Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

In April, a series of "tariff dramas" unfolded, and Trump once again stirred up a storm in the global market.

However, this time, it seems that his wielding of the tariff stick is no longer just about economic interests. Tariffs appear to have become a means of "compliance testing"—Trump is attempting to gauge the tolerance and obedience of global economies to the U.S. government's hardline policies.

With his "tricky maneuvers," the world economy quickly plunged into the abyss of uncertainty: stock markets were in disarray, foreign exchange markets fluctuated, and the crypto market was dragged down as well, with Bitcoin's price experiencing a rollercoaster ride, intertwining panic and speculative sentiment.

In this global game filled with uncertainty and probing, how will the crypto market develop next? The coming months may serve as a true test for the entire crypto market.

The Power Experiment Behind Tariffs

This tariff storm is no longer a traditional economic policy adjustment; it resembles a blatant behavioral psychology experiment.

"Who will comply? Who dares to resist? Who chooses silence?"

Trump acts like a puppeteer, creating uncertainty, carefully setting variables, and observing the reactions of countries around the world. Tariffs are no longer merely economic tools; they have become his "compliance testing" button.

This round of "testing" has a tight rhythm: first, group tariffs create systemic pressure, followed by the introduction of a negotiation window to attract dialogue, then a pause on tariffs for most countries sends a signal of easing, and finally, extreme pressure is applied to the "resisters."

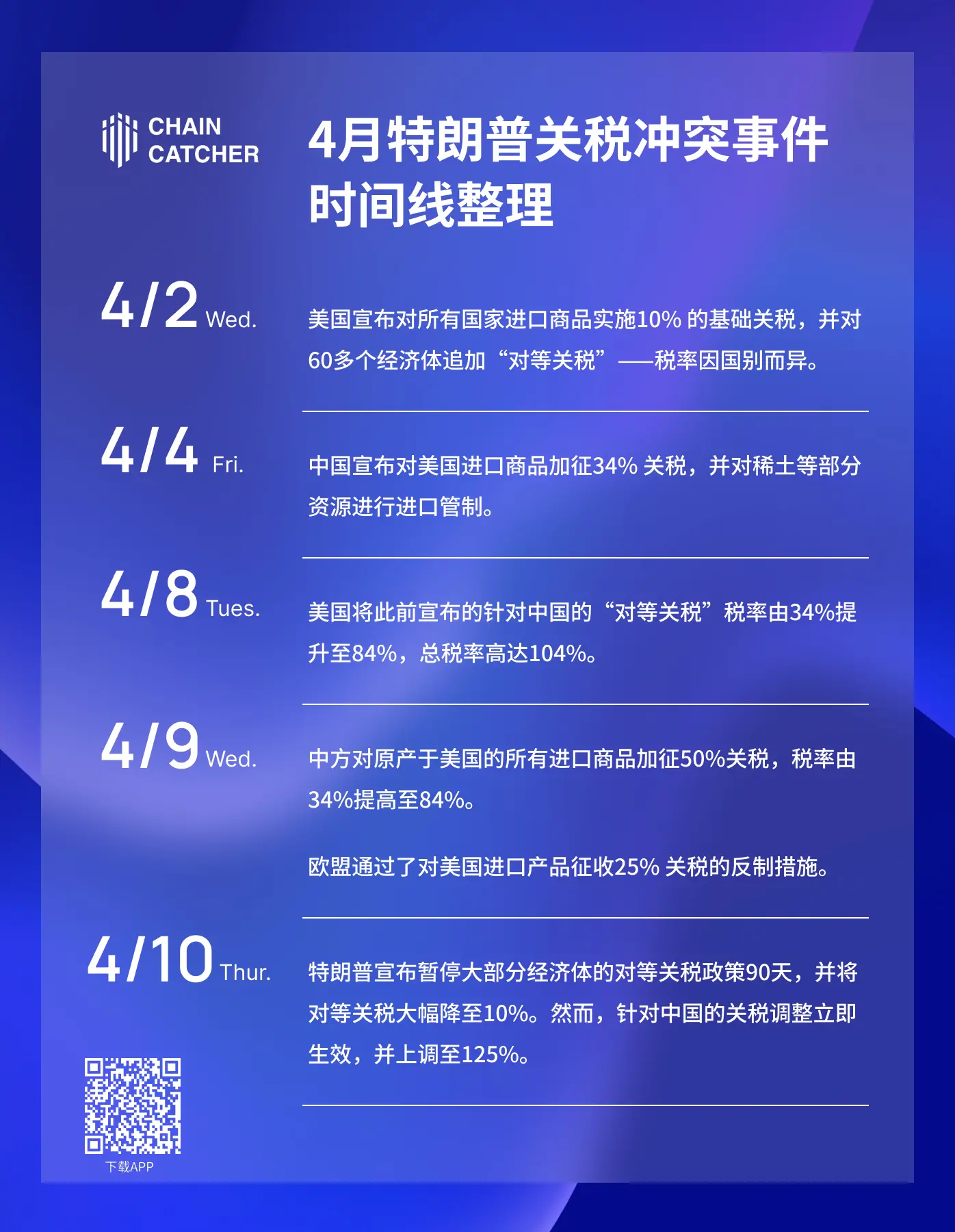

Below is the timeline of the tariff events, revealing the rhythm of this "test":

