Source: Cointelegraph Original: "{title}"

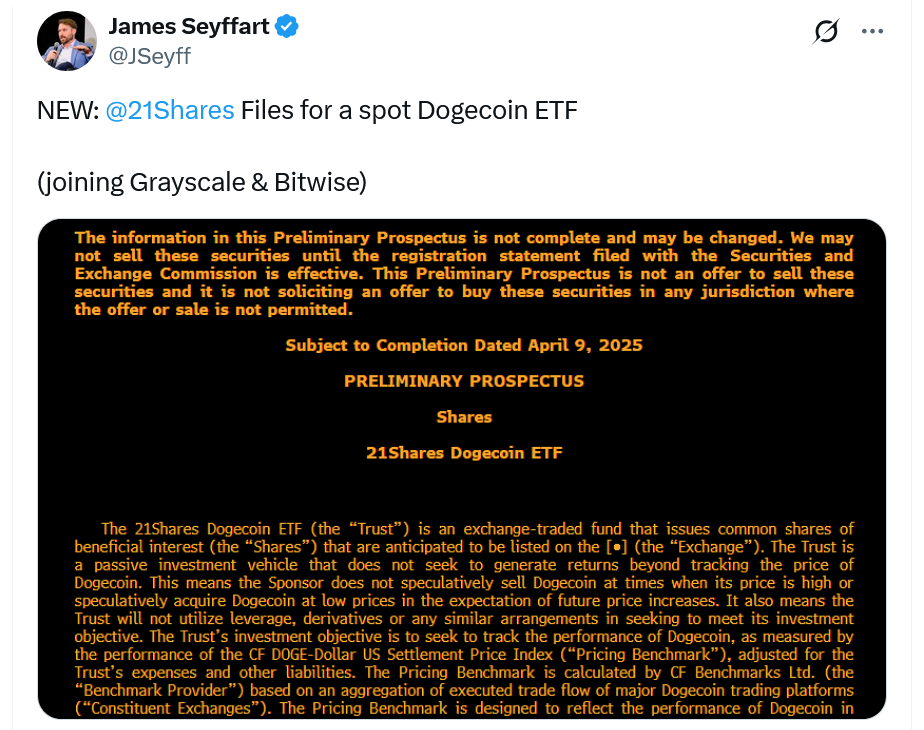

Digital asset manager 21Shares has applied to the U.S. Securities and Exchange Commission to launch a spot Dogecoin (DOGE) exchange-traded fund (ETF), following similar applications from competitors Bitwise and Grayscale.

According to the company's S-1 registration statement on Wednesday (April 9), the 21Shares Dogecoin ETF will seek to track the price of the meme coin Dogecoin. The corporate division of the Dogecoin Foundation, House of Doge, plans to assist 21Shares in marketing the fund.

21Shares stated that Coinbase Custody will be the proposed custodian for its Dogecoin ETF, but did not specify fees, ticker symbols, or which exchange it will be listed on.

Source: James Seyffart

21Shares must also submit a 19b-4 application to the U.S. Securities and Exchange Commission to initiate the regulatory approval process for the fund.

DOGE currently has a market capitalization of $24.2 billion, making it the eighth-largest cryptocurrency by value. It originated as a joke in 2013, being a fork of Lucky Coin, which itself is a fork of Bitcoin (BTC).

The proposed Dogecoin ETF by 21Shares is the company's latest effort to expand its spot cryptocurrency ETF offerings, which currently only include spot Bitcoin and Ethereum funds.

The issuer also applied to the U.S. Securities and Exchange Commission in February to launch a spot Polkadot (DOT) ETF and applied last year to create a spot Ripple (XRP) ETF.

Bloomberg ETF analyst James Seyffart noted in February that the recent surge in cryptocurrency ETF applications reflects issuers adopting a "shotgun strategy"—testing which products the new leadership at the U.S. Securities and Exchange Commission might approve through a large number of attempts.

"Issuers will try to launch many different things to see what will succeed," Seyffart said.

Seyffart and another Bloomberg ETF analyst, Eric Balchunas, stated in February that the likelihood of the U.S. Securities and Exchange Commission approving a spot Dogecoin ETF this year is 75%, while the betting platform Polymarket currently gives a 64% chance of approval.

21Shares and House of Doge Collaborate to Launch DOGE Fund in Switzerland

21Shares also announced on Wednesday that it has partnered with House of Doge to launch a fully supported Dogecoin exchange-traded product on the SIX Swiss Exchange in Switzerland.

The 21Shares Dogecoin product will trade under the ticker "DOGE" with a fee of 2.5%.

Duncan Moir, President of 21Shares, stated that Dogecoin "is no longer just a cryptocurrency: it represents a cultural and financial movement that continues to drive mainstream adoption, and DOGE provides investors with a regulated channel to participate in this exciting project."

Related Articles: If this trend continues, Dogecoin price is expected to rise by 55%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。