Trump’s World Liberty Financial Sells Ethereum, Hits 2Year Price Crash

Ethereum Market Hit Hard As Trump’s World Liberty Financial Sells At Heavy Loss

World Liberty Financial, a DeFi platform with ties to President Donald Trump, has shocked the crypto world. On April 9, a wallet linked to WLFI sold 5,471 ETH for about $8 million. That’s an average price of $1,465 per coin.

This move comes as Ethereum continues to trade at low levels. The sale means Trump’s WLFI loses 55% on its ETH holdings. The firm had originally bought Ethereum at an average price of $3,259, spending over $210 million on 67,498 ETH.

Analysts and traders are now asking why Trump’s WLFI would sell at such a huge loss. It could be a strategy to free up funds or rebalance its portfolio. Others see it as a panic move as markets crash.

Whales Exit as Ethereum Slides Below Key Levels

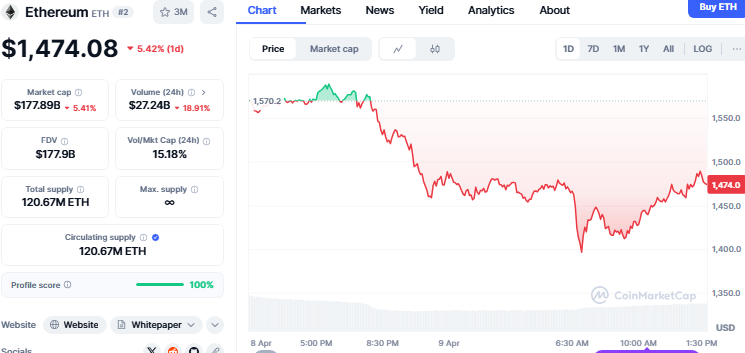

The recent sale adds to the growing pressure on Ethereum. The coin has dropped more than 56% since the beginning of 2025. Over the past week alone, ETH fell 21%, touching a two-year low of $1,396.

Source: CoinMarketCap

Source: CoinMarketCap

ETH is currently floating at around $1,474 with a drop of 5.42% in the last 24 hours. Its market cap dropped by 5.41% just in 24 hours, and went to $177.89 million. Its trade volume also dropped by 18.91% and went to $27.24. Analyst Ali Martinez has pointed out $1,200 as a key support level. If it breaks below this, it could fall even further, possibly to $1,000.

On-chain data shows many investors are giving up. Over $500 million in realized losses have been recorded recently. Much of the selling comes from short-term holders who bought ETH in the past month.

WLFI Launches Stablecoin Despite Massive ETH Losses

Trump’s World Liberty Financial is moving ahead with new plans, even during a tough market. On March 25, it launched a stablecoin called USD1. This token is backed 1:1 by cash, U.S. Treasuries, and similar assets. It’s already live on Ethereum and BNB Chain, with more networks coming soon. WLFI says USD1 is designed for institutions that care about transparency and following the rules.

The reserves are checked by outside auditors, and BitGo keeps the funds safe. Trump’s World Liberty Financial says USD1 is a safer choice than unstable or under-backed stablecoins. The company started in 2024 and raised $550 million in a token sale. Tron founder Justin Sun invested $75 million and later became an advisor.

What’s Next?

Ethereum could stay under pressure in the coming weeks. If it breaks below $1,200, the price might fall closer to $1,000. Many short-term holders are selling, and that’s pushing the price down faster. If fear spreads to long-term holders, the drop could get worse.

WLFI might focus more on its stablecoin, USD1, after the ETH loss. The team says it’s building for institutions and wants to offer a safer option in crypto. If USD1 gains trust, it could help WLFI recover. But for now, the market is watching closely to see if it can hold above key levels.

Also read: Why XRP is Falling: Ripple SEC Case or Trump Tariff War to Blame?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。