Author: Nianqing, ChainCatcher

Yesterday, the Web3 social media platform Wunder.Social announced the completion of a $50 million financing round, led by Rollman Management. The news comes from CoinDesk, which also mentioned that Wunder.Social plans to launch its token later this month. In the context of a persistently sluggish primary market, this large financing amount stands out, especially since both the project team and the venture capital firm are relatively unknown, further deepening doubts about the authenticity of the financing.

Rollman Management is not new to the media. Established in 2022, this firm has only started to make frequent moves since the end of 2024, investing in 11 crypto projects in less than five months, with investment amounts mostly exceeding $20 million. The total investment amount has surpassed $200 million.

At the same time, the projects in Rollman Management's portfolio are relatively low-profile, primarily located in Europe, Australia, and other regions, with the only notable financing history being this abrupt large financing from Rollman. In the press release regarding the financing, most of these projects are about to conduct IDOs or token sales. Additionally, Rollman Management has almost always made individual investments without collaborating with well-known venture capital firms.

Wide Range of Business Involvement

According to its official website, Rollman Management Digital is a global investment network and consulting firm that provides services in mergers and acquisitions, venture capital, real estate, and digital assets for family offices, high-net-worth individuals, and entrepreneurs. It is described that Rollman's business involvement is very broad, offering strategic planning consulting, investment and trading, marketing, tailored banking consulting solutions, and institutional-level Web3 services.

Among these,* institutional-level Web3** services cover almost everything—*including over-the-counter (OTC) trading, banking, hedge funds, venture capital, marketing, cryptocurrency/AI mining, financing, issuance platforms, market makers, liquidity providers, decentralized exchanges (DEX), and centralized exchanges (CEX). Rollman Management also provides marketing strategies for projects to help enhance their visibility and promote customer interaction.

Portfolio and Style Analysis

According to data from RootData and Cryptorank, Rollman Management currently has a portfolio of 11 projects, as shown in the image:

"Investment commitment" is a term that requires caution. Literally, it refers to the project party's promise to invest a specific amount in the project. However, there is significant room for manipulation behind it.

Previously, ChainCatcher had uncovered a venture capital firm similar to Rollman Management's investment style, GEM Digital. A project leader once stated that GEM Digital contacted the project via email and promised to invest $50 million, but when signing the investment contract, the project party found that GEM stated in the contract that it would not directly transfer funds but would fill the investment amount with profits from selling the tokens.

Related reading: The Most "Extravagant" Crypto VC GEM Digital: A Covert and Bizarre Capital Game

Rollman Management's "investment commitment" may differ from GEM Digital, but its investment style is generally similar:

1.High-frequency, large "investment commitments": Rollman Management's investments are relatively dispersed, involving social, RWA, AI, infrastructure, and DeFi sectors, with a median investment amount of $20 million. Among these, nearly half of the invested projects, such as VitalVeda, Tea-Fi, and Candao, are investment commitments rather than normal investments.

2.Choosing low-profile projects: Among the 11 projects invested by Rollman, only the Elastos and ELA projects were established earlier and have some recognition and dynamics in Chinese-speaking regions due to their origin in China; the other projects have had almost no news updates, and the released projects have hardly been listed on mainstream exchanges.

3.Using media to create momentum: Investment news related to Rollman Management is mostly published on mainstream platforms like Cointelegraph and CoinDesk. The vast majority are published on Cointelegraph (with "sponsored" noted in the press releases), and they almost follow a template for financing news, with a highly similar article structure, clearly originating from Rollman. (You can click on the project names to experience this: AstraAI, Tea-Fi, Eventflo)

The purpose of Rollman's investment news is singular—to promote token sales for projects. Rollman has leveraged the crypto community's sensitivity to financing news. By disseminating "huge investment" news through authoritative media, it attracts market attention and even drives up token prices. Of course, even if the project has not issued tokens, there are plans for IDOs or other token sales.

