnet and AI growth agents, participants in the S3 staking activities, and other active users.

Important Events

Senior White House officials stated that the benchmark tariff rate (10%) will take effect at midnight on April 5, and equal tariffs will take effect at midnight on April 9;

The U.S. SEC has postponed the decision on BlackRock's Ethereum ETF options trading to April 9;

The case status meeting for Terra founder Do Kwon, originally scheduled for March 10, has been postponed by the New York District Court to April 10, with the final trial still set for January 26, 2026.

Token Unlocking

Movement (MOVE) will unlock 50 million tokens at 20:00 on April 9, valued at approximately $15.77 million, accounting for 2.04% of the circulating supply;

Aptos (APT) will unlock 11.31 million tokens at 16:00 on April 12, valued at approximately $48.97 million, accounting for 1.87% of the circulating supply;

Axie Infinity (AXS) will unlock 9.09 million tokens at 21:10 on April 12, valued at approximately $22.36 million, accounting for 5.67% of the circulating supply.

About Us

Hotcoin Research, as the core research and investment center of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We build a "trend judgment + value mining + real-time tracking" integrated service system, offering deep analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring, combined with weekly updates of the "Hotcoin Selected" strategy live broadcast and daily news briefings of "Blockchain Today" to provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。