"The lack of respect shown by China towards the world market prompts me to announce an increase in U.S. tariffs on China to 125%. More than 75 countries have called U.S. representatives to negotiate, and these countries, at my strong suggestion, have not retaliated against the U.S. in any way. I have authorized a 90-day pause."

Trump's statement resembles a "phase testing report," simply translated as: "If you behave, I will pause for 90 days; if you talk back, I will raise tariffs to 125%."

However, this is far from over. The 90-day "pause" feels more like a silent observation buffer. No one dares to conclude what Trump will do next. What is left for the global market is a thicker unknown and a deeper game.

This "compliance experiment" is deeply impacting the market. So, how will the crypto market's trajectory develop next?

Bitcoin's "Rollercoaster Market": A Bull Trap or the Start of a New Era?

In the past week, Bitcoin's price briefly fell below $77,000, but after Trump announced a 90-day pause on most countries' reciprocal tariffs, Bitcoin's price quickly rebounded, breaking through $82,000. However, there are differing interpretations and views on the potential impact of this tariff policy.

Viewpoint 1: The Crypto Market's Rebound May Be a "Bull Trap," Caution is Needed

Crypto investment firm QCP Capital states that Bitcoin's current rebound may be a "classic bull trap." They believe that while Trump's decision to pause new tariffs has led to a rise in Bitcoin and other cryptocurrencies, the exception of China may provoke a strong counteraction from China, causing the market's excessive excitement to quickly turn into a bull trap.

QCP also points out that although the short-term policy adjustment has temporarily alleviated market anxiety, the market still faces risks. Market makers may take advantage of this rebound to offload, especially as selling pressure may emerge in the coming months. Therefore, QCP advises investors to remain cautious.

BTSE Chief Operating Officer Jeff Mei shares a similar view: "The market's upward reaction is based on the expectation that most trading partners will negotiate trade agreements with the U.S. to avoid a full-blown trade war. That said, continuing to impose tariffs on China and China's counteractions will lead to a reconfiguration of global trade, potentially altering the way the world operates. We remain cautious until we see the consequences of this process unfold in the coming months."

Viewpoint 2: The Tariff Issue Will Become Hollow, and the Crypto Sector May Experience a Surge in August-September

Charles Hoskinson, founder of Cardano, holds an optimistic view of the future crypto market. He believes that the tariff issue will ultimately become hollow, as the world will recognize that countries are willing to negotiate, and this is actually part of the U.S.-China game. He points out that some countries will support the U.S., while others will support China, leading to a gradual stabilization of the market. People will gradually adapt to this new normal, and the Federal Reserve may lower interest rates, with a significant influx of funds into the market, which will eventually flow into the crypto market.

He predicts: "The crypto market may stagnate in the next three to five months, but by August or September, the market will see a wave of massive speculative interest that could last six to twelve months."

Viewpoint 3: Short-Term Volatility, Long-Term Adoption of Bitcoin May Be Driven

Grayscale believes that the short-term performance of the global market will be influenced by trade negotiations between the White House and other countries. Although these negotiations may lead to a reduction in tariffs, potential setbacks and retaliatory actions during the process will still exacerbate market volatility, bringing significant uncertainty to trade conflicts in the coming weeks.

Nevertheless, Grayscale points out that Bitcoin's price volatility is significantly lower than that of the stock market, and speculative traders in the crypto market hold relatively low positions. If macro risks are alleviated in the coming weeks, they believe the crypto market will rebound.

From a medium to long-term perspective, Grayscale believes that increased tariffs may have a positive impact on Bitcoin, especially when tariffs lead to economic stagnation and weaken demand for the dollar. As international trade patterns change, Bitcoin may be more widely adopted, particularly in a scenario of declining demand for the dollar.

Bitwise Chief Investment Officer Matt Hougan also believes that increased tariffs will lead to a depreciation of the dollar, and the inverse correlation between Bitcoin and the dollar index means that dollar depreciation is typically accompanied by rising Bitcoin prices. In the long run, the weakening of the dollar may drive Bitcoin and other hard currencies to become emerging reserve assets.

Finding certainty in uncertainty, creating order in chaos. Since its inception, Bitcoin has weathered many storms; regardless of how Trump's policies change, the crypto market has proven its resilience in rooting itself amid uncertainty.

How the future unfolds remains elusive. We can only hold our breath and wait for time to reveal the conclusion of this grand drama.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。