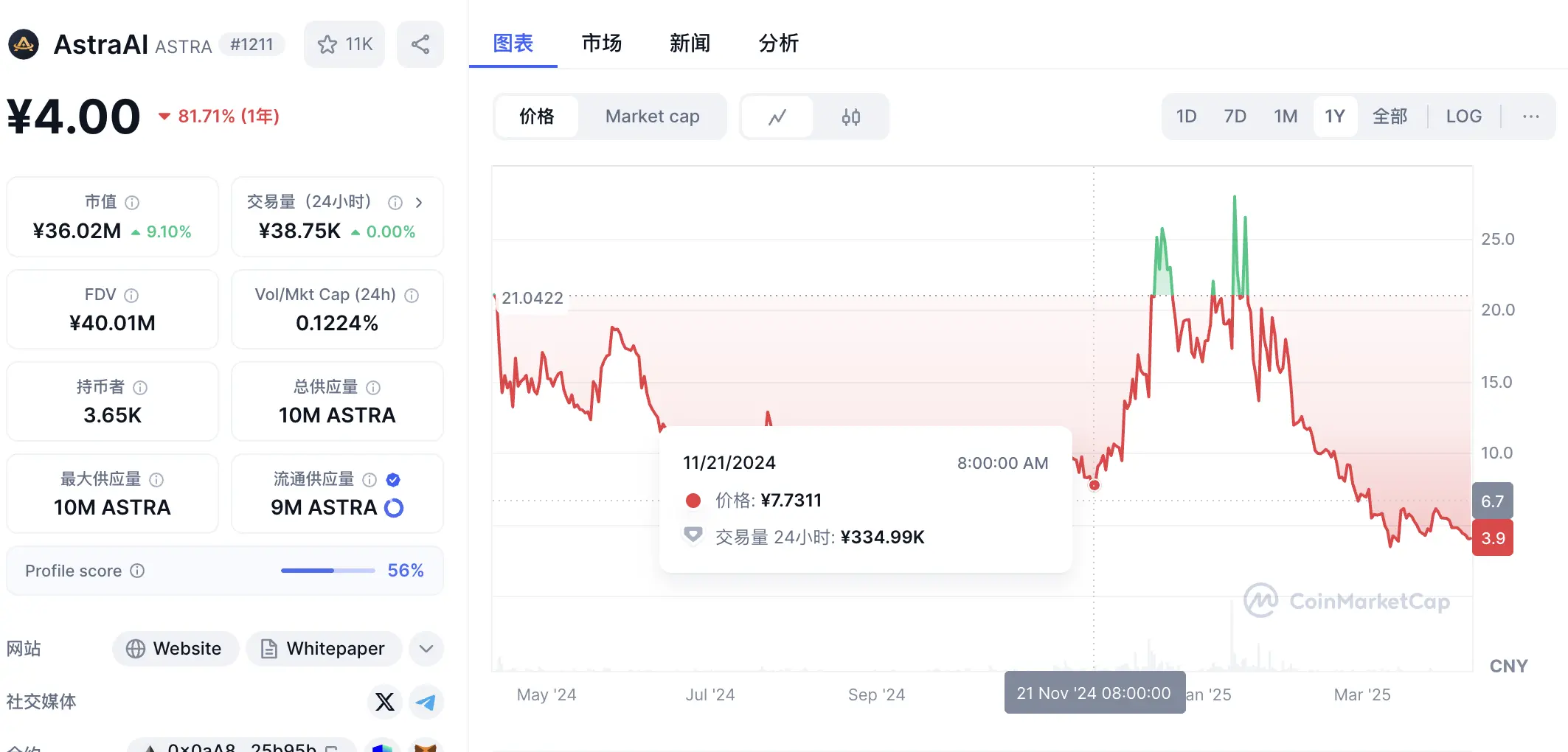

4.**The tokens of invested projects exhibit a "pump and dump" pattern: The token prices of Rollman's invested projects have shown a trend of rapidly rising after news releases, followed by declines. For example, on November 21, 2024, when Rollman announced its investment in AstraAI, its token price surged from $7.7 to a peak of $25, and is currently priced at $4.

On January 30 of this year, Rollman announced its investment in Elastos, and the Elastos token also experienced a rapid increase, rising from $13 to $21.

Hanging the VC Sheep's Head, Selling Marketing Dog Meat

Overall, Rollman resembles a conservative version of GEM Digital, with most of its partnered projects being unlaunched. Therefore, compared to GEM Digital's model of driving prices with positive news, Rollman is essentially promoting token sales for project parties through its investment actions.

"Pump and Dump" was particularly prevalent in the early days of cryptocurrency, especially during the ICO boom, when many projects attracted funds through false advertising and exaggerated financing news, only to run away or collapse afterward. The practices of Rollman and institutions like GEM Digital can be seen as an "upgraded version" of this strategy, donning a legal guise through "investment commitments" and utilizing media and low-profile projects for systematic operations.

Currently, the crypto market is weak, and in the cold environment of the primary market, project survival has become more challenging, especially for projects without significant backgrounds or fame. Thus, where there is demand, there is a market, and coupled with imperfect regulations, especially regarding the definitions and constraints of ambiguous behaviors like "investment commitments," this provides operational space for institutions like Rollman.

ChainCatcher hereby reminds industry participants (including investors, project parties, media, and retail investors) to remain vigilant regarding such investments to avoid becoming victims of capital games.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。